One of the unfortunate problems with the strength that we have seen in the market over the past several years is that it has driven market yields down to incredibly low levels. This could prove to be a problem for retirees or others that are depending on their portfolios for income. As a result, they are forced to sell off their assets in order to generate income, which could prove problematic if the market does not continue to go up. Fortunately, there is a way to remain invested in the market and still generate a very high yield that can provide the income that is needed to support a comfortable lifestyle. That method is by investing in an equity closed-end fund as these funds are able to use a variety of strategies to boost their yields well above what other funds are able to accomplish. There are many such funds available but in this article, we will discuss the Gabelli Equity Trust (NYSE:GAB), which boasts an impressive 8.57% distribution yield at the current price. Throughout this article, we will attempt to determine if the fund could be right for your portfolio.

About The Gabelli Equity Trust

According to the fund’s web page, the Gabelli Equity Trust has the stated objective of generating long-term capital growth with a secondary focus on income. This is a somewhat unusual objective for a closed-end fund, even in the equity space, as many of them attempt to primarily generate income for their shareholders through the distributions that they pay out. The fund’s strategy reflects its objective overall as management invests the fund’s money into common equities that it believes will appreciate over the long term. This is done by seeking out rapidly growing companies that are undervalued, which is a relatively common strategy that is used by many retail and institutional investors.

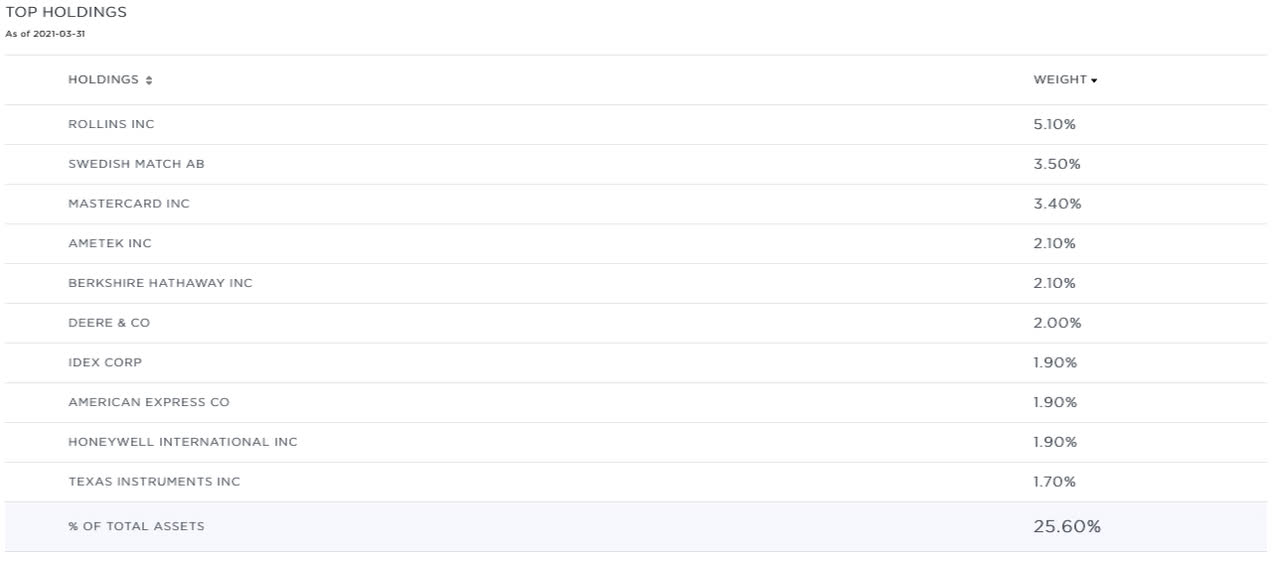

A few of the companies that the fund is invested in are likely to be familiar to most readers but there are also some whose names may not be as well recognized. Here are the largest positions in the fund:

It is certainly not a surprise to see Berkshire Hathaway (BRK.B) here. Warren Buffett is very well known for using a strategy that is very similar to the fund’s management as he has made a career investing in undervalued companies with high growth potential. Sweden Match (OTCPK:SWMAF), which is a Scandinavian tobacco company, is likely not going to be as well known to many readers. I will admit that it is fairly surprising to see a tobacco company here as these entities are not exactly considered growth companies today. Swedish Match is not involved in either vaping or cannabis products, which are generally considered the only real growth opportunities that many of these companies have. It is likely that Swedish Match is in the portfolio mostly for its dividend but at only a 2.10% yield, it is nowhere near the American tobacco companies in this regard.

