Company History and Meet the SOS Management Team

Traded on the NYSE since 2017 as China Rapid Finance, these American Depositary Shares, or ADSs, were brought public by Morgan Stanley, Credit Suisse, and Jefferies Group as discussed in this Form F-1 that was submitted to the SEC during the IPO process. China Rapid Finance has evolved to become SOS Limited (NYSE:SOS). SOS is based in China with these ADSs registered in the Cayman Islands.

Having a top team of Wall Street firms act as the underwriters for the China Rapid Finance IPO, with Morgan Stanley as the lead, is an impressive vote of confidence for a new company. These premier Wall Street firms are each required to perform independent due diligence on any company they intend to underwrite for an IPO. Lead underwriter Morgan Stanley on this deal has a strong reputation for being well versed in the analysis of and vetting of Chinese startup deals.

Perhaps the impressive Morgan Stanley connection for SOS originates with current SOS board of directors member Douglas L. Brown. Brown was a former vice chairman of investment banking at Morgan Stanley with many years of successful U.S.-China investment banking deals to his veteran credits. The following excerpts on management are from the China Rapid Finance / SOS Form F-1 document:

Douglas L. Brown has been an independent non-executive director on our (SOS) board since 2007. Mr. Brown is the founder, chairman and chief executive officer of DLB Capital, which is a private equity firm with a focus on development and startup companies in the financial services industry in the United States and China. He has held positions at DLB Capital since 2006. Prior to DLB Capital, Mr. Brown held the position of vice chairman - investment banking at Morgan Stanley where, among other responsibilities, he advised on initial public offerings and the privatization of Chinese state-owned financial institutions. Mr. Brown currently serves as a director of Shanghai Harvest Network, China, a position he has held since 2006. Mr. Brown also was the non-executive chairman of HighTower Advisors, LLC from its founding in 2007 to 2011, and was its first institutional investor through DLB Capital. He continues to serve as an advisor to HighTower Advisors, LLC. Mr. Brown also serves as a director of Transamerica Corporation, a position he has held since 2008. Mr. Brown received his bachelor’s degree from Bowdoin College.

Brown is the principal of DLB Capital, and currently is a member of the Transamerica Corporation board of directors as well.

I encourage you to read pages 147-148 of the Form F-1 document filed with the SEC during the IPO process for these ADSs. Along with Brown are two veterans of international investment banking deals with major firms, Andrew Mason and Christopher Thorne, who both have earned Harvard MBA degrees. Thorne also has earned his JD from Harvard Law. Mason has achieved success at UBS Warburg Securities and also as an American naval intelligence officer during Operation Desert Storm.

I encourage you to read pages 147-148 of the Form F-1 document filed with the SEC during the IPO process for these ADSs. Along with Brown are two veterans of international investment banking deals with major firms, Andrew Mason and Christopher Thorne, who both have earned Harvard MBA degrees. Thorne also has earned his JD from Harvard Law. Mason has achieved success at UBS Warburg Securities and also as an American naval intelligence officer during Operation Desert Storm.

Andrew Mason has been an independent non-executive director on our board since 2005. Mr. Mason co-founded Jade Capital Management LLC, a private investment fund focusing on venture and growth capital in China’s financial services sector, in 2007, and currently holds the position of managing partner at Jade Capital. Prior to Jade Capital, Mr. Mason founded the Technology Sector Group in Asia Pacific for UBS Warburg, formerly Dillon, Read & Co., where he worked from 1994 to 2012 in New York, London and Hong Kong. In addition, Mr. Mason was instrumental in the founding of Sohu.com, one of the first Chinese companies to list on Nasdaq. Prior to UBS Warburg, Mr. Mason served as an intelligence officer during Operation Desert Storm for the USS Abraham Lincoln, CVN-72. Mr. Mason currently serves on the advisory board of the U.S. Navy League, New York, a position he has held since 2014, and has been a member of the President of Brown University’s China Council since 2010. Mr. Mason received his MBA from Harvard Business School and his bachelor’s degree in History from Brown University.

