It Takes a Village

During their Q3 FY ’19 quarterly earnings call in July, Walgreens (NASDAQ:WBA) management left no doubt about their feelings toward their newly expanded VillageMD partnership: they are bullish.

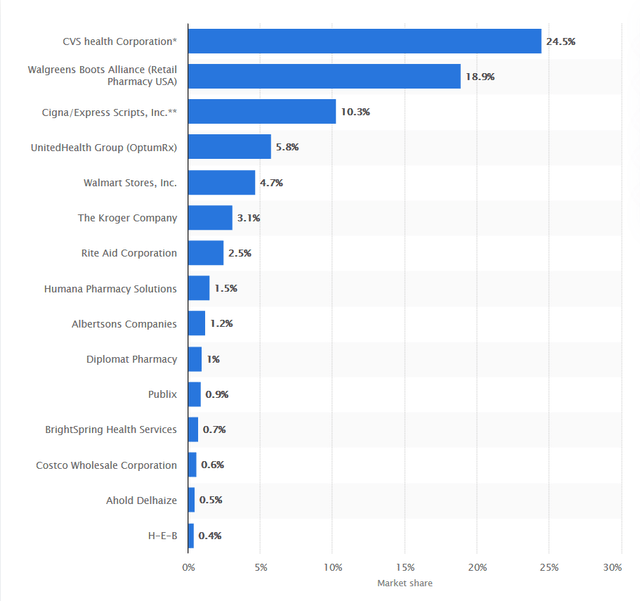

When pressed to qualify and quantify the potential of the relationship, Alexander Gourlay, Walgreens co-COO, noted the company expects a lift in scripts growth; and that while Walgreens commands roughly 20% of the US prescription drug market today, “...[investors] can expect [the company] to be well above 50%...of market share...” as the co-located, integrated-pharmacy primary-care clinics reach steady operation across the United States.

It’s a gutsy forecast:

- Walgreens trails prescription drug market share leader CVS (CVS).

- CVS has a similar initiative to offer its customer base a wider set of health services via its HealthHub locations, and would likely recognize a similar effect in its prescription script business.

- Walmart (WMT) and Amazon (AMZN), as two examples of powerful threats, are pushing programs to grow their respective shares of the prescription drug market; the former via Walmart Health and the latter via Amazon Pharmacy.

Figure 1: CY ’19 US Prescription Drug Market Share by Pharmacy

Source: Statista

Can Walgreens really capture more than half of a market which, by one estimate, may be worth nearly $359B in CY ’20, growing somewhere in the range of 2% to 5% per year? Notably, management provided no specific timeframe to achieve this feat.

Yet, if we assume it is possible, can we then quantify the value of the VillageMD partnership over time? I present such a valuation model in this report in an effort to scrutinize and analyze my own long position in the company.

Partnership Details

Before jumping into some numbers, a few details on VillageMD and the partnership...

Founded in 2013, VillageMD is fairly young, yet has already raised ~$500M in funding-to-date, including Walgreens’ investment of $250M in July. The company is driving primary medical care toward a clinical model with “...consistent, coordinated and personal care [delivery] to all patients at a lower cost...[via physicians enabled with] tools, technology, operations, staffing support and industry relationships.”

While Walgreens generalizes the quality of the partnership around the routine customer benefits you would expect (e.g. better health outcomes, reduced costs, differentiated patient experiences), note that the company is specifically seeking to attract patients with chronic conditions to its footprint, often reiterating VillageMD’s statistic that “...nearly $4T per year is spent on healthcare [in the United States], and over 85% of that is tied to patients with chronic disease.” With a parallel vision to expand beyond physical locations, Walgreens is also “...developing home-based monitoring and telemedicine services leveraging VillageMD's integrated data and technology and [the company’s] own Find Care platform.”

Some key business aspects of the technology-led partnership include:

- Walgreens will make a $1B equity and convertible debt investment in VillageMD. The investment is spread over 3 years with the first $250M equity tranche completed at the time of the announcement in early July.

- Walgreens notes that “[it] is anticipated, assuming full conversion of the debt, that WBA will hold an approximately 30 percent ownership interest in VillageMD at the completion of the investment.”

- Eighty percent (80%) of the total investment will be used to open 500 to 700 physician clinics co-located with Walgreens stores within 5 years; with “most of the clinics...approximately 3,300 square feet each, with some as large as 9,000 square feet [and each] will optimize existing space in the store, which will [continue to] provide a vast range of retail products to customers.”

- Expanding on the benefit of co-location, the pharmacy in each store will be integrated with the corresponding clinic, such that both will share the same technology workflow system from VillageMD. The integration will support sharing of clinical information and create a cohesive patient team inclusive of clinic and pharmacy resources.

- The initial 500 to 700 clinics will be rolled out across 30 US markets in the first 5 years, to be followed by new rollouts in 20 additional markets thereafter.

