Photo by NASA on Unsplash

Loral (LORL) is trading ~20% below an undemanding base-case fair value ahead of an expected Telesat IPO next year, in which LORL holds a majority stake. Much depends on the economics of LEO (Low-Earth Orbit) satellites, as that, for better or worse, is likely to consume Telesat's attractive cash flow and possibly more. There are reasons to be bullish on LEO investments. There is a broad spread of potential outcomes with a positive skew.

I wrote last May that Loral and Telesat may collapse their two company structure as negotiations continued. That is now planned for 2021, as the entity ("new Telesat") expects to list on the Nasdaq, and possibly in Canada too. This is "expected to close in the second or third quarter of 2021". LORL shareholders will also receive a $1.50 special dividend this December (payable on December 17 to shareholders of record on December 4).

The question now is, where might "new Telesat" trade as a more liquid satellite name?

The LEO Push

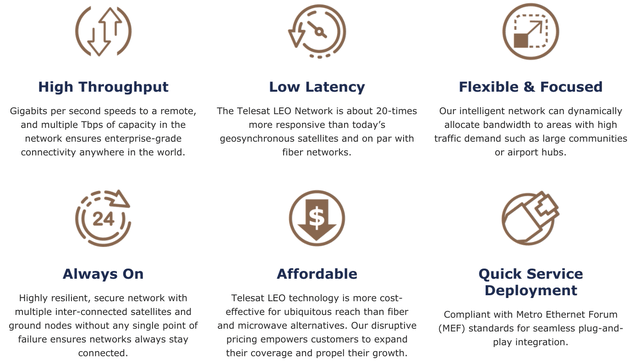

Somewhat related to this announcement, Telesat will go ahead with a capital-intensive push to build out a LEO constellation of 298 satellites. Rather than single bulky satellites weighing tons serving a large geographic area, a group of far smaller satellites will work together to provide communication services. This offers customer benefits as shown below.

(Source: Telesat website)

Competitive Dynamics Of LEO - A Growth Story

The economics of LEO may be favorable, but it will be a "growth" rather than a "value" story for some time as billions are spent deploying LEO infrastructure and new services are established.

The push to implement LEO is not exclusive to Telesat:

- Amazon (AMZN) plans to invest $10 billion in Project Kuiper.

- Elon Musk's SpaceX (SPACE) has already launched the Starlink LEO