Co-produced by CashFlow Capitalist for High Yield Investor

Is the 60/40 portfolio dead? This question has become hotly debated in the financial community.

The traditional advice given to most investors has been to form a portfolio of 60% equities and 40% bonds. The equities, while more volatile, would offer exposure to relatively high upside when the economy is growing. The bonds, while offering lower reward, would provide higher income as well as stability when the economy is performing poorly.

Together, the 60/40 portfolio would perform just a little less well than the stock market as a whole but with significantly less volatility and slightly higher income.

Today, the 60/40 portfolio seems to have run its course. Why? Because:

- Interest rates are ultra-low and likely don't have much lower to go

- Real (inflation-adjusted) bond yields are largely negative

- Equities offer higher income

- Alternatives and real assets are gradually replacing bonds in institutional portfolios

- Cash and ultra-short term bonds combined with a higher allocation to equities/alternatives provide more income with similar stability as the 60/40 portfolio

For all intents and purposes, the 60/40 portfolio is dead. One would do well to realize that and position oneself accordingly before everyone else does. But how do investors do that? Let's explore several options.

But first, we need to understand why bonds have become so unattractive today.

The Unattractiveness of Bonds

David Kelly of JPMorgan Asset Management projected in November 2020 that a 60/40 portfolio should return around 4.2% per year over the next 10-15 years. Since Kelly published that report, global equities have risen a little more than 20% while bonds have been roughly flat, implying that forward returns should be even lower.

The reason for that is simple. Bonds today yield hardly anything, especially when considering the value-eroding effect of inflation.

YCharts

YCharts

Since the fall of 2003, when the iShares Core US Aggregate Bond ETF (AGG) was incepted, investors in the ETF have enjoyed a total return of over 100% as the yield fell from around 3.5% to 1.84%.

Holders of investment-grade corporate bonds have enjoyed similar total returns as the yield on corporates has fallen considerably over the years.

YCharts

YCharts

Historically, a general mix of government and investment-grade corporate bonds has offered investors a respectable yield of 3% to 4.5%. IG corporate bonds have historically offered 3% to 7% yields.

In a bygone era, the combination of yield and capital appreciation could render high single-digit or low double-digit annual returns for bonds. But that was back when bonds offered yields of 4%-5%. At those yields, bonds also offered the potential for ample capital appreciation due to the amount of downside to zero interest rates.

Today, with the Federal Funds rate sitting at zero and bonds yielding, say, 2% in aggregate, bonds offer neither high income nor capital appreciation potential. Could rates go negative? Yes, that's a possibility, but it's unlikely given the poor record of negative interest rates in other regions of the world. Besides, there's such a strong resistance to negative rates that yields never manage to dip very deeply into negative territory.

If you think about it, the investment thesis for an effectively negative-yielding bond relies solely on the Greater Fool Theory — that one will be able to sell the bond to someone else at an even higher price. That strikes me as a poor reason to invest in an asset! In fact, it seems more akin to gambling or speculating than investing.

Now consider the effect of inflation. With the CPI rate running at 4%-5% over the last five months, the idea of bond yields continuing to fall further and further seems increasingly improbable.

The current bout of inflation is widely expected to be temporary as it takes time for supply lines to be rebuilt and for pandemic-era stimulus to fizzle out. But even if inflation rates average only the Fed's target of 2% over time, the entire Treasury yield curve would be negative on an inflation-adjusted basis right now. IG corporate bonds would offer real yields right around 0% or slightly above it.

Clearly, investors can no longer rely on bonds for income.

The S&P 500 (SPY) yields only a little bit less than aggregate bonds at 1.33%, and one can easily find broad-based equity ETFs that offer higher yields than bonds. For instance, the iShares Core Dividend Growth ETF (DGRO) holds 389 stocks and offers a dividend yield of 2.0%. The iShares Core High Dividend ETF (HDV) offers a dividend yield around 85% higher than aggregate bonds.

One reason some continue to maintain 40% exposure to bonds, however, is portfolio stability. Bonds are undoubtedly more stable and less volatile than stocks. The risk of permanent capital losses is much lower for bonds, and therefore they are useful for portfolio stabilization.

But if the risk-reward proposition for bonds, in general, is highly negative, as we've argued thus far, then one would be better off simply holding a cash or ultra-short term bond allocation instead. See, for instance, how much volatility AGG showed during the initial COVID-19 panic compared to the Vanguard Ultra-Short-Term Bond Fund (VUBFX):

YCharts

YCharts

What about the added total returns of a general bond allocation? AGG gave much higher total returns than ultra-short term bonds, as we see in the chart above.

But remember our point above that bonds simply don't have much capital appreciation left to offer because rates are so low. One can generate higher returns anyway by decreasing the total allocation to bonds while increasing one's allocation to equities.

If, say, one holds a 15%-20% allocation to cash/ultra-short term bonds with the remainder in equities, one captures all the benefit of portfolio stabilization from cash as well as the capital appreciation from stocks.

An investor can get as much portfolio stability (or more) and as much portfolio income (or more) by lowering one's bond allocation, switching to ultra-short term bonds, and increasing one's allocation to higher-yielding equities.

Of course, institutional investors such as pension funds, insurance companies, and university endowments generally do not want to take the risk of maintaining a high allocation to either equities or cash, so they have searched for other solutions to their fixed income needs.