Christopher Thorne has served as an independent non-executive director on our board since 2008. Prior to that, he served as our advisor since 2007. Mr. Thorne is the founder and executive chairman of Broadline Capital, a global private equity firm and early pioneer in China’s private equity industry. Broadline Capital primarily focuses on growth capital and impact investments in Asia and North America. Mr. Thorne has held his positions at Broadline Capital since 2005. Previously, Mr. Thorne worked at McKinsey & Company from 1995 to 2000, where he served as a senior management consultant. Mr. Thorne subsequently became a technology entrepreneur and held the position of chairman and chief executive officer of Maverick Xchange Inc., a technology company which he founded in 2000, and served as president of EFS Network Inc., where he initiated a consolidation of technology companies and the resulting company, iTradeNetwork Inc., sold to Roper Industries. Mr. Thorne serves on the board of directors of Powermers Inc. and EndoSphere Inc., and he volunteers as a trustee for Creative Commons, the 501-C-3 nonprofit that focuses on enabling educational access, collaborative research and knowledge-sharing at a global level. Mr. Thorne received his JD from Harvard Law School, his MBA from Harvard Business School, and his bachelor’s degree (magna cum laude) from Harvard University, where he served as president of the university-wide student government and founded the Harvard Negotiation Law Review.

This top-tier team of American investment banking professionals, with decades of experience in successful U.S.-China corporation development, is guiding SOS. The Chinese colleagues at SOS have earned equally impressive resumes with the following excerpts also taken from the Form F-1 and the SOS corporate website:

Dr. Zhengyu "ZANE" Wang founded our company and holds the positions of chairman and chief executive officer. Dr. Wang also advised the PBOC on the creation of the National Credit Bureau from 2003 to 2005. Before founding our company, Dr. Wang was the Head of Analytics at Sears Credit from 1995 to 2000, where he oversaw the creation of a credit data warehouse, developed credit scoring models using credit bureau data, and implemented analytically driven consumer credit borrower acquisitions and portfolio management strategies. Dr. Wang received his Ph.D. in Statistics from the University of Illinois, and his master of science degree from the University of Illinois at Chicago.

Mr. Steven Li - Chief Financial Officer

Steven Li has more than 20 years of financial management work experience: He has served as the Financial Controller in Hong Kong listed company - China Fortune Group Co., Ltd. and then Nasdaq listed company - Focus Media and was responsible for US GAAP financial reporting ; He also served as CFO in Shopex Network, an e-commerce SaaS software service platform jointly invested by Alibaba and Legend Capital, and was responsible for the IPO listing and investment and financing relationship in the United States. He was the vice president of finance in Sanpower Group, an A-share listed company, responsible for overseas Pre-M&A due diligence work and Post M&A integration of health care industry. He also had served as the financial controller of Transfar Zhilian Group and responsible for financial support of overseas business development and expansion.

He graduated from the Accounting Department of the University of New South Wales, Australia. During his work in North America and China, he obtained MBA degree from Texas University and holds a CPA license from the State of Colorado. He is also a member of ACCA, HKICPA and CPP Australia.

The following introduction of Dr. Yan is excerpted from Cision PR Newswire:

Dr. Eric H. Yan is a renewed expert in the blockchain security for cryptocurrency and digital assets in China. Dr Yan has applied seven patents in China related to decentralized cryptocurrency wallets and exchanges, the protections and insurance for digital assets and cryptocurrencies, and blockchain-based security framework and solutions. Prior to joining SOS, Dr Yan founded Shenzhen eSecureChain Technologies Inc which offered various lines of products and services including decentralized cryptocurrency wallets and exchange platforms, and crypto mining; the protection and insurance technologies for digital assets and cryptocurrencies; assets digitization and tokenization; blockchain-based security framework and solutions; Decentralized Finance, DeFi, etc.

