Morgan Somers/E+ via Getty Images

Introduction

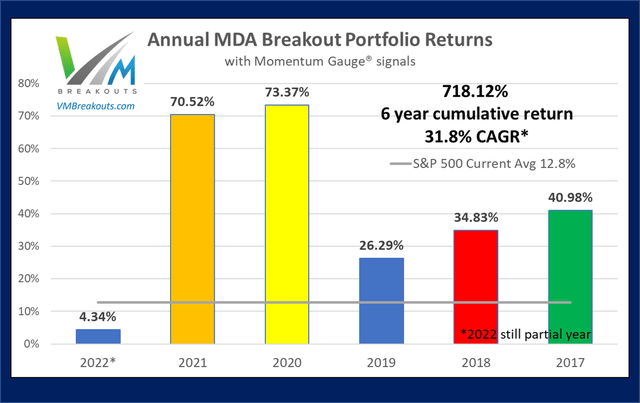

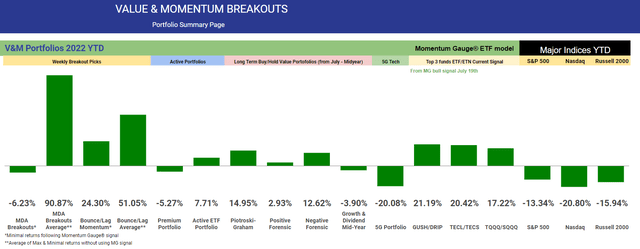

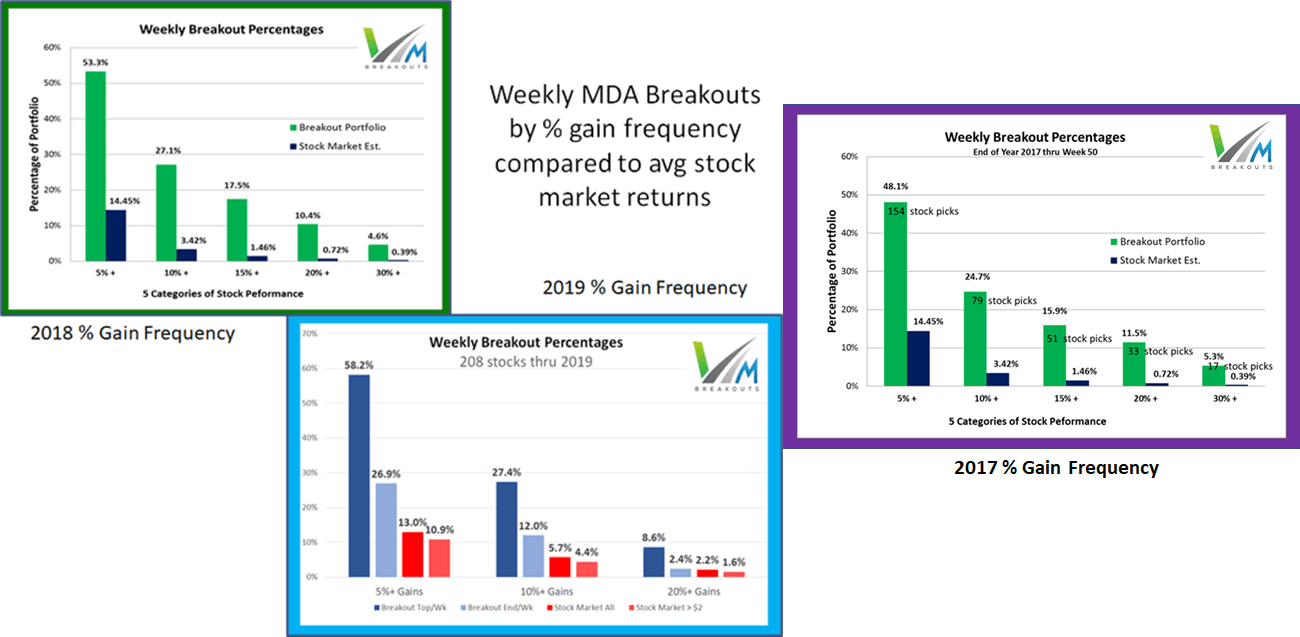

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 7 years. This subset of the different portfolios I regularly analyze has now exceeded 260 weeks of public selections as part of this ongoing live forward-testing research. The frequency of 10%+ returns in a week is averaging over 4x the broad market averages in the past 5+ years.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members' request since 2020, I now generate only 4 selections each week. In addition 2 Dow 30 picks are provided, as well as a new active ETF portfolio that competes against a signal ETF model. Monthly Growth & Dividend MDA breakout stocks continue to beat the market each year as well. I offer 11 top models of short and long term value and momentum portfolios that have beaten the S&P 500 since my trading S&P 500 since my trading studies were made public.

Market Outlook

I took time off this week for my 52nd birthday celebrations and I don't have a Week 31 updated video, but the prior week video remains current with the same S&P 500 targets and support levels. My latest August outlook on the Fed quantitative tightening program is available here.