One very nice thing to see here is that the Gabelli Equity Trust is very well diversified. As my regular readers on the topic of closed-end funds are no doubt well aware, I do not like to see any single position in a fund account for more than 5% of the fund’s total assets. This is because this is approximately the level at which a position begins to expose the fund to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk which any asset possesses that is independent of the market as a whole. This is the risk that we attempt to eliminate through diversification but if the asset accounts for too much of the portfolio, then this risk will not be completely diversified away. Thus, should some event occur that causes the price of a given asset to decline when the market does not, then it could end up dragging the entire fund down with it if it accounts for too much of the portfolio. As we can see above though, there is only one position in the fund that accounts for more than 5% of its total assets and it is not very much above that limit. Thus, the fund appears to be sufficiently diversified to allow us to avoid that risk.

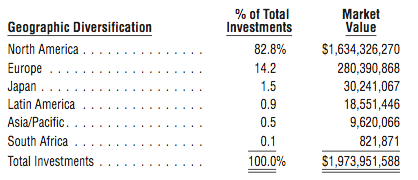

A look at the largest positions in the fund would lead one to the correct conclusion that the Gabelli Equity Trust is a global fund that invests in companies from all over the world. This is nice because of the protection that it provides us against regime risk. Regime risk is the risk that some government or other authority will take some action that has an adverse impact on a company that we are invested in. We saw an example of this recently when the Biden Administration cancelled the permits for the construction of the KeystoneXL pipeline and caused the money that TC Energy (TRP) already invested in it to be wasted. The only realistic way to protect ourselves against this risk is to ensure that our assets are spread around the world in order to limit our exposure to any single government or region. This fund appears to be sharing that philosophy as a way to limit risk. With that said, the Gabelli Equity Trust is still very heavily weighted to the United States as 82.8% of its assets are invested in North American companies:

Source: GAMCO Gabelli

The United States accounts for just under a quarter of the world's gross domestic product and about 40% of the global market capitalization. Thus, this fund is obviously substantially overweighted to that market no matter how we look at it. Admittedly though, it is not unusual for a global fund to have an outsized weighting towards America. This fund has a much higher weighting than the 50%-70% weighting that we normally see for a global fund. Thus, any investor in this fund will want to ensure that they have sufficient foreign exposure from other sources to be sufficiently internationally diversified.

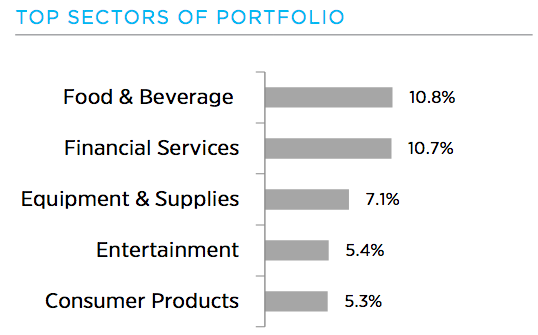

In a previous article, I discussed how the mega-cap technology stocks were responsible for most of the returns of the S&P 500 over the past year. In fact, this small handful of stocks was responsible for a sizable proportion of the gains over a much longer period than that. It may be surprising then that the Gabelli Equity Trust only has a fairly limited exposure to the technology sector:

Source: GAMCO Gabelli

This may be a good thing for diversification purposes since most people that have a significant proportion of their portfolios invested in an S&P 500 index fund, or indeed many other actively managed equity funds, are going to have a substantial amount of exposure to the technology sector. The technology sector is certainly not the only one that is capable of delivering growth though, so this fund looks like a way to profit off of opportunities that may arise in other areas.

The Yield Problem For Investors

As I mentioned in the introduction, one of the problems facing investors needing yield is that most of the broad market indices have ones that are far too low to fund any sort of reasonable lifestyle. As of the time of writing, the MSCI All-Country World Index (ACWI) only yields 1.30%. At that yield, a $1 million portfolio will only generate $13,000 per year in income. The S&P 500 (SPY) is only slightly better as its 1.33% current yield kicks our income off of the $1 million to $13,300 annually. It is a pretty fair bet that this will not be enough income to finance the lifestyle of anyone that managed to save up $1 million over the course of their careers. Thus, retirees are forced to sell off their assets in order to simply pay their bills and that may not be sustainable if the market does not continue to go up indefinitely (and historically it will not).

