"The only constant in the technology industry is change." - Marc Benioff

In the absence of earnings headlines, "sentiment" has taken over the short-term scene. What happens in the immediate term from here will likely have a lot to do with how much more "Fedspeak" we hear in the coming days/weeks. The market has been talking "inflation" for months and now thanks to other economic analyses the discussion has moved to "stagflation". The Fed has a tough task ahead as they attempt to "thread the needle."

Tighten too soon and risk throwing cold water on an economy still trying to return to normal; tighten too late and risk letting inflation get out of hand to a point that might require more desperate action down the road. This same discussion has been around for decades. Some may remember this being described another way "The Fed is in a box" or "the Fed is behind the curve." We can expect these buzzwords to be rolled out as the year unfolds.

It's a slippery slope and everyone seems to have an opinion on the "right" course of action despite this being an unprecedented situation. Here is one thing I have more confidence in. I don't see the Fed suddenly turning overly-hawkish after more than a year of making it clear they're fine letting inflation run above their target for a while. Of course, that's where the debate comes in. The negative views proclaim the Fed won't have a choice but to raise rates if inflation starts to run away. This week the equity market sent its message to the market participants by setting record highs.

The Corporate Macro Scene

Corporate America seems ready to embark on a capital spending binge. Many companies are set to do a lot more investing. Since the Institute of Supply Management's capacity utilization is now at 88%, a post-1995 high, that would appear to be the path they will follow. A solid CAPEX cycle supported by the Manufacturing Renaissance is essential for the healthy MACRO economy backdrop to continue.

In certain segments of the economy, where capital spending won't make much difference to bottlenecks, they will be forced to pay up to attract labor and material supplies. In any other area where technology advances and automation is possible (and there are many), companies will have the opportunity to invest in machinery. That eliminates the need for additional labor. The recent company surveys are telling us they are having difficulty in finding workers lately.

Help wanted signs are everywhere. So far corporations are continuing the search for employees, but if this present employment landscape doesn't change and change fast, they could opt to do a lot more to have technology replace workers. A trend that will pour plenty of cold water into the effort to achieve a lower unemployment rate.

Wage inflation is a great situation for workers, but it can be a nightmare for companies. Especially those that are NOT focusing on productivity growth. We have seen a "V" rebound in revenues and profit margins look to be in good shape. As this recovery matures and this unsustainable growth trajectory subsides to a more normal pace, revenues will slow. When wages then accelerate, profit margins take a hit.

Keep in mind that doesn't include any tax hikes. Now you can see why adding higher taxes to the mix is a potential disaster for corporate profits and the stock market. As this expansion matures, I'll be on the lookout for companies that can produce strong productivity growth. That is where stock performance will be.

Savvy Investors

Ned Davis Research is a well-respected firm that has earned that reputation by correctly assessing the markets over time. Mr. Davis has been quoted stating that All successful investors share four basic traits:

- They use objective indicators.

- They are disciplined.

- They have flexibility.

- They are risk-averse.

While it may be implied, please allow me to humbly add one more to the list. Successful investors use ALL of the data that is being presented. The secular bull backdrop is THE trend in place; it is the wind at investors' backs. The second part of that view is just as important to keep in mind. Corrective activity that comes along washes out the weak hands and often includes scary drawdowns in stock prices. Occasionally it can produce a very short-lived BEAR market as we saw in 2020 with COVID. It is how the market functions over long periods of time.

For those that dismiss all of this as magic and wizardry, I apologize for taking up your time. The participants that embrace this concept and have a long time horizon to build wealth will NOT be disappointed by simply following the primary trend (that includes a downtrend as well). Looking ahead, it becomes a question of whether the stock market meanders around these levels while the Fed agenda, the political backdrop, and the earnings picture are clarified. It isn't rocket science.

At some point, stimulus wears off, then the issues I just mentioned will dictate the pace of the economy and the price of the stock market going forward. As we enter the latter half of 2021, it will be time to review strategies that MUST incorporate ALL of the data points available.

The Week On Wall Street

As trading opened on Monday, I noted that the Dow 30 was down every day in the prior week. That was the first time the index has done that since February 2020 just as the COVID crash was getting underway. The Bulls regrouped to start the week sending the major indices higher, recouping some of the losses suffered during the Fed selling event.

The cyclical/old economy trade received the most attention. Small caps were the winners as the Russell 2000 rallied 2%. The S&P, Dow 30, Dow Transports posted gains north of 1.5+% while the NASDAQ rallied 0.80%.

