Introduction

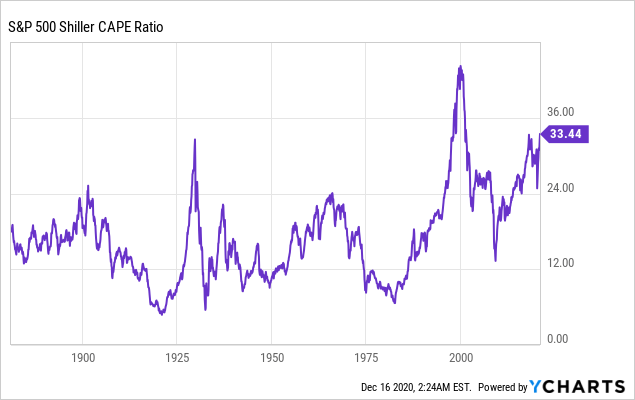

Investors are trapped in a dilemma. Many multiples point to an overvaluation of the market on a broad front. For example, look at the Shiller P/E ratio, an inflation-adjusted comparison of the stock price with the average ten-year earnings. Investors valued the S&P 500 only at two points higher than now. One was before the Great Depression and the other when the tech bubble burst.

Data by YCharts

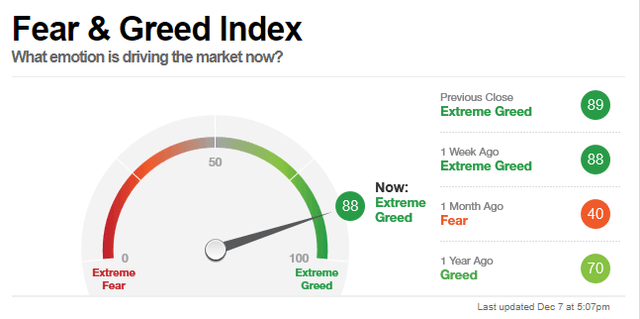

Data by YChartsConversely, investors also know that it is best to stay invested statistically speaking because you cannot predict the market. Additionally, the current market phase is, in my view, characterized by fear and greed. There is certain greed in the markets, as the CNN Fear & Greed Index showed us recently. While the index is very volatile, the Fear & Greed Index correlates with corrections or crashes even if it cannot predict these events' strength.

Source: Fear & Greed Index by CNN Business

On the one hand, there is greed for wealth as quickly as possible. On the other hand, there is the fear of missing out on the wealth that the others could achieve. And with every percent that these stocks rise, a self-fulfilling prophecy manifests itself.

Conversely, we also know that every party will find its end at some point. And most of the time, it was always the case that the volume of the party music correlated with the bang's magnitude. There has never been a "this time everything is different." Therefore, it is unlikely that it will be different this time. However, I fear that investors' frivolity could accelerate the correction or crash (whenever it comes). Responsible for this is a cognitive distortion, which I would like to describe in more detail below.

The perspective has changed

In my view, investors are making one of the worst mistakes. It took me a while to understand why investors buy companies with such airy multiples. It was a conversation with a colleague who told me that he purchased Amazon (AMZN) because he expects the price to rise. However, this was not based on the idea that the price would increase because Amazon is growing enormously, and multiples like P/E ratios are not very meaningful here because the company deliberately does not want to make a profit.

Behind this purchase decision was simply the expectation that the price will rise. For me, who wants to become an owner of companies and therefore wants to get a substance for his money and not just a coupon that might increase in value, this consideration was new. In this respect, the perspective has changed. A share is no longer the proof of ownership of a company but a kind of betting slip with which one can bet that share prices will rise. With this change in perspective, the focus has shifted significantly from investing to speculating.

The cognitive misconception

One of the reasons for this change of perspective is a cognitive misconception, which I have recently encountered more often, especially in some of my articles' comments. Some investors confuse a company's success with a good investment and establish a kind of necessary causality between these two poles.

You must make a clear distinction between an investible company and a good investment. Just because a company is successful, grows, and generates better earnings and cash flows, it does not automatically become a good investment. The question is how much you have to pay to become the owner of these profit and cash flow machines. What I mean by this can be seen in the following companies, some of which I hold myself in my broadly diversified retirement portfolio or have recommended here at Seeking Alpha.

