February 11, 2021, at 7 am PST. Gold has been pretty choppy, trading last at $1842.40, slightly lower. Silver is at $27.24, showing more resilience than gold. The E-mini S&P continues to make new highs at 3911. Bitcoin is making record highs. We can't trade every market, so we focus on gold, silver, the E-mini and Bitcoin. They are volatile, which is great for trading.

Silver

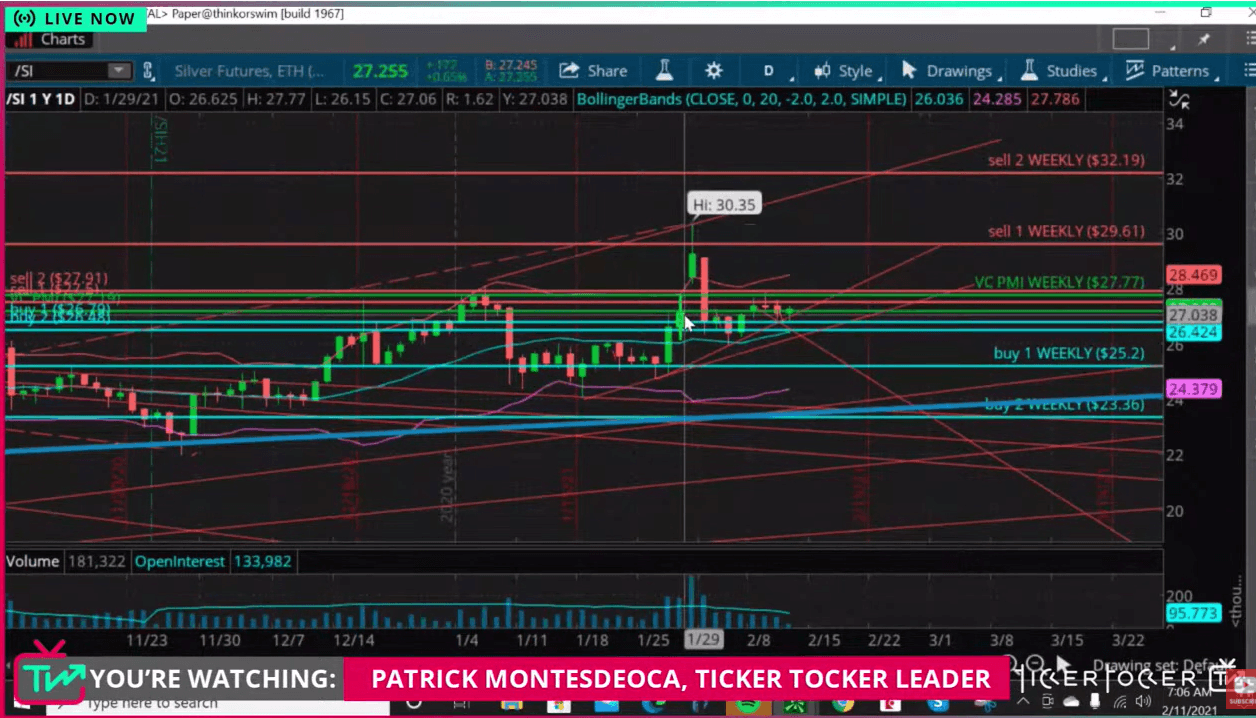

Courtesy: Ticker Tocker

We have a real shortage of supplies, particularly in silver. Premiums are getting high and it takes a long time to get delivery. According to Kitco.com, the industrial demand side may be running out of 1,000-ounce silver bars, which are primarily used by industries. Silver is used in computer chips and in cell phones. Not many people realize how much silver is being used for industrial purposes. If we are facing a shortage of the 1,000 ounce bars, then the sleeping giant demand in silver may be awakened. Silver also is completely undervalued in relation to the price of gold. In August 2002, gold made a high of $2089. Silver has not even caught up to what is usual in that spread relationship. If we begin to see a combination of a shortage in the physical market, the coin market, and it triggers a shortage of 1,000 ounce bars for industrial uses, we could see a really exciting market.

The previous high in silver of $30.35 was purely speculative. There was nothing under it. It was a Wall Street trade. What happened was just an indication of things to come.

Silver is poor man's gold and it's heavily used in high-tech industries, in medicine and many other industries. If silver is undervalued and there's a shortage of silver, especially industrial silver, then we could see silver trading at $50 in the blink of an eye. It could make the Reddit trade of a few weeks ago very, very minor in comparison. It could trigger a massive short covering in silver.

It's just a matter of time before we see the volatility that we see in Bitcoin, stocks and certain other areas related to the recent Reddit trades occur in silver. We are beginning to see various products revert back to their real value based on what's happening in the economy. Soybeans were at $8 in March and are now at $14. Corn reached $5.74, up from $3 in March. The shift in wholesale prices will be reflected in a rise in food prices down the line.

Besides the fundamental tightness of supply in silver, we also are seeing the beginning of inflation in food and other commodities. An inflationary wave is coming. Crude oil is also up, reaching $58.91, up from a negative $35 in April. That's more than a $90 increase since March. The price of commodities is reacting to inflationary fears based on the tremendous amount of stimulus coming into the market as a consequence of the pandemic.

All of this money printed out of thin air creates inflation in the US dollar, which is the world's reserve currency. The purchasing power of the US dollar therefore decreases. Inflation is the result. If you keep $100,000 in cash in the bank, and inflation is at 10% a year, then each year you're silently losing $10,000 a year. Shadowstats.com disagrees with the Fed measure of 2% inflation. Shadowstats looks at energy, food and all elements of the economy and we are already at 10% inflation.

As a trader, we try to take advantage of the volatility caused by the pandemic and the uncertainty of the future. Volatility creates opportunity and we have never had such volatility. Just look at Bitcoin.

We believe that gold and silver are real money, besides having industrial applications. They have been money for thousands of years. They maintain their purchasing power through crises. Before 1971, gold backed the US dollar. Now there are new challenges, such as Bitcoin, but they are far newer and riskier. Bitcoin is not a currency. It's a virtual asset. It may become a currency, but not yet. Precious metals have huge upside potential. If you buy gold and silver, whether physical or in the paper markets, you are converting the US dollar into other assets that will not be devalued by the printing of US dollars. Silver is leading the move up this year ahead of gold. Silver looks to be about to take off. Hold on to your long core positions in precious metals.

Technicals

The average daily VC PMI price is $27.19. Silver is trading above that, so we have a bullish trend momentum with a target of $27.50. Trading around the average price, means there is a 50/50 chance of the market going up or down. It will be choppy. Wait for the market to reach an extreme above or below the average, which the VC PMI identifies for you based on the daily, weekly, monthly and annual averages. Silver has activated $27.50. If the market reaches that level, then we can enter a trade. We do maintain our core long position in silver. If you are a long-term investor, you buy and hold, using corrections to add to your position. Right now, we are in a neutral to bullish state in silver.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold and silver, check out our Marketplace service, Mean Reversion Trading.