Sundry Photography/iStock Editorial via Getty Images

In my last article about Texas Instruments (NASDAQ:TXN), I stated, that price ran away, and fundamentals have troubles catching up. And I was rather neutral about the stock as an investment and rated it as a hold. Now, about nine months later, price is not running away anymore, but the stock was rather stagnating and even declined, while fundamentals actually could catch up. And with Texas Instrument now trading 8.5% lower and earnings per share as well as free cash flow being higher than nine months ago, it makes sense to take a closer look at Texas instruments again and try to determine if the stock is a good investment now.

Intrinsic Value Calculation

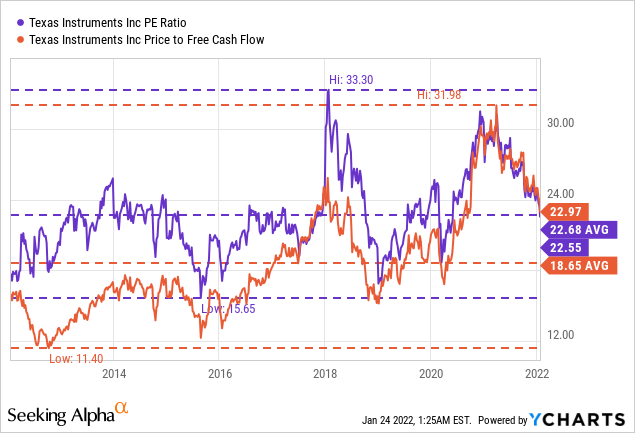

As I have mentioned, the stock price declined in the last nine months and earnings per share as well as free cash flow increased, and the stock therefore seems to be cheaper right now. In order to determine if Texas Instruments is a better investment right now and what the intrinsic value for Texas Instruments should be, we will once again look at the P/E ratio and P/FCF and calculate an intrinsic value once again.

We start by looking at the P/E ratio as well as P/FCF ratio. And as earnings per share increased in the last few quarters while the stock price declined, Texas Instruments is now trading for a more reasonable P/E ratio of 22.5 instead of 30 in April 2021 when my last article was published. The stock is now also trading in line with the average P/E ratio of the last 10 years, which was 22.68. And when looking at the price-free-cash-flow ratio, the picture is similar. Right now, Texas Instruments is trading for 23 times free cash flow and is much cheaper than in April 2021, when it was trading for 30 times free cash flow. But when considering the average P/FCF ratio of 18.65 during the last decade, the stock is still rather expensive when compared to the average P/FCF of the last ten years.

And as I have mentioned countless times in the past, the P/E ratio and P/FCF ratio are good hints to get a feeling for historic valuation multiples and to see where the stock is right now compared to its own history. But it does not really tell us, if the stock is a good investment right now and what an intrinsic value for the stock should be. To answer this question, we need a discount cash flow calculation and in my last article I determine an intrinsic value of $169.50 for Texas Instruments. In this case, the stock would be fairly valued right now with the stock trading for $172 at the time of writing. In my last article I calculated with 8% growth for the next ten years followed by 6% growth till perpetuity, but now we could once again use the free cash flow of the last four quarters, which is much higher now ($7,132 million) and would lead to an intrinsic value of $219.49 for Texas Instruments (assuming a 10% discount rate and 936 million outstanding shares).

In my last article I assume that revenue might grow about 3% annually, margin improvements might contribute about 2% growth and finally share buybacks will also contribute 3% growth to the bottom line resulting in about 8% growth. In the following sections we will once again look at these premises and try to determine if they are realistic.

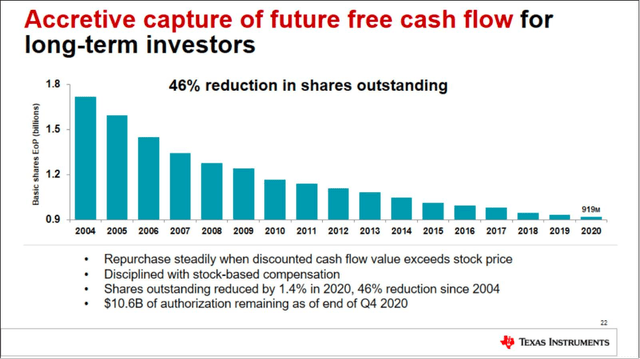

Share Buybacks

We start with share buybacks and try to answer the question if they can contribute 3% to bottom line growth. Considering a market capitalization of $162 billion right now, Texas Instruments would have to spend about $4.86 billion on share buybacks. And just in case you are wondering where the 3% come from. Since 2004, Texas Instruments decreased the number of outstanding shares with a CAGR of 3.8% and share buybacks will most likely stay a priority for management.