The indices flatlined midweek but the NASDAQ Composite was able to post back-to-back new highs on Tuesday and Wednesday as "Growth" was back in demand. The buying spread to other areas of the market as the S&P 500 posted back-to-back new highs to end the week. While that was taking place the NASDAQ Composite added its 4th new high for the week.

The hedgers that jumped on the short-term breakdown and were seen patting themselves on the back were once again frustrated. Buying "protection" and "insurance" as a market makes a new high is one of the quickest ways to throw gains away. The lion's share of the profits goes to the investors who aren't playing the hedging game every time the market rallies.

Every time you "hedge" you're betting against the primary trend. The time to "hedge" and play the "short " game is when the trend is in your favor. The entire "hedging" instinct is a simple emotional response. It's the "instinct " that tells you prices can't keep going up and they are "overdue" for a correction.

After a while one would think the average investor would finally realize that doesn't work. Investing using "instinct" is a mistake.

Washington Policy

The framework for an infrastructure package with NO NEW TAXES was established this past week. That is a positive for the stock market. It is my view that the market has already priced this in as the "no tax" part of the package has been telegraphed for a while. This package is expected to cost about $1.2 trillion over eight years, with $973 billion in the first five years. About $579 billion in new spending would flow to projects such as roads and bridges.

However, Mr. Biden said that he would not necessarily sign the bill unless Democrats passed tax hikes and social spending in a supplemental bill. The stock market has not priced in the "so-called" second bill.

Stay tuned. There is either a solid bipartisan deal with no strings attached or it's back to the drawing table.

Economic Reports

U.S. private sector businesses registered a further marked expansion in activity during June, as further easing of COVID-19 restrictions boosted new orders. The rate of expansion softened slightly from the high seen in May but remained substantial overall. the IHS Markit Flash U.S. Composite PMI Output Index posted 63.9 in June, down from 68.7 in May, but signaling a historically elevated rate of expansion in output across the private sector.

The issue for all to ponder. We may have seen the "peak" in this report and it will be important to see where this activity finally settles. We also have to be on the lookout for other areas of the economy around the globe that may start to show the same pattern. I do expect to see this play out in other areas of the economy as well. The "V" recovery has run its course, it is now up to policymakers to ensure that growth will continue at a solid pace.

The Chicago Fed National Activity Index (CFNAI) is a monthly index designed to gauge overall economic activity and related inflationary pressure. It was reported as +0.29 in May, up from -0.09 in April pointing to a pick-up in economic growth. The index was led by improvements in production-related indicators. Production-related indicators contributed +0.29, up from -0.05 in April; the contribution of the employment, unemployment and hours category rose to +0.16 from +0.06, and the contribution from the sales, orders and inventories category was +0.02 compared to -0.06.

Richmond Fed's Manufacturing index increased 4 points to 22 in June, above forecast, after inching up 1 point to 18 in May. This is the strongest reading since the index jumped 8 points to 29 in October, the all-time peak. It was at 0 a year ago. The components were mixed, however, consistent with the many crosscurrents impacting manufacturing, including supply chain disruptions, labor issues, and rising commodity and input prices.

Durable goods orders bounced 2.3% in May following the 0.8% decline in April. Transportation orders bounced 7.6%, breaking two months of declines with April falling 6.6% and March down 3.1%. Excluding transportation, orders edged up 0.3% versus the prior 1.7% gain.

Housing

Existing home sales fell 0.9% to 5.8 million in May, not as weak as expected. Yet this is a fourth consecutive monthly decline after tumbling 2.7% to 5.85 million in April, as headwinds from inventories and prices continue to weigh. The 6.73 million from October was the highest since March 2006. Single-family sales slumped 1.0% to 5.08 million in May versus the 3.2% slide to 5.13 million in April. Condo/coop sales were unchanged at 0.72 million after rising 1.4% to that level previously. The total months' supply inched up to 2.5 from 2.4 in April and was at an all-time low of 1.9 in December.

New home sales sharply undershot estimates with a 5.9% May plunge to a 769k pace. New home sales look poised for a 39% Q2 contraction rate to a 795k clip. Analysts expect a capacity-constrained 4% 2021 climb, after a 21.1% gain in 2020, leaving a surge in new home prices as captured by today's 2.5% May median price rise to a new all-time high of $374,400.

