As solar stocks continue their parabolic move from April 2020 lows, a familiar question comes to mind. What's different this time?

Historically, the solar industry has rained fortune upon investors and evaporated portfolios in quick succession. An alternative energy roller coaster, with the best of intentions and high hopes, but also littered with pitfalls around the bend. The sector has a tendency of building itself up, only to smother themselves under their success.

Like other commoditized industries, polysilicon and other downstream solar manufacturers are highly dependent on price. Over the years, governments around the globe have encouraged the use of alternative energy, with tax incentives as the primary inducement. As planned, demand for alternative energy picked up significantly, leading to exponential growth in global supply-side capacity.

However, one of the downsides of policy intervention, is the creation of supply and demand mismatches. Oversupply creates higher inventory carry levels, inevitably resulting in falling prices. We saw this play out in the 2010s, as evidenced by the large availability of Chinese units and corresponding low ASPs.

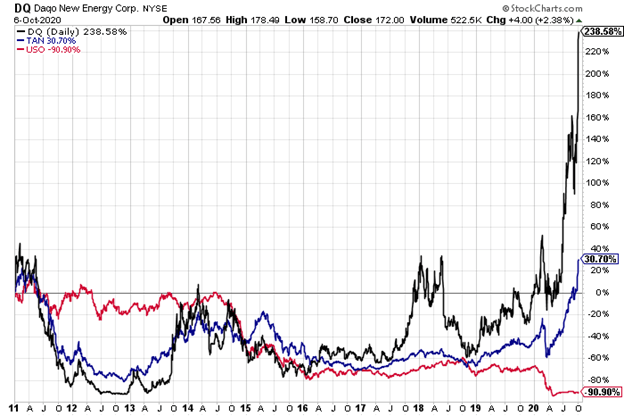

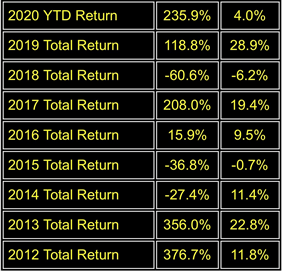

A quick glance at the chart for the Invesco Solar Portfolio ETF (TAN) details the sector is not for the faint of heart. One could argue this looks more like your favorite roller coaster at Cedar Point, than a space investors want portfolio exposure to. Well, if we are getting a ticket to ride, I am making Daqo New Energy Corp. (NYSE:DQ) my coaster buddy.

Dago New Energy Corp. is a Chinese-based polysilicon manufacturer and supplier to their downstream partners. DQ has proven to hit the sweet spot, providing their customers with a high-quality product at a competitive price. Operating within a market that now has the wind at its back after the doldrums seen in March and April. Shares of DQ continue to rank in the top 2% of my Best Stocks Now App.

The initial outbreak and subsequent spread of COVID-19 in China and abroad can be seen as more of a speed bump in a solar sector that had already switched tracks from correlations of the past. Suppressed ASP prices prevalent in Q2 2020 have quickly reversed course and are seen as likely remaining for the next 12 to 18 months.

The solar industry has long been subject to judgement by "cost-benefit analysis" and Dago New Energy Corp. is no exception:

- As the cost of fossil fuels increases, the more attractive alternative energy becomes.

- As costs associated with renewable energy move closer to "grid-parity," so does the attractiveness of alternative energy generation.

- Larger tax incentives for renewable projects, will lead to higher deal flow as more projects are pursued.

- As the cost of capital decreases, the lower the ROI hurdle rate becomes for project approval.

The most apparent indication of "this time it's different" is the decoupling of the solar sector's market capitalization (including DQ) from the price of a barrel of oil. The decoupling can be observed via the chart below:

For much of its existence, there has been a high level of correlation between the price of oil and the underlying value of the solar sector as a whole. The observed relationship began breaking down at the end of 2017, rapidly disintegrating thereafter.

In my opinion, this is a very good sign for the long-term investability of the entire sector. In the past, if you wanted exposure to renewable energy, oddly enough you could mimic the sector more easily (and arguably with less risk) via fossil fuel investment. How long will the decoupling last?

The truth is the high level of long-term correlation seen in the past will most likely never be observed again. Grid parity is here to stay. As an increasing number of markets around the globe attain grid parity, the decreasing correlation significance level will become permanent.

The last two inputs have significant influence on the ROI of each alternative energy project. Ultimately, reducing the hurdle rate on project approval, increasing the probability of go-forward feasibility.

Specifically, the Chinese solar market's waning reliance on tax incentives, has been a very healthy sign for players like DQ within the industry. It is encouraging to see the sector succeed in environments where it must stand on its own merit. Past incentive structures in China, led to the supply glut that drove prices down in the 2010s.

Likely a lasting tailwind for some time in the current environment, interest rates have been driven down as a global fiscal response to the COVID-19 pandemic. Currently, a hurdle rate in the high-single digits may suffice whereas pre-COVID, projects may have required closer to mid-double digits for approval. At the same time, the lower cost of capital also mutes the impact of reductions in tax incentives.

As the economics of the solar sector appears to have reached a stage of maturity, Daqo New Energy Corp. is benefiting. Since Q2 ended, DQ has seen ASPs go from $7.50 per/kg to a median price of $11.50 per/kg. Daqo's stock has moved up accordingly. In a market driven by supply and demand, how long with today's prices last?

On the most recent quarterly earnings call, DQ's management believes the current price environment will remain prevalent for 15 - 18 months. Downstream demand drivers are outpacing any increase in supply-side capacity of polysilicon. The demand-driven mismatch should keep average ASPs in the current range for the foreseeable future, with Daqo participating in any future supply capacity additions.

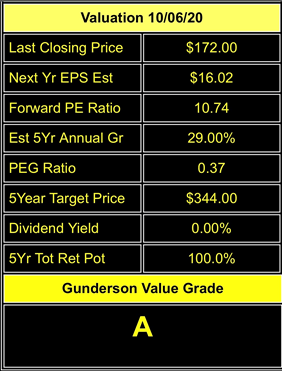

As analysts continue to revise their estimates upwards, the long-term prospects for the stock still seem undervalued with a forward P/E ratio of under 11 and a PEG Ratio at 0.37. In our opinion, the reduced variability of earnings over time as the industry continues to mature is not being accounted for.

For example, over 70% of DQ's production capacity is dedicated to two of the largest downstream partners in the Chinese solar market, LONGi and JinkoSolar (JKS). This greatly reduces the risks of inventory build-up and carrying costs.

From a long-term perspective, I believe the market will take a bit to accept the new set of tracks the solar sector is now on. With the new wheels demonstrated by the sector, Daqo New Energy Corp. is positioned to benefit and has the track record to execute. Proven cost-cutting measures, coupled with access to additional capital via the planned Xinjiang Daqo IPO, give DQ the fuel for visible sustainable EPS growth.

I currently hold DQ in the Gunderson Capital Emerging Growth portfolio indicative of our "Very Bullish" rating and 5-year price target of $344. We see Daqo New Energy Corp. as an attractive way to gain exposure to alternative energy, within the Chinese market. Buckle your safety harness and enjoy the ride.

*All Data From Best Stocks Now Database Unless Noted

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 23 years of experience.

You get Bill's daily "live" buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, and Dividend & Growth. Our Ultra-Growth portfolio has more than doubled the returns of the S&P 500 since its 1/1/2019 inception, while our Premier Growth portfolio has doubled the returns of the market during that same time-period.

JOIN NOW to get daily "live" buys and sells, weekly in-depth market-timing newsletter, access to Bill's proprietary database with daily rankings on over 5,300 securities, and a daily live radio show!