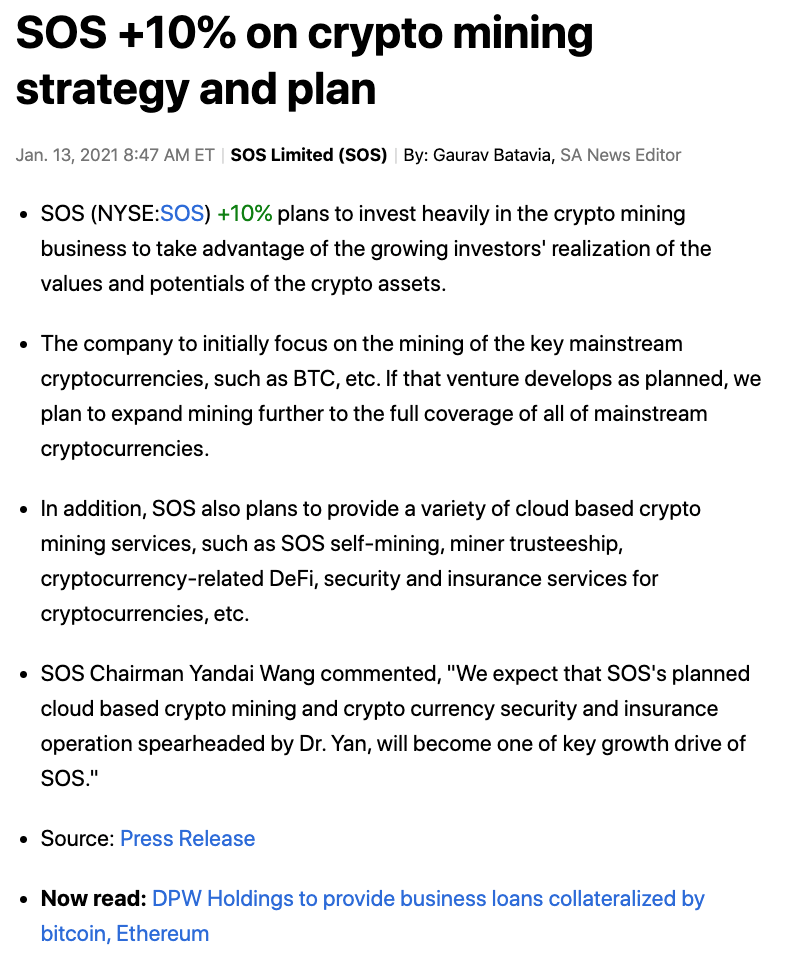

The American-Chinese management team at SOS combines to create an emerging cryptocurrency financial services company that has the potential to become a pioneering giant in the crypto space. SOS may be the first publicly-traded company to mine Ethereum, the second-largest cryptocurrency behind Bitcoin. SOS will primarily mine Bitcoin. SOS will be pioneering the development and introduction of new crypto financial services product, such as insurance, loans, etc.

The Future for SOS Appears Brilliant

While the core business of this microcap company is narrowly profitable per this link to FinViz, revenues have been decreasing YOY. It's the recent move by SOS into the cryptocurrency space that has attracted the market's attention. SOS has conducted a series of offerings that have been placed with accredited investors during recent months. This recapitalization effort has been successful in raising an estimated total of $250M to fund the commencement of operations in the cryptocurrency space.

10,000 of an initial 15,500 crypto mining rigs purchased by SOS have been received to date. 5,000 of these miners have been announced as live and operational within the past week. The next 5,000 rigs are being configured and installed currently. They could be operational by approximately the end of February 2021, perhaps the first week of March. At current crypto pricing, with all rigs deployed possibly by the end of March 2021, SOS should earn an estimated $250K per day from mining operations.

The stock currently trades at roughly just 2x sales including this revenue boost, with revenue growth expected to hit 300% YoY. Clearly, there's much room for significant upside in the price of SOS shares in the near term. As all 15,500 mining rigs become operational in the next few weeks, then shares of SOS could potentially triple from the current $8 per ADS range, and still be considered very undervalued based upon the forward revenue guidance for 12 months out.

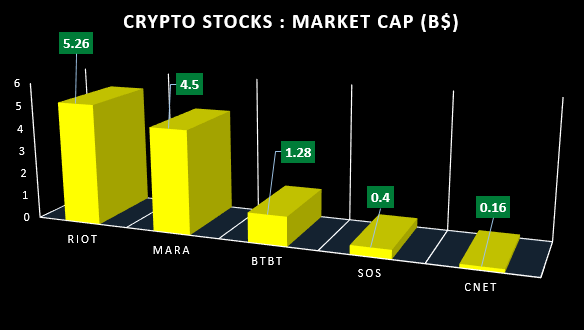

If the two largest cryptocurrencies continue their volatile march higher in the months ahead, then SOS would certainly benefit even further. However, even if the price of Bitcoin and Ethereum were to correct lower, the fact that SOS is ramping up crypto operations from square one right now means that SOS shares could still trade significantly higher. This win/win situation for SOS's ADS holders is because the American Depositary Shares have not yet been fully revalued relative to its peers in the crypto mining space.