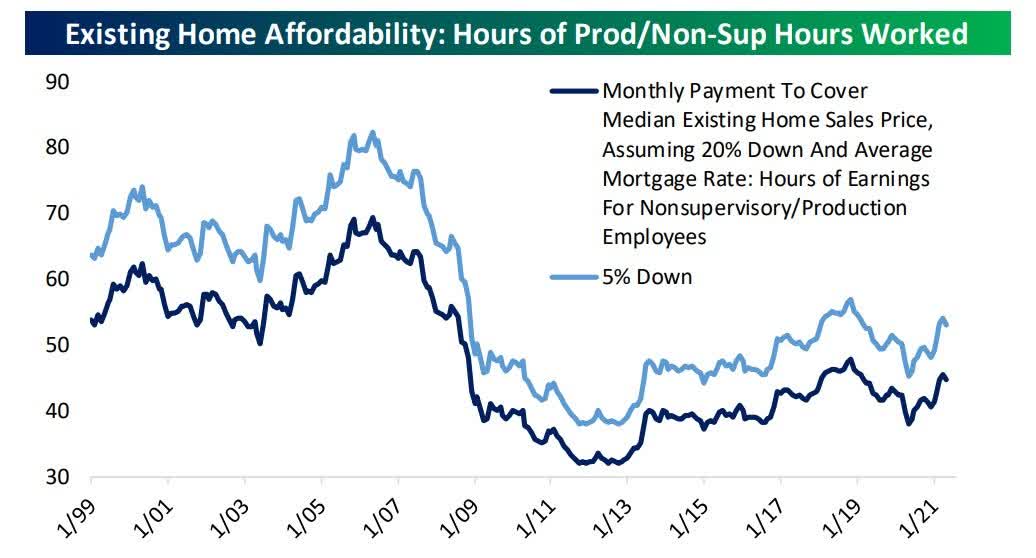

While the massive surge in existing home prices has definitely reduced housing affordability, low rates and large apparent hourly wage gains in recent quarters have helped offset the pain. As shown below, the monthly carrying cost of an existing home in hours worked terms is just below the norm since 1999.

Source: Bespoke

For context, putting 20% down in 1999 would cost more than 2,000 hours worked at the prevailing wages during that period. For sure, housing has gotten more expensive, but this basic picture now does not scream "unaffordable" relative to income and mortgage rates.

Consumer sentiment dipped to 85.5 in the final June print versus the 86.4 preliminary reading. But it is still 2.6 ticks higher than the 82.9 in May. The 88.3 reading from April is the cycle high. Both of the components were revised down. The expectations index dipped to 83.5 versus the 83.8 preliminaries, though is up from May's 78.8. The current conditions index was knocked down to 88.6 from the 90.6 preliminary and compares to the 89.4 in May. The 1-year inflation gauge printed at 4.2%, slightly slower versus May's 4.6%

The Global Report

Eurozone business activity grew at the fastest rate for 15 years in June as the economy re-opened further from virus-fighting restrictions and vaccine progress boosted confidence. The headline IHS Markit Eurozone Composite PMI increased from 57.1 in May to 59.2 in June. That is the highest since June 2006, according to the preliminary "flash" reading*. The latest reading indicated a third successive month of accelerating output growth.

June saw further strong growth in output across the UK private sector. The headline seasonally adjusted IHS Markit / CIPS Flash UK Composite Output Index registered at 61.7 in June, down slightly from May's record reading of 62.9 but still pointing to one of the strongest monthly improvements in business activity across the private sector since 1998.

The headline

au Jibun Bank Japan Manufacturing Purchasing Managers' Index ((PMI)) - which measures the overall health of the manufacturing sector - slipped from 53.0 in May to 51.5 in June, signaling a softer improvement in operating conditions in the manufacturing sector, and the weakest reading of the headline Index for four months.The Daily chart of the S&P 500 (SPY)

When the S&P makes new highs during the week it is hard to find fault with the short to intermediate trend. With a close at 4,280, the S&P has now recorded 31 new highs in 2021, with 5 of those records posted in the last 2 weeks. Savvy investors realize that in a bull market strength begets strength.

If an investor followed the analysts and pundits that called for a 10% correction and positioned their portfolios that way they have been fooled. When you make a mistake like that it takes a long time to regroup and recapture what was lost. In some cases that never happens.

There are numerous support levels under where the index is trading today. We also note that there is no indication that any of the trend lines are about to "roll over". The index can easily check back to support at any time now and that would be a healthy sign.

There are numerous support levels under where the index is trading today. We also note that there is no indication that any of the trend lines are about to "roll over". The index can easily check back to support at any time now and that would be a healthy sign.

