Note: I have covered Ballard Power Systems (NASDAQ:BLDP) previously, so investors should view this as an update to my earlier articles on the company.

Four months ago, I advised investors to get short shares of Canadian fuel cell systems developer Ballard Power Systems ("Ballard" or "Ballard Power") due to material short- and medium-term revenue headwinds from the ongoing COVID-19 pandemic, recently reduced scope under its long-term technology development agreement with Audi, a subsidiary of leading German automaker Volkswagen Group (OTCPK:VWAGY, OTCPK:VLKAF, OTC:VLKPF) and the Chinese government replacing direct subsidies for FCEVs and hydrogen fueling stations with a new, rather complex policy framework.

Suffice to say, my call turned out to be a disaster with shares advancing another 200%+ to new 20-year highs at their peak in early February. Even after the recent setback, the company's stock is still up by 70% from the time my article was published.

The failure actually serves as a strong reminder to avoid shorting story stocks solely due to fundamental concerns as also evidenced by Thursday's action in Ballard Power's shares.

While the company indeed announced another set of disappointing quarterly results with revenues below expectations as well as gross margins remaining at depressed levels and even abstained from providing FY2021 guidance, shares nevertheless rallied by more than 10% as investors apparently decided to look beyond near-term issues and instead focus on management's upbeat comments with regards to the company's materially increased sales pipeline which is up by 55% year-over-year according to statements made on the conference call.

That said, the company actually removed the usual "robust sales pipeline" term from Management's Discussion & Analysis ("MD&A") in the Q4 and full year 2020 report for the first time in years.

Total order backlog at the end of FY2020 was $117.8 million, down 34% year-over-year with approximately $83.5 million scheduled to be recognized in FY2021.

Clearly, these numbers look insufficient to come even close to the current analyst FY2021 revenue consensus of $128.9 million.

So what is going on at Ballard Power Systems?

In contrast to the ongoing hype around hydrogen and fuel cell systems, things continue to move very slow from an operational perspective with COVID-19 causing additional project delays.

In addition, the company's business remains highly concentrated with almost 70% of FY2020 revenues derived from the company's Chinese joint ventures and the Audi engineering contract.

Audi Engineering Contract

With the Audi contract expected to end in August 2022, and an estimated $24 million in remaining contract value, average quarterly contribution should be in the range of $3.5-$4.0 million going forward, roughly unchanged from FY2020 levels.

Source: Company Presentation

China Policy Issues

On the conference call, management remained hopeful on further clarity soon being provided on China's recently announced new, complex policy framework:

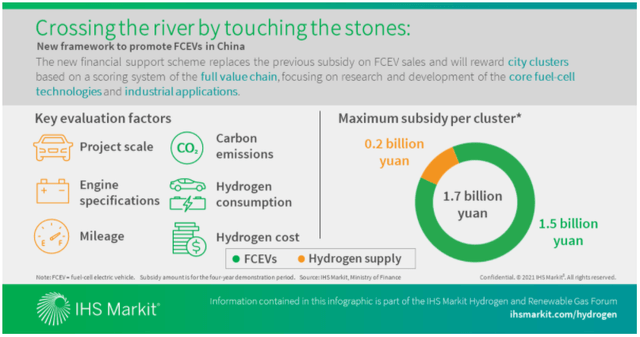

Source: IHS Markit

The new policy framework replaces the previous direct subsidy scheme on fuel-cell electric vehicle ("FCEV") sales and will reward eligible city clusters for the development of the FCEV wider value chain. The central government has supported the development of FCEVs since 2009 by subsidizing consumers, but results have been underwhelming.

Since the subsidy scheme on vehicle sales has not produced significant results, the government shifted its approach to incentivizing breakthroughs in key core technologies and industrialization of basic materials to improve economics across the FCEV entire value chain.

As of 15 November 2020, 15 city clusters had submitted applications, but assessment results have yet to be announced.

With no less than five government agencies being involved in the process, I wouldn't bet on a near-term announcement.

Even worse, with the new approach apparently directed towards establishing a complete domestic fuel cell technology and hydrogen supply chain over time, any near-term impact on FCEV adoption looks highly questionable at this point.

Despite these issues Ballard Power expects the upcoming announcement "to help unlock considerable pent-up demand for FCEVs".

Unfortunately, management has a long history of overly optimistic expectations regarding sales and policy support in the Chinese market.

In fact, the most recent joint venture with Weichai Power is already the company's third attempt to get things up to scale in China and once again Ballard Power appears to have run into problems.

