Business Development Companies offer the retail investor exposure to privately-held firms, which often are funded by venture capital firms. This article covers management's preliminary Q4 2020 earnings estimates, and incorporates it into valuations and dividend coverage, in addition to debt issued recently by BlackRock TCP Capital Corp (NASDAQ:TCPC).

TCPC is a BDC, specializing in direct equity and debt investments in middle-market, senior secured loans, junior loans, originated loans, mezzanine, senior debt instruments, bonds, and secondary-market investments. It seeks to invest in the United States. The fund typically invests between $10M and $35M in companies with enterprise values between $100M and $1500M. It prefers to make equity investments in companies for an ownership stake. (TCPC site)

Its $1.6B portfolio is comprised of 82% first lien assets, with 92% at floating rates. However, 79% of those floating rate assets have rate floors, which limit exposure to any further declines in interest rates.

TCPC's holdings are diversified, with 83 out 90 portfolio companies contributing less than 2% of its overall income. Total debt positions represented ~93% of the investment portfolio at fair value, and equity positions, including equity interests in portfolios of debt and lease assets, represented ~7%, as of 9/30/20.

in Q3 '20, TCPC's biggest industry concentration was still Internet Software & Services, 12.3%, followed by Diversified Financial Services, at 11.6%. It looks well diversified, but it does have limited exposure to Automobiles, 4.5%, Airlines, 3.1%, and Hotels & Restaurants, 2.2%.

Its loans to companies in more pandemic-impacted industries, such as retail and airlines, are generally supported by strong collateral protections. As of 9/3020, total non-accruals were only 0.6% of the portfolio at fair value.

Q4 2020 Preliminary Estimates:

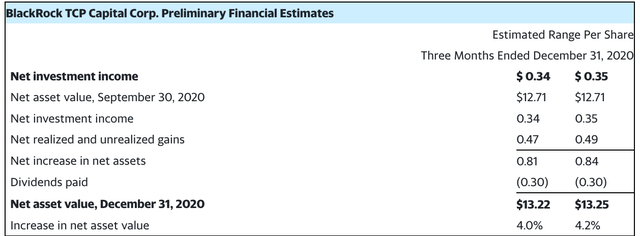

Management recently issued preliminary estimate ranges for TCPC's Q4 '20 net investment income, net realized and unrealized gains, and NAV.

Based

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

Find out now how our portfolio is beating the market since its inception. There's currently a 20% discount for new members.