Sundry Photography/iStock Editorial via Getty Images

ASML (NASDAQ:ASML) benefits from a sustainable competitive advantage. It is the only company globally that offers the latest and most precise chipmaking machines. Amsterdam-listed shares rose thirtyfold over the last decade. When does the industry’s biggest monopoly become too expensive?

This analysis shows that ASML’s market capitalization is starting to approach its intrinsic equity value under its management’s high-market demand scenario, leaving little upside for investors.

ASML is one of few European companies that has turned its R&D investments into a sustainable competitive advantage or wide economic moat. The company started the development of its extreme ultraviolet (EUV) technology over two decades ago and invested more than 6 billion euro in R&D to date.

Customers such as TSMC (TSM), Samsung (OTC:SSNLF), and Intel (INTC) can't do without the chipmaking machines from Veldhoven. Without ASML there wouldn't be any new iPhones. Today, no other company is making these EUV systems. The required technical skills, upfront costs, and large R&D budget serve as barriers to entry, leading to technological superiority and economies of scale compared to smaller competitors.

While Japan’s Nikon (OTCPK:NINOF) and Canon (CAJ) once dominated the worldwide market for lithography systems, both pulled the plug on the development of EUV systems. As the sole provider of next-generation EUV lithography systems, ASML has one of the strongest positions in the semiconductor value chain.

However, trading at 40 times next year’s EBITDA, investors well understand the lithography leader’s unrivaled market position. ASML is no longer a little-known Dutch company. It’s a large holding for international investors like Baillie Gifford and Capital Group.

A discounted cash flow (DCF) analysis shows that management’s high-demand scenario presented at ASML's latest Investor Day leaves little upside at today’s market price.

Investor Day

Two weeks ago, ASML held its Investor Day 2021, at which management – CEO Peter Wennink and CFO Roger Dassen – shared its expectations for the next couple of years. ASML raised its long-term net sales target for the fiscal year 2025.

The Veldhoven-based company expects net sales to rise to between 24 billion euro (low-demand) and 30 billion euro (high-demand) by 2025. Growth in semiconductor end markets and increased lithography intensity will drive demand for ASML’s EUV and DUV systems to record highs.

The corona pandemic has fast-forwarded digitization worldwide, driving demand for laptops, smartphones, and servers. At the same time, technologies such as 5G (the latest generation of wireless internet) and artificial intelligence are maturing, and new chips are needed for this.

Finally, Europe and the United States no longer want the chips for key technology to be made only in South Korea and Taiwan. This so-called chip nationalism will result in significant investments in constructing new fabs within their own borders, all of which need to be supplied with the latest chipmaking machines.

ASML also issued new guidance on the gross margin development until 2025. Depending on the management scenario (low or high-demand) the gross margin will increase to between 54 percent and 56 percent by 2025. In 2020 gross margin was just 48.6 percent.

High Demand

ASML’s total net sales in its high-demand scenario will reach 30 billion euro in 2025. Today’s high-end range is in line with several bullish sell-side analysts. That begs the question, how much of the high-demand scenario is already priced into the shares?

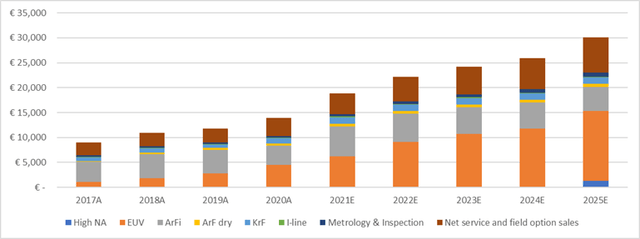

ASML: High-Demand Scenario Total Net Sales in 2025 Source: ASML company reports, Investor Day 2021, own estimates, in millions euro

Source: ASML company reports, Investor Day 2021, own estimates, in millions euro

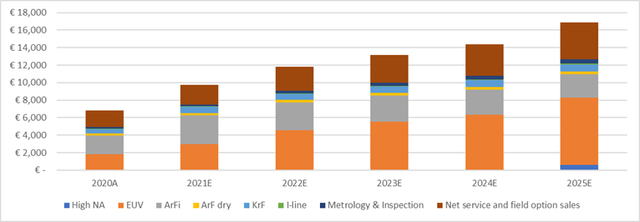

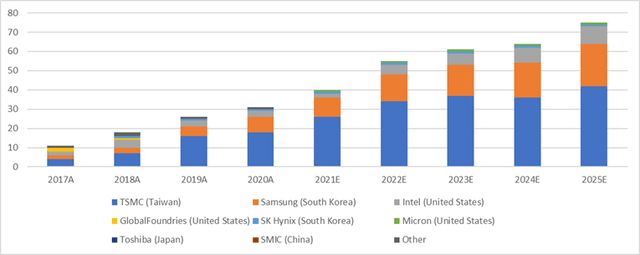

The main driver of the optimistic ASML scenario is increased demand for EUV systems, which is driven by the continued push to lower process nodes, led by the three leading chipmakers TSMC, Samsung, and Intel.

ASML’s three largest customers are committed to adopting (Low NA) EUV in the next couple of years and High NA EUV by the middle of this decade. Other chipmakers such as SK Hynix and Micron have also confirmed EUV adoption. Furthermore, Chinese SMIC is known to be a EUV wanna-have. Although the US and Dutch governments currently don’t allow the export of EUV systems to China.

Management expects that with high demand, it can ship 70 EUV systems (versus 31 EUV systems last year) and 5 High NA EUV systems in 2025.

That would result in net sales from EUV systems (including High NA) more than tripling, from 4.5 billion euro to over 15 billion euro in 2025. Thereby sales of EUV systems will account for almost 70 percent of ASML’s total system sales.

ASML: High-Demand Scenario EUV sales per Customer till 2025 (incl. High NA)

Source: ASML company reports, Investor Day 2021, own estimates, in units

Source: ASML company reports, Investor Day 2021, own estimates, in units

However, ASML sells not just EUV systems but also deep ultraviolet (DUV) systems that produce chips on lagging-edge nodes. Today, these DUV systems have a higher share of the total net system sales (2020: 5.5 billion euro) than EUV systems and due to maturity, a higher gross margin.

ASML expects DUV sales to continue to be stronger than previously expected due to demand in mature 28nm to 90nm manufacturing nodes driven by autos and other logic manufacturers.

There are two DUV platforms: immersion (ArFi) and dry (ArF, KrF, i-line). Last year’s 5.5 billion net sales from DUV systems consisted of close to 4 billion euro from 68 ArFi systems, its most advanced DUV systems. While ASML has a monopoly in EUV, it also dominates immersion lithography, with the highest DUV prices and margins.

ASML expects that worldwide demand for immersion by 2025 will amount to 87 systems, which at its expected 90 percent market share (with Nikon being ASML’s sole competitor) translates into net sales of 78 ArFi systems (or almost 5 billion euro).

In 2020, ASML also sold 159 dry systems in the DUV segment. At the ArF, KrF, and i-line-level, ASML faces more competition from Nikon and Canon. In an optimistic scenario, worldwide demand will amount to 290 dry systems, according to ASML. ASML’s expected 65 percent dry-market share translates into 189 systems (or 2 billion euro in net sales) in 2025.

Lastly, ASML sells metrology and inspection systems. The metrology tooling and products allow improving the overall lithography performance significantly.

ASML sold 137 metrology & inspection systems over the previous year (350 million euro). That number is expected to increase by 20 percent per year by 2025, which adds almost 900 million euro in total net sales.

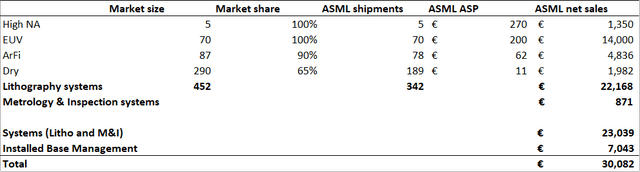

ASML: High-Demand Scenario Net Sales Build-up for 2025

Source: ASML company reports, Investor Day 2021, own estimates, in millions of euro

Adding up sales from EUV, DUV, and metrology & inspection systems result in 23 billion euro in revenue from lithography systems. What is not included here is installed base management (IBM), which is the servicing and upgrading of ASML’s fleet and its customers’ fabs worldwide.

