putilich/iStock via Getty Images

While everyone's attention is focused on high inflation and companies with pricing power, there is another metric that deserves to be prioritized in the highly competitive corporate world. This is customer experience ("CX") or user experience ("UX") and is the reason Concentrix (NASDAQ:CNXC) made a bid to acquire ServiceSource International (SREV) for approximately $131 million.

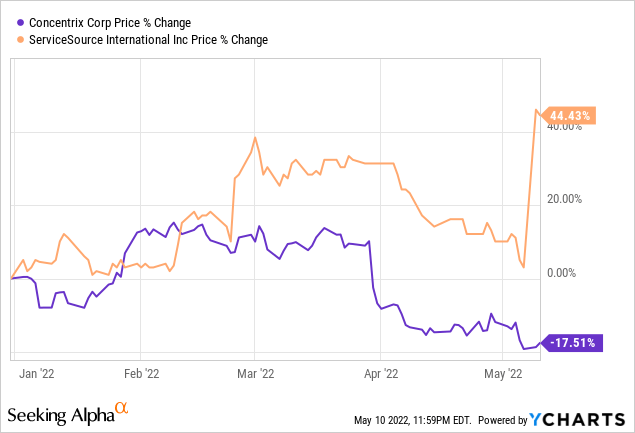

Also, looking beyond the typical surge in the stock price as is usually the case for acquisition targets, ServiceSource's year-to-date price performance of above 0% indicates that it has been less impacted than most other tech stocks including Concentrix which suffered from a 17.5% slide.

Then, adding ServiceSource's products to its portfolio and deriving acquisition synergies out of them should bode well for Concentrix as this thesis will try to demonstrate. I also pay special attention to the company's free cash flow generation capability as the price tag of $1.50/share which it will pay for the acquisition represents a 47% premium to ServiceSource's pre-deal stock price.

I start by providing insights as to what value ServiceSource brings to the table.

ServiceSource's Value Proposition

First, this acquisition represents an industry-level consolidation as its objective is to strengthen Concentrix’s product offerings in its high-growth customer engagement business where demand remains strong.

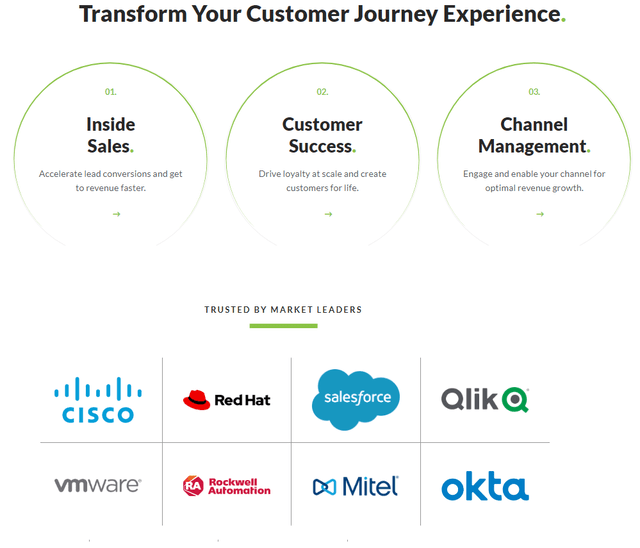

Second, CX has become a key factor in all spheres of business activities especially online interactions following a marketing approach that has shifted from expecting users to adapt to new products to one where the corporate value chain itself is built around customers' needs. With the user now at the center, this opens growth avenues for companies like ServiceSource whose 3,000-strong team in 170 countries designs interfaces for the transformation of functions such as enterprise sales and renewals management as shown below.

Corporate website (www.servicesource.com)

Additionally, as shown above, the company is trusted by some big names like Cisco (CSCO) and Salesforce (CRM) for outsourcing their go-to-market services.

However, in addition to the growth rationale whereby a company can scale by adding customer numbers, it is also important to assess profitability metrics, especially in current market conditions where investors are prioritizing the value strategy. For this purpose, research carried out by Forrester shows that every one dollar invested in CX through actions like increasing customer satisfaction, promoting loyalty, and product differentiation brings $100. This signifies a return on investment of 9,900%.

For this purpose, I noted that ServiceSource has a customized outcome-focused model which guarantees more profitable customer relationships for its clients. Tellingly, it generated more than $7 billion of revenue for them in the last ten years.

Sticking to the profitability rhetoric, instead of continually spending more on marketing to drive sales, the company has managed to moderate SG&A (sales and admin) expenses resulting in positive GAAP operating income in the December 2021 quarter. This partly explains why its share price has suffered less since the beginning of 2022, and I now assess whether the market has disproportionately punished Concentrix.

Concentrix's strength in CX with PK

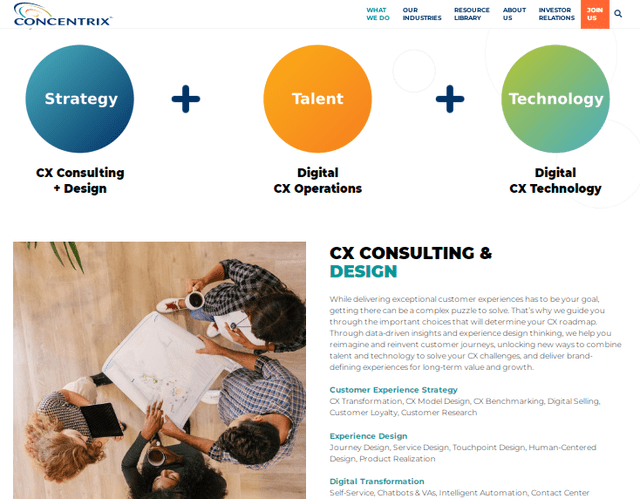

With revenue of $1.54 billion in the first quarter of 2022 (on a constant currency basis), Concentrix grew by 11%, partly due to organic growth through its Catalyst business which is all about changing customer loyalty from conventional points-based rewards programs to actually making them become fans of a brand. The other part of its revenue growth, which consists of providing services across the whole CX spectrum (diagram below), was partly driven by the $1.6 billion PK acquisition last year.

