ljubaphoto

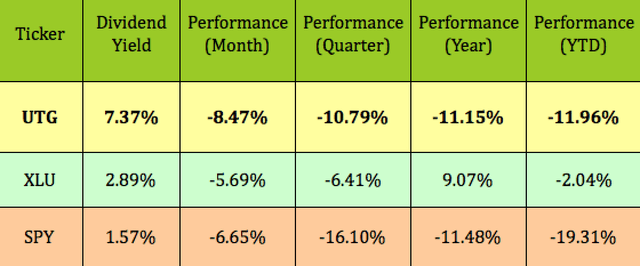

Utilities are boring, right? Well, not in pullback years, like the one we're having in 2022. In fact, the Utilities sector is the 2nd-leading sector so far in 2022, right behind the Energy sector. It has a YTD price performance of -2.04%, vs. -19.3% for the S&P 500 (SPY).

If you'd prefer not to try to stock-pick, you can get broader Utilities coverage via utility funds, such as the Reaves Utility Income Fund (NYSE:UTG), a closed-end fund ("CEF").

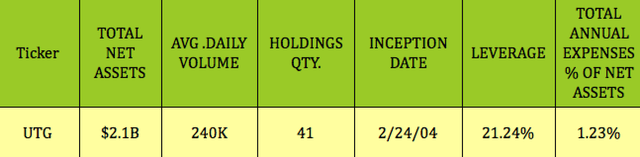

Profile:

As the site states:

"The Fund's objective is to provide a high level of after-tax total return consisting primarily of tax-advantaged dividend income and capital appreciation. It intends to invest at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. The remaining 20% of its assets may be invested in other securities including stocks, money market instruments and debt instruments, as well as certain derivative instruments in the utility industry or other industries." (UTG site)

The fund has a long track record, having IPO'd on 2/24/2004. It has $2.1B in Net Assets, with 41 holdings, and a 1.23% expense ratio, with average daily volume of 240K. Management uses some leverage, which was at 21.24% as of 7/6/22, up a bit vs. 19.14% in late April.

Performance:

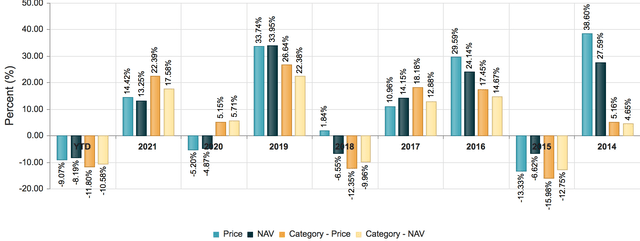

UTG outperformed the Morningstar U.S. Equity CEF Sector in 2014 - 2016, 2018 - 2019, and has held up better so far in 2022.

It has lagged the broad Utility sector, though, as represented by XLU, over the past month, quarter, year, and year to date; and has outperformed the S&P over the past quarter, year, and year to date:

Dividends:

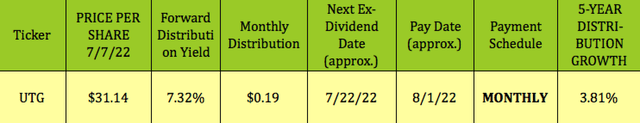

UTG pays a monthly distribution of $.19, with a 5-year distribution growth rate of 3.81%. It has a long history of dividend hikes, having raised its monthly payouts from $.1150 to $.1250 in 2011, with gradual hikes over the past 10 years, including its latest hike in July 2021, from $.18 to $.19. Its last special distribution was $.92 in 2016.

At its 7/7/22 intraday price of $31.14, UTG yielded 7.32%. It should go ex-dividend next on ~7/22/22, with a ~8/1/22 pay date.

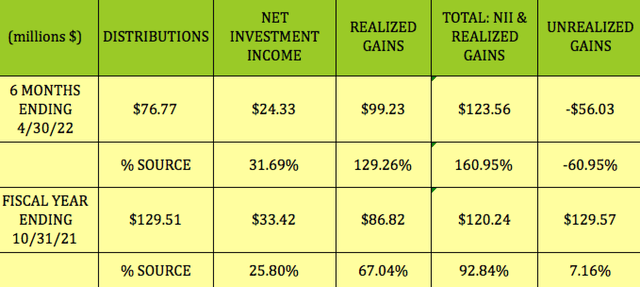

UTG's fiscal year ends on 10/31. It had ample distribution coverage for the fiscal year ending 10/31/21, with ~26% coming from NII, 67% coming from Realized Gains and the Balance from Unrealized Gains.