Valuing the Village

To quantify VillageMD’s potential contribution to Walgreens-specific operations, I constructed a valuation model that forecasts the company’s cash flows as a function of predicted US prescription drug market share for the period FY ’20 – FY ’25. As I always say, any model needs to be looked upon with a cautious eye.

The model utilizes a top-down scheme that effectively “backs into” forecasts for Walgreens’ total revenue in the future periods and subsequently estimates the company’s cash flow for each period. The process to derive the cash flows is fairly straightforward:

1. Forecast the US prescription drug market size for FY ’20 – FY ’25.

2. For each period, I estimate the dollar value of Walgreens’ US prescription drug market share benefiting from growth realized via VillageMD.

3. From the preceding data, I extrapolate an estimate of Walgreens’ total revenue for each period.

4. Using the total revenue figures, I forecast cash flows for the corresponding future fiscal years leveraging FCF margin estimates.

5. Finally, I feed the cash flows into a DCF model to consider the per-share “value” that the VillageMD partnership may offer.

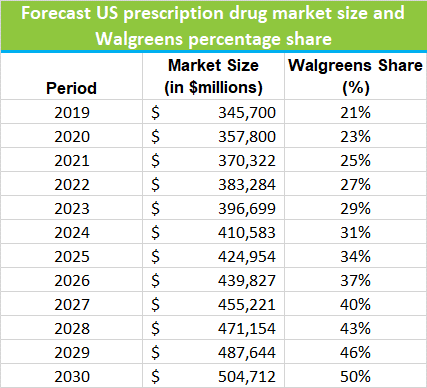

It is a simple exercise to model growth of the US prescription drug market; and I have done so in Figure 2 below assuming a 3.5% CAGR which is the midpoint of the range presented in the first section. Additionally, I have calculated a steady-growth forecast of Walgreens’ share of the US prescription drug market:

- Using Retail Pharmacy US (“RPU”) market share of 21.3% at the end of FY ’19 as a proxy for the company’s share of the US drug market heading into FY ‘20; and

- Assuming it will take the company 10 periods to grow to 50% share of the US prescription drug market (i.e. at the end of FY ’25 – the end period that I will build the model upon – the company will be about half-way there); and

- Ignoring the differential, for my purposes, between Walgreens’ fiscal year end and the calendar period upon which the total market size data is (technically) based. That is to say, I am assuming each of the total market size estimates apply to the corresponding Walgreens fiscal period.

Figure 2: Forecast US Prescription Drug Market Size and Walgreens Percentage Share

Data Source: Statista, QuintilesIMS, Walgreens Q4 FY ’19 Earnings Presentation, Yves Sukhu

Table Source: Yves Sukhu

Notes:

- The implied CAGR for market growth is 3.5%.

- The implied CAGR for Walgreens' share is 8.1%

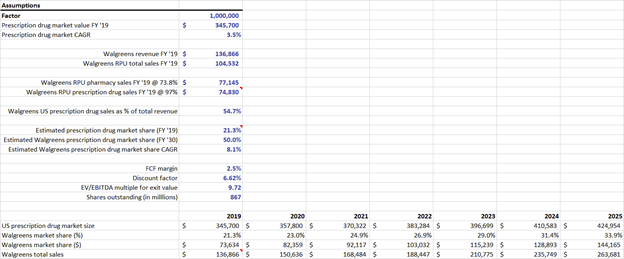

From Figure 2, we can easily calculate an estimated dollar value of Walgreens’ prescription drug market share in each of the forecasted periods. In order to extrapolate an estimate of Walgreens’ total revenue from those figures, I apply a multiple based on a “guess” as to the percentage of FY ’19 RPU revenue that was related to US prescription drug sales:

- Total RPU FY ’19 sales were $104,532M.

- Pharmacy sales represented 73.8% of total RPU revenue, or $77,145M.

- The company notes in its Annual Report FY ’19 that “...sales where reimbursement is received from managed care organizations, governmental agencies, PBM companies and private insurance were approximately 97% of the division’s fiscal 2019 Pharmacy sales.” Assuming that percentage exclusively applies to prescription drug reimbursements, that implies $77,145M x .97 = $74,831M in US prescription drug sales for the period.

- Thus, with total revenue of $136,866M in FY ’19, Walgreens’ US prescription drug sales in FY ’19 (using my various assumptions) represented $74,831M/$136,866M = 54.7% of total revenue; or equivalently, total Walgreens revenue ~ 1.83 x US prescription drug sales.

Supposing this multiple will hold across the forecast periods, it becomes a simple matter to generate estimates of the company’s total revenue. To finally “back-into” a set of cash flows, I apply a FCF margin assumption against the total revenue figures; and the resulting cash flow data can be input into a DCF analysis. So, an example of a completed model through FY ’25 is as follows:

Figure 3: Walgreens/VillageMD Forecast Cash Flow Model

Source: Yves Sukhu

Naturally, I can push the numbers around any way I like and thus produce any result that I desire. Of course, that is the danger of this or any kind of valuation model.

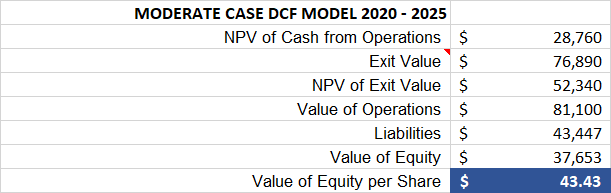

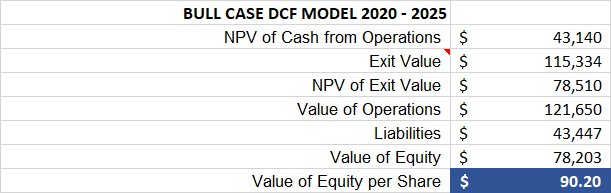

Nonetheless, I considered three DCF cases – bear, moderate, and bull – using 2.5%, 3.0%, and 4.5% FCF margin assumptions respectively. Actual FCF margin has been floating around the middle estimate (3.0%) recently, and the latter estimate is roughly equal to the company’s historical average FCF margin for the period FY ’15 – FY ’19. Note that I used two additional assumptions, leveraging industry data from Professor Aswath Damadoran, to generate the DCF analyses:

- Discount factor of 6.62%.

- EV/EBITDA multiple of 9.72 to estimate exit value.

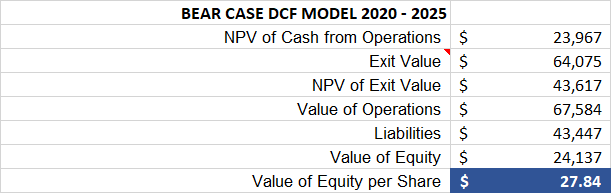

The results of the three DCF cases are as follows:

Figure 4: Bear, Moderate, and Bull Case DCF Models

Source: Yves Sukhu

Of course, the specific per-share values generated by the DCF models carry limited value. However, I extracted a couple possibilities from the results:

- If management is right that they can eventually capture 50% (or more) of the US prescription drug market and my time horizon of a decade or so to get there is reasonable, the moderate case result suggests that there may be a bit of “meat on the bone” at current share price levels, but also that current levels do not represent a gross undervaluation.

- The bear case could apply in a scenario where Walgreens has underestimated the required investment to build out and maintain the physical VillageMD locations, as well as the supporting information technology, with the latter being potentially much more important given the industry’s push toward home-based care and a COVID-19 dynamic that could potentially drag on clinic operations. With shares trading shy of $36 as I write this, perhaps a 20% - 25% downside is not unreasonable for long investors to consider.

Given a slew of potential headwinds, I tend to think share price values approaching the bull case are unlikely over the next few years. For example, as I mentioned already, CVS and Walmart are both in the game, and building on my point in the previous bullet, it is entirely possible that Walgreens’ $1B investment in VillageMD will prove insufficient to remain competitive. And, as they are already sitting on a massive pile of debt, allocating additional capital toward their joint initiative could prove to be a major headache. It is worthwhile to note that Walgreens had a mixed experience with its previous “version 1” clinics, with many already shuttered. Obviously, should the company fail to compete effectively, management’s forecast to claim more than 50% of the US prescription drug market will likely go “right down the toilet”. And the foregoing says nothing of industry-wide dynamics that could impact margins, namely prescription drug pricing-pressure which may be an inevitable result of a market that is considered out-of-control by some.

Looking Ahead

At present, I intend to maintain my long position in the company as I wait with baited breath for FY ’20 results on October 15. As I stated in my prior article on Walgreens, I think “...healthcare remains a high-touch affair”, even in light of current circumstances. While some analysts have argued foot traffic will continue to suffer due to the pandemic, thus impacting the feasibility of the proposed clinics, I remain of the opinion that COVID-19 will not stop patients from seeing their healthcare team, with “healthcare team” being a differentiated component (in theory) of the Walgreens/VillageMD model. As Walgreens – and really the entire industry – looks toward a future where care – chronic or otherwise – is largely home-based, their VillageMD investment may prove reasonable such that a relatively small number of physical clinics – relative to the number of total stores that is – in key markets can be stood up, in support of broader home-centered care services. While I am not too optimistic my bull-case DCF model of the prior section is achievable, I am hopeful management can get enough things “right” with the partnership such that something in between the moderate and bull cases is possible. Certainly, one of the key “things” that I hope they are right about is being able to capture 50%+ of the US prescription drug market. On that point, I am (presently) willing to leave my chips on the table under the assumption the strategy will mostly prevail, offering long investors such as myself reasonable appreciation alongside reasonable dividend growth over the long-term.