Texas Instruments: Share Buybacks

But considering a free cash flow of $6 billion to $7 billion right now and $3,761 million in dividend payments (amount of the last four quarters), we can assume that Texas Instruments can spend about $3 to $3.5 billion on share buybacks, which is not enough right now to repurchase 3% of outstanding shares. In the past, Texas Instruments profited from the rather low valuation multiples it was trading for. With the higher valuation multiples right now (and the higher stock price), it is more difficult for Texas Instruments to repurchase similar amounts of shares outstanding as in the past.

And we also must consider that Texas Instrument has debt on its balance sheet, which must be repaid in the future. On September 30, 2021, the company had $500 million in short-term debt as well as $7,239 million in long-term debt. However, in the next few years (according to 10-Q) Texas Instruments has to pay back $500 million in 2022 and 2023 and $300 million in 2024. Only in 2025, the amount is a bit higher ($750 million). Therefore, Texas Instruments could spend most of its cash on dividends and share buybacks in the next few years. And we also must mention that Texas Instruments has $5,663 million in cash and cash equivalents as well as $4,119 million in short-term investments on its balance sheet and these liquid assets are enough to repay all the outstanding debt.

While Texas Instruments is not generating enough cash to repurchase 3% of outstanding shares right now, we can be confident that Texas Instruments will be able to repurchase shares with a rather high pace. And the solid balance sheet will support this. When comparing the total debt of $7,739 million to $12,151 million in shareholders' equity, we get an acceptable D/E ratio of 0.64. And when comparing the total debt to the operating income Texas Instruments can generate in one year ($8,459 million in operating income in the last four quarters), it would take less than one year's operating income to repay the outstanding debt.

Revenue

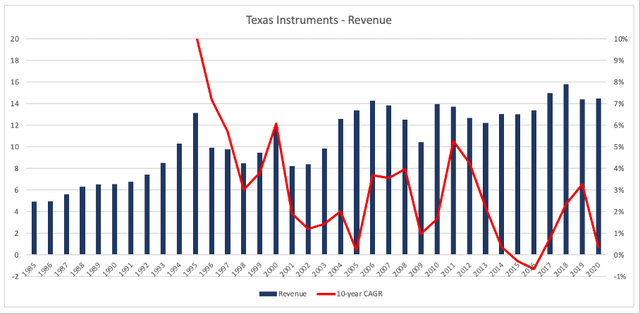

Aside from share buybacks, I also assumed that Texas Instruments can grow the top line 3% annually. And while this might seem like a rather low growth target, we can also see from growth rates in the last decades that higher growth rates are not justified. Especially in the last two decades, Texas Instruments had trouble to grow with a higher pace.

Texas Instruments Revenue Since 1985 Author's work

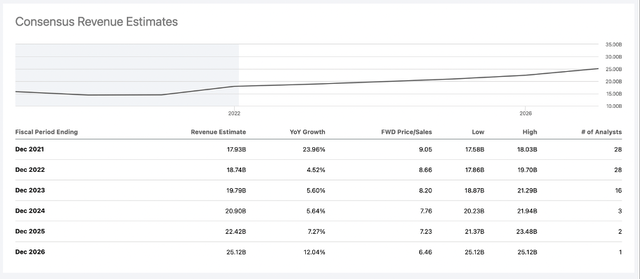

However, analysts are quite optimistic for the years to come. According to Seeking Alpha, analysts are estimating revenue to increase from $17.93 billion in fiscal 2021 (also an estimate) to $25.12 billion in 2026. This leads to a CAGR of 6.98% and even when excluding revenue for fiscal 2026 (which is based only on the estimate of one analyst), we still get a CAGR of 5.75% until fiscal 2025.

But I think we should stick with our rather cautious assumption of only 3% revenue growth for the years to come.

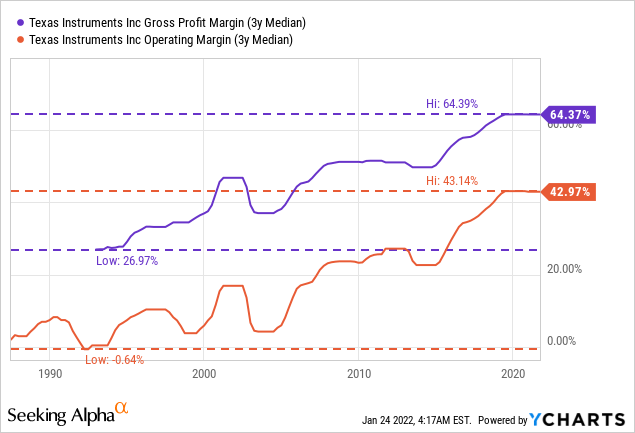

Margins

And finally, I assumed that 2% growth could stem from margin improvements in the years to come. When looking at the last few decades, we can see that Texas Instruments constantly improved its gross margin as well as its operating margin. In the chart below, we used the 3-year median to balance out extreme, short-term fluctuations.

