undefined undefined/iStock via Getty Images

**This article was originally published for ROTY subscribers on June 9th but has been updated where necessary.

Shares of oncolytic immunotherapy pioneer Replimune Group (NASDAQ:REPL) have lost roughly half their value since my March 2021 ROTY update was published. In August, I sold our position after key catalysts were pushed out to late 2022.

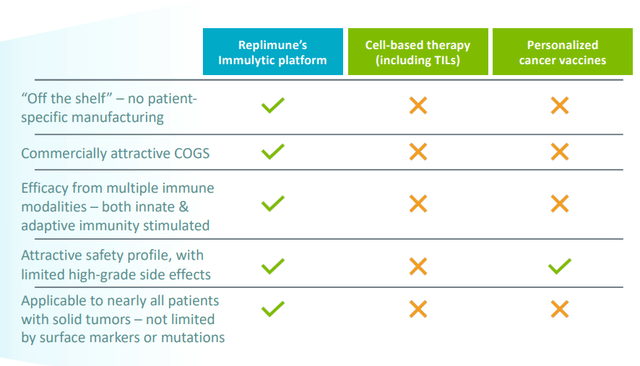

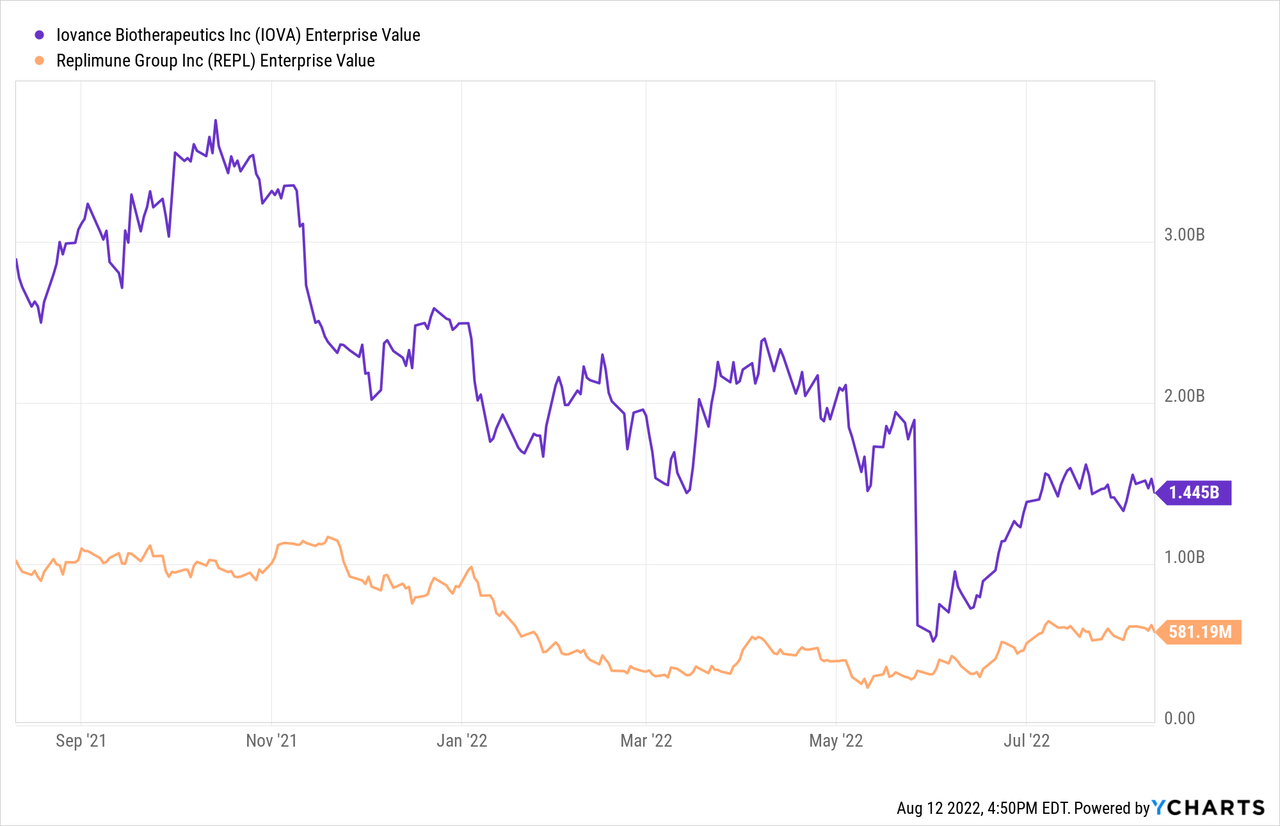

Recently, this one came back to mind after competitor Iovance's (IOVA) disappointing data update in advanced melanoma (shares shed half its market cap). 29% ORR (objective response rate) is still promising but down from the prior number of 35%. Also, keep in mind due to very complicated manufacturing process, TILs (tumor infiltrating lymphocytes) will be quite expensive.

Replimune's oncolytic immunotherapy candidate RP1, on the other hand, has potential advantages including "off the shelf" manufacturing, low COGS, and stimulates both adaptive and innate immunity with an attractive safety profile so far. Importantly, in their most recent data update for melanoma, we see the opposite of Iovance with ORR going up over time (now at 37.5% response rate in PD-1 failed melanoma).

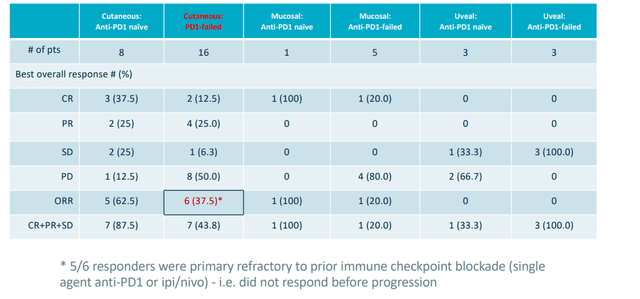

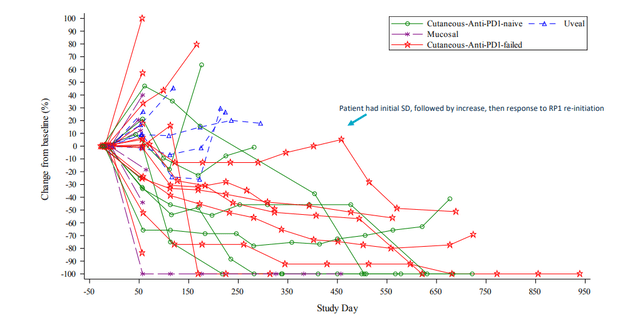

Figure 1: Strong anti-PD1 failed melanoma signal for RP1 (Source: corporate slides)

Additionally, as I point out in the upcoming edition of ROTY, Regeneron's (REGN) purchase of PD-1 inhibitor Libtayo rights for $900M upfront payment from Sanofi (SNY) signal that the company intends to aggressively expand its oncology business (hat tip to ROTY member dombiotech). This follows a 335% premium for April's buyout of Checkmate Pharmaceuticals (CMPI) to gain rights to vidutolimod (stimulates TLR and is also given via injection into tumor). Pembrolizumab combination in phase 1b study achieved 23.5% ORR in PD-1 failed melanoma. It's not a stretch to think that Replimune could also be in Regeneron's sights to acquire and build out its skin cancer franchise.

Given the recent developments above, I'm looking forward to bringing this story back to the attention of the readers.

Figure 2: REPL weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what's going on. In the weekly chart above, we can see shares on a steadily decline over much of the past year, which certainly wasn't aided when key data milestones were pushed out until 2022. More recently in the March to June period, shares have bounced around in the low teens to $20 range. My initial take is that dips to low teens are an ideal spot to accumulate a pilot position ahead of the aforementioned melanoma readout later this year, especially in light of Iovance's declining ORR in its pivotal readout.

