Thaweesak Saengngoen

The iShares MSCI World ETF (NYSEARCA:URTH) is supposedly a broad global exposure, but ends up being mostly skewed to the US and not much better than broad US indices. As such, it also suffers from the issue that its multiple is a little high, and its earnings yield too low, despite the likelihood of a recession. While there is something to be said about peak inflation, which we may be approaching, and the uses of URTH to speculate on that, speaking strictly about value would have us conclude that the ETF isn't very interesting.

URTH Breakdown

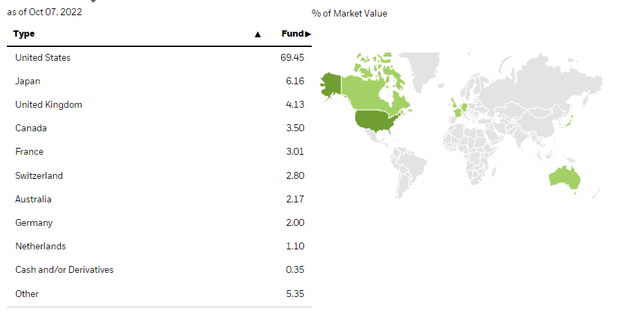

Let's have a quick look at the URTH portfolio.

URTH Top Holdings (iShares.com)

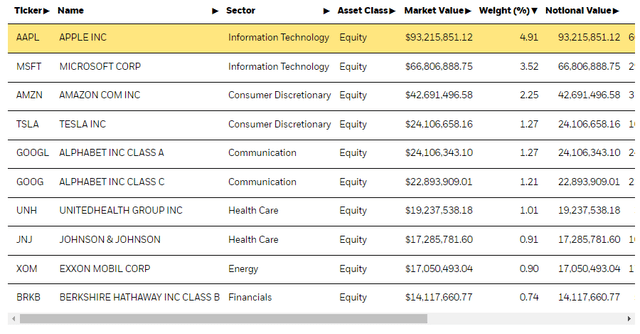

What strikes us is how similar its allocations are to other broad, value weighted portfolios. Take the iShares Core S&P 500 ETF (IVV) as an example.

IVV Top Holdings (iShares.com)

While the URTH ETF has slightly lower weightings on each respective exposure, the lists are almost identical, and the difference in allocations come from the fact that URTH must also include some foreign stocks somewhere. In other words, URTH is just a foreign ETF weighted together with the IVV more or less 3:7. For these additions of foreign stocks, the expense ratio goes from 0.03% to 0.24%. Already on that basis the URTH ETF looks pretty uninteresting, being somewhat redundant while also being expensive. Nonetheless, a discussion can be had on its other merits.

Remarks

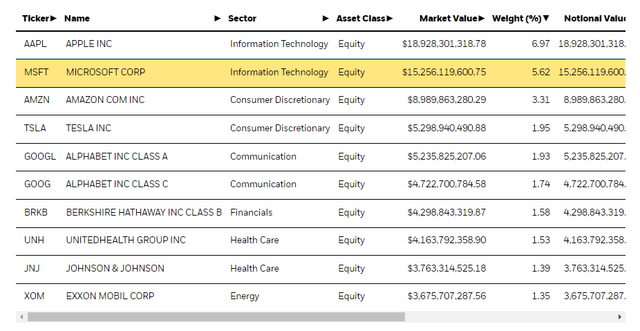

The P/E of URTH is about 15.7x while it's 17.8x on the IVV, showing that the additional foreign exposures, primarily European and Japanese, bring down the multiple a fair bit. This is clearly consistent with the fact that foreign stocks generally are trading at discounts to European stocks, both within sectors, but also taking a coarse average because the US is dominated by higher multiple tech stocks.

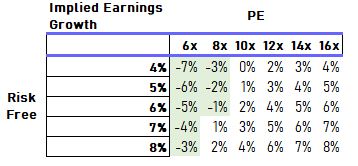

The issue is that we believe that earnings yields, incidentally also in European markets, are generally too low given the probability of a recession and its likely impact on earnings growth. With no earnings growth or negative earnings growth, the higher multiples lose out to even risk-free rates in terms of even risk unadjusted yields.

Value Chart ((VTS))

This comparison of equity yields to risk free rates is critical as risk free rates rise. If Treasury rates stay at around 4%, the implied earnings yield of the URTH portfolio is something like 3.5%. With inflation eroding profits from the supply side, and the concern of demand side pressures as well, such a growth rate remains pretty optimistic.

The only other reason that URTH would be attractive at this valuation depends on beliefs around risk free rates, namely whether the Fed tightening cycle is close to an end. In our opinion, perhaps some premium for American markets make sense given its a more self-sufficient country than most European nations. Moreover, it benefits to some extent from the conflict in that a strong USD reduces imported inflation, and that the dollar and the sanctity of the Treasury has been maintained by a risk off attitude together with more enticing rates. This benefit has offset some of the strategic pains with self-inflicting economic damage on the West by pushing for Russian sanctions. Cost of living concerns have been lesser in the US which is less exposed from an energy perspective. That is all to say that tightening may not have to go on quite as long in the US.

There is also the possibility that almost all the inflation is coming from supply factors. Supply chain pressure will ease as manufacturing data points lower. Key touchpoints like shipping are also seeing rapidly falling charter rates, more than 40% declines in larger TEUs. Semiconductors reserves are rising again, and slowdowns in China as well as targeted strategic moves to block China may make critical products more available in the West as well. If things become less problematic on the supply side, barring energy which is not commanded by free market forces as much, perhaps high employment figures are not going to doom the US to more aggressive rate hiking.

At any rate, if the markets perceive that we are at peak rates, markets will roar back. That is another speculative reason if nothing else to hold URTH. It's difficult to call whether we are approaching a peak. It is becoming more reasonable that rates and inflation are indeed coming to one, but so far employment figures and Phillips Curve logic applies. Moreover, real value destruction from economic disintegration and backtracking on globalization should mean higher baseline supply pressure on inflation until real developments in productive capacity come about. So we continue to imagine that rates will keep rising for a few more months of hiking, but who knows. Regardless, we don't love URTH, and with the option of IVV, we'd take that almost every time on basis of cost.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.