What derails this uptrend is a policy error. The one that has come up once again this week is TAXES. The "part 2" package that the President referred to which will include all of the tax increases that are continually being proposed. The Equity market has NOT priced in any tax increases.

Earnings

The outlook remains positive and analysts' forecasts are finally "catching" up to reality. The results from the second quarter are anticipated to be among the best yet given the stage of reopening that most developed countries were able to reach during this quarter, with year-over-year quarterly earnings growth possibly exceeding 60% for the first time since at least 2002.

Large-cap Tech is NOT overvalued, and there is NO bubble present in the major indices. It may have escaped investors' notice, but with the S&P 500 at record highs, "valuations" are near the lowest levels of the post-COVID era. Valuations positively soared as part of the initial rebound in equity prices, but since last summer they've basically done nothing. Earnings improved while the S&P has basically been in a narrow sideways trading range.

The current 21x forward multiple may not seem "cheap" to some, but with the 10-year Treasury hovering near 1.5% in my view stocks aren't overvalued. So, it should be comforting to investors that the past year or so of gains has not simply come from accelerations in the valuation based on "forward" earnings.

The 12-month earnings estimates are now more than 10% higher than pre-COVID. That is impressive and justifies the S&P's 13% gain this year.

My Playbook Is Full Of Opportunities For 2021

There are plenty of reasons why we are seeing these rolling "pullbacks" in different areas of the stock market. Far too many times investors try and associate an event and focus all of the "blame" in that direction. For sure the Fed announcement was the catalyst for the recent "weakness" in stock prices, but let's take a look at what was also going on.

Many sectors of the market were extended and were at extremes where reversion back to the mean is inevitable. The Industrials stalled on June 1st and broke initial support on June 10th while the Transports broke initial support on June 2nd and never recovered. All of this was well before the Fed spoke. The Russell 2000 failed to make a new high in its last attempt on June 8th, from there weakness set in, again well before the FOMC meeting.

Those are just a couple of "events" that took place before the "catalyst" occurred. In the meantime, the S&P has held firm setting more new highs. The NASDAQ Composite and the NASDAQ 100 have also added new records, making it difficult to envision any real selloff was in the cards. While the other weaker indices I highlighted gave back about 6-9%, It appears the latest pullback in the S&P was capped at just 2%. Of course, there is a contingent that looks at a tiny slice of the market and begins to conclude that if followed will leave investors joining the ranks of the walking dead.

No doubt this is one of the most difficult markets to analyze, but if an investor does not grasp the entire picture they will have difficulty navigating this schizophrenic market. I spoke about this bifurcated market for months and it cannot make up its mind. Technology and growth lead during the pandemic, "value" along with the cyclical sectors takeover, and now Technology looks in the best shape of all the indices we are tracking. Entering this trading week growth had outperformed value by ~8% over the last 11 trading days. That continued this week with the NASDAQ sporting 4 straight days of new highs. An example of how these swift moves will knock the average investor off their feet if they attempt to play the whipsaw game.

We have an unprecedented backdrop on the fundamental side and it's matching an unprecedented technical setup. This past week taught investors once again it doesn't pay to jump to conclusions. For nearly nine months, pundits have been warning of a correction. This past week, Morgan Stanley reiterated its ongoing call for a 10-15% correction. These folks still don't realize that a rotational correction has been taking place. The 5-10% rolling pullbacks that began in April finally took down the economic recovery theme. I suspect this type of price action across sectors may continue. It is a healthy sign as it helps to cleanse the excesses and provides a sound footing for this BULL market to move forward.

Sectors

The collective price-to-earnings ratio for the largest tech-oriented names (Facebook (FB), Amazon (AMZN), Apple (AAPL), Netflix (NFLX), Alphabet (GOOG) (GOOGL), and Microsoft (MSFT)) is trading at the lowest multiple relative to the S&P 500 since 2018 due to its consistently strong earnings and sales beats. It was THE reason I wasn't about to start selling these CORE positions when everyone fell in love with the "cyclical" trade.

The "old economy" sectors (except Energy) all have the same "look" now. In the short term view Financials, Industrials, Materials have all broken short term support. None of their intermediate to longer-term trend lines have been violated, keeping them "in play" for "Investors". "Traders" will have to be nimble when searching for profits in these groups.

Commodities

Commodities still look favorable overall. After some of the extreme rallies in individual commodities during the first few months of the year (e.g. Lumber, Copper, etc.), some sort of pullback was inevitable. Overall, though, I still like the Commodities theme and as a group, they are still holding up thanks to resilience in areas like Oil.

