Investment Thesis

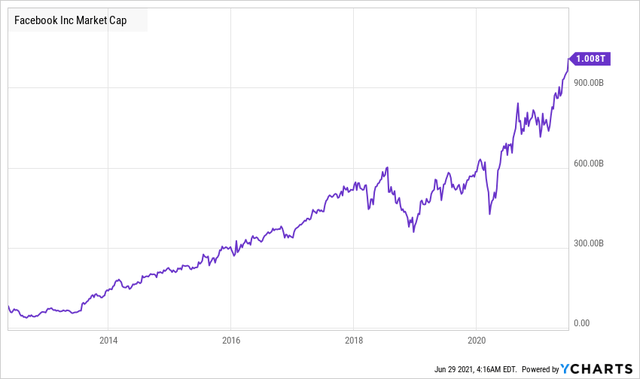

Facebook (FB) is finally a part of the trillion-dollar club; however, there is a lot more shareholder wealth to be created by this amazing social media conglomerate. The global dominance of Facebook, Instagram, and WhatsApp is well-known to all of us; however, partial monetization of these assets leaves a lot of future growth potential for the company. Today, Facebook operates in a triopoly with Google (GOOG) (GOOGL) and Amazon (AMZN) in the massive yet rapidly growing digital advertising industry.

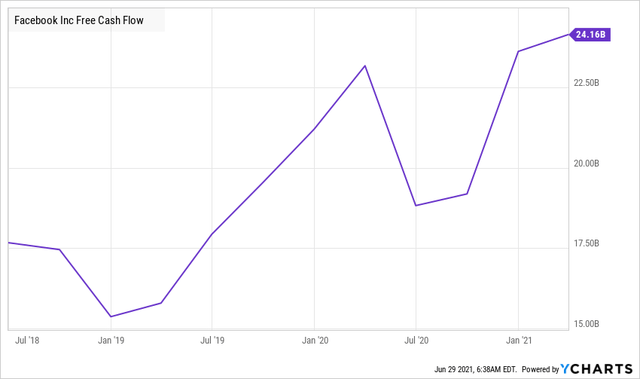

As you may know, selling digital ads is a money-spinning operation, and Facebook's free cash flow generation (~$25B in the last twelve months) serves as evidence for the same. If Facebook's AR/VR and financial services (Novi) businesses prove to be successful ventures, then we (as investors and shareholders) could be positively surprised (in terms of revenue growth and free cash flow) over the next decade. For a long time, regulatory and competitive risks had led Facebook to trade at depressed valuations. However, the stock has been flying in recent weeks, and there's more upside left in this counter.

According to my estimation, Facebook is worth ~$520 per share or ~$1.5T by market cap. With the stock trading at $356, the price rally in Facebook could continue in the second half of 2021. In today's note, I will present a fundamental analysis of Facebook's business and discuss our valuation for the company. Furthermore, we will discuss the risks associated with investing in Facebook as its market cap crosses the trillion-dollar psychological hurdle.

Facebook: $1T And More To Follow

Facebook has found its way into the trillion-dollar club (terminology for companies with a valuation greater than $1T), yet the stock remains undervalued. Let's analyze Facebook's financials to see why I say so.

Before we dive into the numbers, I would like to share our extensive research work on Facebook for your reference:

- Facebook: Vexed By Discounts, So Now You Should Pounce

- Facebook: Introducing President Mark Zuckerberg

- Facebook: The Perpetual Cacophony Of Noise

- Facebook: Here Is My Fair Value Estimation Of Instagram

- Facebook's Future Is Brighter Than Ever

- Facebook: Mark Zuckerberg's 'Atlas Shrugged' Moment

- Facebook: Conviction Buy Despite Regulatory Fears

Now, let's get started.

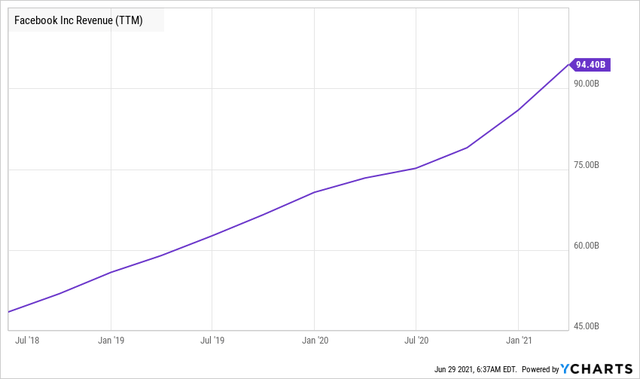

In the last twelve months, Facebook has recorded revenues of $94.4B on the back of strong tailwinds for the digital advertising industry caused by the coronavirus pandemic. As people stayed home, marketers shifted their advertising budgets to digital channels such as Facebook's family of social media apps.

