This article first appeared on Trend Investing on August 17, 2020; therefore all data is as of this date.

It is starting to look like renewable energy and electric vehicles [EVs] will be the two largest trends of the 2020's decade. Certainly in the USA, if Biden is elected, he plans for "the U.S. to be a carbon pollution-free power sector by 2035." This will have to be mostly renewable energy sources. Given that in 2019 just 17% of US electricity generation came from renewables (and only 11% of total energy consumption), to ramp up towards 100% renewables in just 15 years would lead to a massive boom in solar and wind installations. Meanwhile China and Europe continue to lead the way with solar, wind, and EV adoption.

In 2019 it was reported that:

Global supplies of renewable electricity are growing faster than expected and could expand by 50% in the next five years, powered by a resurgence in solar energy.

As solar and wind have become the cheapest forms of energy production the IEA reported that "solar, wind and hydropower projects are rolling out at their fastest rate in four years."

IEA’s executive director, Fatih Birol stated:

This is a pivotal time for renewable energy......Technologies such as solar photovoltaics [PV] and wind are at the heart of transformations taking place across the global energy system. Their increasing deployment is crucial for efforts to tackle greenhouse gas emissions, reduce air pollution, and expand energy access.

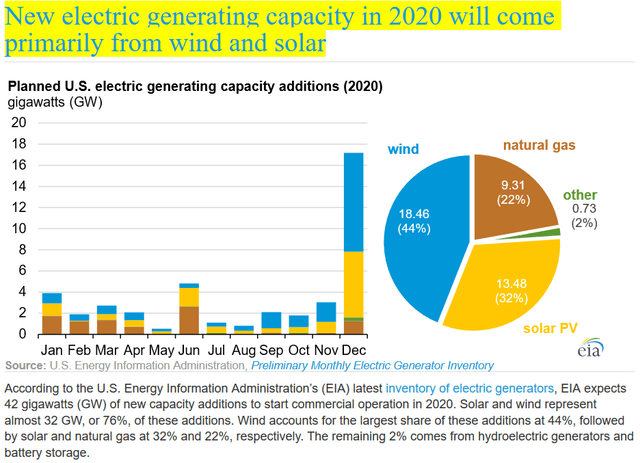

Source: EIA

Renewable energy facts

- In 2018 renewable energy made up just 12.9% of global power generation.

- BNEF - In 2019, the world financed $282 billion of renewable capacity, with onshore and offshore wind leading the way at $138 billion followed by solar at $131 billion.

Renewable energy growth forecasts

- International Energy Agency IEA [USA] - New

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest Trend Investing articles: