Kingsoft Cloud Holdings Limited (NASDAQ:KC) is the largest independent cloud service provider in China. It was spun off from Hong Kong-listed Kingsoft Corporation Limited (OTCPK:KSFTF)(KGFTY) and made its debut on Nasdaq on May 8, 2020. By virtue of being the first Chinese company to list in the U.S. following the coronavirus pandemic stock market plunge in March, Kingsoft Cloud was able to attract investors keen on riding the remarkable V-shaped China recovery.

Consequently, Kingsoft Cloud was able to close its first trading day up 38 percent to $23.49, from the IPO price of $17, the midpoint of the indicative range. Although the stock backtracked in the weeks thereafter, it rebounded strongly from June and has been trading in a roughly $10 range since July.

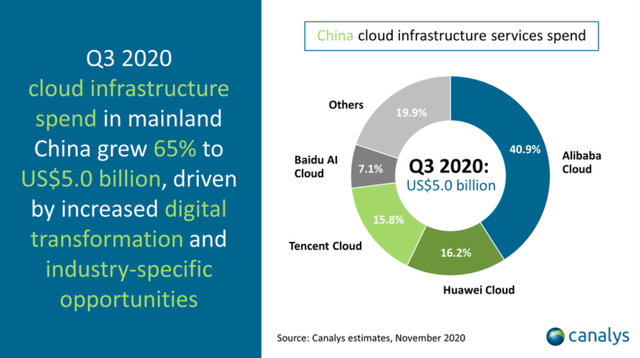

Internet titans Alibaba Group (BABA), Tencent Holdings (OTCPK:TCTZF)(OTCPK:TCEHY), and Baidu (BIDU) collectively held 63.8 percent of China's cloud infrastructure services spend as of the third quarter of 2020, according to research firm Canalys. Kingsoft Cloud, which is understood to be the fifth-largest player after Baidu, differentiates itself from the giants in the fast-growing market with its oft-mentioned neutrality.

Source: Canalys

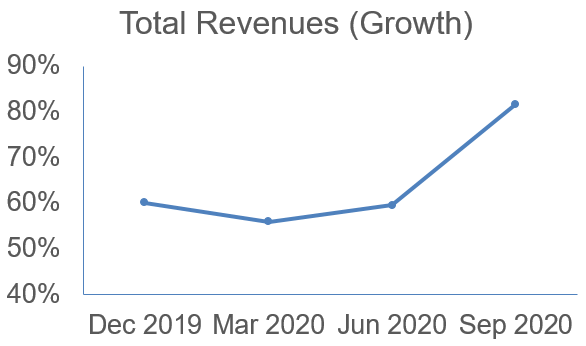

Mr. Yulin Wang, Chief Executive Officer of Kingsoft Cloud attributed the "ongoing digital transformation trends and the increasingly rapid roll out of enterprise cloud projects" across China for the solid revenue growth of 72.6 percent year-over-year [YoY] it achieved in the quarter ending September 2020. As a testament of the strong fundamentals, even as projects were deferred in the first quarter of 2020 on COVID-19 uncertainties and movement restrictions, its YoY growth stayed above 50 percent.

Source: ALT Perspective (company data)

Although the largest business segment of Kingsoft Cloud is the public cloud services, it is the smaller enterprise cloud services that grew rapidly. Revenues from enterprise cloud services jumped 257.3 percent to RMB409.1 million (US$60.2 million) from RMB114.5 million