Vertiv (NYSE:VRT) continues to sparkle as this under-covered technology gem rides the tailwinds of a digitizing global economy. It’s easy to underappreciate the momentous secular growth in data usage which has been accelerated by the COVID-19 pandemic and driven demand for the company’s data center and power solutions. Most will notice an increase in online shopping and a spike in Zoom (ZM) and other communications technologies making virtual meetings possible. But behind the scenes, all of those expanding activities need reliable infrastructure and connectivity. Not just in major urban areas, but increasingly to more rural or distant patches of the telecommunication network as remote work and virtual living expands beyond large corporate headquarter buildings. Benefiting from these trends, Vertiv is clearly in growth mode and set to leverage its cost base to improve margins. But it’s still priced more like a stodgy industrial company, at least according to today’s valuation levels. We previously mentioned that we’d revisit the investment case when the shares crossed $20, and now we have the opportunity to do so.

We conclude that Vertiv still has plenty of upside in a mostly overpriced market, and don’t plan to sell our position.

Vertiv continues to grow and expand margins

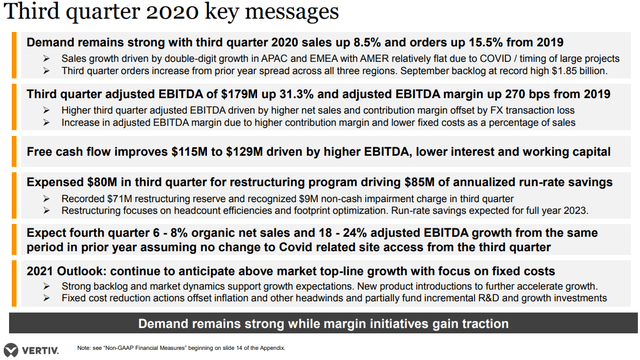

Since our last update in August of 2020, Vertiv has reported its third quarter results. It’s clear from the results that Vertiv remains on a growth path in both revenues and margins. Revenues in the quarter were up 8.5% with orders being up 15.5% while the adjusted EBITDA margin expanded 270 basis points. Importantly, free cash flow production was also strong, padding a recently restructured balance sheet.

Source: Vertiv 3rd Quarter 2020 Results Presentation

We should see that solid revenue growth and margin performance in the upcoming fourth quarter results, and we see little reason to doubt company guidance for 2021. Management flags the strong backlog, and importantly, new product launches as drivers for the anticipated above market top-line growth in the period.

Structural growth drivers are intact and often strengthened by the pandemic

Vertiv is riding on the tailwinds provided by increased data usage, as well as cloud, colocation and 5G related initiatives. It’s clear that digitalization is on “fast forward” as the company describes it. One impact of digitalization (sometimes combined with remote work) is that secure, reliable and efficient networks will need to be expanded to the “edge” or more remote/rural locations. That means more investment in Vertiv’s products as the IT ecosystem essentially expands in size and complexity. Efficiency and reliability will be critical. Monitoring hardware and software will, for example, be needed to minimize site visits in remote areas.

Vertiv’s energy and thermal related solutions are also set to benefit from structural growth trends. Businesses and consumers alike are benefiting from 5G technology as it is rolled out and makes exciting new applications possible. But 5G requires a dense network that is estimated to increase energy demands 3.5 times more than 4G, according to Vertiv. The natural result, as sustainability comes more and more into focus, will be on reducing energy consumption and efficiency.

For investors curious about Vertiv’s growth drivers, we suggest this short video detailing several opportunities.

The stock has boomed, is there still upside?

This article is meant to confirm that Vertiv is executing well according to our investment case, but also to reevaluate the valuation opportunity. The stock traded at about $16.50 the last time we posted an update, and there was clearly substantial upside at that point. We were happy to see investors like Leon Cooperman from Omega Advisors decide to build a stake in the company. The stock price has since crossed $20, triggering a valuation review from our side.

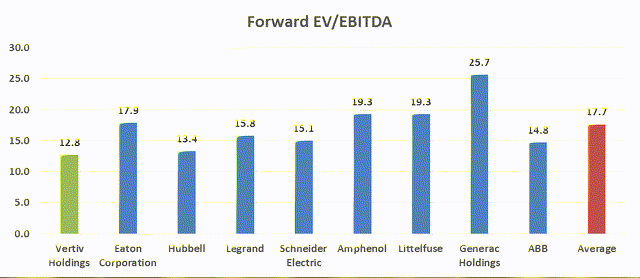

Sell-side analysts remain generally positive on the company with many covering the name having a buy or strong buy rating for the company and an average fair value listed at $24 according to Refinitiv. The share price has risen over 20% since our last update, but the forward adjusted EV/EBITDA multiple close to 13x is essentially the same as it was in August of last year. Unlike much of the market where share prices have risen on the back of expanding multiples (and stagnant or declining earnings), Vertiv has grown and is set to grow earnings substantially with strong double digit increases looking likely over the coming years. The end result is that valuation continues to look attractive. If the market applied an EV/EBITDA multiple in-line with the peer average shown below, it would mean more than 30% upside. And we would argue that a company with expected earnings per share growth for 2021 in excess of 30% (according to Refinitiv) might deserve a premium valuation.

Source: Refinitiv

We see no need to exit a company that is executing well on our investment case that has significant upside potential. And with so few quality growth opportunities trading at a discount and offering reasonable predictability, we don't plan on selling our shares.

Conclusion: It’s still not time to sell Vertiv

Vertiv has powerful structural growth drivers related to explosive growth in data usage and the consequent need for data center and telecom infrastructure such as 5G. While the COVID-19 pandemic has presented headwinds for part of the company’s business, it has also accelerated and accentuated many of the growth drivers in key product areas. The company also has many levers to pull for margin improvement and has already started down the path to a higher EBITDA margin. Recent order intake, free cash flow and coming product introductions give reason for optimism. Vertiv’s valuation remains reasonable, or even highly attractive should the company close the gaps to peers in terms of margins and multiples. We plan to consequently maintain a position in the company, but will keep position sizing in mind as usual. In short, Vertiv has a number of attractive attributes combined with several potential upside drivers to the current share price, and now is not the time to sell.