Rockwell Medical (NASDAQ:RMTI) came across our desk as an attractive value play with plenty of potential. This company operates in the iron deficiency market where its goal is to improve patients' lives through its respective treatments. First off, the stock is cheap from both a dollar standpoint as well as from a valuation one. Shares are trading with an ultra-low sales multiple of 1.2. The 10-year average for example comes in at 4.5. Furthermore, the stock is optionable which means we have the opportunity to reduce basis by selling options against a basket of shares.

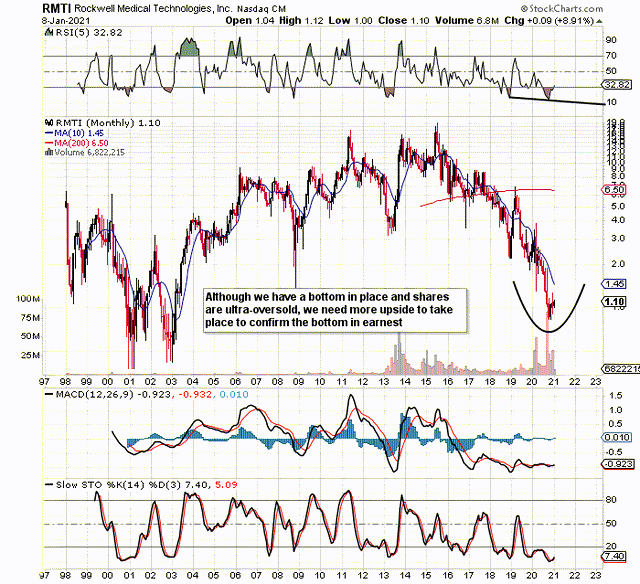

The undervaluation of the shares can really be seen on the long-term chart below. Shares dropped well under $1 a share late last year but have already rallied over 30% off their lows since last October. From a technical perspective, we would be taking a "wait and see" stance here for the following reason. Momentum for example really accelerated to the downside prior to the bottom shares printed last October. This means we continue to see bearish divergences on the RSI momentum indicator.

From a sheer technical standpoint, we would be first looking for the 10-month moving average ($1.45) to be taken out before contemplating putting long deltas to work in here. Investors only need to look at where the share-price traded around 2014 and 2015 to see the potential here. Therefore we do not mind giving up some upside here. If indeed, rising prices are ahead of us, we should be seeing some bullish trends in the financials and fundamentals. Therefore, let's delve into the most recent quarterly earnings report to see where we stand.

From a forward-looking earnings standpoint for example, analysts who cover this company definitely see potential. Earnings in the most recent third quarter met expectations at -$0.08 but projections are expected to significantly improve in Q4 and beyond. Although net profit in fiscal 2021 is expected to also be negative, consensus expects a 74% improvement in EPS (-$0.19) over 2020. Therefore it is fair to say that investors undoubtedly will be asking when the company will finally be able to generate a profit. Followers of our work will be fully aware that our value picks almost always are profitable either from an earnings standpoint or a cash/flow standpoint. Rockwell's cash/flow generation long-term record is very similar to its earnings record - predominately negative.

In fact, top-line sales have been the only key financial metric which has held its own over the past decade (1%+ annual growth on average per year) and management reiterated this on the latest earnings call. In fact, the forward sales multiple of 0.93 looks very attractive due to the 62% expected increase in top-line sales in 2021 ($110 million).

Although margins have been shrinking, Rockwell's sound revenue base gives the company a firm footing in dialysis clinics in the US. Rockwell hopes to gain more momentum from Triferic AVNU rollout as it should be able to piggy-back on top of the success of Triferic Dialysate to date.

Momentum though is not only expected from the home market but also internationally in markets such as China, India & South Korea where Rockwell has already made inroads. The size of the market here though is key for the bulls not just with respect to the amount of people who need iron but also how the condition is generally treated. Intravenous iron for example has to be administered frequently to patients due to the limitations of current treatment options (Tablets, etc).

This is where Rockwell's FPC (Ferric Pyrophosphate Citrate) platform could be a key fundamental driver for the company. The reason being is that through this platform, iron can be immediately available to organs irrespective of inflammation (which traditionally restricts the flow of iron) and can be administered at home. Therefore, management intends to develop this platform for new indications not solely in the iron deficiency segment but also in other areas where there are large unmet medical needs.

To sum up, although we expect solid momentum from the roll out of Triferic AVNU in due course, the real potential in Rockwell's eyes will be the upcoming trials in FPC for both home infusion therapy and congestive heart failure. If Rockwell can gain some solid wins here, the share price should easily bounce into double digit numbers. We though will wait for some solid resistance levels to be taken out first starting with the 10-month moving average. Rockwell has serious potential but the COVID situation may also delay matters somewhat over the near-term. Let's see what the fourth quarter brings.

----------------------

Elevation Code's blueprint is simple. To relentlessly be on the hunt for attractive setups through value plays, swing plays or volatility plays. Trading a wide range of strategies gives us massive diversification, which is key. We started with $100k. The portfolio will not stop until it reaches $1 million.

-----------------------