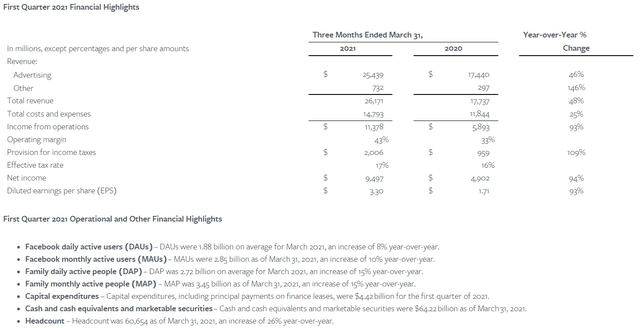

In Q1 2021, the trends in digital advertising have remained strong, and riding high on that strength, Facebook registered revenues of $26.17B (up 48% y/y). The robust revenue growth materialized from combined growth in average ad prices (up 30% y/y) and the number of ads (up 12% y/y).

Source: Facebook Q1 2021 Earnings Release

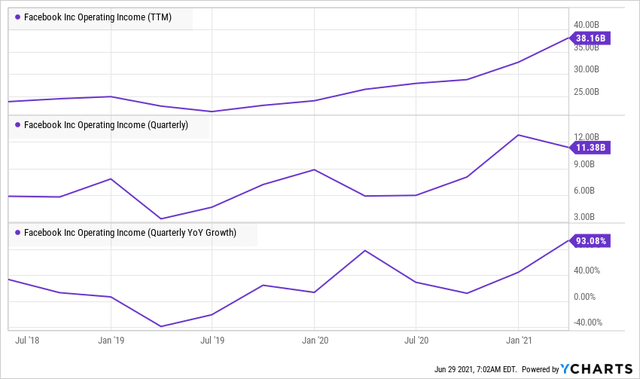

Facebook's ultra-high gross margins of 80%+ serve as evidence of its dominant position in the marketplace and the high value it creates for its customers. After dipping into the low 20s (in 2019), Facebook's operating margins are now back up to the mid-40s and likely to stay here in the long run.

The combination of higher revenues and higher operating margins is driving Facebook's free cash flow higher. In the last twelve months, Facebook has delivered free cash flows of $24B. And as you already know, free cash flow is the primary driver of stock price. This is why Facebook's stock has been on a tear upwards.

Source: YCharts

Interestingly, Facebook's TTM operating income of $38B is much higher than TTM free cash flow of $24. Therefore, Facebook's potential free cash flows are likely much higher. With operating margins stabilizing in the 40-45% range, Facebook's FCF margins will expand from ~25% to ~35% in the coming years.

The Q1 earnings data from Facebook points towards longer-term sustenance of the shift in advertising budgets towards digital channels. As you may know, the digital advertising industry was growing rapidly well before the coronavirus pandemic came along; however, in the last twelve months or so, we have seen a massive acceleration in these growth trends. Now, we may see a bit of a reversal in these trends in the near term, but in the long run, I see digital advertising as a powerful secular growth trend for the rest of this decade. According to eMarketer, the global digital ad spend is set to grow from $389B in 2021 to $526B by 2025.

Facebook owns highly valuable, as yet under-monetized assets in its family of apps. And so, I believe that Facebook is poised to deliver solid revenue growth for years to come. According to consensus analyst estimates on Seeking Alpha, Facebook is likely to maintain growth rates in the mid-teens for another five years. With potential upside to come from Facebook's AR/VR and decentralized finance (Defi) services, I think that Facebook will grow at a healthy double-digit rate for the next ten years.

