This article can be considered a sequel to my most recent article, "A+ Top Quant Rated Healthcare Stocks For Value, Growth, And Profitability." Both articles screen Seeking Alpha's Top Healthcare universe of 880 stocks for premium investment candidates.

The end product of the two different exercises is very different. In terms of market cap, the A+ article selected two top flyweight and one bantam weight contender; this article focuses exclusively on health sector heavyweights.

Here the discussion is on a less adventuresome quant screen that returns seven larger large cap (>$100 billion), high dividend (>3%) biotechs with attractive profiles. This article discusses the attributes which favor two of the seven, albeit each of the seven fits comfortably in a conservative retirement investment account.

Those interested in a detailed discussion of the content and organization of Seeking Alpha's quant rating system should access the A+ article. Of particular interest are its supporting citations, particularly the Steve Cress quant system founder, cited interview.

For investors during year 2021, safety will be particularly elusive for those seeking anything beyond a nominal yield.

I recently did something that spoke volumes about today's investing environment. I purchased a three year CD yielding 0.20%. Every thousand dollars invested in this CD will yield a magnificent return of $6.00 over three years. I could have scooped a marginally higher yield if I were willing to move away from the brokerage where I had the account, but that would be more hassle than it would be worth.

The following yield curve for US government securities paints the picture:

I got no bargain to be sure, but that 0.20% was pretty much at the market. Safety? I got FDIC insurance. It protects me if the bank issuing the CD becomes insolvent. I have no protection for the purchasing power of my investment.

With "safety" yielding so little, it is hardly surprising that investors are settling for a lesser species of safety for some portion of their nest eggs. This article speaks to yields available from the safer corners of the biotech universe.

A combination of quant and fundamental analysis pinpoints large cap biotechs (>$100 billion) with reasonable prospects for proliferating returns.

Based on the yield curve above, those who want the safety of US government yields are confined to yields of <~1% for ten years, ~1.5% for twenty years and not quite 2% for thirty years. In this article I am talking about yields of >3%, a nice multiple jump from those available from Uncle Sam.

Now such an increase is only worth it if the risk to principal is not too high. Accordingly, I will keep a keen eye on the risk as we go forward with this article.

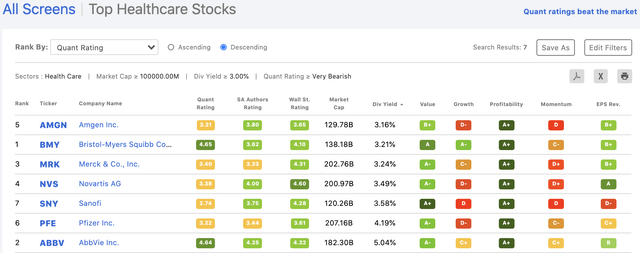

Seeking Alpha's quant ratings screener allows me to test my preference for large cap in my retirement biotech portfolio against a powerful screen of 880 healthcare stocks. The extract below (taken 12/28/20) shows the seven stocks in the quant top healthcare universe that have both market caps >$100 billion and dividend yields of >3%. In the extract below the seven are listed in ascending order of dividend yield:

Each of these seven stocks has its attractions and its supporters across all three ratings measures, quant, Seeking Alpha and Wall Street Analysts. They all show "A+" quant scores for profitability. All but Amgen rate at least "A-" for value with Amgen bringing up the rear on that metric with its "B+" for value.

Most have lengthy strings of annual dividend increases paired with reasonable payout ratios as shown below:

- AbbVie (ABBV) >25 years; payout ratio ~49%

- Novartis (NVS) ~23 years; payout ratio ~53%

- Bristol-Myers (BMY) >10 years; payout ratio ~31%

- Merck (MRK) >9 years; payout ratio ~43%

- Pfizer (PFE) >9 years; payout ratio ~55%

- Amgen (AMGN) >9 years; payout ratio ~43%

Interestingly, the only one of these seven to cut the dividend during the great recession was Pfizer, although to be fair Amgen did not pay dividends until 2011 and AbbVie was not a separate company until 2013.

AbbVie and Bristol-Myers stand out from the other five; between the two it is a toss up with Bristol-Myers scoring higher for dividend safety and for growth.

The large cap biotech grouping ranks at the top of the healthcare pack from a current profitability standpoint, all seven scoring A+. On the other hand, growth, of the sort which would comfort in terms of future profitability, is a far more challenging metric for large cap biotechs.

Low quant rated growth metrics for so many of the seven screened stocks on 12/27/20 warn that future profitability for these stocks may be challenging. The quant system assigns growth grades of "C-" to Merck, "D" to Sanofi (SNY), "D-" to Amgen, Novartis and Pfizer.

This quant screen growth deficit is discouraging for investors in those names but is no reason to kick them to the curb. The quant screen is helpful as a screen but should not be taken as the last word on any particular stock for any particular factor.

In sum, the focus on AbbVie and Bristol-Myers should not imply any negative view on those not selected. Rather, exclusively for his article, wishing to avoid paralysis by analysis, I am following the lead of the quant system and disregarding the others:

With overall quant rating grades of 465 for Bristol-Myers and 466 for AbbVie, they are functionally tied in this regard. Both are swallowing recent jumbo-sized acquisitions, Bristol-Myers' 4/12/2019 ~$74 billion acquisition of Celgene, and AbbVie's 5/8/20 ~$63 billion acquisition of Allergan.

Dividend safety and yield are contrasting factors with AbbVie at the top in terms of yield and Bristol-Myers for safety.

AbbVie's >5% yield coupled with its record of increases and its reasonable payout ratio of <50% have proved irresistible for many investors. Not too long ago in an 09/2020 article, "AbbVie: High Yield Dividend Anxiety," I pointed out as a cautionary note that AbbVie's dividend safety quant rating was "F."

It has since improved to a "D" as shown by the following 12/29/20 excerpt:

The question marks opposite the Dividend Grades heading leads to the following drop box explaining the grade system:

I do not draw much comfort from AbbVie's grade raise from "F" to "D." Its Q3 2020 10-Q (p. 4) shows substantially the same mountain of outstanding long-term debt as did its Q2 2020 10-Q (p. 4). It has the same issues with its pending Humira patent expiration as discussed in the article above.

This article is my first discussion of Bristol-Myers. It has priced its dividend more in line with the market as reflected by its several peers with equivalent dividends. In doing so it has earned a stellar quant dividend rating as shown below:

Its dividend yield and growth grades lag that of AbbVie; however, its trade-off in terms of safety and consistency will resonate with more cautious investors.

Its dividend yield and growth grades lag that of AbbVie; however, its trade-off in terms of safety and consistency will resonate with more cautious investors.

Conclusion

Today's investment climate poses serious roadblocks to investors who are looking for a combination of growth and yield at a reasonable price without undue risk. Both AbbVie and Bristol-Myers offer attractive investment options that check all four boxes. In doing so they stand out as potential dividend growth investments.