The biggest reason for these low yields is that the policies of the Federal Reserve have pulled money out of the banking system and into the capital markets where it has driven up equity prices and by extension driven down yields. The specific policy that caused this is the central bank’s control over the federal funds rate, which is the rate at which commercial banks lend to each other on an overnight basis. As of the time of writing, this rate sits at 0.07%, which is very close to its all-time low. As we can see though, the rate has been at historically low levels over the past decade:

Source: Federal Reserve Bank of St. Louis

This is important because the federal funds rate affects the interest rate of everything else in the economy. This is the reason why the interest rates on your bank savings accounts and certificates of deposit have been so low. This situation has caused investors to pull their money out of these types of accounts and put it into the capital markets in search of any type of yield. The increased amount of money attempting to purchase stocks has pushed stock prices up. This causes the yields on these stocks to go down. This is also not strictly a problem limited to the United States as the European Union has also had incredibly low interest rates for years. There have even been a few central banks, such as those of Switzerland and Japan, that have been purchasing American equities in an effort to control the values of their own currencies. These sorts of actions have also had the effect of pumping money into the markets and driving down yields.

The Gabelli Equity Trust is able to deliver a much higher yield than these other funds, which is partly due to the fact that its closed-end structure allows it to do a number of things that other funds cannot. The fund currently yields 8.57%, as already mentioned. At that yield, our hypothetical $1 million portfolio will generate $85,700 in annual income. This is the sort of income level that is needed to support anything approaching a reasonable retirement for someone that managed to earn enough to amass a portfolio of that size.

Leverage

One of the strategies that the fund is able to use to boost its yield is leverage. In short, the fund borrows money (or issues preferred stock, as is largely the case here) and uses the money to invest in stocks. As long as the returns that it is able to generate off of these stocks are higher than the price it must pay for the money, then this works quite well to amplify the profits off of the portfolio. As we have already seen, interest rates are incredibly low and this also affects the yield that the fund must pay on its preferred shares. Thus, we can assume that the stock returns are indeed higher than the price of the borrowed money. The use of debt is a double-edged sword however, as leverage enhances both gains and losses. As such, we want to ensure that the fund is not using too much leverage as that would expose us to unacceptable losses in the event of a market downturn. In a previous article, I stated that I do not like seeing a fund’s leverage over about a third as a percentage of assets. However, a common stock fund should have lower leverage due to the riskier nature of common stocks versus fixed-income. The Gabelli Equity Trust only has a leverage ratio of 20.41% though, so it certainly seems to be striking a reasonable balance between risk and return.

Distribution Analysis

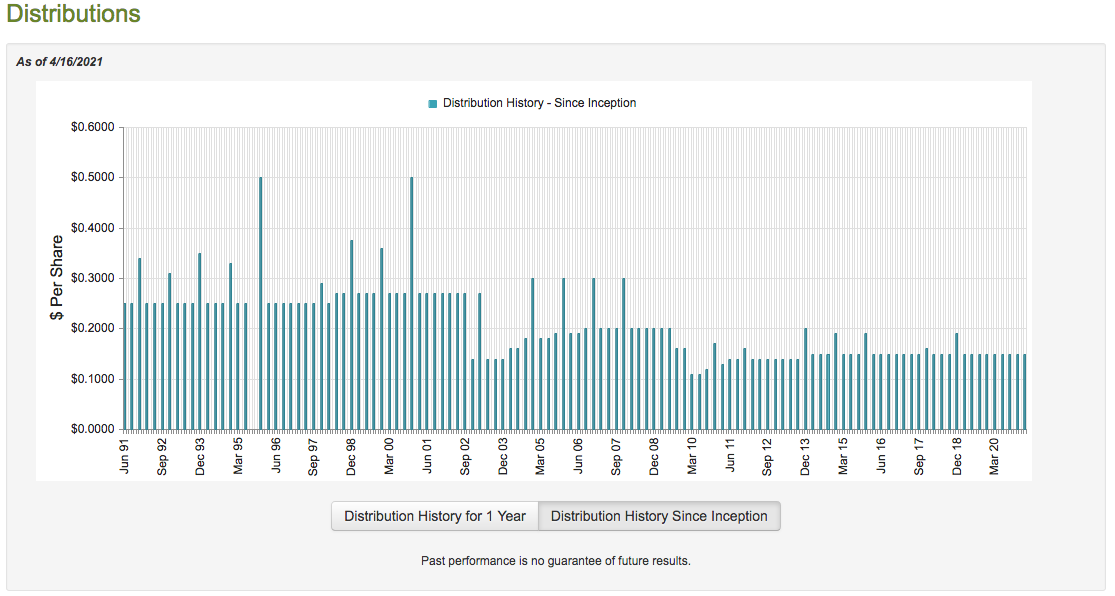

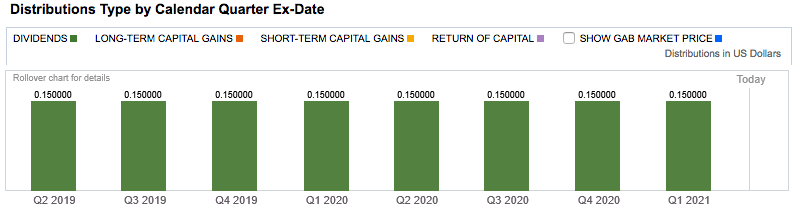

As mentioned earlier, the Gabelli Equity Trust has the objective of long-term capital appreciation but does have a special emphasis on current income, as is the case with many closed-end funds. This is reflected in the fact that the fund pays out a regular quarterly distribution to its shareholders. Currently, the fund’s distribution is $0.15 per share quarterly ($0.60 per share annually), which gives the fund an attractive 8.57% distribution yield at the current share price. The distribution has varied a great deal over the years:

Source: CEF Connect

It is not unusual for a closed-end fund to vary its distribution over time. This is because the distribution frequently depends on the performance of the fund’s portfolio, which can be dependent on the market as a whole. In the case of this fund, it pays out an average of 10% of its net assets each year as that is a level that management expects to be able to earn through income and capital gains. Obviously then, if it cannot generate at least that level, the fund’s assets could be depleted. This could naturally then prove to be a problem in a sustained bear market, although we have not had a sustained bear market for many years.

It may thus be somewhat comforting that the fund’s distributions are entirely classified as dividend income, without any return of capital:

Source: Fidelity Investments

The reason why this may be comforting is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. Obviously, this scenario is not sustainable over any kind of extended period. In the case of this fund, a return of capital could also indicate that the fund failed to generate the 10% return needed to satisfy its managed distribution policy. As I have pointed out though, it is possible for these distributions to be misclassified and, admittedly, it is pretty hard to believe that the fund managed to generate enough dividends and interest in 2020 to be able to totally cover a payout of 10% of net assets. As such, we want to investigate and see how exactly the fund is financing these distributions and how sustainable they are.

Fortunately, we have a fairly recent report that we can consult for this purpose. The fund’s fiscal year runs in line with the calendar year so the most recent report corresponds to the full-year period ended December 31, 2020. This report should thus tell us how well the fund weathered through the turbulent conditions early in the year and the market’s subsequent recovery. Over the course of the year, the fund collected $29,735,571 in dividends and $300,579 in interest off of its investments. This gives the fund a total income of $30,036,150. It covered its expenses out of this amount, which left it with $10,632,558 available for the common and the preferred shareholders. This was not enough to cover the $18,778,088 that it paid to the preferred shareholders, let alone the $155,427,477 that it paid to the common shareholders. A fund like this does of course have other ways of getting money to distribute, such as through capital gains. Fortunately, the fund did manage to have some capital gains in 2020 as it realized $92,881,823 in realized capital gains and $67,427,671 in unrealized capital gains over the course of the year. After the fund paid the distributions to the preferreds, it had $152,163,964 available from all sources for the common shareholders. Even this was not enough to cover the distribution but it did get close.

As everyone reading this is no doubt well aware, 2020 was a very unusual year as it was the first time in history that nations all over the world shut down their economies and essentially quarantined all of their citizens. This led to severe problems in many sectors and an overall turbulent market. Thus, it may be helpful to look at a more typical year to truly analyze the fund’s ability to cover the distribution. In 2019, the Gabelli Equity Trust saw its assets increase by $316,134,261 from all sources after covering the payments to the preferred holders. This was more than enough to cover the distributions that it made to the common shareholders and make up for the 2020 shortfall. Overall, the fund’s net assets were higher at the end of 2020 than they were at the start of 2019 after accounting for all distributions and other transactions. Thus, it does appear that the fund’s distributions are sustainable (as long as the market remains strong). However, they are not entirely dividend income.

Valuation

As is always the case, it is critical to ensure that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return off of that asset. In the case of a closed-end fund like the Gabelli Equity Trust, the usual way to value it is by looking at a metric known as the net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt (or preferred stock). It is therefore the amount that the common shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can get them at a price below net asset value. That is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not the case here. As of April 16, 2021 (the most recent date for which data is currently available), the Gabelli Equity Trust had a net asset value of $6.61 per share but it trades hands for $7.00 per share. That gives the fund a 5.90% premium at the current share price. While this is a decent fund and the current price is more attractive than the 8.43% premium that it has averaged over the past month, that still seems like a pretty steep price to pay. I would wait and see if it would be possible to acquire it at a discount to net asset value.

Conclusion

In conclusion, the Gabelli Equity Trust does appear to be a reasonably solid closed-end fund that can help investors overcome the problem of low yields that has been plaguing the market for quite some time. This fund boasts a fairly high distribution yield that it appears able to maintain, as well as offers a reasonable amount of diversification. Unfortunately, the fact that it trades at a premium means that you are paying a lot for these good things. It might be better to wait on this one.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!