Source: Seeking Alpha

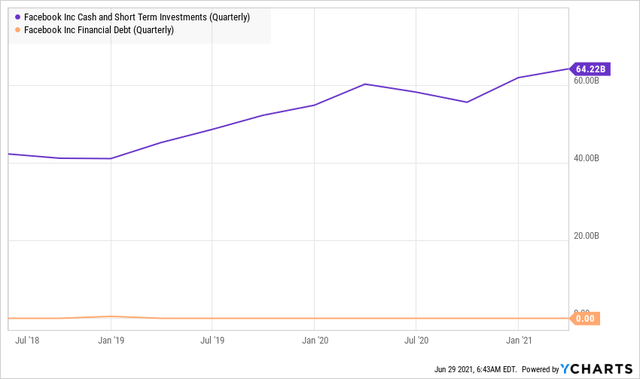

As of Q1 2021, Facebook had ~$64B in cash and short-term investments on its balance sheet with zero debt. Therefore, it is fair to say that Facebook's balance sheet is a fortress. Now, as I always say, it is really hard for a business to go bankrupt without debt. Hence, Facebook has minimal liquidity and bankruptcy risk.

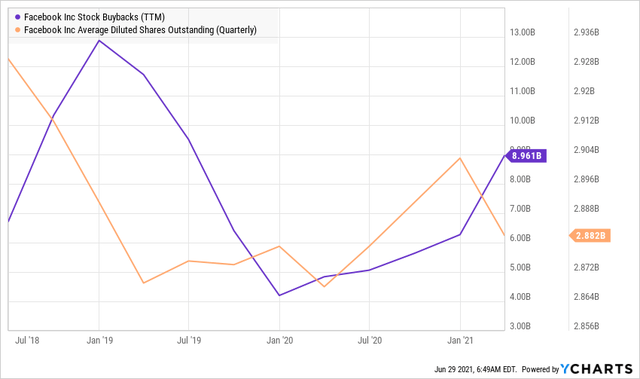

So far, Facebook's stock buyback programs have been limited in size. In the last twelve months, Facebook bought back shares worth $8.96B while making ~$25B in free cash flow. As long-term investors, we do not like to see massive cash hoards being built up at our companies because they reduce our returns.

Over the next twelve months, Facebook would likely generate $25-35B of free cash flow (depending on PPE investments). With the announcement of a new $25B stock buyback program having already been made, we know how most of that free cash flow is going to be utilized. Such large stock buyback programs have the potential to generate massive shareholder wealth (as evidenced by Apple's (AAPL) buyback program). Although I do like the upsized buyback programs from Facebook, I think the company should look to perform leveraged recapitalization and buy back as much stock as it could while it is undervalued.

Fair Value And Expected Returns

Facebook is set to generate massive amounts of free cash flow for years to come as the company is expected to grow at a healthy clip over the next decade. With margins staying strong, Facebook has the potential to create massive shareholder wealth. However, the price being paid for an asset determines the future return. Hence, we must estimate Facebook's fair value before making an investment decision.

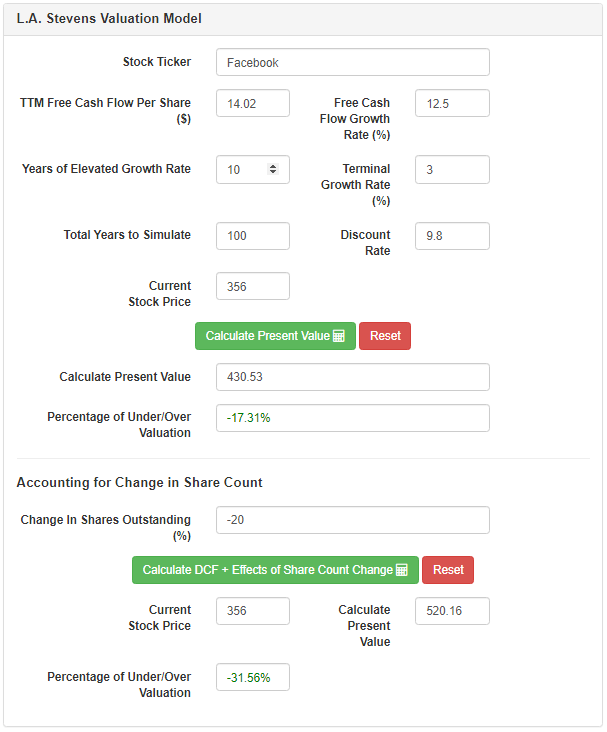

To determine Facebook's fair value, we will employ our proprietary valuation model. Here's what it entails:

- In step 1, we use a traditional DCF model with free cash flow discounted by our (shareholders) cost of capital.

