Introduction

Natural Resource Partners (NYSE:NRP) might offer income investors plenty to love with their well-covered high distribution yield of almost 10% but at the same time, their coal exposure poses one big problem, as my previous article discussed. During the subsequent months, their results for the fourth quarter of 2020 have been released and whilst digging through their latest annual SEC filing, I discovered another obscure problem that sees their high distribution yield of almost 10% living on borrowed time.

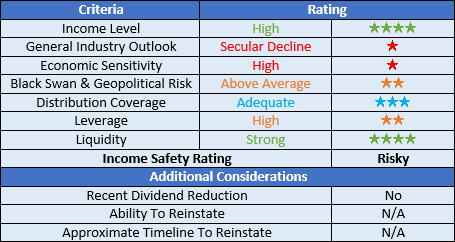

Executive Summary & Ratings

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that was assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Image Source: Author.

Detailed Analysis

![]()

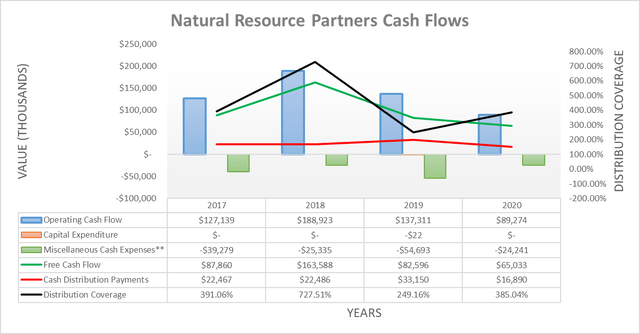

Image Source: Author.

Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and best captures the true impact on their financial position. The main difference between the two is that the former ignores the capital expenditure that relates to growth projects, which given the very high capital intensity of their industry can create a material difference.

It was little surprise that a partnership whose operations focus very heavily on coal was severely impacted during the Covid-19 economic downturn, the pain of which is easily visible in their cash flow performance. They saw their operating cash flow decrease by 34.98% year on year during 2020 with it falling to only $89m versus $137m during 2019, however, if removing the impacts of working capital movements the decrease expands even further to a very large 53.54% year on year. Since these results both represent