Housing stocks had been outperforming the market over the past year and in 2021 due to record low interest rates and pent-up demand. The recent rising rate scare has scaled them back somewhat, but the long-term outlook is still positive for the industry.

However, the problem for income investors is that homebuilder stocks generally don't offer attractive dividend yields. The top 5 dividend yields in the industry range from 1.2% to 2.8%, and that 2.8% is the only yield above 2%.

CatchMark Timber Trust (CTT) is a higher-yield alternative which you may want to consider. It's a REIT which "seeks to deliver consistent and growing per share cash flow from disciplined acquisitions and superior management of prime timberlands located in high demand U.S. mill markets."

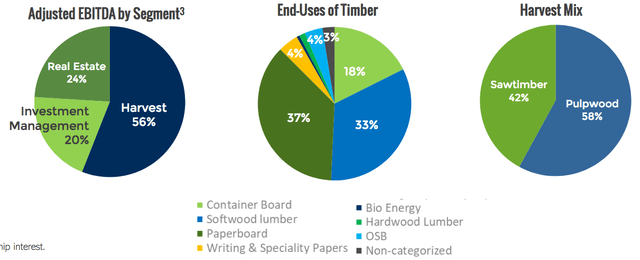

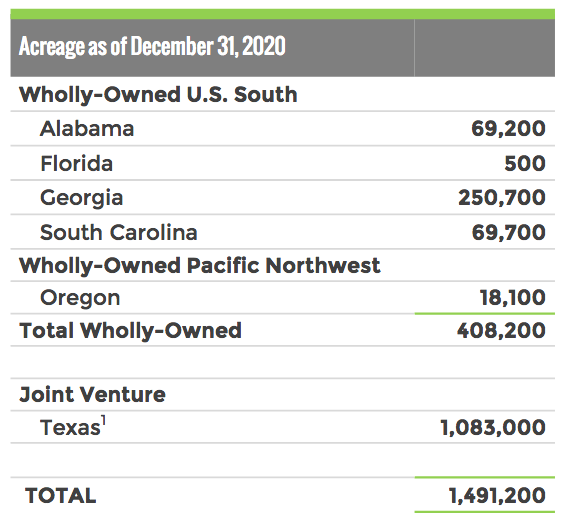

CTT owns timberlands in Texas, Oregon and several southeastern states. Its biggest acreage is in Georgia, where it owns 250M acres. It also owns a 22% interest in the Triple T JV that has over 1M acres in Texas. Management has diversified the company's earnings, via adding an investment management segment to its Harvest and Real Estate operations:

(CTT Site)

Management has sought to diversify the company's earnings via a mix of Harvest, Real Estate, and Investment segment operations. The end uses of its timber cut across several industries, while the harvest mix is 58% pulpwood and 42% saw timber:

(CTT Site)

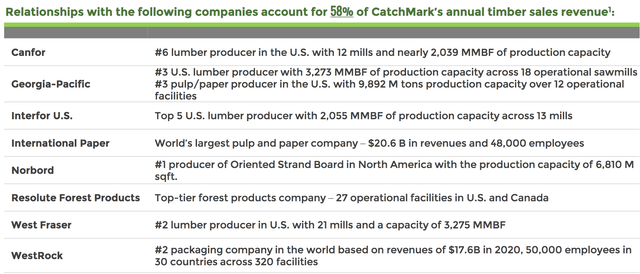

Its customer base includes some of the biggest players in the lumber, paper, and packaging industries, including International Paper, Georgia Pacific, and WestRock, with its top eight customers comprising 58% of annual timber sales:

(CTT Site)

In the U.S. South, 91% of CatchMark's total timberlands are located in three of the top five markets. This offers advantages in pulpwood and saw timber pricing, as well as in Site index, which is the height, in feet, of a softwood tree at age

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

There's currently a 20% discount, and a 2-Week Free Trial on offer.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, many of which are selling below their buyout and redemption values. Our latest success story had a 30% total return in 3 months.