Note: Some links in this article are in Russian.

Despite the recent volatility, Qiwi (NASDAQ:QIWI) struggles to recover after the crash in late 2020. In my opinion, there's little-to-no chance that the stock will ever return to its pre-crash prices as the regulatory headwinds are still there. QIWI may be somewhat suitable for short-term speculations but certainly doesn't look like an interesting long-term investment even at such low multiples.

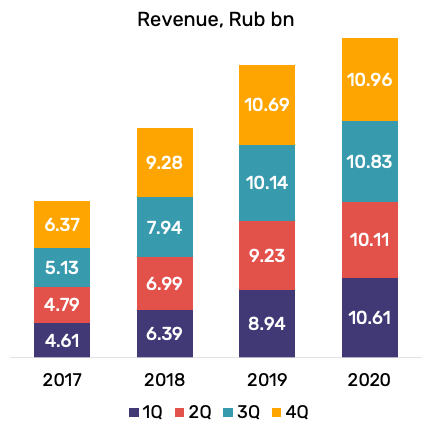

Full-Year Results Quick View

Source: Company data, Author's spreadsheet

Revenue in Q4 2020 increased by 2.5% YoY to 11 billion rubles.

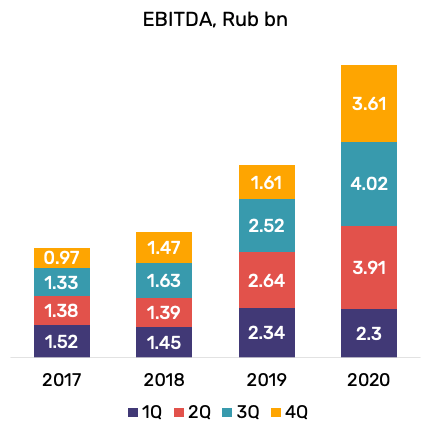

Source: Company data, Author's spreadsheet

Adjusted EBITDA is up 2.2 times YoY to 3.6 billion rubles.

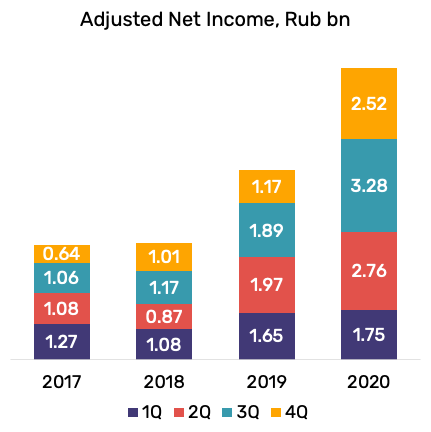

Source: Company data, Author's spreadsheet

Adjusted net income in Q4 grew 3.6 times YoY to 2.5 billion rubles.

QIWI vs. Bank of Russia

In December 2020, the Central Bank of Russia (CBR) imposed restrictions on some of QIWI Bank's operations with foreign companies, as well as the transfer of money to prepaid cards of corporate clients.

After the publication of Q4 earnings, QIWI stated that the company is working together with the CBR to fully eliminate all violations. As of today, the CBR allowed the company to resume payment processing for certain key foreign companies and removed some other restrictions introduced in December 2020.

However, QIWI notes that there is no guarantee that there will be any further easing of restrictions or that they will ultimately not become permanent, including through the adoption of new laws or regulations. According to the management's guidance, QIWI's total revenue may fall by 15-25% YoY, and adjusted net income may decline by 15-30% in 2021. Thus, the company seems to expect that it won't be able to fully restore its operations this year.

In the meantime, QIWI still wants to become the only company responsible for accounting interactive bets, according to Kommersant. In December 2020, the Russian government established a Unified Gambling Regulator to oversee the betting market and created the role of a single Unified Interactive Bets Accounting Center (ETSUP). ETSUP will soon replace the two existing Interactive Bets Accounting Centers (TSUPIS), and one of them belongs to the company.

QIWI, as well the owner of the second TSUPIS, proposed to become that one ETSUP. Nonetheless, it is unclear whether the government will accept this proposal, so the failure to inherit the ETSUP status will lead to losses of payment volumes and, consequently, earnings.

Otkritie Bank Plans To Sell Its Stake

Even if QIWI will somehow resolve all regulatory issues, it doesn't mean that investors would be able to relax and enjoy their gains.

Back in February, the head of Otkritie Bank Mikhail Zadornov said that the bank is waiting for favorable conditions for the sale of its stake in Qiwi as the asset is not strategic.

I confirm that the stake in QIWI is not strategic for us. We are looking for a convenient moment and a way to sell, negotiating with "strategists", - he said.

For reference, Otkritie Bank owns 37.4% of QIWI, and the bank wants to sell the whole stake. Given that any strategic investor will likely ask for a discount for this stake, the sale may send the stock into limbo again if it grows high enough. This factor seems to be overlooked by a broader audience, though it by no means should be underestimated.

Dividends

The company should announce Q4 dividends soon. The company already paid $0.81 for the previous three quarters of 2020, and Q4 dividends may amount to ~$0.15. Sell-side analysts expect a 7-8% dividend yield for 2021, which is the only sweetener of the whole investment case.

The Bottom Line

Regardless of how successfully QIWI overcomes regulatory issues this year, the potential stake sale by Otkritie Bank may easily nullify gains of those investors who bought the stock after the crash. At the same time, the instability of the company's earnings doesn't allow me to recommend buying QIWI for dividends. There are much better dividend stocks in the Russian stock market - Mobile TeleSystems (MBT), for example.