Juan Jose Napuri/iStock via Getty Images

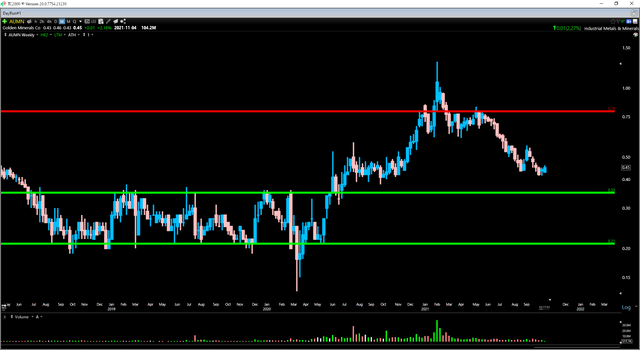

It's been a tough 9-month stretch for the Gold Juniors Index (GDXJ), and while Golden Minerals (NYSE:AUMN) started off the year with massive outperformance, the stock has given up all of its gains since. This is although the company continues to report solid operating results from its Rodeo operations, with record production in Q3. While the Rodeo operation is quite small, a potential restart to Velardena could provide a meaningful boost to revenue by H2 2022. After a 65% correction in the stock, Golden trades a large discount to NAV, with further upside if the company can extend the mine life at Rodeo. With Golden Minerals now oversold and nearing a key support level, a strong bounce in the share price in Q4 would not surprise me, with the valuation supporting a move higher.

(Source: Company Presentation)

(Source: Company Presentation)

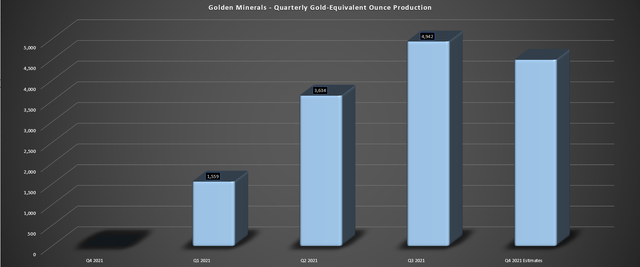

Golden Minerals ("Golden") released its preliminary Q3 results this week, reporting quarterly production of 4,942 gold-equivalent ounces [GEO], a 38% increase on a sequential basis. This trounced my estimates of ~4,100 GEOs produced in the period and has put Golden Minerals in a position to easily meet its FY2021 production guidance of ~13,400 GEOs at the mid-point (~10,100 GEOs currently). The solid quarter was driven by higher mill throughput and much higher grades processed (4.0 grams per tonne gold), offset by slightly lower gold recovery rates (76.5%). If not for the 150 basis point dip in recovery rates, this would have been a 5,000+ GEO quarter for the company.

(Source: Company Filings, Author's Chart)

(Source: Company Filings, Author's Chart)

The current gold recovery rates and year-to-date average (78.4%) are well below the Preliminary Economic Assessment design, which estimated 83.8% recoveries on gold. However, the company hopes to improve this and is working to optimize the mill circuit, focusing on a finer grind and additional aeration in the leach tank train. If Golden can push recovery rates closer to the PEA design, this would provide a meaningful boost to gold production, with this being the only area where the operation is performing below expectations. In addition to the solid operating results, with ~49,000 tonnes processed at 4.0 grams per tonne gold, Golden also reported solid drill results from its Rodeo Project.

In mid-September, Golden provided an update from its 2,500-meter drill program at Rodeo, with highlight intercepts including 78.7 meters of 1.06 grams per tonne gold, 70 meters of 0.56 grams per tonne gold, 64.4 meters of 0.85 grams per tonne gold, and 26 meters of 0.82 grams per tonne gold. While very thick intercepts, these results are well below the average resource grade at Rodeo of 3.3 grams per tonne gold, making this a less exciting update than the much higher-grade holes intersected in RDO-021-003, RDO-021-010, and RDO-021-009 in June. This is not to say that these results are economic, but if the updated resource grade comes in at below 2.25 grams per tonne gold, we would see a meaningful drop-off in production from Rodeo, with similar throughput producing just barely 10,000 ounces of gold per annum. As it stands, Rodeo is projected to remain in production looking out to mid-2023 based on its 2.5-year mine life with average quarterly payable production of ~3,800 GEOs.

