Investment thesis

Welcome to a new edition of my series of articles focused on companies with dividend yields in the double digits. I've always liked high-yield dividend opportunities and my first ever SA article was about a gold producer with a dividend yield of over 7%.

Today, I'm taking a look at Chesapeake Granite Wash Trust (OTC:CHKR), which is a U.S. oil and gas royalty investment vehicle with interests in wells in Washita County, Oklahoma. The trust has a TTM dividend yield of 14.3% as of the time of writing and I think it’s a value trap. The financials of Chesapeake Granite Wash Trust have benefited from elevated natural gas prices over the past few months but the wells are almost depleted. Even if natural gas prices remain high, the trust looks significantly overvalued from a fundamentals point of view. I’m bearish on this one.

Overview of the business

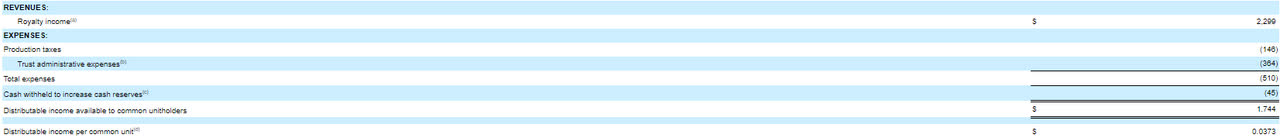

Chesapeake Granite Wash Trust was created in 2011 when Chesapeake Energy Corp. (NASDAQ: CHK) decided to create an investment vehicle for its Colony Granite Wash Play assets within the broader Granite Wash formation of the Anadarko Basin. The portfolio of the trust included royalty interest on a total of 69 existing horizontal wells and 118 horizontal development wells to be drilled by Chesapeake Energy.

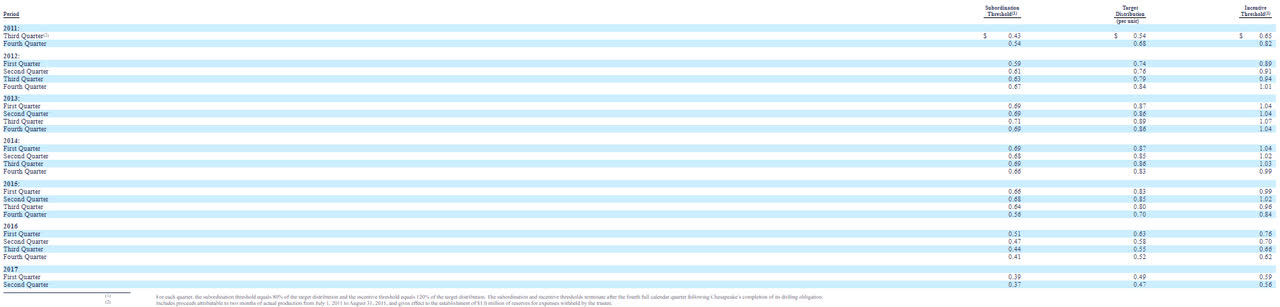

(Source: Chesapeake Granite Wash Trust 2011 prospectus)

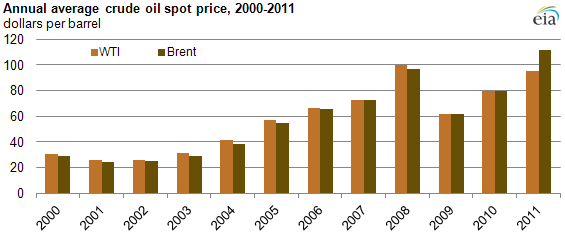

The total reserves estimated to be attributable to the trust were 44.3 million barrels of oil equivalent (mmboe) and the expected dividend distributions looked compelling.

(Source: Chesapeake Granite Wash Trust 2011 prospectus)

