Introduction

The Top Dividend Growth stock model expands on my doctoral research analysis on multiple discriminant analysis (MDA) adding new complexities with these top picks. Research shows that the highest frequency of large price breakout moves is found among small cap stocks with low trading volumes offering no dividends and delivering higher than average risk levels.

The challenge with the Top Dividend & Growth model is to deliver a combination toward optimal total return with characteristics that typically reduce the frequency and size of price breakouts, but deliver more reliable growth factors for higher profitability longer term.

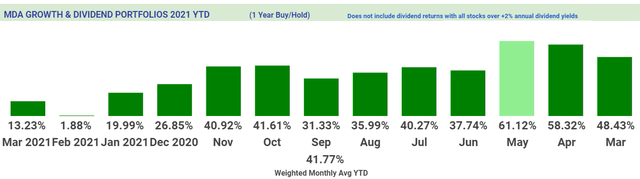

Returns to date on the MDA Growth & Dividend selection model not including large % dividends from all stocks:

V&M Top Growth And Dividend MDA Breakouts: 2020 Year-End Report Card

The 1-year measurement period of the April 2020 portfolio ended with 58.3% annual gains not counting dividends. Readers are free to buy/hold for the one-year measurement period of each portfolio, hold longer, or update and refresh your Growth & Dividend portfolios with newer selections.

Each monthly selection portfolio consists of 5 stocks above a minimum $10 billion market cap, $2/share price, 500k average daily volume and a minimum 2% dividend yield. The population of this unique mega cap segment is approximately 330 stocks out of over 7,800 stocks across the US stock exchanges. While these stocks represent less than 5% of available stocks, their market cap exceeds $19 trillion out of the approximately $33 trillion (57.6%) of the US stock exchanges. Efforts are made to optimize total returns on the key MDA price growth factors (fundamental, technical, sentiment) for the best results under these large cap constraints with high priorities for dividend growth and dividend yield.

Top Growth & Dividend Stocks For April 2021

Score Overview of

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 1,400+ outstanding members at Value & Momentum Breakouts

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 1,400+ outstanding members at Value & Momentum Breakouts

- Subscribe now and learn why members are hooked on the Momentum Gauge® signals!

- The Premium Portfolio gained 47.5% and MDA Breakout picks gained +73.4% last year.

- 10 different portfolio types beat the S&P 500 last year.

- Now into our 5th year, this rapidly growing service has consistently outperformed the S&P 500 every single year!

See what members are saying now - Click HERE