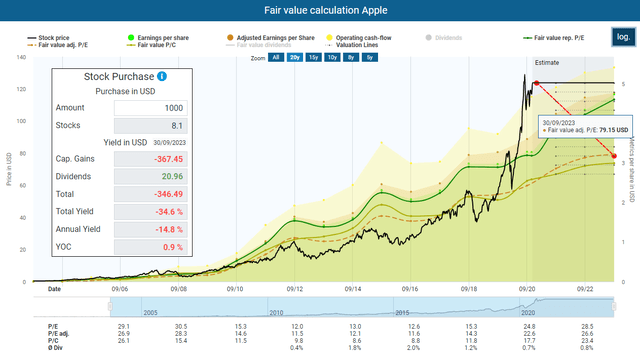

Apple (AAPL), for example, is an excellent company, and I predict great prospects for them. The transformation from a pure hardware company to an integrated service giant with good prospects in the healthcare segment has been successful. This development was already foreseeable many quarters ago, and the reason why I put Apple in my portfolio. So Apple has an investable business model. But does that also make Apple a good investment?

Fundamentally, Apple was undervalued for almost ten years and offered investors an excellent opportunity to increase their shares in the company over the long term. That has changed in the meantime. Look at how Apple has grown since the COVID crash. Is the company different now than it was a year ago? Have the fundamental prospects of the company changed? Why is the company today worth more than 80 percent more than it was a year ago? There are no rational reasons for this.

Fair value calculation Apple, Source: DividendStocks.Cash

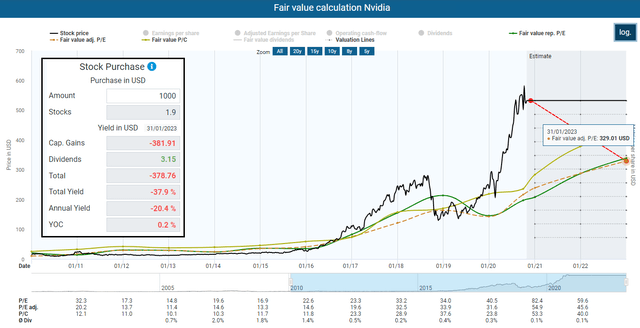

Also, Nvidia (NVDA) is such a "Chase the Runner" stock. The company is exceptionally well-positioned in future markets. 5G, the ARM acquisition and the tailwind of the expected growth in the cloud market will ensure that Nvidia will massively increase revenues, cash flow, and profits in the coming years. In my latest Nvidia analysis, I wrote:

Growth is always right, and Nvidia is growing like crazy. Since 2016, revenue has risen from USD 5 billion to an estimated USD 15 billion this year. But the growth will continue. According to analysts, revenues are expected to reach almost USD 20 billion in 2022 and USD 22 billion in 2023. Earnings per share will also increase. Last year, EPS was USD 6.63 per share and is expected to be USD 10.5 per share in 2023. Rising margins accompany this development. The gross margin in 2016 was still 56.6 percent. It currently stands at over 63 percent. The net margin was 12.2 percent in 2016 and is now more than twice as high at almost 26 percent.

And of course, a company with such prospects is an excellent investment opportunity. But it is not automatically a good investment if you have to pay so much that the purchase price completely eats up the expected opportunities. What then remains fundamental are risks or at least an adverse opportunity/risk ratio. An investable business does not necessarily correlate with a good investment. Nvidia was an excellent investment and, in some cases, even undervalued before it (like Apple) took off at the beginning of the year to such an extent that I consider it too overvalued.

Fair value calculation Nvidia, Source: DividendStocks.Cash

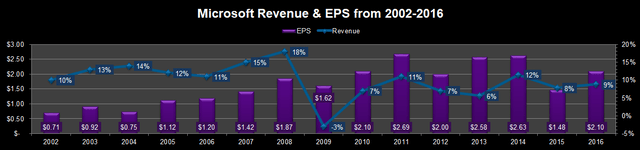

A third company is Microsoft (MSFT). And it is precisely here that I find it fascinating how investors fade out what the dot.com bubble burst made with the stock. It has been shown in an almost exemplary manner that growth does not necessarily correlate with rising share prices. The company grew from 2002 to 2016 at a respectable pace.