For the 6 months ending 4/30/22, NII covered 31.7%, and Realized Gains more than covered the balance:

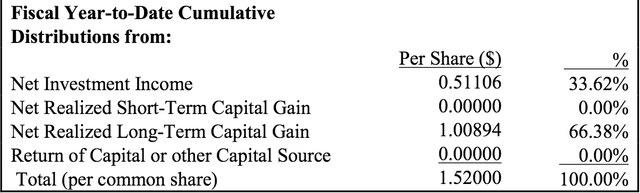

Taxes:

Management estimated that 66.38% of the November '21 - April '22 distributions were from long-term capital gains and that 33.62% were from NII:

NAV Pricing:

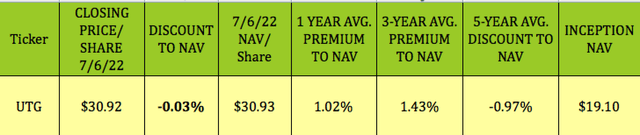

Since NAV/Share is calculated at the end of each trading day, you have to look at the most recent closing values to determine the current NAV discount or premium.

Buying CEFs like UTG at a deeper discount than its historical average discounts/premiums can be a useful strategy, due to mean reversion.

At its 7/6/22 closing share price of $30.92, UTG was just about even with its NAV/Share of $30.93. That's cheaper than its 1-year average premium of 1.02%, and its 3-year 1.43% average premium, but more expensive than its 5-year -0.97% discount.

Holdings:

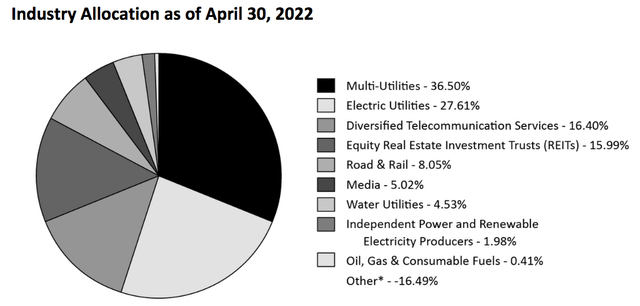

As of 4/30/22, 12/31/22, ~69% of UTG's portfolio was comprised of Utilities, up from 55% at the end of 2021, with Multi/Diversified and Electric Utilities in the top 2 slots. REITs and Diversified Communications Services were both near 16%. Road & Rail was ~7% and Media at 5%, respectively.

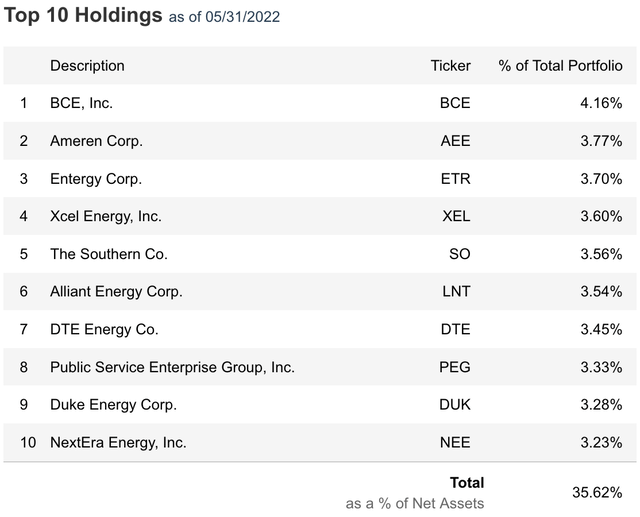

As of 5/31/22, UTG's top 10 positions formed 35.62% of its portfolio, very similar to 3/31/22. The only big change in the top 10 was that CMS Energy dropped out of the top 10. BCE Inc. (BCE) and Ameren (AEE) remained the top 2 positions while NextEra (NEE) dropped from #3, at 3.53%, to #10, at 3.23%:

Parting Thoughts:

If you're looking for some defensive income-generating exposure, UTG can fill the bill. Management has built up the NAV/share since inception, from $19.10 to $30.93, while also paying out attractive monthly distributions.

If you're interested in other high-yield vehicles, we cover them every weekend in our articles.

All tables by Hidden Dividend Stocks Plus, except where otherwise noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on diverse, undercovered, undervalued income vehicles, and special high yield situations.

There's currently a 20% discount, and a 2-Week Free Trial on offer.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won't see anywhere else.

We offer a range of income vehicles, many of which are selling below their buyout and redemption values. Find out how our portfolio continues to beat the market by a wide margin in 2022.