Article Thesis

Arcturus (NASDAQ:ARCT) has seen its share price explode upwards in 2020, mainly due to speculation around tailwinds from a potential COVID-19 vaccine. Such a vaccine could, indeed, generate sizeable revenues and profits for the company, but nothing is guaranteed and competition is fierce. We believe that other stocks could be a better play on a vaccine, which is why we are not bullish on Arcturus, even though we were at one point in the past.

An R&D-Focused Small Biotech Company

Arcturus is a lesser-known, rather small biotech company that is focused on RNA medicines. RNA is a term many will likely have heard about in recent months, as it relates to the topic of finding a COVID-19 vaccine. It stands for ribonucleic acid, which basically is a type of coding genomics, somewhat similar to DNA.

Arcturus targets a range of indications with its products, made up of RNA medicines and RNA vaccines. The company is, however, not yet at a point where it has any drugs on the market that generate meaningful revenues, which is why it has generated sales of just $2.3 million during the most recent quarter. This is, by far, not enough to operate profitably, and the company's top line number is also not high enough to supply meaningful cash flow. According to its most recent 10-Q, Arcturus had an operating cash burn of $20 million during the first six months of fiscal 2020, or $40 million on an annual basis. At the end of the period, it had $162 million in cash, which would be enough to finance operations for a full four years at the cash burn rate that was recorded during the first half of 2020. That is not a bad position for an R&D-focused biotech, as four years of development could get the company quite far in case its pipeline candidates are delivering solid results.

Even better, Arcturus has issued another $170 million worth of shares during the third quarter, which is why its cash position at the end of Q3 likely was somewhere around $320 million:

$160 million at the end of Q2

+ $170 million through the secondary in Q3

- $10 million in cash burn during the quarter (at the pace of H1)

$320 million in available cash should be more than enough to finance Arcturus' operations for a couple of years, which is why liquidity isn't a near-term concern with this company. The secondary, done at a share price of $53, shows that management has proactively used the recent share price strength to increase available funds, which seems like an opportune move. On the other hand, management's willingness to increase the share count quite meaningfully at that price could indicate that management sees shares trading above fair value - if they thought shares were cheap, they surely wouldn't have issued equity. Shares are currently trading at $57, thus slightly higher than the price where management was willing to sell shares, which could be an indication that current prices are on the high side relative to what management thinks intrinsic value looks like.

Looking at Arcturus' pipeline, we see that candidates include LUNAR-COV19, a COVID-19 vaccine candidate (and the reason shares have performed very well in 2020), as well as LUNAR-OTC and LUNAR-CF. The latter two target ornithine transcarbamylase deficiency and cystic fibrosis, respectively. OTD is a urea cycle disorder that leads to increasing ammonia levels that can become toxic at some point, whereas cystic fibrosis is a genetic disorder that mostly affects one's lungs, but also other organs.

Among these two, CF is the by far bigger indication, with a market size forecasted at more than $30 billion by 2027. CF, however, is also a market many competitors are active in. Key players include Vertex (VRTX) with Trikafta, Kalydeco, etc. and Roche (OTCQX:RHHBY) with Pulmozyne, but there are additional companies that are developing treatments, including AbbVie (ABBV) and many others. It is not at all known whether Arcturus will become a meaningful player in this large market eventually.

Arcturus has a range of partnerships with major biotech/pharma companies to develop some of its pipeline candidates, such as with Johnson & Johnson (JNJ) for hepatitis B or with Takeda (TAK) for NASH. The willingness of such large and experienced players to partner up with Arcturus could indicate that its science is solid and its pipeline has value, although there is, of course, no guarantee for that.

COVID-19 Vaccine Hopes

Overall, so far, Arcturus looks like a solid, R&D-focused biotech company with a healthy balance sheet and ample liquidity. At the right price, shares could be a speculative, but potentially rewarding play for those that believe that its pipeline and partnerships will eventually deliver meaningful revenues a couple of years down the road. In recent months, however, shares exploded upwards not due to its candidates in CF, OTD, etc., but due to one single reason, which is the company's COVID-19 vaccine candidate.