Microsoft revenue & EPS from 2002-2016; taken from MSFT investor relation/graph by author

But there was not much left for investors. Investors who bought the stock at the peak of the tech bubble suffered book losses of 60 percent. It took a full 15 years for the share price to break-even again. Right now, the stock has also massively departed from its fair values and is trading almost 30 percent above appropriate values based on adjusted earnings expectations for 2023.

Fair value calculation Microsoft, Source: DividendStocks.Cash

Dividend stocks that are worth a second look

So how can one escape from this dilemma? I think it is difficult. On the one hand, we see the massive stock price developments. On the other hand, we have a terrible feeling about playing this game. It would also be wrong to keep your hands off the tech stocks because there is no denying that they will play a significant role in shaping our future. Those who think long term and have an investment horizon of 15, 20, or 30 years should also be able to sleep soundly despite the high valuations. Microsoft, in particular, has seen that such companies do not disappear despite overvaluation. Even overvalued shares can, in the long run, grow back into fair valuation and justify higher prices. It may just take time.

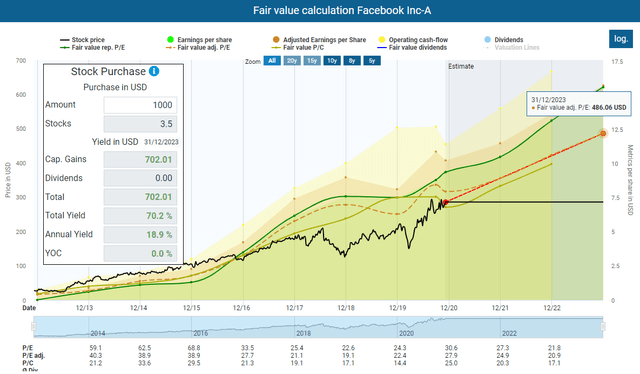

There are also fair or undervalued tech stocks compared to their historical multiples. Facebook (FB), for example, is currently trading at a substantial discount and, unlike the companies mentioned above, has more or less completely missed the rally.

Fair value calculation Facebook, Source: DividendStocks.Cash

I also think the dividend is a good indicator for a good investment. The ratio of cash flow to share price is also an excellent measure to examine how far companies have moved away from their historical fair values. Why is that so? The reason is the answer to the question of why I invest. The following words by Warren Buffett are a proper way to summarize my philosophy:

The only reason for putting cash into any kind of investment now is because you expect to take cash out; not by selling it to somebody else because that’s just a game of who beats who.

These are not empty words. Instead, they have consequences for your investment decisions. They focus on investing and not on speculation, which brings us back to the distinction mentioned above and the shift I have observed towards speculation. According to this philosophy, dividends and cash flow show you the true return of a company to its investors. It's not about the share and what someone else is willing to pay for it, but what the company pays you in cash.

Therefore, it makes sense to look especially for those dividend stocks that have a return that is halfway in line with the historical average. One option is my TEV ex-dividend calendar, which summarizes the ex-dividend dates every week. Below you will find the ex-dividend dates for the upcoming week:

