Less than two months ago, I started to cover an interesting Cybersecurity play: Check Point Software Technologies (NASDAQ:CHKP).

Since then, the stock price has plummeted by about 15% (see the picture below). Therefore, my initial investment thesis probably needs a quick follow-up.

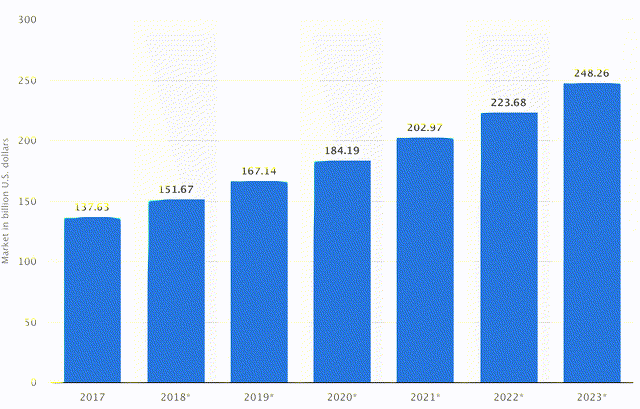

The company is one of the most important players in the cybersecurity business, with strong prospects and a CAGR estimated to be in the double digits for many years. Moreover, the statistics shown in the picture below do not take into consideration the boost this sector will receive from the life changes brought by the Covid-19 pandemic: things like remote working and massive on-line shopping will certainly not vanish even when the emergency does.

Cybersecurity Market Size - Source: Statista

Cybersecurity Market Size - Source: Statista

However, the fourth quarter release clearly disappointed the Street, although the overall results were positive. The top line grew by 3.5% in 2020 and the bottom line increased by around 10%, both above estimations.

Yet, the guidance was not inspiring, with a top-line growth estimation ranging between 1% and 7% YoY. 2021 EPS looked flat when compared to 2020 and, admittingly, this is a red flag. However, the forecast was made on the basis of the same dollar exchange level and interest rates we had at the beginning of the year (It’s worth mentioning here that CHKP has a strong cash position, which leads to a significant interest income).

Actually, because of a weak US dollar, CHKP costs (50% of which are in non-dollar currencies) should climb up in 2021. The interest income, then, will be impacted by a lower interest rate. These two assumptions, in any case, must be taken with the traditional grain of salt, in light of the last shifts in the yield curve. In other words, the guidance could be too conservative, at least as far as the bottom line is concerned.