Investment Thesis

I continue to be "Neutral" long-term on RWE as the forecast of falling revenues and legal disruption caused by its legacy generation businesses offset the renewable generation exposure at the current price.

In the shorter term, I believe that insider buying and excellent yearly results will cause full-year earnings to exceed expectations and cause a short term bounce in the stock price.

Introduction

In my initial article on RWE (OTCPK:RWEOY) (OTC:RWNEF), I was cautious due to the 10% equity dilution, the continued share of revenues from coal and the legal discussion with the German government on the lignite phase-out. I felt that this offset the positives of the third-largest European renewable energy producer.

RWE has core businesses and non-core businesses. The core businesses are made up of Offshore wind, Onshore wind/solar, Hydro/Biomass/Gas and Supply & Trading. Non-core businesses are Coal/Nuclear.

As of the Q3 2020 presentation the core businesses made up 83% of adjusted EBITDA. As such, many could have expected that RWE would have received similar treatment from the market as other clean energy providers.

Data by YCharts

Data by YCharts

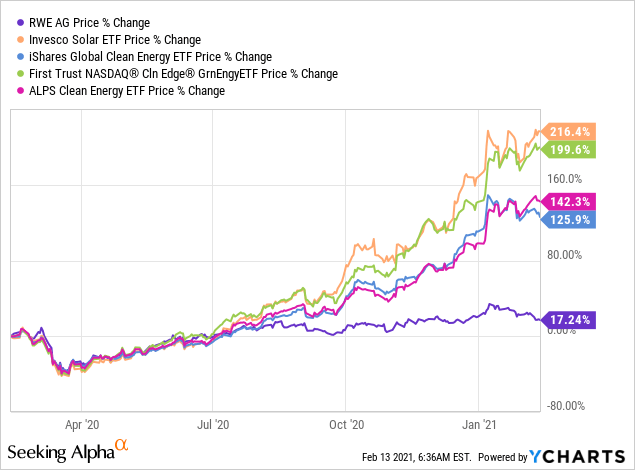

Figure 1 - RWE vs ICLN, PBW, TAN and QCLN

Figure 1 shows RWE vs the four largest clean energy ETFs by assets under management. RWE has been significantly outperformed. I'd like to point out that some of these ETFs contain companies such as Tesla (TSLA) and Nio (NIO) which have really helped to drive returns for these ETFs. Their large positions (in the ETFs) decrease the comparability of the assets but demonstrate the enthusiasm in the area.

Data by YCharts

Data by YCharts

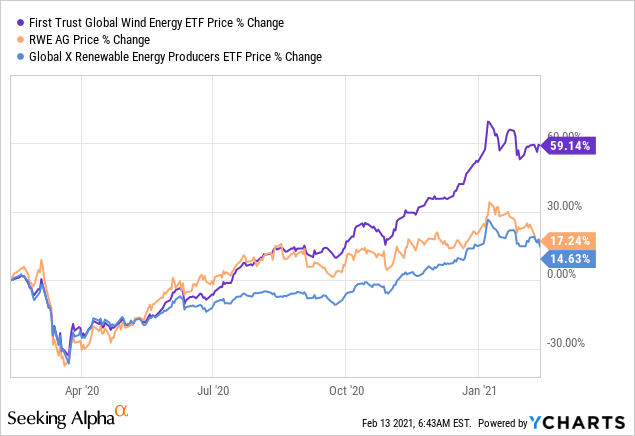

Figure 2 - RWE vs FAN and RNRG

These ETFs are more comparable, First Trust Global Wind Energy ETF grants exposure to the wind industry (50% of RWE's core EBITDA) and Global X Renewable Energy Producers ETF grant exposure to a cross-section