Overview

In my March 2021 update, I touched on the following keys to my bullish thesis:

- Management team appeared highly experienced- back in 2011, they sold BioVex to Amgen (AMGN) ($425 million upfront, $575 million in development in sales milestones). The key asset acquired was the genetically modified oncolytic viral therapy marketed as Imylgic (also known as T-VEC), which was approved in 2015 by both the FDA and EMA. Replimune co-founder and CEO Robert Coffin essentially invented all BioVex products including T-VEC and oversaw all clinical development through dual pivotal phase 3 trials.

- This time around, leadership's goal was to build on prior success to maximize effectiveness of oncolytic immunotherapy by exploring various initiatives, such as loading multiple immune stimulating genes and extending utility to other solid tumor types. I noted that the company's immulytic platform incorporates a proprietary strain of herpes simplex virus armed with a fusogenic protein enhancing its ability to kill cancer cells and delivering immune stimulating proteins directly to tumors. A logical approach was being taken, first going after "easier" indications in order to gain regulatory approval. For example, the RP-1 clinical strategy involves the so-called rapid path to approval, namely going after tumor types that are already known to be sensitive to anti-PD1 agents. This would be followed up with increasingly more challenging tumor types in a stair-step, incremental fashion. I noted that while there's still substantial risk involved, if management could pull off becoming a universal combination agent for anti-PD1/L1 drugs, patients and shareholders would stand to benefit.

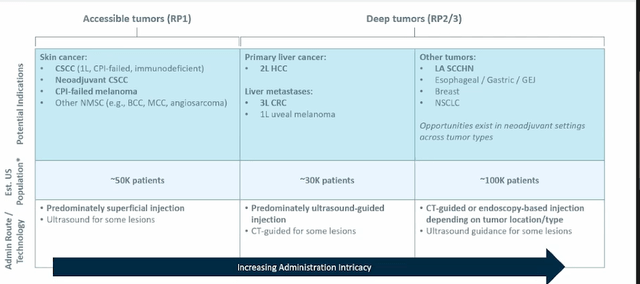

Figure 3: Advantages compared to competitor approaches (Source: corporate slides)

- Playing devil's advocate, I admitted that in the crowded immuno-oncology field several approaches are being tried out to make immune checkpoint blockade effective for most cancer patients (currently best responses are only in patients with pre-existing immune response and inflamed tumors). While I was initially skeptical considering many companies out there are claiming to "turn cold tumors hot," prior evidence already existed showing the company's unique approach has synergies with checkpoint inhibitors such as ipilimumab. For the indication of cutaneous squamous cell carcinoma or CSCC alone, I noted that four thousand to nine thousand deaths occur annually in the US and it's expected to overtake melanoma as the most lethal skin cancer. While Regeneron's cemiplimab has shown activity (46% response rate), that unfortunately comes with low rate of complete responses. The indication also seemed ideal in that the majority of tumors are accessible for direct injection and there is substantial unmet need here. For Replimune's registrational study in CSCC, I stated that the bar to beat is Libtayo's ORR in CSCC as a single agent (47.2%), which I believe seems readily achievable with the RP1 Libtayo combination. CR rate for Libtayo is just 13% (locally advanced disease) to 20% (metastatic), so again pivotal trial goal of greater than 15% delta improvement in ORR and 2x to 3x improvement in CR rate seemed quite feasible.

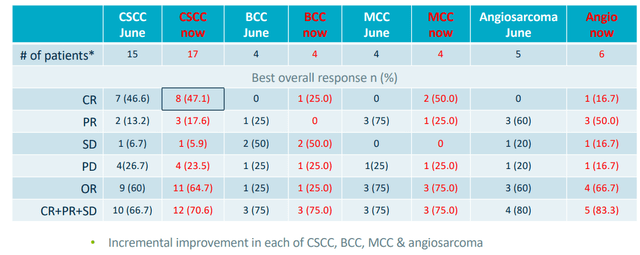

Figure 4: High rates of complete responses in prior trial for RP1 (Source: corporate slides)

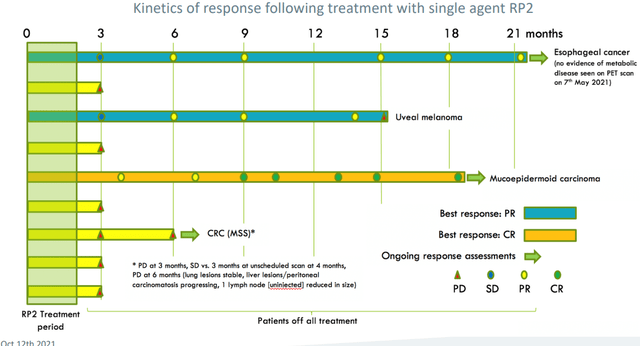

- Far from clinical progress being limited to just RP1, I noted that additional efforts including intratumoral anti-CTLA-4 and co-stimulatory pathway agonists were set to enter the clinic in the near to medium term (RP2 and RP3). The former could be interesting as it could overcome a key obstacle (reducing toxicity) and potentially improve activity as compared to current combination of anti-PD1/anti-CTLA-4. To be fair, with suboptimal data so far for RP3 it's always possible it gets discontinued in the near term.

Figure 5: Initial signs of activity for RP2 in traditionally "cold" tumor types (Source: corporate slides)

Let's move on to March's Investor Day Presentation to better determine how the story is progressing (lasts 3 hours, you've been warmed).

Nuggets from Investor Day Presentation

- Data for RP1 in melanoma in prior June cut off were already quite mature. Thus, changes observed with newer March cut off have been more modest in scale. Still, it's promising that they've observed further uplift in overall response rate (increased in PD-1 failed cutaneous melanoma to 37.5% from initial 31.3% originally seen). For mucosal melanoma they saw a prior partial response deepen and convert to complete remission of disease.

- Spaghetti or spider plot shows encouraging depth and durability of response. Very durable treatment benefit is being observed in PD-1 failed cutaneous melanoma. In fact, outcomes appear to be similar whether or not patient has had prior PD-1 therapy. Highlighted patient (blue arrow) had durable stable disease on single agent PD-1 then was re-initiated on RP1 and entered partial response.

Figure 6: Strong PD-1 failed melanoma signal with general deepening of responses over time (Source: corporate slides)

- As for plans for registration directed study and opportunity here, consider that there are over 7,000 US deaths annually and around half of patients are refractory to anti-PD1 monotherapy, PD-1/CTLA-4 combo or will ultimately progress on this treatment. Response rate to further immune challenge (single agent anti-PD1) is around 7% and there are not yet approved therapies for this setting. Replimune has ongoing registration-directed single arm phase 2 study in 125 patients with anti-PD1 failed cutaneous melanoma. Interim data is expected at the end of 2022.

- As for NSMC (non-melanoma skin cancers), refer to figure 4 above. As with the melanoma data, we see incremental improvement in response rates. CSCC is particularly of interest given ongoing registrational CERPASS study. CSCC overall response rate increased from 60% to 64.7%. Very high rate of complete remissions was maintained at 47.1%. The activity continues to be observed in other skin cancers (basal cell carcinoma, merkel cell and angiosarcoma). This highlights the potential of RP1 across a broad range of tumor types (skin cancer franchise).

- CERPASS randomized phase 2 study in CSCC (RP1 cemiplimab combo versus cemiplimab alone) has dual independent primary endpoints of overall response rate and complete remission rate. Enrollment will be completed midyear with topline data available at beginning of 2023.

- As for first look at RP1 Opdivo combo in PD1-failed NMSC, number of patients is small but initial data is promising (responses in CSCC, MCC and angiosarcomas with all of responding patients in maintained response to date). Overall response rate for this group on the whole is 1 in 3 or 33% and number of other patients not on study for long are in stable disease (anticipate that some of these may evolve into further responses).