The Momentum Gauges®, economic events, and weekly market outlook are now separated into a new weekly article here which also includes my new weekly Technical Market update videos.

- Market Outlook Signals Week 29 - July 2022 And Video Update | Seeking Alpha Marketplace

- Market Outlook Signals Week 28 - July 2022 And Video Update | Seeking Alpha Marketplace

Momentum Gauge® stoplight signals

All the Momentum Gauges® are positive ahead of Week 31. We have not yet had the weekly gauges positive for 3 consecutive weeks since November and they have already been positive for 2 consecutive weeks. The monthly gauges continue negative from November and are not shown on the stoplight.

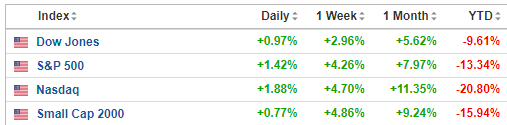

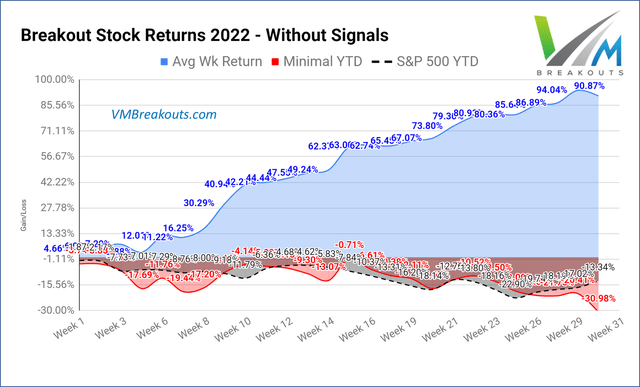

Current Returns

In a quick study of the MDA breakout selections YTD there are 77 picks in 30 weeks beating the S&P 500. 42 picks are beating the S&P 500 by over 10%. Leading gainers +87.5% (TDW), +78.9% (RES), +23.9% (GNK), and +59.2% (CLFD) are significantly beating the major indices YTD.

Additional background, measurements, and high frequency breakout records on the Weekly MDA Breakout model is here: Value And Momentum MDA Breakouts +70.5% In 52 Weeks: Final 2021 Year End Report Card