Shares have risen by a massive 397% year to date, with most of those gains following the news around its vaccine development. It is impossible to forecast what vaccine candidate will be the most efficient one, and it is even possible that none of the current candidates will result in a strong enough immune response to warrant global roll-out. We know, however, that Arcturus' candidate does not belong to the leading COVID-19 vaccine candidate in the world. Those in leadership position, with phase III funding through Operation Warp Speed, are the candidates developed by Moderna (MRNA) (mRNA-1273), AstraZeneca (AZN) (AZD1222), and Pfizer (PFE) and BioNTech (BNTX) (BNT162). It seems reasonable to assume that these have the biggest chance of becoming the vaccine of choice eventually, although there are no guarantees here, either. Other major players with candidates include Johnson & Johnson, which has a candidate in phase III, and Novavax (NVAX), which also has a phase III candidate. Arcturus is not among those with a phase III candidate for now, although it has been testing its vaccine in a phase I/II trial in Singapore.

What We Think About Arcturus Here

Since we won't know whether any of the vaccine candidates will turn into a big success, and since it seems rather unlikely that Arcturus' candidate will be the winner, putting money into the stock now seems like a somewhat risky bet, we believe. If Arcturus' candidate turns out to be very efficient, the company could generate high revenues from that, but those would nevertheless be limited in time, and this will, even in a bullish scenario, not result in a long-term earnings stream.

If, however, Arcturus' candidate turns out to be inefficient, or if other candidates simply are better, then this will not result in meaningful revenues for the company. Shares would, in this scenario, likely fall back to levels seen earlier this year, which could result in losses of ~80% for those that buy here.

Buying Arcturus shares now thus seems like somewhat of a binary bet - if things go right, you could gain a lot, but if things don't go perfectly right, you would likely lose a lot of money. For those that want to be part of such a bet, Arcturus could be the right choice. For those that have in-depth knowledge about the workings of vaccines, and that feel that the market is underappreciating the potential of Arcturus' candidate, the stock could be interesting as well. But for us, this looks like too much of a bet for now, and we believe there are better vaccine plays.

With Johnson & Johnson or Pfizer, for example, you get an established earnings and cash flow stream at a low price, strong dividends, and the vaccine kicker is an additional plus - but if the vaccine candidate does not deliver, there likely wouldn't be a lot of downside. Cash Flow Kingdom founder Darren McCammon has written about Arcturus in 2017, arguing that the merger with Alcobra allowed for a situation where shares could be purchased at a discount. Those that bought back then have seen very nice returns of more than 550% since then. Right now, following these huge gains, and the huge dependence on Arcturus' COVID-19 vaccine candidate, we are substantially more cautious with Arcturus. This is, we think, only a stock for those that have a high risk tolerance, and we do not deem it a good value at current prices. We rate Arcturus Neutral, and think that there are better vaccine plays from a risk-reward standpoint, even though Arcturus could have significant upside potential if everything goes right.

One Last Word

If you found this article interesting or helpful, it would be greatly appreciated if you "Follow" me by clicking the button at the top, or if you "Like this article" below, as this will help me in building an audience and continuing to write on SA. If you want to share your opinion or perspective, you are also very welcome to comment below. Happy investing!

Is This an Income Stream Which Induces Fear?

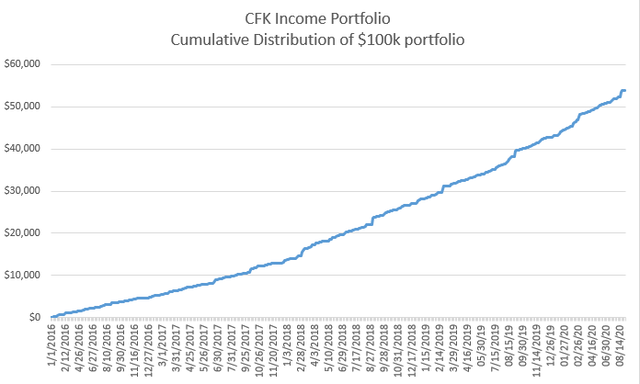

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% - 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio's price can fluctuate, the income stream not so much. Start your free two-week trial today!