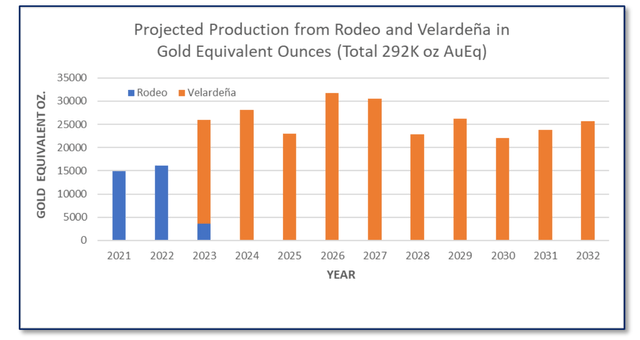

(Source: Company Presentation)

(Source: Company Presentation)

Fortunately, while Rodeo's preliminary drilling suggests that we could see a dip in resource grades, even if the company can add a year or two onto the mine life, Golden seems confident that it can restart its Velardena Project. The company noted that it hopes to make a positive construction decision at Velardena by the end of the year, and this would translate to a meaningful increase in revenue starting in Q4 2022 based on the potential for full production within six months. As the chart above shows, annual GEO production from Velardena is expected to replace ounces coming from Rodeo, given Rodeo's short mine life. However, suppose Rodeo can increase its mine life. In that case, Golden could potentially boost annual production to more than 30,000 GEOs per annum in FY2023 and FY2024 and FY2025, translating to annual revenue of more than $50 million even at conservative gold prices ($1,650/oz).

So, how's the valuation look?

Based on a conservative After-Tax NPV (8%) of $20 million at Rodeo, and more than $80 million at Velardena, Golden's combined After-Tax NPV (8%) for these two projects comes in close to $100 million. If we divide this figure by ~185 million shares fully diluted, this translates to a net asset value of close to $0.60 per share after adding in expected year-end net cash. This figure is more than 20% above current levels, and most importantly, cash flow from Rodeo plus the current net cash position should be able to fund most of the Velardena restart. So, this growth can be achieved without any meaningful dilution. So, with Golden trading at $0.45 per share, the valuation looks quite reasonable finally, with this most recent leg down in the share price pushing the stock to a deep discount on a P/NAV basis.

It's important to note that this ~$0.60 per share fair value does not bake in any value for Yoquivo, Golden's exploration property which it holds an option to purchase, or El Quevar, which has an NPV (5%) of more than $40 million. Given that Barrick (GOLD) has an earn-in agreement and it's unclear on the asset's future, I have valued this asset at zero for the time being. However, if Barrick decides to develop this project, Golden would retain 30% interest and a 5% net smelter return royalty on the first 29 million ounces of silver produced. Even at a $22.00/oz silver price, this would have a value to Golden of more than $31 million. Let's look at the technical picture:

As the chart above shows, Golden Minerals has suffered a violent correction from its February highs, sliding 65% to a recent low of $0.41 share. The stock now has a strong resistance level overhead at $0.79, which is an area where the stock has been rejected on two occasions this year (March and May 2021), and also in December of last year. With the stock well below this level and lots of volume traded in this area, I would expect this area to provide overhead resistance, given that investors will be anxious to get back to break-even. However, at a share price of $0.46, there is now more than 70% upside to this potential resistance level, and the stock is getting closer to a strong support area at $0.35 per share. So, while it's certainly possible that this share-price decline continues into Q4, the reward to risk has been improved considerably.

With an estimated combined After-Tax NPV (8%) of more than $100 million combined at Rodeo and Velardena when factoring in more recent metals prices, and modest capex to restart Velardena (assuming a positive construction decision), Golden looks very reasonably valued after this sharp correction. As noted previously, this assumes no value for El Quevar, where Golden would retain a 30% interest and 5% net smelter return royalty on silver production. Given my risk profile and minimal interest in sub $100 million market cap names, I have no plans to start a position here currently, and I much prefer names like Karora Resources (OTCQX:KRRGF) for growth and value. However, if I were looking to step out on the risk curve, I would consider starting a position if the stock re-tests the US$0.41 level for a swing trade back towards the US$0.65 to US$0.70 level.