Potential Severe Impact On New Chinese Joint Venture

The new policy framework represents a major setback for the company's new, all-important Chinese joint venture, Weichai Ballard Hy-Energy Technologies Co. ("the Weichai JV").

In FY2020, Ballard Power recognized almost $45 million in revenues from the Weichai JV while deferring another $23.5 million "until (...) products are ultimately sold by Weichai Ballard JV" according to statements made in the MD&A (page 18).

But with the new policy framework not exactly suited to increase near-term FCEV adoption, the joint venture is unlikely to sell much if anything over the next couple of quarters.

At this point, the Weichai JV is apparently sitting on $47 million in inventory purchased from Ballard which makes additional, near-term orders highly unlikely.

On the conference call, management basically admitted to the issue but remained hopeful of meaningful joint venture product sales towards the end of this year.

With ballooning inventory levels and limited near-term sales prospects, the joint venture might very well decide to push out the remaining $10.4 million in MEA shipments under the December 2019 order currently scheduled for Q1/2021.

Under a worst case scenario, Ballard won't be able to ship additional MEAs to the Weichai JV this year thus resulting in zero product revenue from the joint venture as compared $23.5 million in 2020 (assuming no recognition of previously deferred product revenue).

That said, there are still approximately $45 million in revenues left under the original $90 million technology transfer agreement with the Weichai JV which should provide a rather steady revenue stream until the end of next year.

Also keep in mind that Weichai Power is currently sitting on an approximately $1 billion gain from its 46.1 million share stake in the company. Other than originally expected by management, Weichai Power has not exercised any anti-dilution rights with regards to Ballard Power's recent series of capital raises thus causing its ownership in the company to decrease from 19.9% to approximately 15.5% as of today.

In addition, MEA supply to the company's legacy joint venture in China Guangdong Synergy Ballard Hydrogen Power Co. ("the Synergy JV") which accounted for 8.4 million of FY2020 revenues could also be impacted by the new policy framework.

Other Business Initiatives

The company recently announced a number of fuel cell bus module follow-on orders from Wrightbus and Solaris as well as orders for two fuel cell train demonstration projects with Arcola Energy and Canadian Pacific (NYSE:CP) but estimated aggregate revenue contribution is likely to remain substantially below $10 million with no shipment date given for the Wrightbus order.

While the company claims "the Fuel Cell Electric Bus market is now gaining momentum and is expected to continue on an aggressive growth path in Europe and globally" the reality looks quite different with the major European projects JIVE and JIVE 2 already being far behind schedule before COVID-19 even hit and China hindered by the above discussed policy issues.

In addition, management didn't even mention the company's much-touted H2Bus Europe initiative on the conference call despite the stated target to roll out 600 fuel cell buses in Denmark, Latvia and the UK by 2023.

Clearly, there's still much work to do before fuel cell buses will become material revenue contributors on a more regular basis.

Ballard Power is also focusing on the commercial vehicle market through its recently announced collaboration with MAHLE, a leading German transportation industry supplier but material revenues are likely still years out in the future with a 240-KW prototype engine for the heavy-duty commercial truck market expected to be ready for testing by the end of this year.

Commercial sales of fuel cell modules for trains and particularly vessels are even further out according to CEO Randy McEwen on the call with these segments still in their very early innings of development.

Bottom Line

Ballard Power remains a story stock with actual results and particularly the company's near-term outlook not suited to justify the company's eye-watering valuation of 70x estimated FY2021 revenues.

Under a worst case scenario, sales could be down by 20% year-over-year.

At least liquidity won't be an issue for the foreseeable future as management wisely decided to seize the opportunity by raising more than $1 billion in a series of recent equity sales thus increasing cash and cash equivalents to an estimated $1.3 billion as of today.

While the company guided for increased investment levels going forward, I would actually be surprised to see cash used in operating and investing activities exceeding $100 million this year.

That said, management hinted to potential M&A activity on the call albeit Ballard Power is not looking to follow competitor Plug Power's (PLUG) lead and become a vertically integrated supplier of solutions across the entire fuel cell and hydrogen value chain. Hopefully, the company will be able to use its expensive stock as the main currency given heavily elevated industry valuations.

With China currently providing plenty of cause for concern and most of the company's other business initiatives still in their infancy, investors should prepare for a couple of tough quarters ahead particularly in case analysts don't adjust their FY2021 models with many of them expressing a woefully short understanding of the company's business on the conference call.