As an example, for the latest EUV systems, about 5 to 6 percent of the tool’s ASP (Average Selling Price) translates into recurring annual service revenue. ASML net sales of (Low NA) EUV systems are expected to reach 70 units. Together with continuing price improvement per EUV model, resulting in an estimated 200 million euro ASP in 2025, service revenue will steadily rise over the next few years.

Furthermore, ASML expects service revenue from other lithography tools to amount to 30 percent of its total DUV sales in 2025. Together, this will result in 7 billion euro in net sales from IBM (also called net service and field option sales), which brings total expected net sales to just over 30 billion euro by 2025.

Gross Profit

The increase in the ASP of the newest EUV systems will also improve the gross margin for EUV and thereby ASML. ASML in earlier years experienced significant margin dilution due to the low volume of EUV systems.

ASML's EUV systems were still loss-making at the gross margin level in 2017 (11 EUV systems, 1.1 billion euro in net system sales). The gross margin of EUV has since then improved to above 40 percent last year.

The latest 3600D tool of ASML will bring EUV gross margins to over 50 percent next year. ASML, at an earlier investor conference, shared that the gross margin for new EUV tools (NXE:3800E in 2023 and NXE:4000F in 2025) will move further up to corporate gross margin by 2025.

ASML: High-Demand Scenario Gross Profit Build-up for 2025

Source: ASML company reports, Investor Day 2021, own estimates, in millions of euro

ASML's legacy DUV systems today have higher gross margins, which lie in the range of low to high 50 percent. The DUV system margins are better at the immersion level but lower at, for example, the KrF level, where ASML has more competition (with roughly 50 percent market share) from companies like Canon and, to a lesser extent Micron (MU).

The overall gross margin of ASML in the high-demand scenario will improve from below 50 percent last year to 56 percent in 2025. With ASML's total net sales reaching 30 billion euro, this will result in close to 17 billion euro in gross profit in 2025.

Other Operational Expenses

At the Investor Day, CFO Dassen also shared details on its other financial drivers in its high-demand scenario in 2025. R&D expenses are expected to be at 3.7 billion euro, SG&A costs close to 1 billion euro, and a tax rate of around 16 percent for 2025.

Projecting Net Operating Profit After Tax (NOPAT)

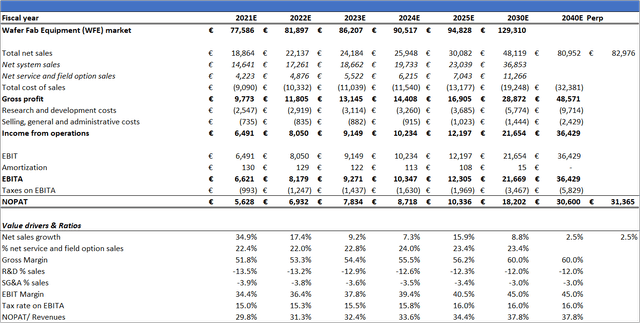

To value ASML shares under the high-demand scenario, the five-year detailed forecast shared by management is used for calculations till 2025.

For the remaining sub-period of five years, the market size projection from semiconductor research firm VLSI Research of 150 billion dollars (or close to 130 billion euro) in wafer fab equipment sales in 2030 is used. This estimate is combined with the assumption of increasing lithography intensity (30 percent) and ASML market share of lithography, which rises towards 95 percent.

The lithography intensity over the past two decades has meandered between 17 and 25 percent. Therefore 30 percent is optimistic, although considered realistic by some analysts. ASML’s market share will increase due to its monopoly position in EUV lithography systems.

The resulting total net sales level by 2030 (near 50 billion euro) will be close to the estimate of the most optimistic sell-side analyst (source: Bloomberg). Lastly, as a result of ASML’s monopoly position in EUV and resulting pricing power, the gross margin might also move up to 60 percent in 2030.

The revenue growth rate after 2030 is assumed to slowly converge towards a reasonable long-term growth rate which is in line with the calculated discount rate - see details under ‘Estimating Continuing Value’ and ‘WACC.’

Below the NOPAT projection is presented, which is the result of the detailed information above.

