Chairman Powell no longer appears to be the stock market whisperer he once was. It seems he thinks that he can maintain the ultra-easy monetary policy of the past decade to support financial markets, while also achieving the Fed's objective of full employment without realizing the higher long-term interest rates and inflation that come with it. Despite his assertion that he will not withdraw any of the continuing monetary policy accommodations, the bond market is tightening financial conditions for him. Inflation expectations have risen to a 12-year high, long-term bond yields are soaring as a result, and the stock market darlings of yesterday are no more.

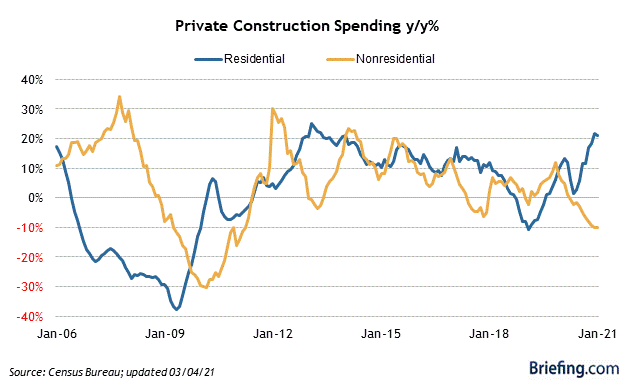

Construction Spending

Construction spending rose 1.7% in January, led by the residential side again, where spending was up 2.5% for the month and 21.1% year over year. Non-residential spending rose 0.5% for the month but has declined 5% over the past year. The good news is that there was strength in January across the board.

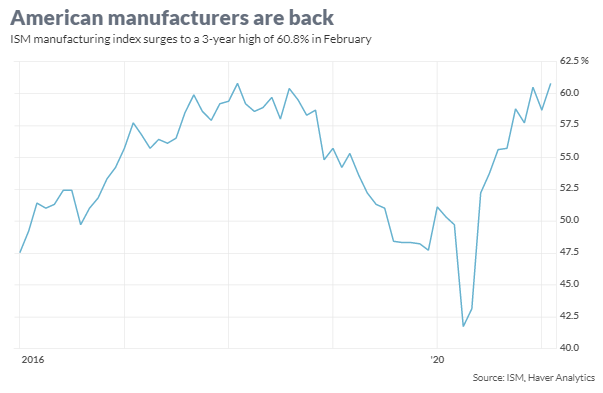

ISM Manufacturing Index

The Institute for Supply Management's Manufacturing Index rose for the ninth consecutive month to a three-year high of 60.8% in February. New orders and production are showing particular strength, as well as the employment sub-index, which climbed for a third month in a row to 54.4%. Sixteen of the 18 industries surveyed by the ISM were expanding last month. The only concern comes with the shortage of raw materials, which is leading to a surge in prices. That could be a headwind to demand and growth if the price surge continues.

IHS Markit Manufacturing Index

IHS Markit's Manufacturing Index for February came in at 58.6 and tells the same story as ISM. It was the second fastest rate of growth since April 2010, led by output and new orders, but input costs are soaring due to supply chain

The Portfolio Architect is a Marketplace service designed to optimize portfolio returns through a disciplined portfolio construction and management process that focuses on risk management. If you would like to see how I have put my investment strategy to work in model portfolios for stocks, bonds and commodities, then please consider a 2-week free trial of The Portfolio Architect.