The S&P GSCI Commodity Index is made up of 53% Energy, 19% Agriculture, 11% Industrial Metals, 7% Livestock, and 6% Precious Metals, and this heavy weighting in Energy is helping right now. As mentioned before, GSG is a fund that tracks this index and is one way to play the commodities/inflation theme. I still like the overall chart pattern.

Energy

The Energy sector got caught up in the "cyclical" selling last week but I noted that crude oil itself closed higher while that selling took place. A clear signal that the weakness would be short-lived. The longer-term view still looks OK. We saw WTI break resistance around $65-67 and said it could be a sign that it's going MUCH higher. So far, that seems to be playing out, as the commodity keeps grinding higher to again show that the "inflation" theme might not quite be as broken as some think. Resistance is just ahead so there still may be some volatility as the commodity near that.

Energy stocks as measured by the Energy ETF (XLE) have rebounded nicely from the brief selloff and its uptrend is intact. The Exploration and Production ETF (XOP) looks particularly impressive as it seems poised to add to the new high set on June 8th.

Financials

While the Fed selling event was underway I heard pundits talking about how the Financials were getting CRUSHED. I did mention last week that the sector had joined others that have broken their short-term trend lines. In another case where an investor can't keep the situation in perspective, they are set up for failure. The Financial ETF (XLF) rallied 48% from the November '20 breakout to the early June high. The approximate 8% give back is "normal". So far the financials have retraced about 25% of that move, and perhaps that will be the extent of the drawdown.

As expected all of the large-center banks easily passed their "stress tests " this week. We are now at a point in time where the banks do not need any approval to authorize additional buybacks of their shares, nor do they need any approval to raise their dividends. Perhaps that will be a catalyst to stabilize the sector. In addition, I do not believe interest rates remain at these levels for too much longer.

As of the close of trading this week, the Financial ETF ($37) is caught between support and resistance. If that is a correct assumption I can see the XLF making a new high down the road.

Healthcare

I continue to monitor the Healthcare ETF (XLV) as it continues its "tease" by hovering just above its old high. A flattening top pattern that looks poised for a breakout. If that occurs, XLV will be another sector that could pick up the slack from the weaker Industrials, Materials, and Financials.

Gold/Silver

A weaker dollar would likely help the Gold/Silver trade and the recent strength in the USD ushered in a pullback in both. After holding up relatively well in early June after making a big upside move in April and May, Gold and silver tanked after the Fed's comments. Gold went from around $1900 earlier this month to below $1800 in no time at all, and in doing so broke through what I thought would be a very strong support zone around $1800-1850.

Now, this breakdown needs to be remedied ASAP, or else the precious metals will fall off my radar completely until they start acting better. The next move in the dollar will dictate the next move in this sector.

Technology

The "story" has followed the "analysis" presented here very nicely.

"I believe that when the growth situation levels out and returns to more of the norm, investors will scurry back looking for that alpha trade for their portfolios."

"Money is going to start flowing back into sectors like Biotech, Healthcare, and select Technology.

The NASDAQ Composite and the NASDAQ 100 have both recorded multiple new highs since those comments. Large-cap technology is supporting this move. Microsoft took another leg higher and set a new record high this past week. Nvidia (NVDA) and Shopify (SHOP) among others also joined the new high list. While the noise from the Fed caught the attention of many, Savvy Investors watched a stealth rally that is producing nice gains.

With renewed interest in Technology, the ARK Innovation ETF (ARKK) continues its march higher off the base it built in the $100-$105 range. Trading at $125 now represents a nifty 20% gain. There is resistance ahead so I wouldn't be surprised if there is a pullback soon. I still have my "trading" position that was added at recent lows along with my CORE shares purchased in May 2020 at $63. I may be exiting the "trade" soon.

I sold my "trading" position in another High Beta position. Shopify was added in early March and sold at $1,495 for a 33% gain in 3+ months. I maintain my remaining shares as a CORE position. For those that continue to wonder how someone that is bullish and invested can have the cash needed to "buy the dip", there is your answer. It is called portfolio management.

All of these trades are fully documented in my "service".

Consumer Discretionary

The Sector ETF (XLY) is nearing its old high and I do like "select" names in this space. I added a premier restaurant franchise two weeks ago as a CORE position. It's up 8% and looks poised to move much higher.

