Written by Nick Ackerman, co-produced by Stanford Chemist

BlackRock Science and Technology Trust II (NYSE:BSTZ) isn't having the 94%+ total NAV return performance type year that it was able to pull off last year. However, it is still up quite respectably through 2021. The fund has been able to add a significant pool of realized gains for the first 6-months of the year. For that reason, we could be looking at a year-end special distribution or another distribution increase. Earlier in the year, they increased the monthly distribution substantially by 48.7%.

BSTZ might not be an investment for everyone, it is a rather volatile fund due to the growth-oriented investments in the underlying portfolio. This just so happened to be what worked out incredibly well during the 2020 pandemic. While this year has also produced some reasonable returns, it is falling short of the indexes as those growth names take a breather. It seems as though producing these sorts of gains year after year would be hard to replicate. That being said, they don't need to produce the same returns they did since they've launched to be a successful fund.

Their objective is "providing total return and income through a combination of current income, current gains and long-term capital appreciation." To achieve this, they will "invest at least 80% of their total assets in equity securities issued by U.S. and non-U.S. science and technology companies in any market capitalization range, selected for their rapid and sustainable growth potential from the development, advancement and use of science and/or technology."

They also utilize an options strategy to help generate additional returns. At this time, the fund is 20.66% overwritten. This is on the lower end and indicates they are more bullish. Writing calls against positions in their portfolio is a slightly defensive strategy. So a lower overwritten amount could indicate their overall stance at the moment.

The fund is a significant size for a closed-end fund, with over $3.4 billion in total managed assets. The fund has an expense ratio of 1.33%. That is on the higher end for BlackRock funds. However, this is likely due to the private investments the fund carries. We often see higher expenses for more illiquid funds that would require more work to invest in.

Performance - Off To A Good Start

The fund isn't all that old. It was launched midway through 2019. That means 2020 was its first full year of operation. To finish up as the strongest performing CEF really put the fund off to a good start.

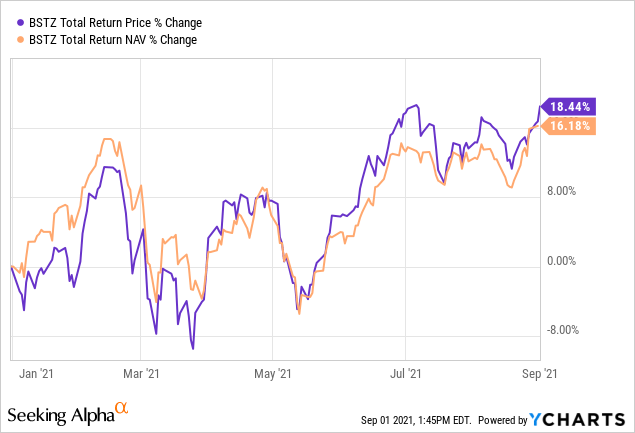

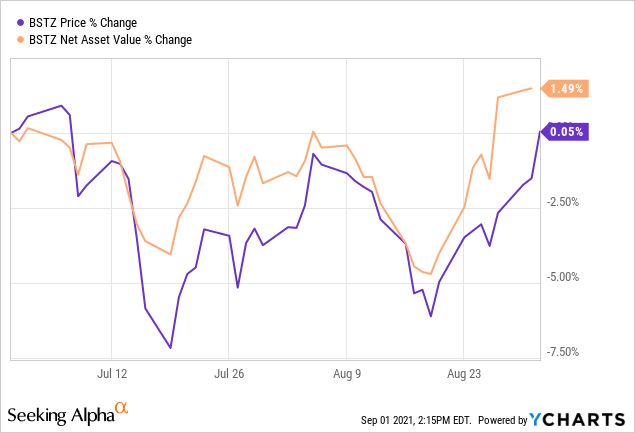

As mentioned above, this year has been a bit more subdued.

The Nasdaq 100 itself is up just over 21%, and the S&P 500 is up around a similar amount at 20.78% YTD as of September 1st, 2021. Really, the whole market is following up on last year's strong performance. Though relatively speaking, we can see that BSTZ isn't quite as strong as it was last year. Fortunately, they had just invested in the right place at the right time. I suspect strong returns in the future as this fund continues to navigate a pricey market. However, I'm not sure we see the 90%+ returns again.

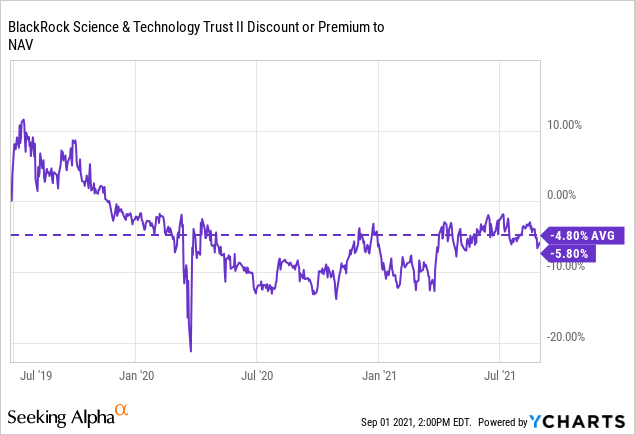

Despite the strong performance, the fund is trading at a discount. It has been plagued with a discount since shortly after its launch. This isn't uncommon for closed-end funds. However, due to the strong performance, it is a bit surprising that investors don't seem to be trying to pile in.

