Before we get started, take a quick look at this photo from the motorhome retirement.

Delicious Mango-Sriracha sea scallops at a restaurant in Wildwood, Florida.

Introduction

In my first article, I introduced a real money portfolio using the "Permanent Portfolio" strategy. I want to see if it is an appropriate portfolio for me to use in retirement as there may come a time when I am no longer willing or able to manage a portfolio of stocks. The portfolio was started 2-1/2 years ago.

About the permanent portfolio

The concept of the permanent portfolio was created by Harry Browne in the 1980s. There are various studies of this portfolio and they generally show results of 5-9% over time with lower drawdowns during market swoons. Its purpose is to be an all-weather portfolio and it comprises the following allocations:

- 25% gold

- 25% stocks

- 25% long-term U.S. bonds

- 25% money market

The gold is for inflationary environments. The stocks are for prosperous or growth environments. The long-term bonds are for deflationary environments. The short-term bonds/money markets are for recessionary environments.

Test portfolio set-up

I chose the following ETFs for this experiment.

- IAU, a gold ETF

- VOO, Vanguard S&P 500 ETF

- TLT, iShares 20+ Year Treasury Bond ETF

- SHV, iShares U.S. Treasuries of one year and less to use as a money market substitute

What are the expectations?

During retirement, I believe it is important that a portfolio has the following characteristics.

- Minimal drawdown and volatility less than the overall market.

- Provide a modest level of income.

Regarding the income from this portfolio, with the allocation to gold, which has no income component, and the money market, which has very small level of income, it is understood that this portfolio will not supply the total income needed and assets will have to be sold to make the difference. While this is not ideal, it will be better than going all cash when the time comes to stop analyzing individual stocks. If the studies are correct, the portfolio should be able to provide a 3-4% level of income and still show modest growth.

The portfolio was started with $10,000 on October 1, 2018.

Due to the large size of the share prices of the ETFs relative to the total portfolio, the allocation was not perfect, but it was about as close as I could get it. Another $10,000 was added in 2019, bringing the total investment to $20,000.

At the end of 2020, the portfolio looked like this.

Permanent Portfolio 12/31/2020 | ||||

Shares | $/Sh | Value | % | |

VOO | 20 | $ 343.69 | $ 6,873.80 | 27.3% |

IAU | 340 | $ 18.13 | $ 6,164.20 | 24.5% |

SHV | 55 | $ 110.53 | $ 6,079.15 | 24.1% |

TLT | 38 | $ 157.73 | $ 5,993.74 | 23.8% |

Cash | 64.5 | $ 1.00 | $ 64.50 | 0.3% |

Total | $ 25,175.39 | 100.0% | ||

Source Author

Here is the portfolio at the end of Q1 2021

Permanent Portfolio 3/31/2021 | ||||

Shares | $/Sh | Value | % | |

VOO | 20 | $ 364.30 | $ 7,286.00 | 30.2% |

IAU | 340 | $ 16.26 | $ 5,528.40 | 22.9% |

SHV | 55 | $ 110.51 | $ 6,078.05 | 25.2% |

TLT | 38 | $ 135.45 | $ 5,147.10 | 21.3% |

Cash | 102.96 | $ 1.00 | $ 102.96 | 0.4% |

Total | $ 24,142.51 | 100.0% | ||

Source: Author

The portfolio began underperforming in 2020 Q4 and that has continued in 2021. For the first quarter, the return was -4.10. This was the worst quarter since I started this experiment and the only quarter in which all three months were negative. The S&P 500 (VOO) was up 6.00% in the quarter.

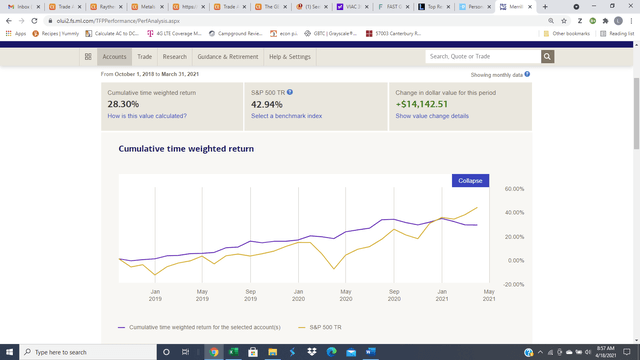

Here is a chart comparing the portfolio to the S&P 500 since it was started.

Source: Merrill Edge account performance tool

Note how the ride is much less exciting for the portfolio than the S&P 500. More on that later.

Since starting the portfolio in 2018, the total return is 28.4% or 10.48% annualized vs. 42.94% or 15.36% annualized for the S&P 500.

Drawdown and volatility

Using monthly closing values, the maximum drawdown for the portfolio was in March 2020 when the portfolio dropped 1.95% from the end of January. There have been 9 negative months for the portfolio, with the greatest monthly drop of 3.13% in February 2021 and the most recent in March 2021 (-0.75%)

The maximum monthly drawdown for the S&P 500, using VOO as a proxy, was 12.85% from $271.74 to $236.82 in March 2020. There have been 8 negative months for VOO, most recently January 2021 with a drop of 1.02%.

The standard deviation based on monthly closing changes for VOO was 5.71% over the life of the portfolio. The portfolio had a standard deviation of 2.02% all time. The portfolio has lower volatility and a lower drawdown than VOO since inception. This is depicted graphically in the figure above. The portfolio is the blue line and the S&P 500 TR is the orange line.

As expected, the portfolio continues to show lower volatility and trail the performance of S&P 500 in strong markets.

Summary of performance over time.

Q1 2021 | 2020 | 2019 | Inception | |

PP | -4.10% | 15.51% | 15.82% | 28.30% |

S&P 500 (VOO) | 6.00% | 16.28% | 31.49% | 42.94% |

The portfolio nearly matched the S&P 500 since until the most recent quarter when the S&P 500 performed well while gold and long-term Treasuries declined.

Income generated

The portfolio generated $45.49 of income in 2021 Q1. This is about 1%.

A yield of 1% is less than half the amount a portfolio will need to yield during retirement. There is no way to sugar coat it, this level of income is not sufficient to support a retirement without selling off assets. Although this is not ideal, the draw could happen at the same time as the annual rebalance. At this point, the portfolio is performing well enough to sustain a retirement assuming a 3.5-4% withdrawal rate.

How does the portfolio measure up to the expectations?

To summarize, since its inception on October 1, 2018, the portfolio:

- Showed lower volatility and a lower drawdown than the market.

- Yield was about 1% for Q1.

- Underperformed the S&P 500 the last six quarters and had returned about 28% since inception (October 31st, 2018).

With the exception of income generation, the portfolio has met or exceeded the expectations we have for a retirement portfolio.

The path forward

I do not expect this portfolio to outpace the S&P 500 in bull markets. However, I expect it to remain less volatile and perform better in down markets. I am looking forward to monitoring its performance and to see if it continues to meet my expectations for a retirement portfolio. I will continue to provide quarterly updates.

What do you think of this portfolio? Do you think it is appropriate for retirees? Please comment below and let me know.

I recently published an article regarding my thoughts on Amgen (AMGN). You can find it here, in case you missed it.

If you enjoyed this article and wish to receive updates on our latest research, click "Follow" next to GrayBeard Retirement at the top of this article.

Came across this bird while on a nature trail at some natural springs. Can you spot the two turtles?