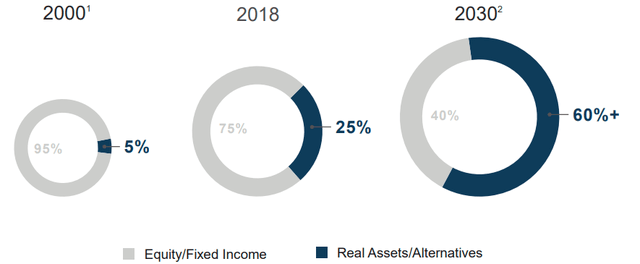

The solution that institutional investors are coalescing behind is alternatives/real assets.

As interest rates have compressed to near-zero, institutions have rapidly expanded their exposure to alternatives and real assets in recent years, and this expansion is expected to continue as long as rates remain ultra-low.

Source: Brookfield Asset Management

What exactly are alternatives? Everything from private equity to private loans to real estate and infrastructure.

As explained in the Q2 Net Lease REIT Report, single-tenant real estate properties leased to investment-grade companies have become a popular choice for institutions. As a result, cap rates (net operating income yields) have compressed rapidly for these assets.

The same sort of yield compression is occurring in virtually all of the alternative asset classes into which institutional money is flowing.

5 Blue-Chip, Recession-Proof Bond Alternative Stocks

It's exactly these sorts of real assets and high-income alternatives for which we ceaselessly search for. Our goal is to find those income opportunities before they're bid up to unattractive levels by the yield-hungry institutions.

One may object that even the strongest of dividend-paying stocks are not really bond alternatives. They still sell-off when the market is panicking. And that's true — for most dividend stocks, but not for all of them.

Consider, for example, the following five blue-chip, recession-proof stocks as a way of generating high income while maintaining portfolio stability. Notice that I said recession proof, not just recession resistant. These companies don't merely do better than the average stock during downturns. Rather, they tend to perform exactly the same or even better during recessions.

1. The Kroger Co. (KR)

Kroger is a well-known grocery store brand with which many people around the country are familiar. But even if there are no Kroger stores in one's region, there might be another of Kroger's extensive family of grocery store chains. Included in this portfolio of brands are City Market, Ralph's, King Soopers, Fred Meyer's, Food 4 Less, and lots of others.

Everyone has to eat. And when workers are laid off due to a bad economy, some of them are able to receive assistance from the government in the form of unemployment or EBT cards and food stamps. Business remains steady for grocery stores during recessions. In fact, these companies often see their sales rise during recessions because people eat out at restaurants less frequently.

Perhaps this is why the moment the economy entered the "COVID recession" is when Kroger's stock price began to rise.

YCharts

YCharts

With a dividend yield about the same as that of bonds (1.85%), Kroger looks like an excellent bond alternative.

2. Walmart Inc. (WMT)

Much the same could be said for Walmart, which is not only the country's largest seller of groceries but also is the nation's largest employer. Walmart sells lots of general merchandise catering to people's everyday needs, making it extremely resilient to almost any kind of economic shock.

While the stock sold off a little bit during the height of investor panic, the market quickly came to its senses and realized Walmart's resiliency in the face of this crisis.

YCharts

YCharts

The stock currently yields a mere 1.5%, but that is still higher than most Treasury bonds.

Of course, in our opinion, one would do better to own Walmart's landlords, such as Realty Income (O), instead of the company itself.

3. SpartanNash Company (SPTN)

Taking one step back in the supply chain, we find grocery distributors like SpartanNash, which offers an attractive dividend yield of around 3.75% and barely blinked during the COVID selloff.

YCharts

YCharts

Like Walmart (and corporate bonds, for that matter), SpartanNash suffered a very brief plunge in the Spring of 2020 before quickly reversing course and shooting up as the market realized how the company benefited from the crisis.

4. Verizon Communications (VZ)

Verizon, unlike other telecommunications companies that have taken on massive debt to branch out ("ahem" AT&T (T) "ahem"), has remained laser focused on its core business of mobile communications. This is an extremely resilient line of business since most people will move heaven and earth to keep their smartphones and service. Aside from the grocery bill, a person's cell phone bill is one of the last things they would give up when money is tight.

Perhaps this is why, after a brief and shallow selloff, Verizon's stock quickly bounced back.

YCharts

YCharts

In case it isn't clear by now, even "bond alternative" stocks can sell off when investors are sufficiently panicked and emotion-driven. But those recession-proof stocks will quickly see a rebound back to their previous levels — or higher.

Verizon's yield of ~4.6% is nearly 2.5 times that of aggregate bonds.

5. Crown Castle International (CCI)

Along the same lines, taking one step further back in the telecommunications supply chain, we find cell tower and fiber owners like Crown Castle. This company is perhaps even more protected than Verizon because its revenue comes from the blue-chip telecom corporations rather than individuals and businesses paying their cell phone and cable bills.

Hence we find the same story with Crown Castle — a brief selloff followed by a rapid rebound.

YCharts

YCharts

With each of the five picks above, the brief drawdown was about the same as (or shallower than) the drawdown in the highest rated corporate bonds, as illustrated here by the iShares Aaa - A Rated Corporate Bond ETF (QLTA):

YCharts

YCharts

Closing Note

For those who wish to move on from the outdated 60/40 portfolio, raising one's equity allocation, shifting over to ultra-short term bonds or cash, moving into alternatives/real assets, and/or increasing allocation to recession-proof stocks could be better strategies for a low interest rate future.

The challenge is then to find the right stocks at the right prices. At High Yield Investor, we are still able to achieve a 5%-plus yield from our equity portfolio by being very selective:

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Investor.

We are the fastest growing high yield-seeking investment service on Seeking Alpha with ~1,000 members on board and a perfect 5/5 rating from 100+ reviews:

Our members are profiting from our high-yielding strategies and you can join them today at our lowest rate ever offered.

With the 2-week free trial, you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!