- In the first 6 patients (solid organ transplant recipients) they have achieved one PR, one CR, one responding patient died from Covid before benefit could be assessed. Covid has significantly impacted recruitment to trial, but now it is picking up as pandemic is waning. 1/3rd of patients had response, promising but early in nature.

- The company is entering a critical 12 months as they prepare on the commercial side for initial launches. The first goal is to rapidly establish RP1 in CSCC (could provide better 1st line/neoadjuvant therapy as well as better 2nd line therapy post CPI). Second launch will be in PD-1 failed melanoma to continue the momentum and build meaningful skin franchise. They can then move into other skin cancers (MCC, angiosarcoma, etc). Across all segments you are looking at a US population of around 40,000 patients.

- As for skeptics asking why they are different to predecessor T-Vec, management states that T-Vec was great proof of concept but did not launch with strong data or label. Replimune aims to come to market with compelling value proposition and strong data set (a more potent oncolytic immunotherapy platform drives stronger systemic immune response). RP1 can be used in combination of standard of care (not replacing IO).

- Beyond skin cancers, the second step to pursue is to make intratumoral injections into tumors a routine part of care (inject in deeper areas such as visceral lymph nodes and metastases). This includes indications where delivery is part of routine medical practice (ie. liver cancer or metastases where use of repeat ultrasound and injections into liver already occurs). They are "swimming with the tide" in these indications versus against it.

Figure 7: Indication prioritization via means of administration (Source: corporate slides)

- HCC, RCC, head and neck are areas of unmet need and also represent indications where they can more easily do deep injections. Liver mets jumps out as a key commercial opportunity here (tumor microenvironment here is a real issue for existing IO treatments). Proof of concept data in late line patients will allow them to rapidly move into larger opportunities in earlier disease.

- RP2 nivolumab combo data in 30 patient phase one study resulted in 7 responses, all of whom failed prior anti PD-1 therapy (2 uveal melanoma, 4 cutaneous melanoma, 1 SCCHN). RP3 was well tolerated so far, but there was little sign of efficacy in these later line patients (devil's advocate, consider it to be a zero).

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $395M comparing favorably to net loss of $42.3M. R&D expenses rose to $29.5M, while SG&A rose to $11.4M. Management is guiding for cash runway into the second half of 2024.

Accumulated deficit since inception in 2015 is $311.2M per latest 10-K filing. As for prior financings, in October of 2020 the company sold roughly 4.7 million common shares at $40/share for gross proceeds of $40/share, in addition to pre-funded warrants to purchase 1.56M common shares at $39.99/share (represents more than a double from current levels).

Again, the two main catalysts that come to mind are PD-1 failed melanoma data by year end 2022 and pivotal CSCC results in early 2022. For CSCC, cemiplimab was approved in 2018 followed by pembrolizumab in 2020 (ORR ~35-45%, CRR~ 5-15%). Pivotal trial for RP1 combo has dual primary endpoint of CRR (complete response rate) and ORR (15% absolute difference required). For pivotal PD-1 failed melanoma trial, primary endpoint is ORR and I would think 30% or more would be quite good when looking at Iovance's data (mid to high 30's even better). Again, a second-line of anti-PD1 therapy achieves mid to high single digit ORR at best.

Data for RP2 and RP3 later in the year will determine which candidate moves forward to phase 2 studies.

As for leadership, CEO and co-founder Philip Astley-Spark was President & CEO of BioVex before it was sold to Amgen in 2011. Founder, President and Chief Research & Development Officer Robert Coffin was previously founder and CTO of BioVex. Chief Operating Officer Colin Love was SVP of Product Development at BioVex and remained at Amgen as VP of R&D Operations working on T-VEC until it was approved in 2015. Chief Commercial Officer Sushil Patel has highly relevant experience (prior served as Franchise Head for Lung, Skin, Tumor Agnostic, and Rare Cancers within Global Product Strategy at Genentech).

On the board of directors, it's interesting to find Paolo Pucci (CEO of ArQule which he sold to Merck (MRK) for $2.7B). Chairman of the Board Dieter Weinand is the Executive Vice President of Primary Care and a member of the Executive Committee at Sanofi.