And of course, it will get more difficult for Texas Instruments to improve margins further in the years to come as gross margin and operating margin are already rather high. But small improvements are certainly possible and improved margins could contribute about 1% or maybe even 2% to the bottom-line growth.

Quarterly Results

In the third quarter of fiscal 2021, Texas Instruments however reported much higher growth rates (but of course we always must remember that we are comparing to 2020, which was not a great year for many businesses). Nevertheless, Texas Instruments could increase revenue from $3,817 million in the same quarter last year to $4,643 million in the third quarter of fiscal 2021 - an increase of 21.6% year-over-year. Operating profit also increased 43.4% YoY from $1,609 million in Q3/20 to $2,305 million in Q3/21. And finally, diluted earnings per common share increased from $1.45 in Q3/20 to $2.07 in Q3/21 - an increase of 42.8% year-over-year.

Intrinsic Value Calculation II

At this point we can return to our intrinsic value calculation and once again try to determine a realistic intrinsic value for Texas Instruments. Considering that share buybacks won't contribute 3% with current share prices, we are a little more cautious and assume only 6% growth for the next ten years as well as for perpetuity. When using these growth assumptions as well as the free cash flow of the last four quarters, we get an intrinsic value of $190.49 for Texas Instruments. And when also including a necessary margin of safety of 15%, Texas Instruments seems to be fairly valued right now and can be bought. We are not talking about a bargain - and I usually try to identify bargains - but Texas Instruments is a solid investment.

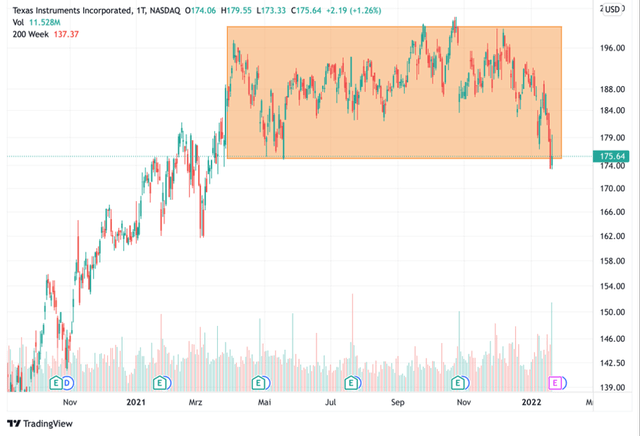

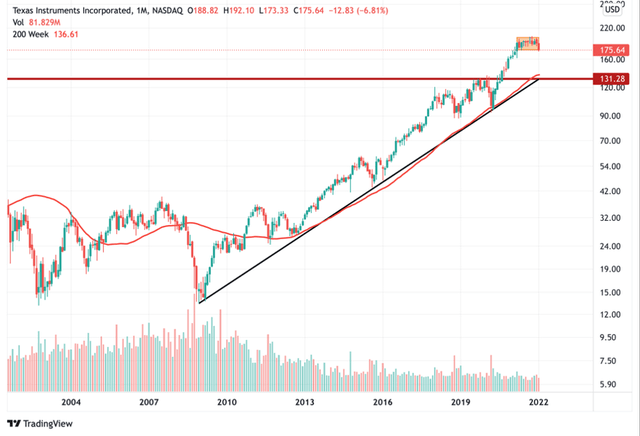

Technical Picture

While Texas Instruments might be fairly valued from a fundamental point of view, we can also look at the chart of TXN and the last few months can be described as a sideway correction and the stock is currently trading at the lower end of that sideway range. Two scenarios seem possible: the stock could break below the support level and fall even steeper, or the support level will hold and TXN will move higher again. The outcome might also depend a bit on how the overall market will perform in the next few days and weeks. If the bullish momentum should return, the support level could hold, but if the overall market - and especially technology stocks and the Nasdaq-100 (QQQ) - should continue to decline, Texas Instruments might break through the support level and decline further.

And if the current support level should not hold and Texas Instruments will break below, the stock could drop as low as $130 where we find the next strong support level for the stock. At $130, we not only have the 200-week simple moving average, but also a trendline, which is in place since 2009 and has been tested several times (black line). Additionally, we find the previous highs at this level, which are now a strong support level.

Texas Instruments Weekly Chart

Conclusion

Texas Instruments seems to be more or less fairly valued at this point, but the stock is certainly not a bargain, and the technical picture is also indicating, that further downside potential is at least a possibility. But right now, the stock is certainly more interesting for long-term investors than it was in April 2021, when my first article about Texas Instruments was published. The stock is reasonably valued even when using a bit more cautious growth assumptions than last time - and these growth rates should be achievable for Texas Instruments (and investors are still protected by a 10% margin of safety).