The market leader in the cannabidiol (CBD) space remains a stock to watch during a difficult regulatory period. Charlotte's Web Holdings (OTCQX:CWBHF) had a difficult 2020, but the company is poised to grow when the FDA finally sets guidelines surrounding CBD in dietary products. My investment thesis remains very bullish on the stock, especially on regulatory delay induced dips.

Image Source: Charlotte's Web website

Growing Despite FDA

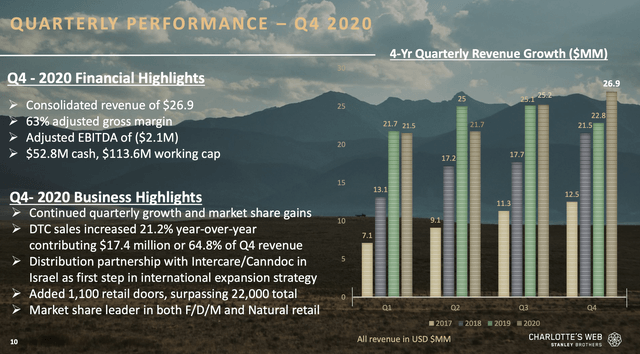

Acquiring Abacus Health last year has helped the quarterly results, but the key is that CWBHF is positioned for success once the FDA provides new guidelines. The company now has 22,000 retail doors after adding another 1,100 in the last quarter.

For Q4, revenue reached a record high at $26.9 million. The numbers offered limited growth going all the way back to Q4 in 2019 when revenues hit $21.5 million. The revenue amount was up 7% sequentially from $25.2 million in the prior quarter as more consumers ordered online, but the main gain came from some retail and health practitioners reopening businesses.

Source: Charlotte's Web presentation

Source: Charlotte's Web presentation

CWBHF now has a $100+ million annualized revenue run rate which is virtually EBITDA breakeven. For Q4, the adjusted EBITDA loss was only $2.1 million due to a 62% gross margin and cost controls.

The company lowered annualized operating expenses by $10 million in order to keep expenses in line with revenues here all while absorbing Abacus Health into the business. In addition, CWBHF opened up a new 137,000 sq. ft. facility to increase production capacity ahead of anticipated growth from updated FDA guidelines expected this year.

Big Days Ahead

The quarterly revenue levels are major disappointments for a company, when combined with Abacus Health, were once expected to generate over $100 million in quarterly revenues, or $400 million annually, by now. Though, investors need to remember that Charlotte's Web is better positioned now after

If you'd like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to double and triple in the next few years without taking on the risk of over priced momentum stocks.