ASML: High-Demand Scenario NOPAT Projection Source: ASML company reports, Investor Day 2021, VLSI Research, EUR/USD 1.16, own estimates, in millions of euro

Source: ASML company reports, Investor Day 2021, VLSI Research, EUR/USD 1.16, own estimates, in millions of euro

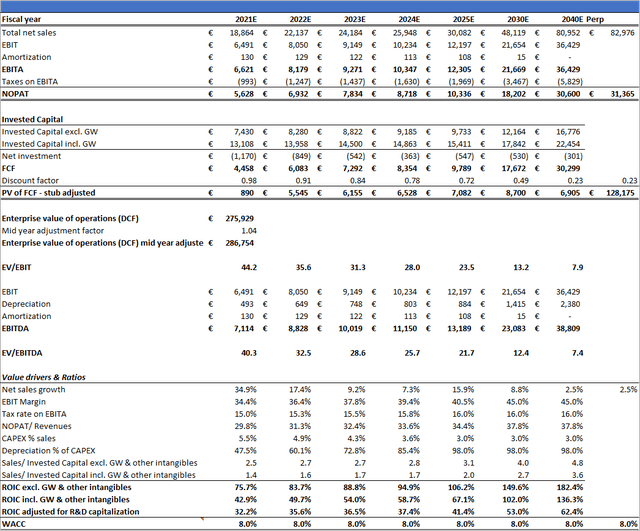

Estimating Continuing Value

ASML's return on invested capital (ROIC) lies above the weighted average cost of capital ((WACC)). This is the result of the aforementioned technical expertise and high R&D expenses that serve as barriers to entry, which were built over the last two decades.

These returns are unlikely to fall substantially as ASML continues its growth path. The company’s sustainable competitive advantage will keep competitors at bay for an extended period.

While incremental ROIC (or RONIC) will likely continue to be high, ASML’s sales and NOPAT growth will over time drop towards lower levels as the semiconductor market slows down. The assumption that RONIC will remain above WACC is therefore coupled to a reasonable long-term growth rate.

WACC

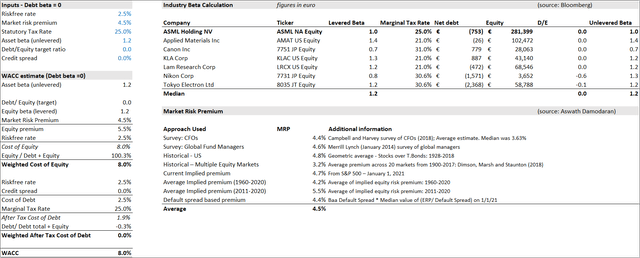

To calculate the value of ASML using enterprise DCF analysis, the future free cash flows need to be discounted by the WACC. This discount rate represents the required return by all investors (debt and equity) in ASML.

ASML is aware of the uncertainties of the global economy, the bulky character of its lithography business, and the cyclical nature of the semiconductor industry. As such, ASML wants to maintain a capital structure that targets a solid investment-grade credit rating. The company received an A3 (stable) credit rating from Moody’s and A- (stable) rating from Fitch.

As such, ASML will continue to operate with its current conservative capital structure, which is characterized by low leverage, holding more cash than debt on the balance sheet (753-million-euro net cash). Therefore, ASML's WACC will be close to its cost of equity.

ASML's cost of equity is calculated with the capital asset pricing model (CAPM). The expected market return is calculated by adding a normalized risk-free rate (per Duff & Phelps 2.5 percent) to the market risk premium, which, based on several approaches, amounts to 4.5 percent (see table below).

ASML: WACC Calculation Source: ASML company reports, Duff & Phelps, Bloomberg, Aswath Damodaran, own estimates

Source: ASML company reports, Duff & Phelps, Bloomberg, Aswath Damodaran, own estimates

The cost of equity of ASML is calculated as the risk-free rate plus ASML's beta times the market risk premium. The beta is based on peers Applied Materials (AMAT), Canon, KLA (KLAC), Lam Research (LRCX), Nikon, and Tokyo Electron (OTCPK:TOELF), which are benchmarked against the MSCI World Index.