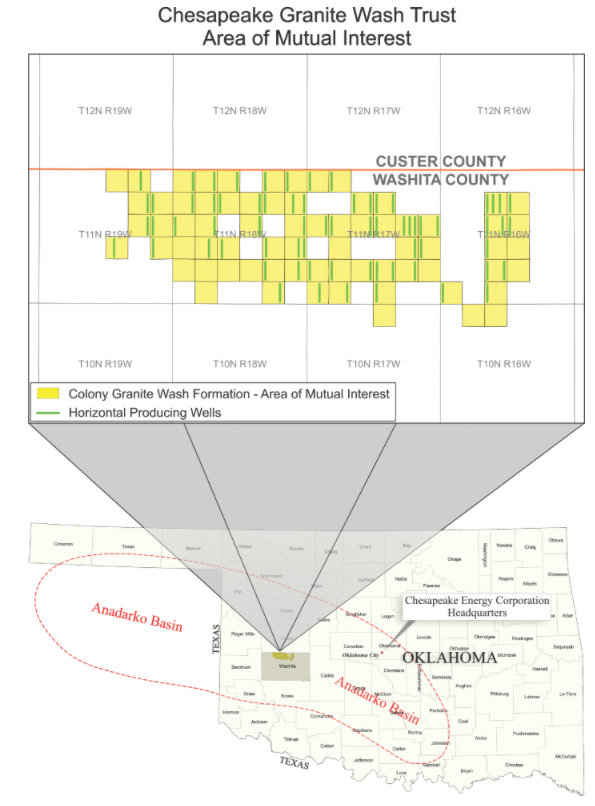

Considering natural gas prices were high and Brent crude oil prices averaged over $100 per barrel in 2011, I think the decision to create this trust at that moment was a masterstroke by Chesapeake Energy.

(Source: US EIA)

(Source: Trading Economics)

However, the fortunes of Chesapeake Energy and this trust went downhill during the following years.

In June 2020, Chesapeake Energy filed for Chapter 11 bankruptcy due to low gas prices and heavy debts from overspending on deals. It emerged from bankruptcy in January 2021 and some of the assets it sold before that included its Mid-Continent portfolio that consisted of 736,000 acres producing an average of about 14,000 barrels of oil equivalent per day (boepd). The buyer was Tapstone Energy, which is an energy company led by former Chesapeake Energy executive Steve Dixon.

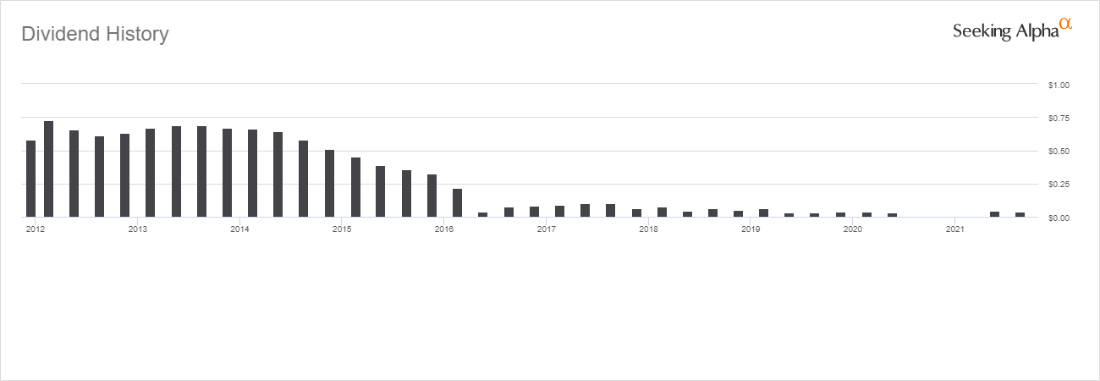

Today, Tapstone operates 96% of the producing wells and the completed development wells of Chesapeake Granite Wash Trust. Production from the wells has been dropping over the past several years and with the dividend payment amounts crashing due to low oil and gas prices, the trust was delisted from the NYSE at the end of February 2020 as the unit price dropped below $1 apiece.

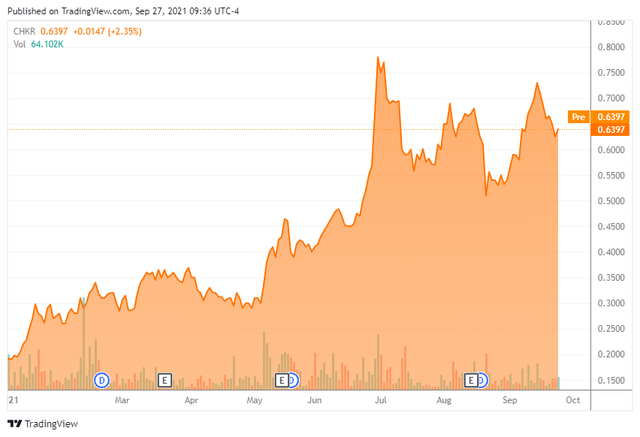

However, something remarkable happened to Chesapeake Granite Wash Trust in 2021. Dividend payments for the past two quarters soared and the unit price has more than tripled since the start of the year.

(Source: Seeking Alpha)

Looking into the financials of the trust, I think this is unsustainable.

Chesapeake Granite Wash Trust was covered extensively on SA by Daniel R Moore between 2014 and 2017 and he called it a value trap in his latest article. In my view, Chesapeake Granite Wash Trust is also a value trap at the moment.