On the other hand, a CEF is often known for high yields. With BSTZ, you currently get 5%. That isn't a terrible amount at all; it is quite respectable, in fact. However, for CEFs, that is on the lower end of what else you can get out there. That could be the reason investors have largely ignored the fund.

To me, it seems as though it is at an attractive value with the current discount of nearly 6%. I would be buying here if it wasn't already such a large position in my portfolio.

Distribution - Year-End Special Or Another Increase

Part of the reason why CEFs pay out such large distributions is because they are required to as part of their structure. The majority of their income and realized capital gains are required to be distributed annually.

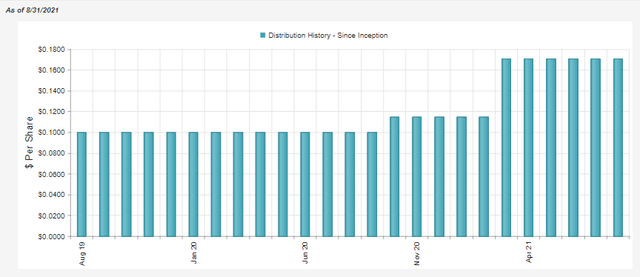

BSTZ increased its distribution last year by 15%. They turned around and boosted it substantially by another nearly 49% this year. That put it at a 71% increase from the $0.10 monthly distribution to the $0.171 monthly it pays out.

(Source - CEFConnect)

Looking at the latest Semi-Annual Report indicates that it might not be over yet either. They might be required to increase the distribution again or pay out a special by year-end. The one way around this is if they start taking losses and realizing them. In that way, the realized capital gain portion that they racked up the first 6-months could be offset.

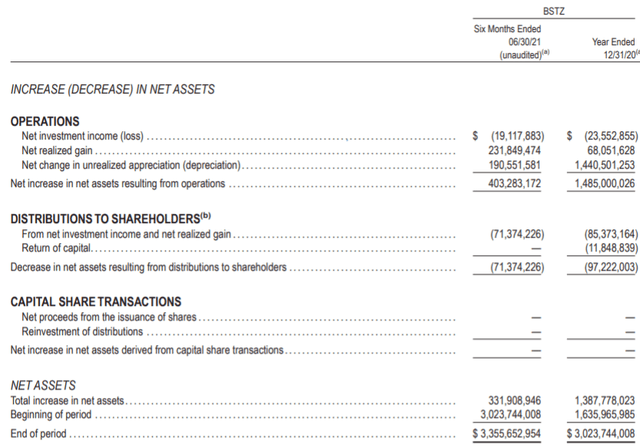

(Source - Semi-Annual Report)

From what we can see above, the fund doesn't have any net investment income [NII]. This is the amount of dividends and interest minus expenses. As they are invested heavily in growth, hardly any of their underlying positions even pay dividends. Thus, it's no surprise that they show a loss in NII.

What we are looking at is the realized gains this year. At nearly $232 million, this is substantial. They even had around $190.5 million in unrealized appreciation lined up too. However, there is no obligation to paying out unrealized gains as long as they stay unrealized.

Since that time, NAV has even increased a bit more too. Meaning that as of this writing, gains would have increased.

So why does this matter? Well, the fund pays out an annualized $2.052 currently. Based on the reported 78,089,962 million outstanding shares, that would work out to having to pay out $160.241 million annually. At the same time, the fund didn't increase its distribution until March. So it would work out to even less being paid out this year.

That's where the "problem" comes in. They have realized nearly $232 million in gains. That is substantially under what they will be paying out at current levels. That is why I believe that a large special year-end could be coming, or perhaps another increase even.

Of course, the market could absolutely tank from now until the end of the year. That could change my mind materially if the market declines enough. As that would mean they could take enough losses to offset these substantial gains they've taken in.

Holdings - Low Turnover, More Private Holdings Shared

The portfolio turnover they reported for the first 6-months came to 14%. This seems quite low considering the substantial amount of capital gains they could produce with such low turnover.