As for institutional investors of note, Redmile Group owns 9.9% of the company and BVF (Biotechnology Value Fund) owns around 926,000 shares. Founder, President and Chief Research & Development Officer Robert Coffin owns nearly 1.8 million shares, while Co-Founder and CEO Philip Astley-Sparke owns around 1.4 million shares.

Compensation for CEO seems in line for a company this size ($533,000 base salary, $1.69M option awards and $226,525 non-equity incentive plan compensation).

As for competition, we've seen multiple competitors hit obstacles along the way that improves the case for Replimune. Iovance is the first that comes to mind, having reignited my interest here as a result. Also, compare a complicated 22-day GMP manufacturing process to Replimune's non-patient specific ("off the shelf") approach resulting in far more attractive COGS (cost of goods sold). Oncorus was another player in the oncolytic virus space I was keeping an eye on, but valuation has fallen by 90% in the past year (sub $30M market capitalization) after initial phase 1 data disappointed (1 RECIST response in 8 patients).

Final Thoughts

To conclude, if the valuation were at the same level as last time we owned this name, I would not be interested as it would require higher confidence on my part in efforts to expand to other solid tumor indications. However, at current levels, I view shares as attractively priced given potential for broad opportunity in skin cancers starting with PD-1 failed melanoma and CSCC. I appreciate how response rates are improving with the most recent data cutoff (not what one would expect), and note that abscopal effect (activity in uninjected lesions) has been observed unlike predecessor T-VEC. I also like that management has significant skin in the game and highly relevant prior experience (sold last oncolytic virus company to Amgen), although that's no guarantee in and of itself.

For readers who are interested in the story and have done their due diligence, REPL is a Buy and my suggestion is to accumulate dips into the near term. Clinical momentum should accelerate as initial pivotal readouts take place for lead indications, from there the company expanding into additional skin cancers and earlier line settings (broader opportunity) and finally into other solid tumor indications via RP2/RP3.

As for a possible price target, I could see shares returning to $30 (double from current levels) IF pivotal readouts hit their endpoints. That would equate to a $1.5B market cap (add another $300M for dilutive secondary offering to help them into commercialization), which is still significantly lower than the valuation of Iovance BioTherapeutics ($3B market capitalization) late last year before its fall from grace.

As for risk rating (1=low, 5= high), I'd put this one in the middle of the range (3) given the prior promising data observed for RP1 in multiple skin cancer indications and how response rates have improved over time with respectable durability. The company has a cash runway into 2H 2024 but I wouldn't be surprised to see additional dilution from a secondary offering in the second half of the year or early 2023 after pivotal data sets. Speaking of which, the key risk here is disappointing clinical data for the PD-1 failed melanoma readout as well as pivotal CSCC trial (prior promising results do not translate into higher number of patients). The stock could also be impacted by negative developments if the company announces that RP3 is discontinued, RP2 data in additional solid tumor patients disappoints or they take longer to move into planned expansion cohorts such as liver metastases.

For our purposes in ROTY, I currently own an 8% portfolio weighting with plans to hold patiently throughout this year and next for data catalysts and accelerating clinical momentum.

OTHER LINKS OF INTEREST

Oncolytic viruses: a new class of immunotherapy drugs

Advancing oncolytic virus therapy by understanding the biology

Integrating oncolytic viruses in combination cancer immunotherapy

Editor's Note: This article was submitted as part of Seeking Alpha’s stock catalyst competition which runs through August 31. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors -- is not one you want to miss. Click here to find out more and submit your article today!

Join 500+ investors and traders in the ROTY Biotech Community!

- Participate in a Live Chat where members generously share due diligence, conviction picks and genuinely wish to see each other profit.

- Get access to JF's high conviction ideas and quarterly updates on our model portfolios

- Trade to Live, NOT Live to Trade philosophy (low maintenance, follow our thesis and make changes to positions only as merited)

Check out recent reviews of the service here.