| Company | Payout Date | Yield |

| Monday, December 21, 2020 | ||

| Albany (AIN) | January 08, 2021 | 1.12% |

| CMC Materials (CCMP) | January 29, 2021 | 1.21% |

| Eversource Energy (ES) | December 31, 2020 | 2.66% |

| Medtronic Plc. (MDT) | January 15, 2021 | 2.02% |

| Medifast (MED) | February 05, 2021 | 2.26% |

| PerkinElmer (PKI) | February 12, 2021 | 0.20% |

| ProAssurance Corp. (PRA) | January 07, 2021 | 1.09% |

| The Toro Co. (TTC) | January 13, 2021 | 1.14% |

| Tuesday, December 22, 2020 | ||

| Agree Realty Corp. (ADC) | January 06, 2021 | 3.71% |

| Bank First Corp. (BFC) | January 06, 2021 | 1.21% |

| Gladstone Capital Corp. (GLAD) | December 31, 2020 | 8.78% |

| LTC Properties Inc. (LTC) | December 31, 2020 | 5.70% |

| Luminex (LMNX) | January 14, 2021 | 1.71% |

| Marvell Technology Group Ltd. (MRVL) | January 14, 2021 | 0.53% |

| Seagate Technology Plc (STX) | January 06, 2021 | 4.04% |

| Philip Morris Intl (PM) | January 11, 2021 | 5.61% |

| Washington REIT (WRE) | January 06, 2021 | 5.11% |

| Xcel Energy (XEL) | January 20, 2021 | 2.62% |

| VICI Properties (VICI) | January 07, 2021 | 5.07% |

| Wednesday, December 23, 2020 | ||

| Alico Inc. (ALCO) | January 08, 2021 | 2.27% |

| Franchise Group Inc. (FRG) | January 08, 2021 | 4.21% |

| Getty Realty Corp. (GTY) | January 07, 2021 | 5.23% |

| McAfee Corp. (MCFE) | January 07, 2021 | 2.27% |

| Dentsply Sirona Inc. (XRAY) | January 08, 2021 | 0.75% |

| Thursday, December 24, 2020 | ||

| Altria (MO) | January 11, 2021 | 7.98% |

| American Tower Corp. (AMT) | February 02, 2021 | 2.20% |

| Balchem (BCPC) | January 17, 2021 | 0.46% |

| Cerner Corp. (CERN) | January 12, 2021 | 1.14% |

| Danaher Corp. (DHR) | January 29, 2021 | 0.32% |

| International Flavors & Fragrances Inc. (IFF) | January 07, 2021 | 2.75% |

| Independent Bank Corp. (INDB) | January 08, 2021 | 2.42% |

| Investar Holding (ISTR) | January 31, 2021 | 1.56% |

| Limoneira Co (LMNR) | January 15, 2021 | 1.92% |

| Zimmer Biomet Holdings (ZBH) | Janaury 29, 2021 | 0.64% |

| Friday, December 25, 2020 | ||

| Merry Christmas! |

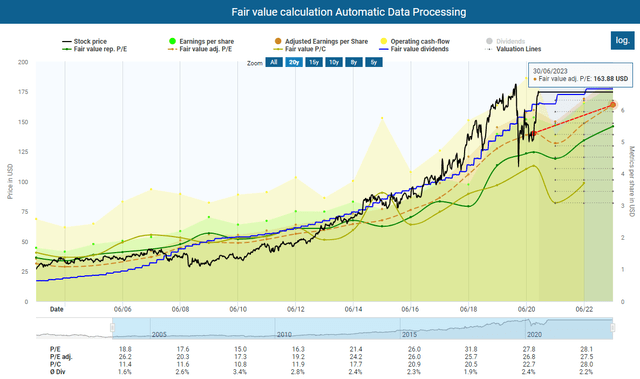

With my calendar's help, I was able to identify Automatic Data Processing as a good investment and bought the company in September. The company is still absolutely worth investing in. But after it has gained 30 percent in value within a short time, it is unfortunately no longer such a good investment. The company now also ranks above its historical dividend yield, which means that I will not make any further purchases of this stock for the time being.

Fair value calculation Facebook, Source: DividendStocks.Cash

Conclusion

The potential of the next correction or stock market crash could be substantial. Additionally, the destructive potential shifts from the financial world to society's social world because retail investors have a lot of skin in the play. I have already pointed this out several times (here, here, and here). However, there are increasing signs that retail investors can move the markets.

In many ways, the retail investor has become a more powerful collective force than the professional investor, and they simply don't care about the same things as the experts. In fact, individual investors now account for roughly 20% of stock-market activity on average and nearly one-quarter of trades on peak days, according to Joe Mecane, the head of execution services at Citadel Securities. The firm is the leading retail market maker in the U.S., handling 40% of the shares and options traded by individual investors.

...

The retail bros also don't care about traditional parameters of valuation (P/E and P/S ratios) and could always trade out of a stock for free because of commission-free trading.

This scenario combined with a wrong investment approach can increase the severity of the correction. Investors should, therefore, strictly adhere to their risk allocation rules. Besides, it is advisable to look more closely at fundamental data and speculate less solely on further price increases.

Some companies named in this article are part of my diversified retirement portfolio. If you enjoyed this article and wish to receive other long-term investment proposals or updates on my latest portfolio research, click "Follow" next to my name at the top of this article, and check "Get email alerts".