About six months after I originally looked at this fund, I revisit the Cambria Tail Risk ETF (BATS:TAIL). Reassessing this instrument today may be timely as the broad equity markets begin to show signs of fatigue. The Nasdaq 100 (QQQ), in particular, has been down 5% since reaching its mid-February peak, and the index seems far from regaining its footing.

Back in 2020, I concluded that TAIL would likely "never find its way into my portfolio, even if my concerns over an imminent stock market crash grew larger." Could now be a good time to change my mind on this safety-net ETF?

Credit: Photoholgic @ Unsplash

A brief recap

Those not familiar with TAIL should note that this is not your average, long-only fund that one buys and holds in hopes that it will go up over time. Owning the ETF only makes sense when it is paired with the S&P 500 (SPY), thus providing some protection against broad market declines.

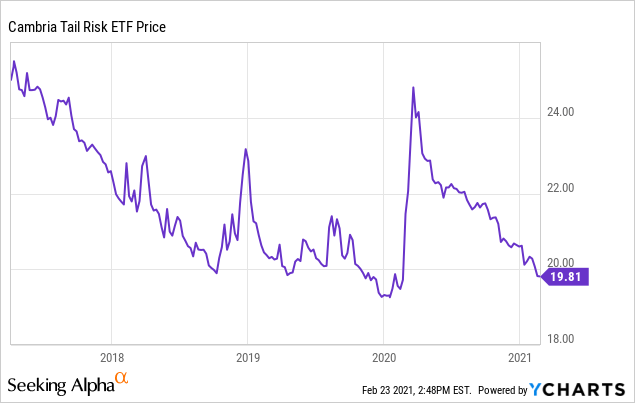

The graph below helps to illustrate the point. TAIL has historically lost about 5% per year since its 2017 inception, and it did so by design. The ETF's performance is primarily driven by its exposure to a long S&P 500 put option position (up to 30% out of the money) that's expected to incur losses, as the stock index rises over time and the value of the derivatives decay.

Worth noting, TAIL also invests in nominal and inflation-linked intermediate-term treasuries, which tend to correlate negatively with the S&P 500. Although the allocation is high, at over 90%, the bond position should play less of a role in providing protection against stock market selloffs than the high allocation ratio might suggest.

Data by YCharts

Data by YCharts

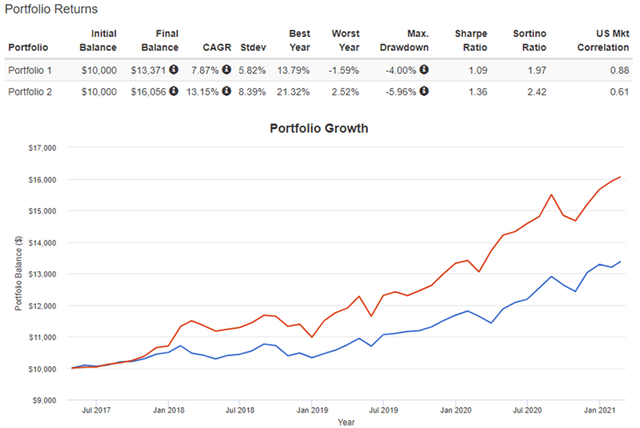

Iffy historical performance

As I pointed out in my original analysis, a 60/40 portfolio allocated to SPY and TAIL, in this order, would have done much better than a "naked" position in the S&P 500 during the thick of the COVID-19 crisis. Its maximum drawdown of only 13% would have looked compelling compared to the market's 34% peak-to-trough decline.

However, the downside protection would not have come without a steep price. Because of TAIL's expected longer-term losses, this 60/40 strategy would have produced returns of only 7% per year between 2017 and 2020, substantially less than the S&P 500's 12%.

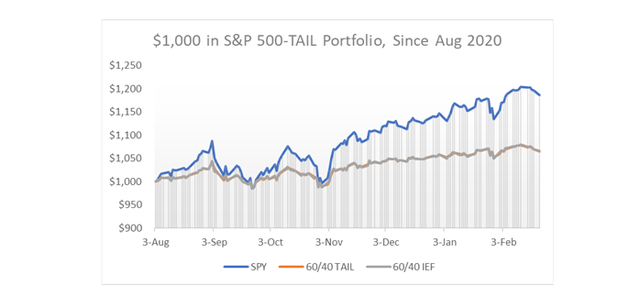

Since I published my most recent article, in August 2020, the performance of the SPY-TAIL portfolio would have been even worse relative to long-only stocks: Annualized return of 12% vs. the S&P 500's 36%. A maximum drawdown of 5% would have been better than the S&P 500's 9% worst decline during the period, but not enough to justify the substantially lower returns. See chart below.

