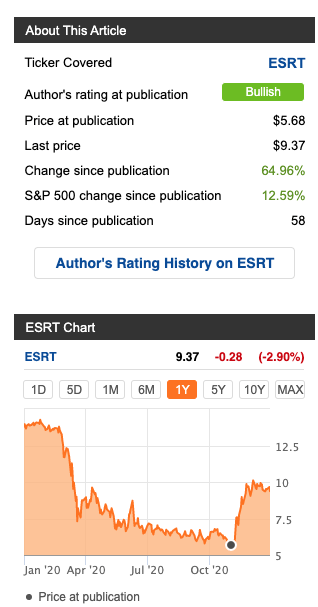

In early November, I published a bullish article on Empire State Realty Trust (NYSE:ESRT). My bullish stance wasn't premised on a quick snapback of the commercial office market in New York as the economy comes out of a recession. Quite the contrary, I believed (and still do) that the New York office market is extremely challenged. And the powerful impact on demand and supply caused by a confluence of secular and cyclical forces will take the best part of a decade (or more) to work through.

My bullish thesis, however, was primarily based on a wide margin of safety embedded in the share price underpinned by uncorrelated future cash flow from the Empire State Building Observatory. I calculated that on a fully normalized basis, the valuation at that point was to a large extent supported single-handedly by the Observatory. Or in other words, by buying the shares, one is effectively gifted a considerable commercial office portfolio for a small fraction of its value.

My thesis seemed to play out quickly as the stock catapulted higher in a short time frame.

Given the sharp move up in the stock, I am now changing my rating to Neutral. In my view, it is time to start thinking about thinking of fading this rally.

(Source)

The Thesis

The NY commercial office market is exceptionally challenged in the medium term. In a sense, it is a perfect storm where a confluence of both secular and cyclical factors is hitting this market at the same time.

The secular forces include the "remote working" and "shared office" trends.

The cyclical factors include an office glut that will take the best part of a decade or longer to work through. The situation is further exacerbated by increased sub-leasing activity driving transactions' prices lower as is typical of this part