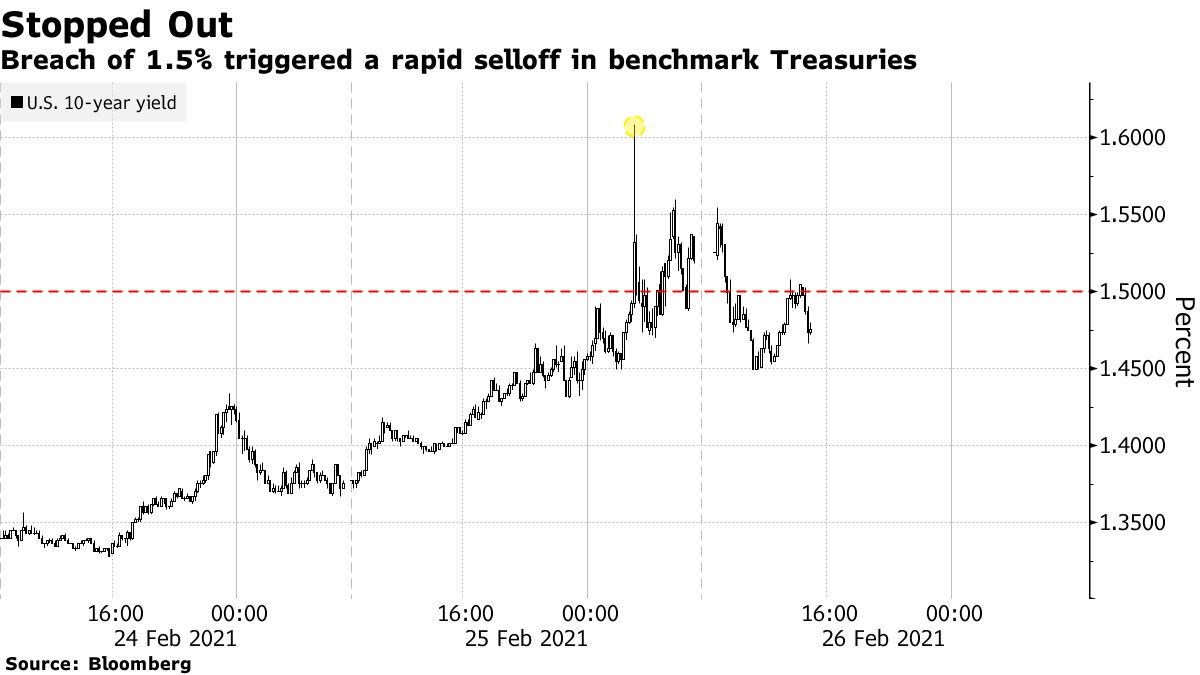

I have been suggesting in this weekly economic report that as the economy starts to roar back, the stock market may struggle. We got a glimpse of that yesterday, as the major market indices plummeted across the board under the weight of higher long-term interest rates, which are indicating investors see faster rates of economic growth and inflation ahead. While a 1.5% yield on the 10-year Treasury may not seem like a big deal to the average investor, it is extremely consequential to the large institutions that manage the majority of market wealth. Yesterday the yield skyrocketed as high as 1.61% after a 7-year Treasury note auction was met with far less demand than normal. The yield on the 10-year closed at 1.51%, surpassing the dividend yield of the S&P 500 for the first time in several years.

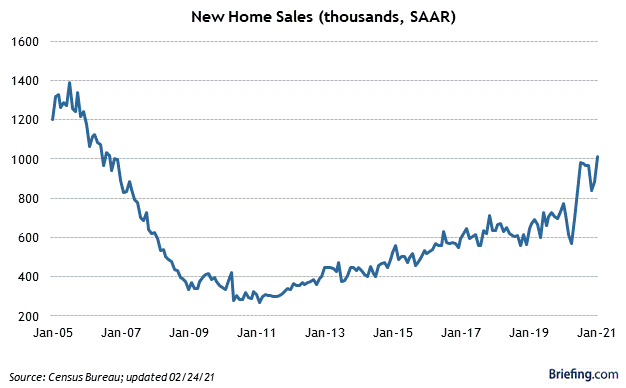

New Home Sales

New home sales rose 4.3% to an annualized 923,000 from an upwardly-revised 885,000 in December, which is up 19.3% from a year ago. The median price of a new home has risen 5.4%% from the year prior to $346,400 and there is now 4 months of inventory, which is still less than the six months experts considered to be balanced. Housing suddenly has a new headwind - rising mortgage rates. That is likely to moderate the rate of growth in existing and new homes sales moving forward.

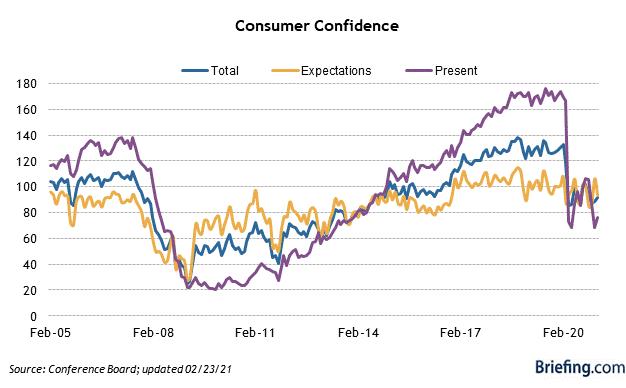

Consumer Confidence

The Conference Board's Consumer Confidence Index rose to a three-month high of 91.3 in February from the 88.9 reading in January. There is lots of room for improvement, which I expect we will see once another round of stimulus checks are distributed, vaccines become more widely available, and the economy gradually reopens this spring.

Durable Goods Orders

Orders rose for a ninth consecutive month in January, surging 3.4% after the prior month

The Portfolio Architect is a Marketplace service designed to optimize portfolio returns through a disciplined portfolio construction and management process that focuses on risk management. If you would like to see how I have put my investment strategy to work in model portfolios for stocks, bonds and commodities, then please consider a 2-week free trial of The Portfolio Architect.