I bought CF Industries (NYSE:CF) in 2020 as I was looking for basic material stocks in the agriculture sector. CF Industries has a fantastic track record when it comes to capital gains during agricultural upswings, offers an attractive dividend yield, and does not expose its investors to high balance sheet risks. Even more important, my bullish agriculture call turned out to be right as we are currently witnessing a steep increase in agriculture prices. In this article, I am going to update my call and tell you why CF Industries remains a fantastic long-term investment.

Source: CF Industries

What I Expected & What Happened

Basically, what I expected was a new agriculture bull market supported by a number of factors:

- Higher economic growth, resulting in increased energy demand. This, generally speaking, supports ethanol prices (corn).

- A weaker dollar, which almost always ends up pushing inflation higher

- A mix of higher demand and supply issues

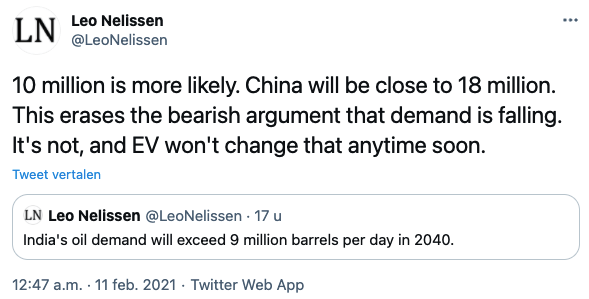

There are many ways to measure energy demand. On one hand, we have a long-term uptrend in energy use when it comes to emerging market demand with India adding 50% to its demand until 2040. On the other hand, we have a short-term decline due to lockdowns that limit the use of on-road and air travel. During the first lockdown in 2020, refinery utilization in the United States hit a low slightly below 70%. This number, while still subdued, has recovered to 83%.

Source: Twitter (Based on Statista data)

Source: Twitter (Based on Statista data)

The third point is a bit more complicated as explaining the global agriculture supply/demand situation is extremely complex.

Basically, what we are dealing with is a situation of subdued supply as we are dealing with factors like worse (expected) weather, supply issues in Brazil, and fewer corn acres planted. Meanwhile, demand is rising as we are dealing with the reopening of the economy, China