Welcome to the nickel miners news for February. The biggest news the past month is probably the surging nickel prices and talk on a new key green metals supercycle that is only just beginning. President Biden also had an impact with his executive order "to review critical supply chains" particularly for semiconductors and electric vehicle metals and other critical materials to supply the US renewable energy boom.

Nickel price news

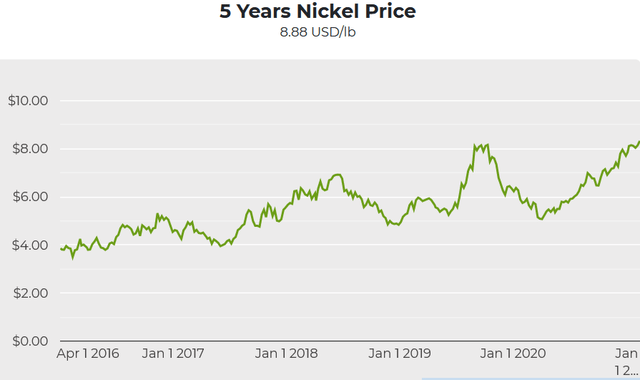

As of February 26, the nickel spot price was USD 8.88, up from USD 8.08 last month. LME shows the price at USD 19,568/tonne. Nickel inventory at the London Metals Exchange [LME] was slightly higher than last month at 251,058 tonnes (248,886 tonnes last month).

Nickel spot prices - Long term chart - Current price = USD 8.88/lb

Source: Mining.com

Nickel Long-term Price Projection

Source: Kalkine Media courtesy DIS

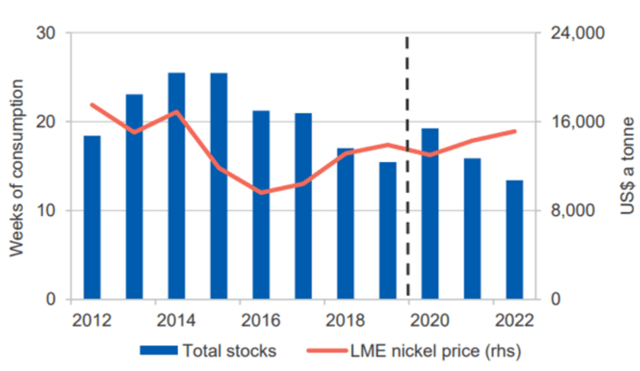

Nickel demand vs. supply charts

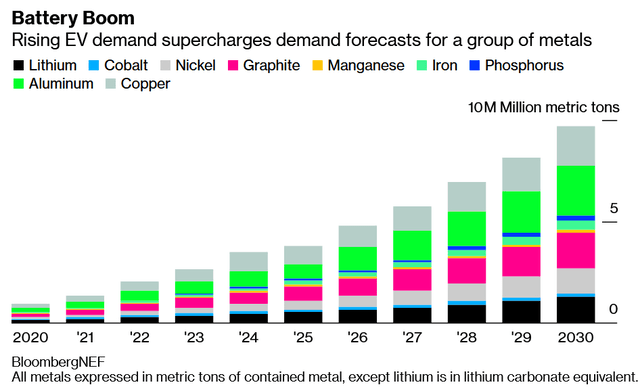

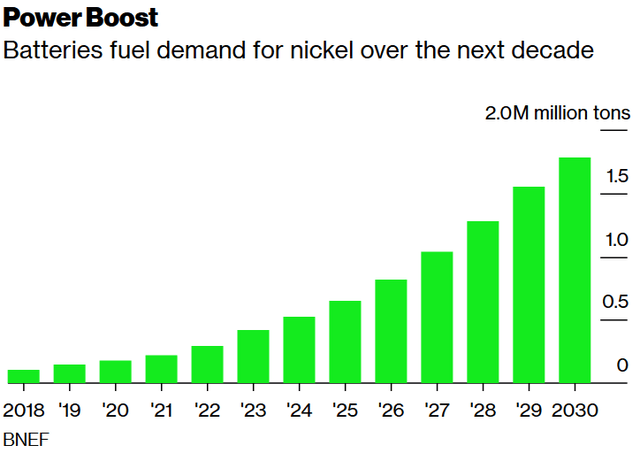

Battery nickel demand set to surge over ten fold this decade as the EV boom takes off

Source: Bloomberg

2019 to 2030 'battery' demand increase forecast for EV metals - Nickel 'battery' demand forecast to increase by 14x

Source: Courtesy BloombergNEF

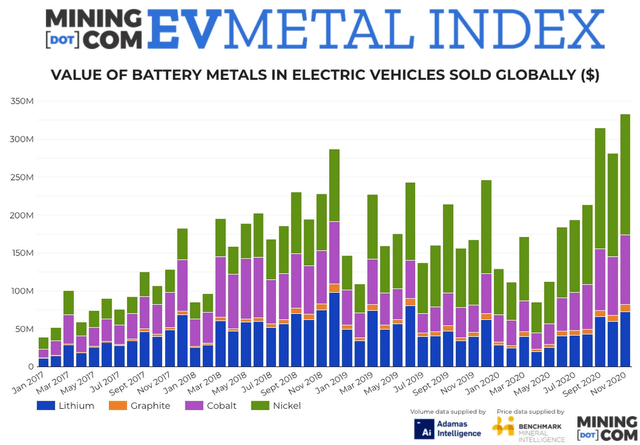

Benchmark Mineral Intelligence - Simon Moores's - forecasts

Source: Benchmark Mineral Intelligence Twitter

BloombergNEF EV metals demand forecast

Source: BloombergNEF

Nickel Market News

On February 4 CNBC reported:

Indonesia, world’s biggest nickel producer, says it received an investment proposal from Tesla... the focus of their discussions had been on batteries and energy storage solutions.

On February 11 Bloomberg reported:

JPMorgan says commodities may have just begun a new supercycle. With agricultural prices soaring, metal prices hitting the highest in years and oil well above $50 a barrel, JPMorgan Chase & Co. is calling it: Commodities appear to have begun a new supercycle of years-long gains... Prices may also jump as an “unintended consequence” of the fight against climate change, which threatens to constrain oil supplies while

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors. You can benefit from the work I've done, especially in the electric vehicle and EV metals sector. You can learn more by reading "The Trend Investing Difference" or sign up here.

Latest articles: