After years of speculation, the day has finally come.

AT&T (NYSE:T) announced, on February 25, that it will dispose of its DirecTV domestic business via a spinoff in the second half of 2021. The Dallas-based carrier will walk away with 70% ownership in the new entity, whose minority holder is investment firm TPG Capital, plus $7.6 billion in cash. The deal values the asset at $16.3 billion, nearly 10% above what had been speculated earlier this week.

I have been advocating for a disposition of the linear TV business at least since activist investor Elliott Management made the same argument, in 2019. With the deal, I believe that AT&T will emerge a better, more focused and more valuable company – which might help to break the spell of years of relentless stock price decline.

Weight off the shoulders

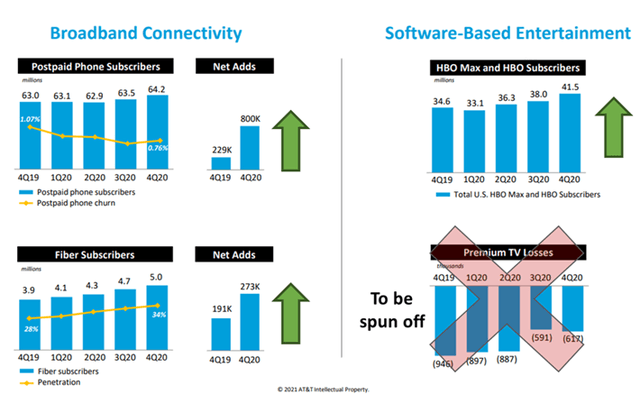

With the disposition of the US video business (the Latin America assets will remain in the conglomerate's portfolio, for now), AT&T turns into a slightly more streamlined company focused on wireless, fiber and HBO Max. These three businesses have been performing relatively well lately, as the graphs below depict. Premium TV, on the other hand, has been the thorn in AT&T's side for many years.

With video out of the picture, investors should expect to see a couple of improvements to AT&T's operational and financial performance, although probably not until 2022. First, revenue growth should suffer less of a drag from a business undergoing secular decline. For reference, total company sales declined 5% in 2020, but the video sub-segment in which DirecTV "lives" saw a much sharper drop of 11% during the period.

Source: charts form company's earnings slide

Second, the profile of AT&T's P&L will likely also improve substantially. As disclosed by the carrier, the US video unit being spun off (representing roughly one-sixth of

Join our community

Stocks have been on a choppy ride lately, and the future looks even more uncertain. But all my SRG portfolios have been beating the S&P 500, in risk-adjusted terms, since inception. To find out how I have created a better strategy to growing your money in any economic environment, click here to take advantage of the 14-day free trial today.