Momentum Gauge® trading signal: Positive conditions ahead of Week 31

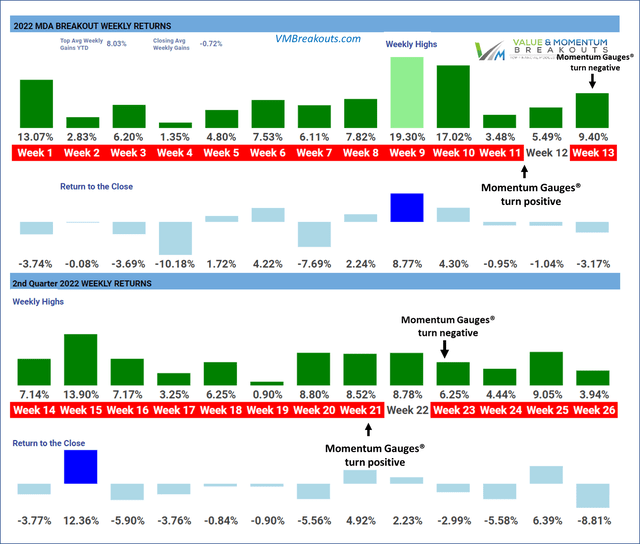

2022 First-half weekly return results

The complete weekly returns are all available on the V&M Breakout Dashboard for members.

Red weekly color indicates negative Market Momentum Gauge signals. MDA breakout selections outperform when the market signal is positive and daily negative values are below 40 level.

Historical Performance Measurements

Historical MDA Breakout minimal buy/hold returns are at +70.5% YTD when trading only in the positive weeks consistent with the positive Momentum Gauges® signals. Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week continues at highly statistically significant levels above 80% not counting frequent multiple 10%+ gainers in a single week.

Longer term many of these selections join the V&M Multibagger list now at 116 weekly picks with over 100%+ gains, 53 picks over 200%+, 21 picks over 500%+ and 13 picks with over 1000%+ gains since January 2019 such as:

- Celsius Holdings (CELH) +1,792.8%

- Enphase Energy (ENPH) +1,954.8%

- Intrepid Potash (IPI) +1,237.2%

- Houghton Mifflin Harcourt (HMHC) +1413.8%

- Trillium Therapeutics (TRIL) +1008.7%

More than 200 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. A frequency comparison chart is at the end of this article. Readers are cautioned that these are highly volatile stocks that may not be appropriate for achieving your long term investment goals: How to Achieve Optimal Asset Allocation

The Week 31 - 2022 Breakout Stocks for next week are:

The picks for next week consist of 3 Energy, and 1 Healthcare sector stocks. These stocks are released to members in advance every Friday morning near the open. Prior selections may be doing well, but for research purposes I deliberately do not duplicate selections from the prior week. These selections are based on MDA characteristics from my research, including strong money flows, positive sentiment, and strong fundamentals -- but readers are cautioned to follow the Momentum Gauges® for the best results.

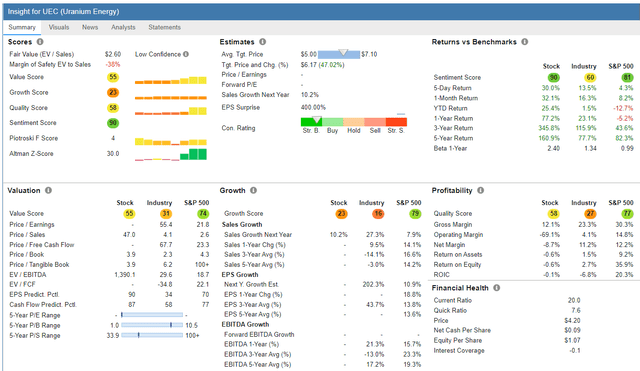

Uranium Energy - Energy / Uranium

FinViz.com

Price Target: $5.50/share (See my FAQ #20 on price targets)

| Jul-28-22 07:39PM | Uranium Energy Corp announces receipt of a competing offer to acquire UEX Corporation PR Newswire |

| Jul-27-22 07:00AM | Uranium Energy Corp Achieves Key Milestone at the Burke Hollow ISR Project with Installation of 106 Monitor Wells in the First Production Area CNW Group |

| Jul-21-22 04:46PM | Uranium Energy Corp Announces Results of Annual General Meeting CNW Group |

| Jul-20-22 07:00AM | Uranium Energy Corp Files SK-1300 Technical Report Summary Disclosing Resources for Its Yuty Project in Paraguay CNW Group |

| Jul-18-22 09:40AM | Is Uranium Energy ((UEC)) Outperforming Other Basic Materials Stocks This Year? Zacks |