With all 15,500 mining rigs operational, possibly in the next 30 days, SOS may become the largest crypto miner in the world. According to this excellent article published on SA, Riot Blockchain (RIOT) currently has 11,542 Antminers in operation. In addition to having nearly 30% more miners than RIOT in future operation, SOS has announced a unique advantage to source cheap power from a hydro-electric plant. This power cost advantage in China gives SOS an advantage over peers Riot Blockchain and Marathon Patent (MARA) that operate in the U.S. Because power costs are typically the primary expense for a crypto miner, SOS may trade at a premium valuation due to the fact that their power costs are much lower than peer companies.

Consider the graphic below that illustrates the market cap of SOS (shown in position No. 4 from left with 0.4 market cap) relative to its crypto mining peers. Now factor in that SOS will very soon be as large, or larger, than its peers when all 15,500 mining rigs are operational. Then discount the Chinese hydroelectric power costs for SOS, vs. the higher power costs of its peers. Clearly, this significant advantage in power costs for SOS is likely to receive a premium valuation in the market, relative to the peers of SOS.

Certainly, it's plausible that SOS could begin to catch up to the market caps of RIOT and MARA during the next 12-24 months (please consider that the volatile nature of each of these crypto stocks means that the precise market caps shown below are dynamic, the graphic is for illustrative purposes only):

While more information is needed from the company, and a few quarters of financial reporting, to flesh out the specifics of revenue growth, costs, etc., it seems pretty clear that directionally the trade here is higher. This stock is likely to form a stair step pattern higher on the chart as it's discovered by the marketplace and continues to progress in its new business model. Perhaps the recent pre-market price that traded about $16.50 could form a near term bottom of the upcoming trading range for SOS shares, up from the current $8 price of SOS ADSs.

I want to increase awareness regarding the extremely volatile nature in the trading range of this security. SOS is a very high risk-reward trade. Volatility to both the upside and downside is a characteristic of this stock's normal trading behavior. Risk management techniques definitely are necessary to protect against this extreme volatility going against you. This is a high-risk trade. Please use risk management techniques.

Determining the top end of a fair valuation trading range might extend the chart into the $20s due to the extreme volatility of this stock and its crypto group. The progress into the crypto space at SOS is occurring at such a lightning fast pace right now, that the market has not had time to process this trade and revalue the shares of SOS properly. Fair valuation for this ADS today would seem to be in the $16-$25 trading range considering the inherent volatility of these shares. Clearly, SOS is collapsing time frames and has had no problem raising capital. This may be in large part due to the Wall Street team in management led by Douglas Brown and his connections. The offering shown below is among the most recent portion of the company's recapitalization effort:

Again on 2/25/21 SOS raised nearly $96.7M in new capital by issuing the exercise of warrants. This capital raise is essential to fund the expansion of operations and pay for the pivot of the company's business model in cryptocurrency.

Here's a daily chart of RIOT, indicating that SOS shares may have significant upside in the near future relative to the price performance of a peer company's stock in the crypto mining space:

Summary

With Bitcoin and Ethereum trading near all-time highs, and with the trend for cryptocurrencies now higher, the potential for SOS shares to be revalued relative to its new peers would be extremely bullish for the price action in this emerging leader in the cryptocurrency space. Additionally, SOS has plans to increase revenues from its legacy business, while also bringing on new streams of income from crypto financial services. This additional revenue for SOS will be combined with the ramp higher on cryptocurrency mining of Bitcoin and Ethereum.

- SOS may soon become one of the largest cryptocurrency miners in the public markets based upon number of miners and daily revenues generated from mining.

- SOS will benefit from the advantages of reduced hydroelectric power in China.

- SOS may be the only publicly traded company that's mining Ethereum, the second largest cryptocurrency.

- SOS has stated plans to pioneer cryptocurrency financial services, including insurance and cryptocurrency loans, among other services.