- In step 2, the model accounts for the effects of the change in shares outstanding (buybacks/dilutions).

- In step 3, we normalize valuation for future growth prospects at the end of the 10 years. Then, using today's share price and the projected share price at the end of 10 years, we arrive at a CAGR. If this beats the market by enough of a margin, we invest. If not, we wait for a better entry point.

Assumptions:

2021E revenue [A] | $115.5 billion |

Potential Free Cash Flow Margin [B] | 35% |

Average diluted shares outstanding [C] | ~2.882 billion |

Free cash flow per share [ D = (A * B) / C ] | $14.02 |

Free cash flow per share growth rate | 12.5% |

Terminal growth rate | 3% |

Years of elevated growth | 10 |

Total years to stimulate | 100 |

Discount Rate (Our "Next Best Alternative") | 9.8% |

Here are the results for fair value (step 1 and 2):

Source: L.A. Stevens Valuation Model

As you can see, Facebook's fair value is ~$520 per share. The stock is trading at ~$356, which means Facebook has to climb +46% to realize its fair value. By utilizing conservative growth and margin assumptions, we have ensured that we have ample margin of safety in this investment.

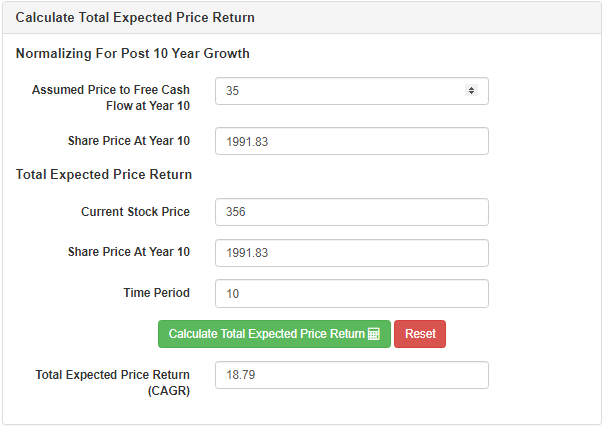

To calculate the total expected return, we simply grow the above free cash flow per share at our conservative growth rate, then assign a conservative multiple, i.e., 35x, to it for year-10. Thereby, we create a conservative intrinsic value projection by which we determine when and where to deploy our capital.

Here are the results for expected returns (step 3):

Source: L.A. Stevens Valuation Model

According to the above set of results, Facebook's stock has the potential to grow from ~$356 to ~$1,992 at a CAGR of ~18.8% in the next ten years. Since the expected return for Facebook is greater than my investment hurdle rate of 15%, I rate Facebook a buy at $356.

Risks

- Facebook is facing the looming antitrust regulations along with other big-tech companies. However, FTC's case being tossed out in the federal courts is a big win for Facebook. The social media giant operates in a triopoly with Google and Amazon in the digital advertising world, and these three companies have a combined market share of ~60%. Hence, government agencies will likely fail to prove Facebook as a monopolistic business.

- The bigger threat to Facebook's business comes from platform changes made by tech-rival Apple. With the iOS 14.5 release, Apple is set to force apps like Facebook to explicitly ask user permission to get access to their data. Such platform changes could affect Facebook's ability to provide targeted ads, and this could lead to lower ad pricing. Therefore, Facebook's revenues and margins could come under pressure. We will be monitoring this situation over the upcoming quarters.

- Facebook's AR/VR and financial services (Novi) business lines are moonshot investments at this point, and if these businesses fail to achieve mass adoption, Facebook's growth trajectory could be curtailed.

- Digital advertising is probably one of the strongest secular growth trends in the world; however, a slowdown in this industry's growth could lead to lower-than-expected growth rates for Facebook. If the company fails to meet our revenue and profitability projections, our stock price targets may not be met.

Concluding Thoughts

After careful consideration of the risk/reward opportunity offered by Facebook, I like the odds of beating the market with this investment. To be frank, Facebook is a free cash flow generating machine that's available well below fair value. Therefore, I am buying Facebook as it joins the trillion-dollar club.

Key Takeaway: I rate Facebook a buy at $356.

Thanks for reading, remember to follow for more, and happy investing!

At Beating The Market, we focus on making lives meaningfully better through investing. To join a rapidly growing community of like-minded, long-term growth investors --> Click Here