Source: Sprout 4Q20 Investor Presentation

Introduction

My investment thesis for Sprout Social (NASDAQ:SPT) mirrors my investment thesis for Shopify (SHOP) to some extent; in that, one of the central pillars of my investment thesis for Shopify in early 2019, when I was buying the company originally, was that it was the best platform for omnichannel selling of physical products. Today, Shopify unequivocally remains the best platform for selling physical products via an omnichannel strategy, i.e., selling through Instagram, Facebook (FB), a company's main website, Pinterest (PINS), etc.

Similarly, Sprout Social enables companies to optimize the execution of their content strategy via an omnichannel approach to social media. In essence, Sprout Social optimizes that voice (of the brand; not actual voice) and messaging that often corresponds with physical products being sold from a platform like Shopify; though Sprout Social fits within any business, product-oriented or not, that's looking to communicate a message via an omnichannel social media approach.

In short, Sprout Social certainly has a winning approach in our current world of ever-proliferating social media channels.

Investment Thesis

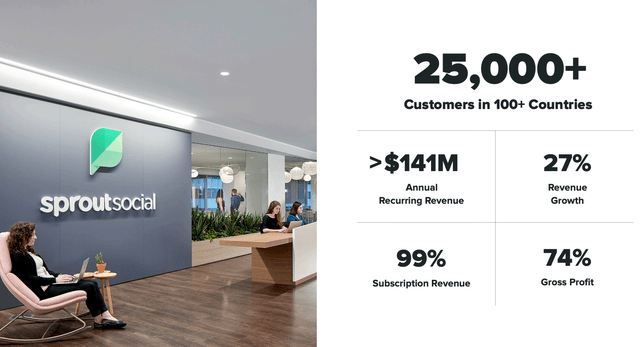

From a more technical perspective, Sprout Social is a cloud-based software company that provides solutions for its customers to easily manage their social media accounts in such a way that they get the most out of them (higher ROI on resources expended by the business).

With the proliferation of Social Media channels in full swing, e.g., TikTok, Facebook, Instagram, Snap (SNAP), Pinterest, and many more, companies' social media operations have become entire divisions of their businesses. These social media channels are no longer optional: they are core drivers of business development.

As the world continues to blend the digital realm with the physical realm, social media sales, in many instances, will become the sales for a company, if they are not already so.

Beating the Market: The Time Is Now

There has never been a more important time in stock market history to buy individual stocks at the heart of secular growth trends. Mature market performers/underperformers and index funds simply will not cut it, as we face a decade during which there is absolutely no guarantee the overall markets will rise.

This is why the time is now to discover high-quality businesses with aggressive, visionary management, operating at the heart of secular growth trends.

And these are the stocks that my team and I hunt, discuss, and share with our subscribers!