The ongoing low interest rate environment has undoubtedly led to increased interest in dividend-focused ETFs. Readers will no doubt be aware of the big domestic names, with the likes of VYM and DVY now holding tens of billions of dollars' worth of assets combined.

Their international-focused cousins, on the other hand, remain quite a bit smaller. Take BATS:IDV for example, or the iShares International Select Dividend ETF to give it its full name, which sports net assets in the $4B region.

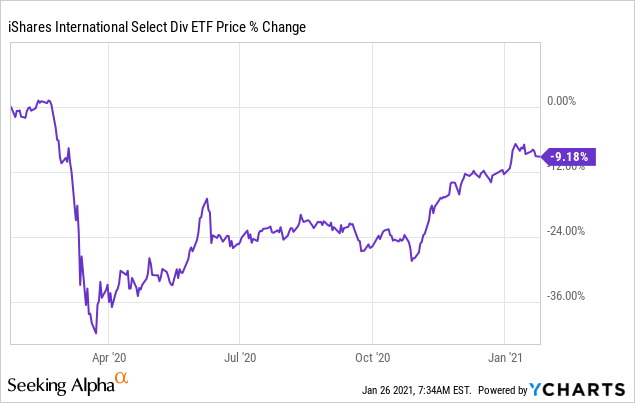

Past performance here does not look so great compared to its larger domestic-focused peers. Still, with international equities arguably offering a decent value case these days, now may be a good time for investors to take a closer look abroad.

Methodology

A good place to start is usually with the index being tracked. In terms of IDV, that leads us to the Dow Jones EPAC Select Dividend Index. EPAC stands for Europe, Pacific, Asia and Canada, and that makes the full title pretty self-explanatory: developed world ex-US dividend stocks, essentially.

The methodology underpinning the index is also fairly straightforward. It first takes companies in the S&P EPAC BMI and the S&P Canada BMI indices, excluding REITs. Rules based on dividend history, dividend cover, size (float-adjusted market-cap of at least $1B for new entrants; $750M for current constituents), volume and so on are then introduced. Readers will note the lack of any mention of quality screens, but more on that below.

The first 100 stocks based on dividend yield make up the prospective index, albeit with some extra rules that favor current constituents in order to reduce turnover. For instance, current constituents ranking in the top 200 rather than the top 100 get to stay in.

Weighting is a bit more complex: countries are weighted according to yield; stocks are weighted by annual dividend within their respective countries. Multiplying those weights together produces the final weight of each constituent within the index.

Portfolio

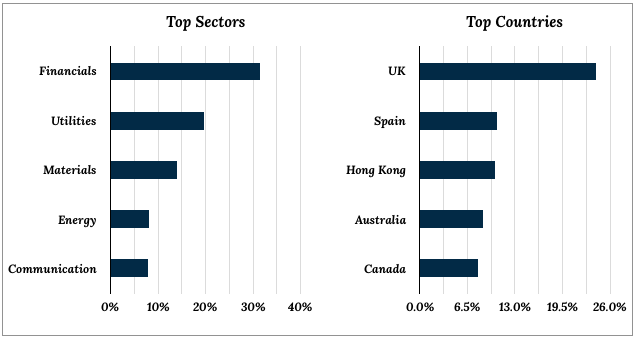

As you would expect, the above leads to a plethora of sectors that offer pretty fat dividend yields. Financials, miners, utilities, telecoms and energy stocks all feature quite heavily here.

In terms of the portfolio, a few other points are worth mentioning for investors. Firstly, the methodology outlined above can result in outsized country exposure. Stocks listed in the UK, for example, currently make up a hugely disproportionate share of the portfolio.

Source: iShares IDV Fact Sheet

Source: iShares IDV Fact Sheet

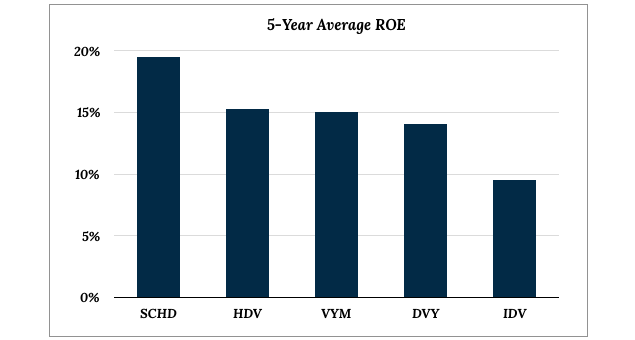

The second point relates to earnings quality, which clocks in lower at IDV compared to domestic-focused peers. Broadly speaking, ETFs will behave in a similar way to individual stocks in that three things will drive long-term returns: quality, growth and valuation.

All three are connected of course, with the latter two largely self-explanatory. Quality - as shown by higher ROIC and higher ROE - supports higher shares of profit going to investors. Or put another way, high quality stocks can pay out a higher share of earnings via things like dividends and buybacks while still growing underlying earnings at the market-average rate. At the risk of stating the obvious, higher quality is clearly more desirable than lower quality.

Source: Author Calculation

The third point rests on the dividend yield. IDV will always offer a very high current yield, relatively speaking. The current 5-year average yield stands at 5.4% according to Seeking Alpha data, which compares quite favorably to a basket of similar ETFs. Of course, this doesn't confer any special advantage in terms of total returns, though it may appeal to those investors looking for current income.

Performance

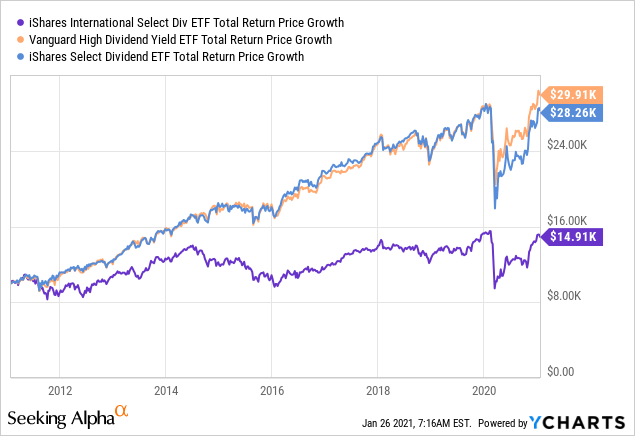

Reading previous articles on the site, it is clear that historical performance is one of the major issues when it comes to the international dividend vehicles like IDV. Many readers rightly point to their historical performance versus US-focused ETFs, which is quite poor. IDV, for example, has returned just 3.8% per annum over the past ten years. Domestic counterpart DVY returned a much healthier looking 11% per annum over the same period.

Data by YCharts

Data by YCharts

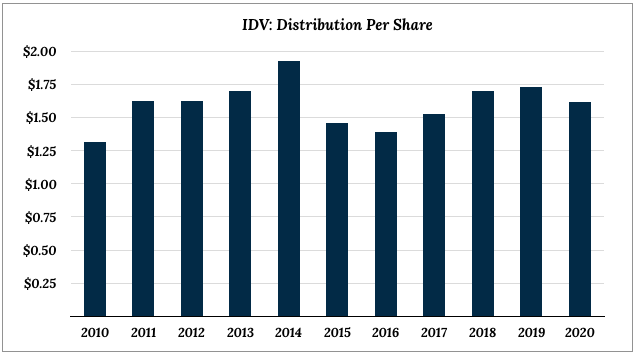

Likewise, dividend growth looks a whole lot better for the home team. IDV recorded a dividend growth rate of just over 2% per annum over the past decade. DVY puts that to shame, with its 10-year DPS CAGR currently standing at just over 7.5%.

Source: Seeking Alpha

Due to IDV's composition, that appears to be the norm. IDV holds lower quality stocks on the whole, but with a higher payout ratio too. That, in turn, produces a lower growth profile than the likes of DVY and VYM. The idea is that a higher dividend yield compensates for this, all other things being equal. It is also worth pointing out that the home players also received a boost from the 2017 Tax Cuts and Jobs Act. Foreign currency changes versus the USD, not to mention COVID, also played their part.

Outlook

As most investment products and platforms point out: past performance does not equate to future returns. On that note, a vehicle like IDV arguably has a reasonable future ahead of it. At $30.50 per unit, it has shrugged off most of its COVID induced losses from last year. Still, it currently trades at a weighted forward PE ratio of circa 11. The 12-month distribution yield clocks in at around 5.3%.

Data by YCharts

Data by YCharts

Growth here will never be heroic, but nor does it really need to either. With the underlying weighted ROE at circa 10%, it does not seem a stretch to imagine this one returning around 9% per annum for long-term investors. That is net of the current 49 bps annual management fee. On a standalone basis, that looks fairly attractive given the current interest rate environment. Investors looking for a high current yield and an opportunity to diversify abroad may therefore wish to take a closer look.