Andrii Yalanskyi

Published on the Value Lab 27/09/22

Prologis (PLD) is a company we've covered in the past. Besides its solid tenants and decent rent-hike scheme, it is a real estate play, which are well suited to these stages of market cycles. Looking further at its balance sheet, investors can find another way to play PLD, which is with the preferred shares in the Prologis Preferred Shares (OTCQB:PLDGP) yielding 8.54% on a headline basis. As far as we can tell, they are substantially undervalued with a very high implied credit risk premium despite lots of assets, limited debt and likely no issues with redeeming the liquidation value fully.

Reminder on PLD

PLD owns warehouses and other logistics real estate and leases them to entities that require them.

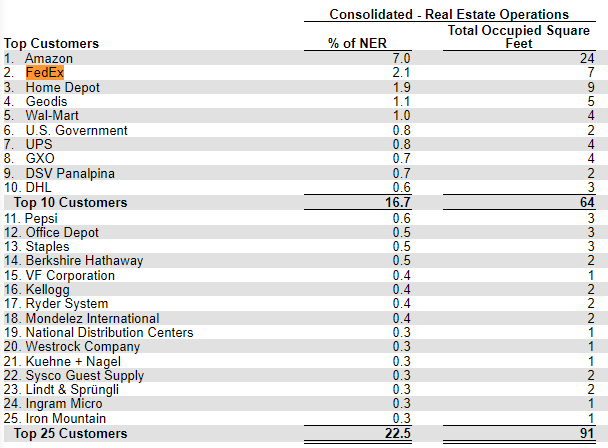

Tenants (10-K PLD)

The value of these assets are falling a little just because rates are rising and goods demand is supposed to be cooled by monetary tightening efforts. However, the mark-to-market ahead of the rent increases baked into the current contracts are likely beyond 20% of book value of leases. This would be the future growth opportunity. As of the 10-K, the figure was even higher.

We estimate that our net effective lease mark-to-market is approximately 36%, which represents the growth rate from in-place rents to market rents based on our weighted average ownership of the O&M portfolio at December 31, 2021.

10-K PLD

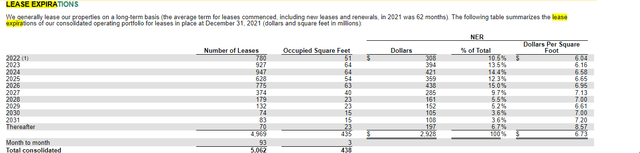

Annual contract increases are around 4% which is likely rent growth for the company even before contract rollovers in a totally new paradigm. A bulge of leases expire in the next two years, about 33% of the lease values, and they should come in at better rates despite macro headwinds incoming.

Lease Expiration Table (10-K PLD)

The Preferreds

The preferred shares could be redeemed in November 2026, so about 4 years from now. Let's ignore this for a second and focus on the simpler calculation of liquidation value.

Preferreds function like this. On liquidation, sale or other change of control event, the preferreds are entitled to a return of capital much like bonds, except bonds are always more senior in the debt stack. In this case, the liquidation value is $50 per share which would be paid out if there are excess assets over the bond claims. PLDGP shares trade at $55, which already shows promise of value.

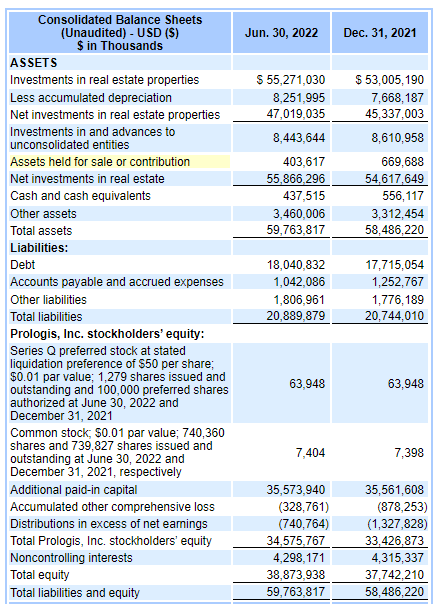

The $50 is well covered by looking at net real estate assets also net of debt. The company has $57 billion in real estate assets, and about $18 billion in debt. The preferreds are few in number, about 1.3 million units, and their book value is around $64 million. If you take the assets minus the debt, you have $39 billion, which obviously covers the next claim to the stack of net assets which are those $63 million in preferred liquidation preference.

The point is there is limited credit risk for the preferreds. Real estate is easy collateral, and there is plenty left after debt makes its claim. The current YTM is 7.7%, which implies a credit risk premium in excess of 4% at current reference rates, which means essentially a junk B1 rating. This appears excessive. We believe a higher rating could be justified like A, in which case the YTM could justifiably be half what it currently is, which would double the share price.

Equivalently, if you take the preferreds after all the debt out of the net asset stack, preferreds still get to share in the residual value pro-rata with equityholders. That would mean the small percentage of the equity which preferred holders would be entitled to after liquidation preference would also be equal around $50 per share. On this basis as well, the share price of PLDGP should be double?

Final Remarks

Why is it not? It's because of the option of PLD to redeem the preferred shares at their option after November 2026. If they redeem then, PLDGP holders would only be entitled to $50 per share. If the shares were trading at $100 as of the day before that redemption, the investment return would be -50%, i.e. a disaster.

Recent Balance Sheet (10-Q PLD)

Is there still value then? Yes, there is. The share pays 7.7% yield per year. The dividend is quarterly. The current price is only 10% above liquidation preference. On a discounted cash flow basis that implies the redemption will happen in less than 2 years. That's impossible, earliest it will be in 4 years. The DCF of the dividends assuming a November 2026 redemption is about a 23% bonus on the current PLDGP liquidation price. In other words, you will likely have a 13% upside from the current $55 price. Moreover, the liability of the preferreds against the assets of Prologis is limited. Would PLD redeem it just because they can? Maybe not. The dividend burden is tiny as well. Every year of non-redemption would be pure value for the preferred shareholders. With a floor of 13% upside according to our DCF logic, and a bull case of 100% upside, PLDGP looks really interesting for the income investor. The opportunity looks pretty asymmetric.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.