Bitcoin

A very interesting week for the crypto watchers. Just when it appeared the "breakdown" was going to take another leg lower, buyers stepped in at the 29K level and sparked an intraday reversal on Tuesday. Traders witnessed the asset post a 10% intraday decline coupled with a 10% intraday bounce. That is practically unheard of in the equity markets, but for bitcoin, it has become increasingly common. This year alone, this week's reversal marks the fifth such intraday rebound of 10%+ following a 10%+ intraday decline. That only happened twice in 2020 and three times in 2018.

When it comes to technicals (and that is all that matters with bitcoin), the more often a security tests support or resistance, the weaker it is considered to become. If that holds with bitcoin, a few more tests of the 29k-30k level in the short term could open the floodgates to the downside. However, the intraday reversal this past week was impressive.

International Markets

We can see the importance of the dollar on commodities and precious metals. It also has a huge influence on domestic versus international investment returns. The performance of the MSCI World ex U.S. index shows that while it wasn't always a straight line, in each of the three U.S. Dollar BEAR markets, the MSCI World Ex-US Index rallied by a sizable amount. If that trend is now reversing it will have a large negative impact on the international markets.

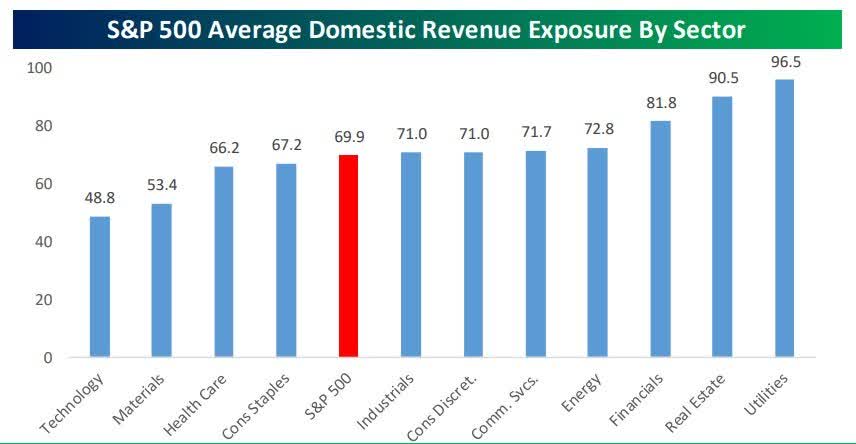

The chart below shows the average domestic revenue exposure of companies in the S&P 500 across each of the eleven major sectors. Sectors with the smallest percentage of domestic exposure are Technology and Materials and would therefore be expected to outperform when the dollar is weak. At the other end of the spectrum, when the dollar is strong, sectors most leveraged to the US economy include Utilities, Real Estate, and Financials.

Source; Bespoke

While that is interesting information I wouldn't try to guess what the USD is going to do next and change my investment strategy based on that. Taking an across-the-board approach and staying with quality companies is a much better plan. Adding a small amount of international exposure is always a good idea but as I have mentioned before it isn't my preference to make a large bet on international markets.

While it may be an interesting and confusing market backdrop, assessing the BIG picture always simplifies the investment process. If you didn't hear the market's message, please let me repeat it today. The S&P set another record high. The Nasdaq set 4 new highs in a row. The declines in the Dow 30 and the Dow Transports have slowed and those indices have stabilized.

If you wish to "guess" that this is the top, please be my guest. I'll also offer congratulations because at some point you will be right. However, you will be looking up at the contingent that has followed the trend and listened to the market.

Postscript

Please allow me to take a moment and remind all of the readers of an important issue. I provide investment advice to clients and members of my marketplace service. Each week I strive to provide an investment backdrop that helps investors make their own decisions. In these types of forums, readers bring a host of situations and variables to the table when visiting these articles. Therefore it is impossible to pinpoint what may be right for each situation.

In different circumstances, I can determine each client's personal situation/requirements and discuss issues with them when needed. That is impossible with readers of these articles. Therefore I will attempt to help form an opinion without crossing the line into specific advice. Please keep that in mind when forming your investment strategy.

THANKS to all of the readers that contribute to this forum to make these articles a better experience for everyone.

Best of Luck to Everyone!

While many market forecasts have been wrong, the message here as been "Crystal" clear.

Its also been correct. In the process it keeps investors focused on what really matters, and avoids the whipsaws that are part of this bifurcated market.

The S&P and Nasdaq posted new highs. I've called for a return to "Growth" for over a month now. If you are serious about investing, please consider joining The Savvy Investor Marketplace. It is where members get ALL of the details.

Get started with our Limited free trial offer today.

Sit back, relax, and Invest with the Best!