Source: DM Martins Research, data from Yahoo Finance

Source: DM Martins Research, data from Yahoo Finance

It is interesting to note that the 60/40 SPY-TAIL portfolio would have very much matched the performance of a much simpler and cheaper stocks-plus-bonds (IEF) strategy. Notice that the gray and orange lines above nearly overlap each other, suggesting that simply adding bonds to a stock portfolio would have worked just as well as bringing TAIL into the mix over the past several months.

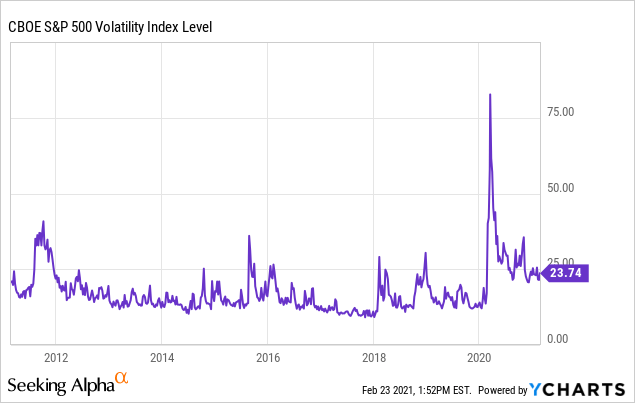

Less protection in high volatility

We are currently living in a high volatility environment. The graph below, depicting the VIX over the past decade, helps to illustrate the point. Notice how the fear index has stabilized around what used to be high levels between the European debt crisis of 2011 and last year's COVID-19 bear market, near the 25 mark.

High volatility usually leads to higher option prices since these derivatives generally serve the purpose of protecting against undesirable price movements in the underlying asset. Because TAIL commits a flat 1% of its capital per month to put options, as described on the prospectus, higher option prices mean fewer options in the portfolio, hence less protection against a decline in the S&P 500.

Data by YCharts

Data by YCharts

This may help to explain why the 60/40 SPY-TAIL portfolio described a few paragraphs above offered little (if any) extra downside protection in the past six months compared to a plain 60/40 stocks-and-bonds strategy. Perhaps in a high volatility environment, the benefit of allocating 1% of the capital to put options lessens, as the lion's share of the value offered by an ETF like TAIL comes from its easily replicable exposure to treasuries.

Better alternatives

But wait, am I not missing the main point? TAIL is designed to protect a portfolio against (as the name suggests) tail risks. Wouldn't a SPY-TAIL strategy finally pay off, should the S&P 500 decline by some 30% to 50%?

The answer is yes, most likely. But I believe that there are better, possibly simpler and cheaper ways to achieve this goal. Luckily, we already have experienced a black swan event since the inception of TAIL and have had the opportunity to make a few assessments.

For starters, simply investing in a stocks and bonds portfolio would have worked fine during the past three years, which included the COVID-19 crisis. A 60/40 SPY-IEF portfolio did just as well, in risk-adjusted terms, as a 60/40 SPY-TAIL one - except with much better absolute returns, at about 300 bps of outperformance per year.

Here is potentially an even better alternative: A 90/10 S&P 500 and short-term VIX fund (VIXY). This hypothetical portfolio would have performed way better than the SPY-TAIL approach since 2017, both from an absolute and risk-adjusted perspective, while still providing quite a bit of downside protection. The chart below depicts the comparison (the red line is SPY-VIXY, a.k.a. portfolio 2).

Source: Portfolio Visualizer

To be fair, using VIXY as an alternative hedge relies on the assumption that the strong, negative correlation between stocks and the volatility index will hold. But doing so also offers benefits beyond the historical performance advantage over a TAIL strategy, including:

- Lower costs, since less capital needs to be committed to VIXY than to TAIL to build a balanced portfolio, and

- Higher expected returns, absent the use of leverage to boost the return profile of the SPY-TAIL portfolio.

Join our community

"Thinking outside the box" is what I try to do everyday alongside my Storm-Resistant Growth (or SRG) premium community on Seeking Alpha. Since 2017, I have been working diligently to generate market-like returns with lower risk through multi-asset class diversification. To become a member of this community and further explore the investment opportunities, click here to take advantage of the 14-day free trial today.