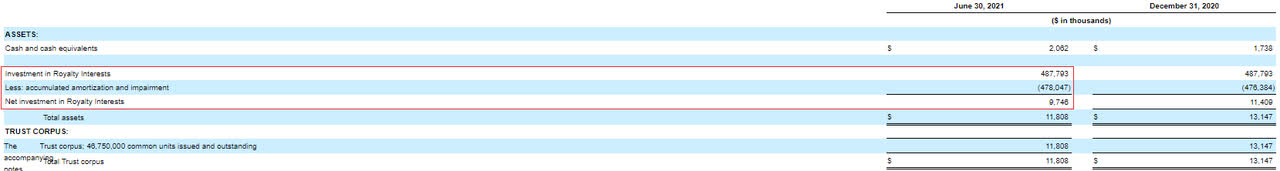

As of June 2021, the royalty interests had a book value of just $9.75 million and this is because the wells are on their last legs.

(Source: Chesapeake Granite Wash Trust)

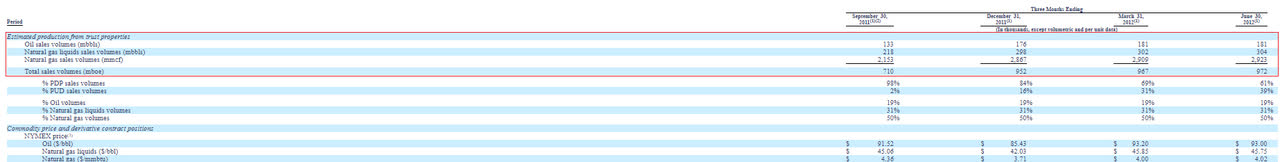

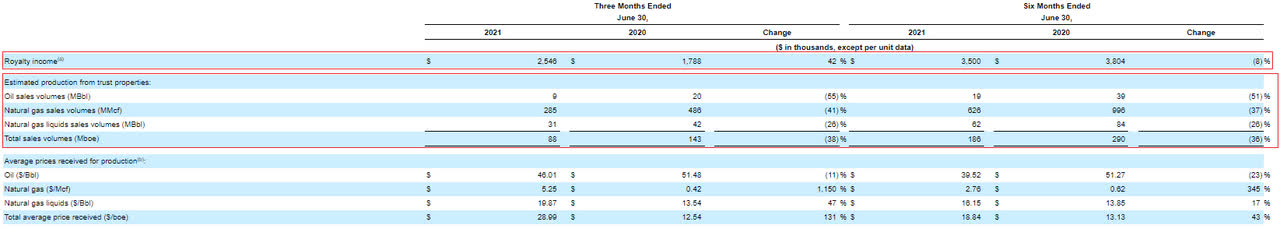

One decade ago, the properties linked to the trust had expected quarterly sales of almost one million barrels of oil equivalent (boe). In Q2 2021, sales from them came in at just 88 Mboe, down by 38% year on year.

(Source: Chesapeake Granite Wash Trust)

The royalty income in Q2 2021 soared by 42% to $2.55 million but this is due to unusually high natural gas prices in 2021. If oil and gas prices had remained the same as Q2 2020, the royalty income would be $1.45 million lower and there would be barely anything available for distribution.

(Source: Chesapeake Granite Wash Trust)

Chesapeake Granite Wash Trust is trading at $0.64 per unit as of the time of writing, which implies that the trust could keep quarterly distributions at an average of $0.04 per unit for a period of at least four years. I see this as highly unlikely. The wells linked with the trust are depleting fast and this can be seen through the carrying value of the royalty interests. Keep in mind that the latter is calculated based on the net present value of estimated future net revenues from proved reserves using a 10% discount rate.

Natural gas prices are currently at their highest level since 2009 and the only way that the market valuation of Chesapeake Granite Wash Trust could become justified from a fundamentals point of view is if they reach the crazy levels from 2008 or 2005. In my view, this is unlikely.

The key reasons for the current high natural gas prices include decreased Russian supplies for Europe as well as strong buying by China in a bid to secure supply for the 2021-2022 winter-spring heating season. Both of them are temporary events and the natural gas market is likely to return to normal in the coming few months.

In light of all these factors, I’m bearish on Chesapeake Granite Wash Trust. However, taking a short position could prove tricky. The trust is traded on the OTC, which means there are no put options. According to data from Fintel, there are more than 500,000 units available for borrowing as of the time of writing, but the short borrow fee rate stands at a whopping 65.56%.

Investor takeaway

Chesapeake Granite Wash Trust is a small investment vehicle with a portfolio of royalties on a bunch of almost depleted oil and gas wells in the Anadarko Basin. The market valuation of the latter has more than tripled in 2021 due to high natural gas prices but I doubt the latter can last for long. Even if they do, there isn’t much natural gas left in those wells and the trust looks overvalued. In view of this, I’m bearish.

Overall, I think this one is a sell but the short borrow fee rate stands at over 65%. Unless you have a very high risk tolerance, the most prudent action might be to put this one on your watchlist and wait for lower short borrow fee rates.