(Source: Company Resources)

Uranium Energy Corp., together with its subsidiaries, engages in exploration, pre-extraction, extraction, and processing uranium and titanium concentrates in the United States, Canada, and Paraguay. It owns interests in the Palangana mine, Goliad, Burke Hollow, Longhorn, and Salvo projects located in Texas; Anderson, Workman Creek, and Los Cuatros projects situated in Arizona; Slick Rock project in Colorado; Reno Creek project in Wyoming; Diabase project located in Canada; and Yuty, Oviedo, and Alto Parana titanium projects in Paraguay.

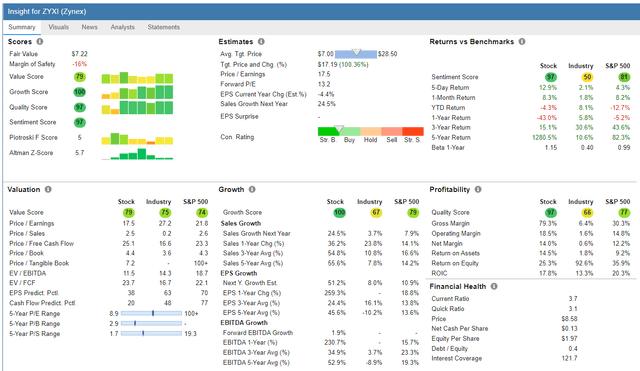

Zynex, Inc. - Healthcare / Medical Devices

FinViz.com

Price Target: $11.00/share (See my FAQ #20 on price targets)

| Jul-28-22 06:15PM | Zynex Inc. ((ZYXI)) Tops Q2 Earnings and Revenue Estimates Zacks |

| Jul-28-22 04:01PM | Zynex Announces 2022 Second Quarter Earnings PR Newswire |

| Jul-20-22 09:15AM | Zynex, Inc. to Announce Second Quarter 2022 Financial Results PR Newswire |

| Jul-11-22 07:00AM | Zynex Reports Preliminary Second Quarter 2022 Results and Reiterates Full Year Revenue and EBITDA Guidance PR Newswire |

| Jul-09-22 08:12AM | Investors in Zynex [NASDAQ:ZYXI] have made a incredible return of 991% over the past five years Simply Wall St. |

(Source: Company Resources)

Zynex, Inc., through its subsidiaries, designs, manufactures, and markets medical devices to treat chronic and acute pain; and activate and exercise muscles for rehabilitative purposes with electrical stimulation. The company offers NexWave, a dual channel, multi-modality interferential current, transcutaneous electrical nerve stimulation, and neuromuscular electrical stimulation (NMES) device that is marketed to physicians and therapists by field sales representatives; NeuroMove, an electromyography triggered electrical stimulation device; InWave, an electrical stimulation product for the treatment of female urinary incontinence; and E-Wave, an NMES device.

Top Dow 30 Stocks to Watch for Week 31

First, be sure to follow the Momentum Gauges® when applying the same MDA breakout model parameters to only 30 stocks on the Dow Index. Second, these selections are made without regard to market cap or the below-average volatility typical of mega-cap stocks that may produce good results relative to other Dow 30 stocks.