When levered by ASML's capital structure, this results in a beta of 1.2. Taking all items together results in a long-term growth rate of 2.5 percent and a corresponding WACC of 8 percent. Assuming a higher long-term growth rate would increase WACC, and vice versa (see sensitivity analysis under 'Value per share').

Value per share

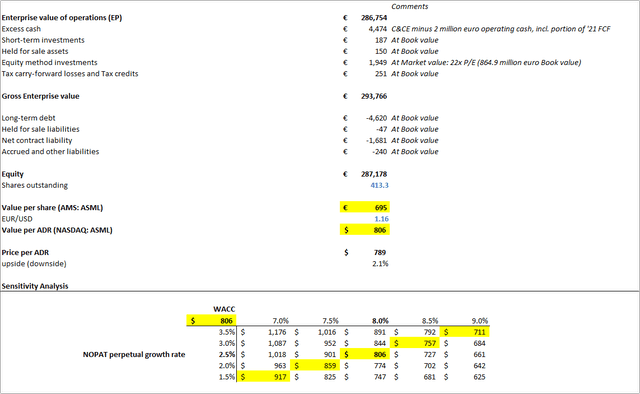

The table below shows the value of ASML’s operations, which amounts to 286.8 billion euro as of October 2021. To calculate the market equity value, the following assets are added to obtain the gross enterprise value:

- ASML’s cash and cash equivalents of 5.2 billion euro are estimated at book value. The minimum operating cash of 2 billion euro is deducted. Added is FCF generated since mid-year of 2021 and taken together excess cash amounts to 4.5 billion euro.

- The short-term investments of 187 million euro are estimated at book value.

- Held for sale assets are estimated at 150 million euro in book value.

- Equity investments include an indirect interest of 24.9 percent in Carl Zeiss SMT, its single supplier of optical columns for lithography systems. The interest is valued at a trailing price-earnings (P/E) multiple of 22, based on ASML peers like Applied Materials, KLA, and Lam Research. Multiplied by 89 million euro in profit, results in a value of 1.9 billion euro.

- ASML’s tax losses and credits of 251 million euro are estimated at book value.

ASML: Enterprise Discounted Cash Flow (DCF) Valuation In this way, gross enterprise value amounts to 293.8 billion euro. Subtracted from gross enterprise value are debt and debt equivalents to obtain equity value.

In this way, gross enterprise value amounts to 293.8 billion euro. Subtracted from gross enterprise value are debt and debt equivalents to obtain equity value.

- ASML's debt (only long-term debt) amounts to over 4.6 billion euro.

- Other debt equivalents include held for sale liabilities of 47 million euro.

- Net contract liabilities are estimated at book value of 1.7 billion euro.

- The accrued and other liabilities amount to 240 million euro in book value.

ASML: Enterprise Value to Equity per Share The resulting total equity value of 287.2 billion euro is divided by the shares outstanding (413.3 million), which results in a value per share of 695 euro, or 806 dollars per share.

The resulting total equity value of 287.2 billion euro is divided by the shares outstanding (413.3 million), which results in a value per share of 695 euro, or 806 dollars per share.

This means shares of the global lithography leader assuming management's high-demand environment look almost fully valued. Thereby its IRR will be just over 8 percent until 2025, close to its estimated cost of equity.

Margin of safety

The DCF analysis shows that ASML shares under the high-demand scenario have just a little upside left. Investors looking for substantial upside will need ASML to grow much faster, and longer and/or expand margin further than management currently in a high-demand environment foresees.

That said, ASML has a track record of beating its long-term guidance, with the company raising the top end of the guided range at Investor Days in 2018 and 2021. There might, for example, be upside to the High NA EUV expectations as it enters high volume manufacturing from 2025. High NA EUV systems have an initial ASP of around 270 million euro, moving significantly over 300 million euro ASP in later years.

However, lithography intensity will likely start to reach its limits at an assumed 30 percent level. Further upside also assumes the semiconductor industry continues its strong growth path. While that might certainly happen, there is always the risk of pullbacks in the cyclical semiconductor industry.

ASML is arguably chipmaking's biggest monopoly, with very bright prospects for the next decade. But with little upside potential left under management's high-demand scenario, a wider margin of safety might be desirable for investors.