Speed Record For Dividend Reinstatement

I last covered Penske Automotive Group (NYSE:PAG) in June 2020 after it announced it would suspend the dividend to conserve liquidity in the pandemic. At that time I mentioned that I sold the stock (after it had doubled from the March 2020 crash lows) although I rated it Neutral in the article. This turned out to be my biggest trading mistake of 2020 as the stock has gained over 63% since publication. While I was able to replace the lost dividend income, I sacrificed a much larger total return. I estimate my total portfolio would be about 1.2% higher value today if I had not made that trade. For more discussion about the perils of chasing income, please see my most-read article on Seeking Alpha, "Don't Sell Potential 10-Baggers Just To Chase Income".

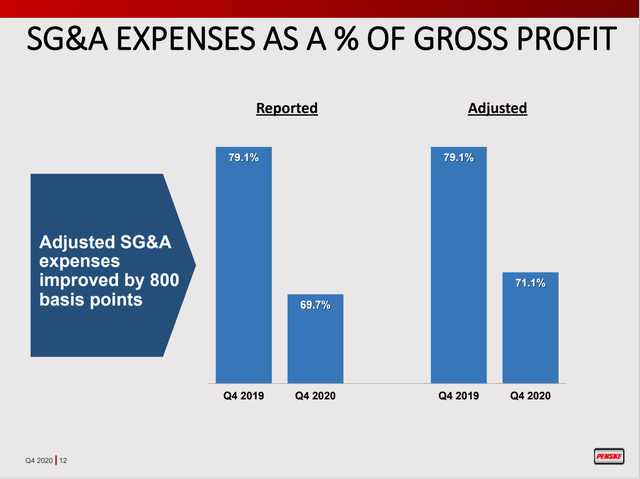

It turns out that the dividend cut was exactly what Penske needed to help stabilize the balance sheet. Long-term debt has fallen to $1.60 billion (1.7 times EBITDA) at the end of 2020 from $2.26 billion (2.7 times EBITDA) in 2019. Additionally, Floor Plan debt also decreased to $3.1 billion from $4.0 billion. Floor Plan interest expense went down by a much larger percentage due to the decline in short-term interest rates. 2020 Floor Plan interest was $46.3 million (1.5% interest rate) compared to $84.5 million in 2019 (2.1% interest rate). Finally, the company was able to cut SG&A expenses by more than the drop in revenues, leading to improved operating margins. Looking forward, cost will come back up as all dealerships reopen fully and sales increase. From the earnings call, however, Penske still expects the longer term SG&A run rate to be in the 73% - 74% range, about 3 to 4 percentage points lower than pre-2020 historical.

Source: Penske 4Q