As Spotify Technology (SPOT) surges this year based on excitement around new podcasts, the market appears to ignore some deep value in the actual podcast leader, iHeartMedia (NASDAQ:IHRT). The media company leads in podcast streams and has seen those related revenues surge despite hits to traditional broadcast radio revenues. The company is heavily in debt, but a strong cash flow profile makes the stock a deep value here.

Image Source: iHeartMedia website

Digital Push

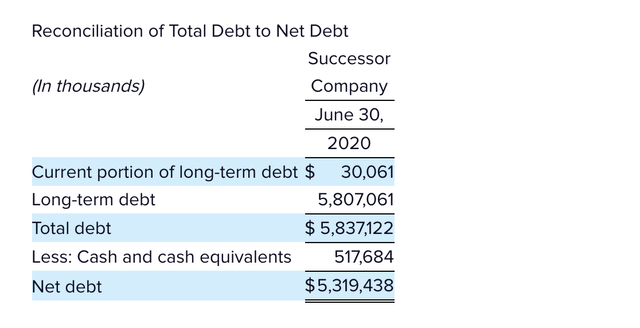

The media enterprise has shown a big push into digital during the last few years evident in the quarterly results. Unfortunately, revenues were still too focused on traditional broadcast revenues and even digital that was hit by the pause in the ad markets. Even Facebook (FB) saw U.S. ad revenues collapse 10% during Q2 while radio revenues as a whole were down 42%.

Based on these following statements by CEO Bob Pittman on the Q2 earnings call, iHeartMedia is positioned to benefit from higher audiences in the future as ad revenues normalize:

Based on these following statements by CEO Bob Pittman on the Q2 earnings call, iHeartMedia is positioned to benefit from higher audiences in the future as ad revenues normalize:

...digital is up 2.4%, driven by podcasting, which is up over 100%...From a consumer engagement perspective, since the pandemic began, listening on the web is up 19%; gaming consoles up 25%; and smart TV are up 13%. Even in July, as things showed signs of returning closer to normal, digital listening on home devices is still up.

The podcast business remains a prime focus on the new digital wave at iHeartMedia, but the media empire is moving beyond traditional AM/FM radio with the ability for listeners to utilize modern devices such as gaming consoles and smart TVs. For these reasons, ad revenues were only down 27% in July.

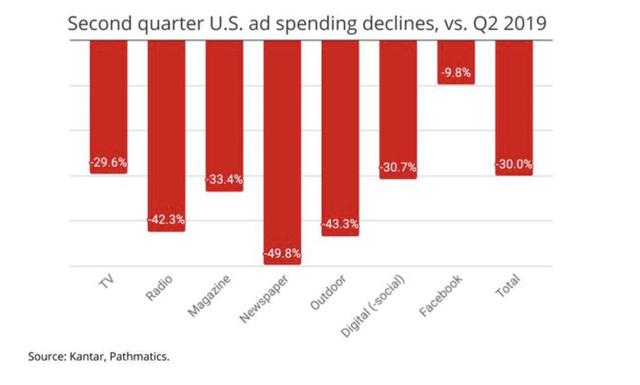

The company remains in strong contention with NPR for the top podcast network. In August, iHeartRadio had the most global podcast downloads and streams at 234 million. The company plans to add high-profile podcasts such as Bill Clinton to further expand its market leadership in the segment.

Source: Podtrac Aug. 2020

Source: Podtrac Aug. 2020

EBITDA Machine

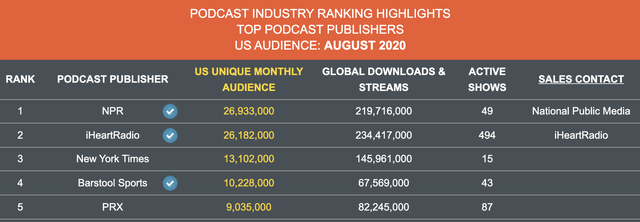

iHeartMedia has net debt of $5.3 billion, causing the biggest consternation with the stock. The stock is only worth $1.2 billion giving the company an EV of only $6.5 billion here, with the stock down 50% from the 2020 highs.

Source: iHeartMedia Q2'20 earnings release

Before the virus, iHeartMedia had a strong free cash flow profile. Last Q2, the company generated adjusted EBITDA of over $263 million. Now, the media empire is in the process of cutting over $200 million out of operating expenses plus the company has plans to remove up to another $100 million from expenses via modernization plans through mid-2021.

iHeartMedia was able to cut free cash flow burn from operations to only $7 million in Q2 despite revenues declining by $425 million in the quarter. Yes, the media company only slightly burned cash during a quarter when revenues collapsed by nearly 50%.

When asked by Jim Goss of Barrington Research regarding the 28.8% EBITDA margins last Q2, CFO Rich Bressler confirmed a plan to improve margins to increase shareholder value:

..our objective here – again, it’s great shareholder value. That’s going to include improving our operating margins. It’s going to – it’s absolutely going to include improving our operating leverage with the cost savings that we announced...

iHeartMedia not providing any real guidance for 2H is a prime reason the stock is still down near the pandemic fear lows at $8. The market is still likely shy that the company entered Chapter 11 back in 2018 due to a large debt load. Under the reorganization plan, iHeartMedia reduced its debt from $16.1 billion to $5.75 billion where the amount sits now.

With 30% EBITDA margins next year, iHeartMedia would generate nearly $1 billion in EBITDA profits. The stock trades just slightly above 1x EBITDA targets and of course closer to 7x EV/EBITDA. Naturally, the EV/EBITDA multiple starts collapsing as the media company repays debt with positive cash flows in the future.

Takeaway

The key investor takeaway is that iHeartMedia is a risky stock considering the massive debt loads and a tough ad market. While a second wave hit to advertising dollars doesn't appear likely, the company isn't in a position to absorb significant losses. Regardless, the media company appears poised to ride new digital revenue sources to solid EBITDA margins and cash flows that make the stock insanely cheap at $8.

If you'd like to learn more about how to best position yourself in undervalued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.