The most recent picks of weekly Dow selections in pairs for each of the last 5 weeks:

| Symbol | Company | Current % return from selection Week |

| (AMGN) | Amgen | +0.62% |

| (HON) | Honeywell International | +6.06% |

| (UNH) | UnitedHealth Group | +4.34% Reported Q2 - July 15th |

| (AXP) | American Express | +9.86% Reported Q2 - July 22nd |

| (WMT) | Walmart | +4.90% |

| (TRV) | The Travelers Companies | -6.71% Reported Q2 - July 21 |

| (KO) | Coca-Cola | +1.49% Reported Q2 - July 26 |

| (PG) | Procter & Gamble | -4.28% Reported Q2 - July 29 |

| (GS) | Goldman Sachs | +14.64% Reported Q2 - July 18 |

| (NKE) | Nike | +4.36% |

If you are looking for a much broader selection of large cap breakout stocks beyond the weekly stocks, I recommend these long term portfolios. The new mid-year selections were released to members July 1st:

- Piotroski-Graham enhanced value -

- July up +14.95%

- January portfolio beating S&P 500 by +24.23% YTD.

- Positive Forensic -

- July up +2.93%

- January Positive Forensic beating S&P 500 by +5.49% YTD.

- Negative Forensic -

- July up +12.62%

- January Negative Forensic beating S&P 500 by +12.19% YTD

- Growth & Dividend Mega cap breakouts -

- July down -3.90%

- January portfolio beating S&P 500 by +10.26% YTD

These long term selections are significantly outperforming major Hedge Funds and all the hedge fund averages since inception. Consider the actively managed ARK Innovation fund down -52.3% YTD, Tiger Global Management -52% YTD, RTW Investment Group -34% YTD.

The Dow pick for next week is:

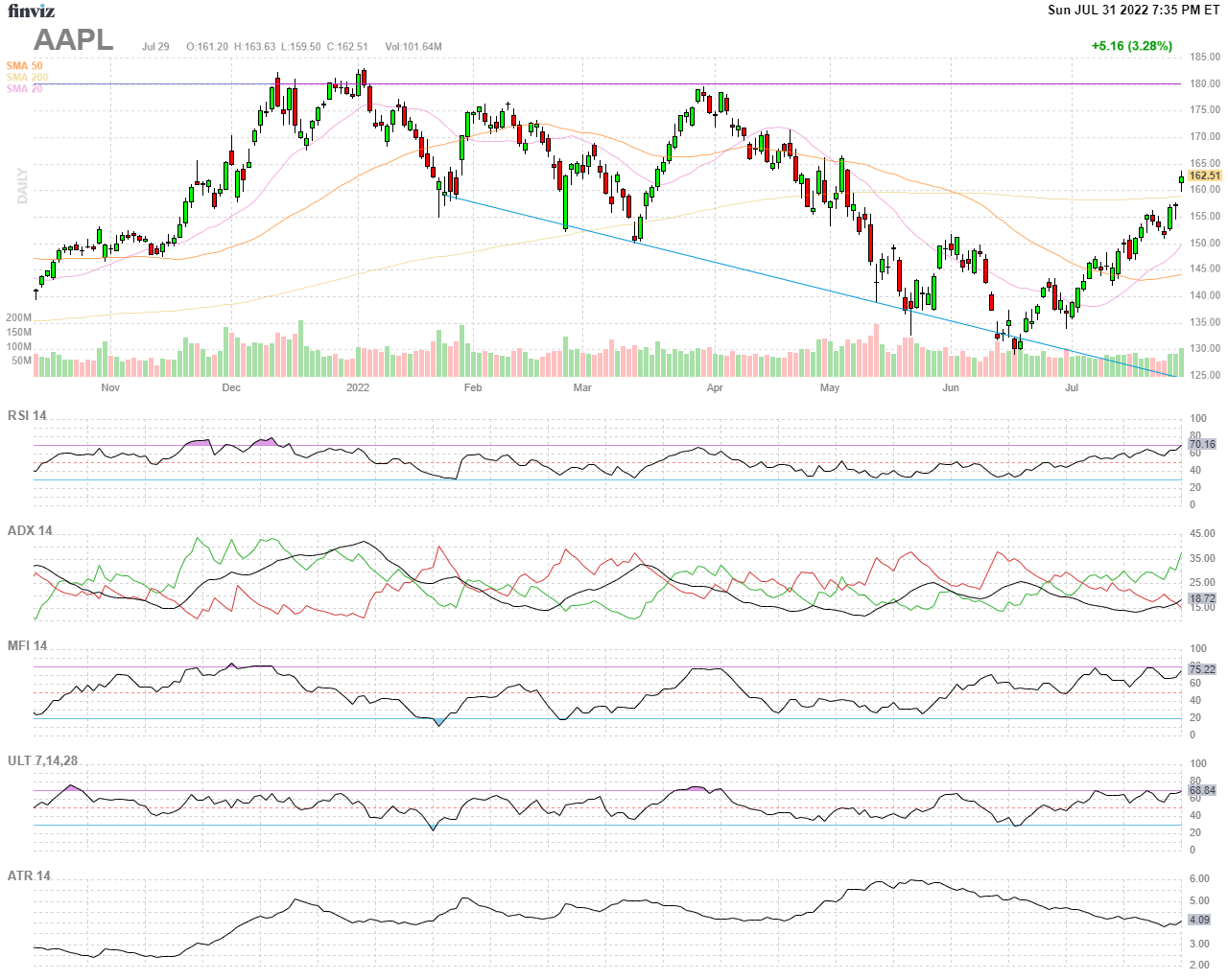

Apple Inc. (AAPL)

Apple beat on top and bottom numbers on July 28th and consensus analyst targets are for 181/share near prior peaks in January and April. All the technical indicators remain positive with high net inflows and net institutional buying.

FinViz.com

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

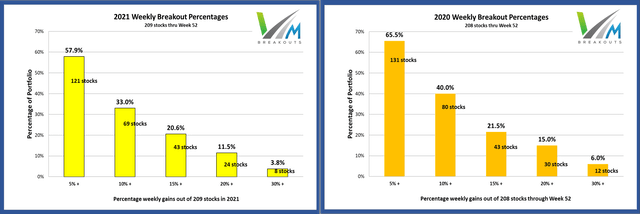

These documented high frequency gains in less than a week continue into 2020 at rates more than four times higher than the average stock market returns against comparable stocks with a minimum $2/share and $100 million market cap. The enhanced gains from further MDA research in 2020 are both larger and more frequent than in previous years in every category. ~ The 2020 MDA Breakout Report Card

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

VMBreakouts.com

The 2021 and 2020 breakout percentages with 4 stocks selected each week.

MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. Penny stocks well below these minimum levels have been shown to benefit greatly from the model but introduce much more risk and may be distorted by inflows from readers selecting the same micro-cap stocks.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that also include one-year buy/hold value stocks. Remember to follow the Momentum Gauges® in your investing decisions for the best results.

All the V&M portfolio models are beating the market indices through the worst 6 month start since 1970.

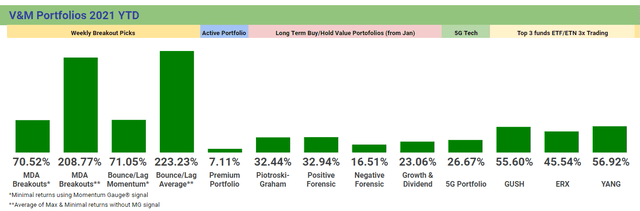

The final 2021 returns for the different portfolio models from January of last year are shown below.

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

If you are looking for a great community to apply proven financial models with picks ranging from short term breakouts to long term value and forensic selections, please consider joining our 1,200+ outstanding members at Value & Momentum Breakouts

- Subscribe now and learn why members are hooked on the Momentum Gauge® signals!

- For the 5th year in a row 6 different portfolio models beat the S&P 500

- The MDA Breakouts gained 70.5%

- Now into our 6th year, this rapidly growing service has consistently outperformed the S&P 500 every single year!

See what members are saying now - Click HERE