- SOS has assembled a premier management team that has decades of experience on Wall Street and with U.S.-China publicly-traded corporate operations.

- The recent recapitalization of SOS will enable the company to achieve both of its stated goals of building revenues in its legacy business, while ramping up revenues in its newly entered cryptocurrency space.

In view of this substantial operational improvement for SOS, 300% YOY revenue growth for this microcap may be achievable for 2021 estimates. Factoring in the significantly reduced cost of energy from SOS's hydro-electric power generation deal, and the revaluation of SOS shares higher could become very significant.

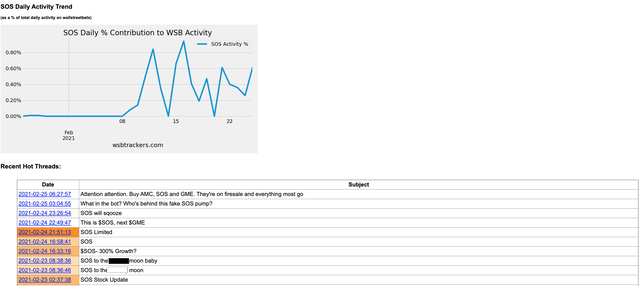

All of these exciting developments have not escaped the early notice of the WallStreetBets crowd on Reddit. SOS has begun to show up on the radar of the wsbtrackers.com. The graphic below indicates that SOS is on the WSB radar now, and gaining traction. We all know how important social media sentiment can be for a stock today. We also know that the recently increased short interest in SOS can be an attractive target for bulls who have performed proper due diligence on this SOS trade.

The bear thesis on this SOS short seems to be limited to the repetition of the falsehood that SOS is a Chinese scam. This is why I have gone to some lengths to introduce the management of SOS, as they each carry an impeccable resume of credibility, experience, and success on Wall Street and in China for decades. After reading the biographies/resumes of each of the key team members of SOS management, we can certainly put the falsehood of SOS being a "Chinese scam" to rest. SOS is a very solid, legitimate, and soon to be highly successful new entry into the cryptocurrency space.

It would make good sense for the WSB/Reddit crowd to target the short interest in SOS and ride this trade from the $6 range into the $20 range in the near term.

Longer term SOS is likely to accumulate some reasonable amount of Bitcoin, Ethereum, and launch its crypto financial services division, while also improving revenues from the legacy business. Perhaps 24 months out, we might deem it to be reasonable that the market cap of SOS could exceed the current market cap of RIOT and MARA combined. If this type of growth were to occur for SOS over the next 24 months, or so, then this very bullish valuation for SOS would assign a $10B market cap.

Longer term SOS is likely to accumulate some reasonable amount of Bitcoin, Ethereum, and launch its crypto financial services division, while also improving revenues from the legacy business. Perhaps 24 months out, we might deem it to be reasonable that the market cap of SOS could exceed the current market cap of RIOT and MARA combined. If this type of growth were to occur for SOS over the next 24 months, or so, then this very bullish valuation for SOS would assign a $10B market cap.

Although future offerings are likely for SOS, the current share count would trade at about $120 per ADS. Candidly, as you perform your due diligence and calculate valuations relative to SOS's peers in this crypto space, this bullish target for $120 is not unreasonable. Of course, if Bitcoin and Ethereum continue their volatile march to higher prices during the next 24 months, then increase the $120 price target for SOS accordingly. If these cryptos decline in price from current levels over the next two years, then reduce.

Conclusion

Directionally, the call for SOS to trade significantly higher seems reasonable. Achieving a valuation that is just half of RIOT's market cap today would value SOS shares at about $25. Within a number of weeks from this article's publication date, SOS will have 30% more crypto miners online, much cheaper energy costs, existing revenues and profits from an improving legacy business, and the launch of a cryptocurrency financial services division. Perhaps SOS should be assigned a valuation well north of just half of RIOT's market cap. We will see what the market thinks of this trade as the facts of SOS become disseminated into the marketplace.

Members of our Trader's Idea Flow community always receive our trading ideas and updates first. Traders know that timing is everything. Receiving information early and being prepared ahead of the competition is valuable. Please feel welcome to free trial our marketplace service, Trader's Idea Flow. Just one successful trading idea can cover the cost for many years of the very affordable subscription price.