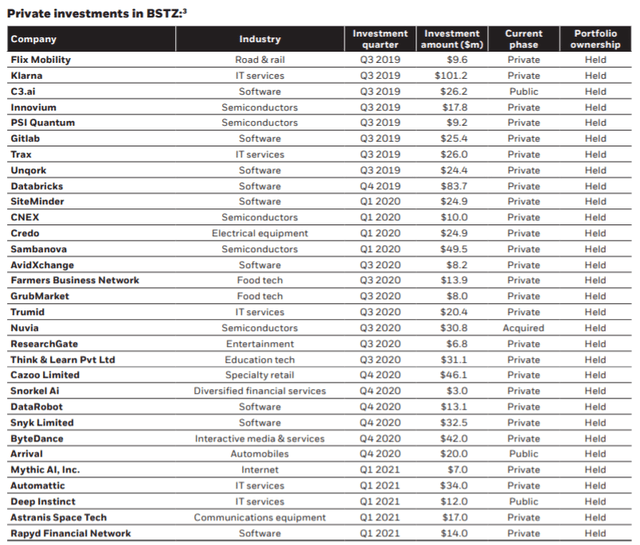

The way BSTZ operates, they don't show what their private holdings are for the current quarter. They delay the release by a quarter, supposedly so no one can copy them. Although the investment would have already been made, I'm not sure that is valid reasoning.

That being said, last quarter, they commented that they were at capacity for their private investments. They have a target of around 25% of assets. We discussed that in the prior coverage of BSTZ.

They simply list them as Company A, B, C, etc...Then in the next quarterly commentary, they provide the name and then sometimes touch on the investment a bit more. Ideally, I wish they would provide a bit more color on their private investments. Despite that, the performance has been attractive nonetheless - they've certainly been making the right moves so far.

With the latest commentary, we don't see any of those placeholder names. That doesn't mean we won't in the future. This could happen as the companies go public, which would open up more room for private investments. As of June 30th, 2021, they had above their 25% target; they reported 26.9% being in private investments. These private investments "were selected to illustrate the Trust's private investments made." This isn't a listing of all their private investments. As we will see in their top 10 holdings, there are several missing.

(Source - Commentary)

3 of their investments above have gone public, and one of the companies they invested in has been acquired. Interestingly, all of these private investments were still "held," going all the way back to Q3 2019.

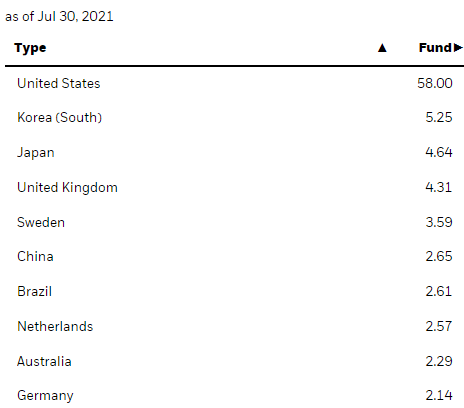

One other thing that should be noted about BSTZ is that they carry a relatively higher allocation outside the U.S. There are even "global" focused funds with more U.S.-based exposure than BSTZ does.

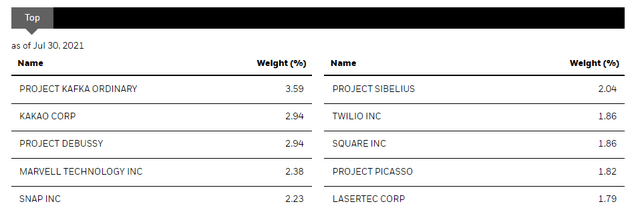

(Source - Fund Website)

I view this as favorable since it allows them the flexibility to invest where they believe the best opportunities are. They aren't forced to invest in any particular geographic region. Though as their name would suggest, they are focused on the tech space.

(Source - Fund Website)

Project Kafka remains their largest position at 3.6%. We have limited information on what this investment actually is besides being in the "IT services" industry. It is also one of those not listed above in the private investment table. That is along with Project Debussy, Project Sibelius and Project Picasso. None of these projects are listed in the private investment table above. Project Sibelius is in the "semiconductor & semiconductor equipment" business, however.

These investments can make BSTZ a riskier investment as information is quite slim on what these investments are. That is where having some trust in the managers at BlackRock will come in.

As of June 30th, they also mentioned that they reduced their China exposure. Instead, they went with "more attractive risk-reward opportunities" in emerging Asia and Europe. This seemed to be right in time as China continues its war on capitalism.

Conclusion

BSTZ should be a strong consideration for any investor looking for an attractive distribution plus some growth potential. As it stands now, it would appear that BSTZ could pay out a substantial year-end special distribution. On the other hand, they could also increase their distribution. That is after they have already done so quite aggressively earlier in the year. That is on top of investors collecting the 5% regular distribution right now.

Profitable CEF and ETF ideas for income and arbitrage investors

We’re currently offering a limited-time-only free trial for the CEF/ETF Income Laboratory with a 20% discount for first-time subscribers. Members receive an early look at all public content together with exclusive and actionable commentary on specific funds. We also offer managed closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting ~8% yield. Also, check out our 5-star member reviews.

SIGN UP FOR A FREE TRIAL AND 20% DISCOUNT OFFER HERE.