Corporate Website (www.concentrix.com)

PK which is a CX digital design and engineering firm has enabled Concentrix to grow with over 5,000 staff in four countries. When the acquisition was closed in November 2021, it was growing by 20% and was expected to contribute approximately $530 million to Concentrix's revenue in 2022. As a result, the latter raised its full-year guidance to $6.45 billion-$6.6 billion, whose mid-point would imply a 16.8% increase over the fiscal year 2021 which ended in November. Had it not been for the acquisition, I calculated that the company would only have grown by only 7.3%.

More important, GAAP operating income in 2022 is expected to be in the range of $660 million-$700 million compared to $554.7 million in 2021. Thus, using the mid-point of $680 million, this comes to an increase of 22.6%. This ultimately shows that as a result of synergistic growth, profit margins should grow faster than revenues in 2022 as more technology solutions are rapidly delivered to the CX marketplace.

By synergistic growth, I mean that in addition to extending Concentrix's client portfolio and expanding the range of solutions it provides to garner more sales, the acquisitions of both Service Source and PK should result in cost synergies whereby there are more cross-selling opportunities for the combined customer base.

Equally important in a tight labor market, the acquirer (Concentrix) instantly has access to an additional talent pool of over 8,000 professionals who can support and sell its broad portfolio and unique product mix. This is much faster than having to painfully fish for individual skills.

However, two acquisitions in a row cost money and it is important to assess Concentrix's finances.

Valuations And Key Takeaways

First, with only $182 million of cash on the balance sheet in 2021, the company's debt level rose from $800 million to $2.27 billion as a result of financing the PK deal. It will rise by a further $131 million for ServiceSource. Second, some of the company's clients have been facing supply-chain-related pains in the first quarter (December 2021 to February 2022). This could persist with China's COVID-induced lock-downs, in turn impacting demand.

On the other hand, Concentrix has seen "early positive trends" for its Canada Experience platform together with its innovative solutions that are aimed at transforming the work-from-home UX experience into more social and engaging interactions. This is in line with the current demands of the hybrid workforce who want to work from the comfort of their home while being able to collaborate with colleagues as in a normal office setup.

The company also has levers to increase efficiency through AI tools. Concretely, it recently launched the CX Quality Insight which is expected to be deployed across the whole enterprise within the next 1.5 years. Now, efficiency gains mean better profitability, which could, in turn, lead to an increase in operating margins, possibly at a higher rate than the 22.6% from 2021 to 2022 I mentioned earlier, thereby helping to release cash for debt repayment purposes. For this matter, Service Source generated a free cash flow of $1.4 million, out of revenues of $48.9 million in the first quarter of 2022, which is up 8.6% on a year-over-year basis.

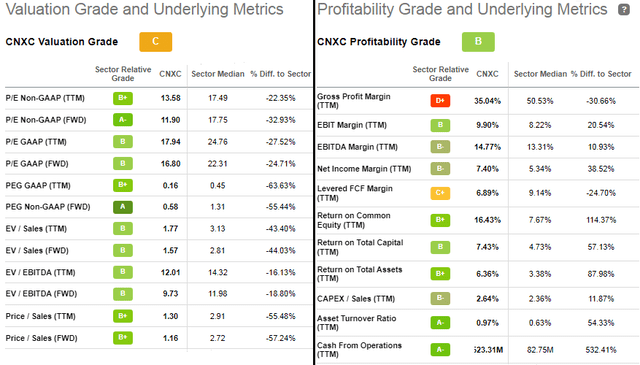

Also, after its stock has cratered, Concentrix's valuations have come down and they are 16% to 55% undervalued with respect to the IT sector as shown in the table below. Furthermore, it has a profitability grade of B.

Valuation and profitability grades (www.seekingalpha.com)

On the other hand, the company exhibited break-even free cash flow ("FCF") in Q1-2022 with capital expenses ($45 million) negating the money obtained from operations. The executives attribute this state of affairs to seasonal factors and anticipate significant FCF only from Q3 in accordance with past trends. Thus, the stock could be volatile when second-quarter financial results are announced at the end of June this year.

In this respect, investors should be aware that with high inflation and rising borrowing costs, the market's attention will be on Concentrix's ability to deliver on FCF in the second half of this year. Consequently, investors' sentiment towards Concentrix seems justified for the time being in view of short-term volatility risks. Still, the stock should be on your watchlist as it aims for more profitable growth in CX, an area that is being prioritized by corporations as the costs of acquiring new customers rise and competition accentuates.

Finally, as for ServiceSource, at $1.44 to $1.45, its stock price is around 41% above its initial price (pre-deal) of $1.02, and since this is an all-cash acquisition, shareholders will get money directly in their savings account when the deal is closed. Considering the deal is at 47% of the initial value, the target price should be around $1.49. Thus, the company is still undervalued by around $0.04-$0.05, but investors do not currently seem to find that difference attractive enough to put their money.