Portra

STAG Industrial (NYSE:STAG) is an industrial REIT which trades at some discount to peers. Due to a recent slide in the stock price, the valuation has dipped to buyable levels. That said, investors will be wise to temper their expectations in light of the rising interest rate environment, as the growth rates of the past are unlikely to repeat themselves moving forward, at least based on current market conditions. While the long-term future for industrial REITs like STAG remains bright, the leveraged balance sheet means that growth will need to take a breather.

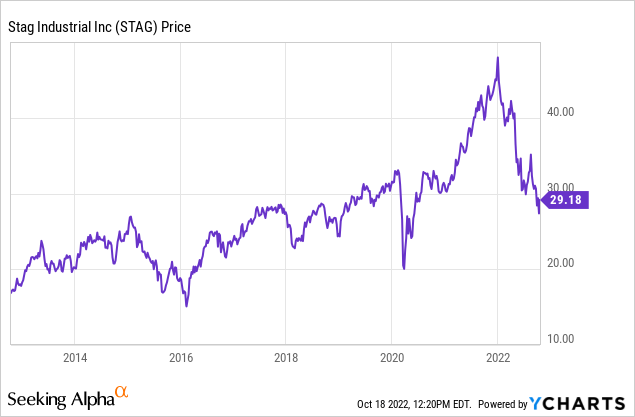

STAG Stock Price

STAG achieved its all-time high of $48.27 per share just at the end of 2021 but has since fallen 40%.

Other industrial REITs have also fallen by similar amounts, largely due to valuation as this sector had been bid up to unrealistic levels. The lower equity valuations will unfortunately disproportionately affect STAG’s business growth prospects relative to peers.

STAG Stock Key Metrics

STAG owns 559 properties spread across 40 states. STAG is an industrial REIT which means it owns industrial warehouses often used for logistics.

2022 Q2 Presentation

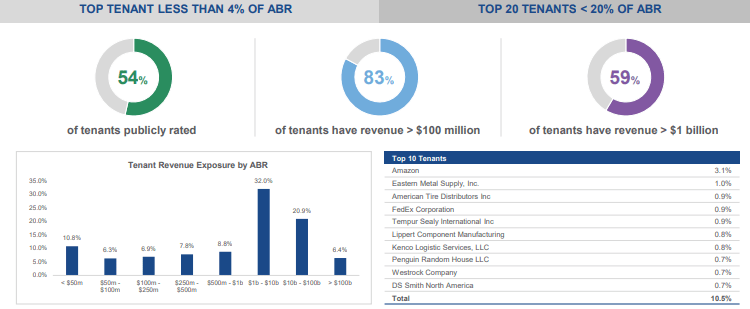

STAG’s largest tenant is Amazon (AMZN) but its tenant roster is quite diversified with the vast majority of tenants having over $100 million in revenue.

2022 Q2 Presentation

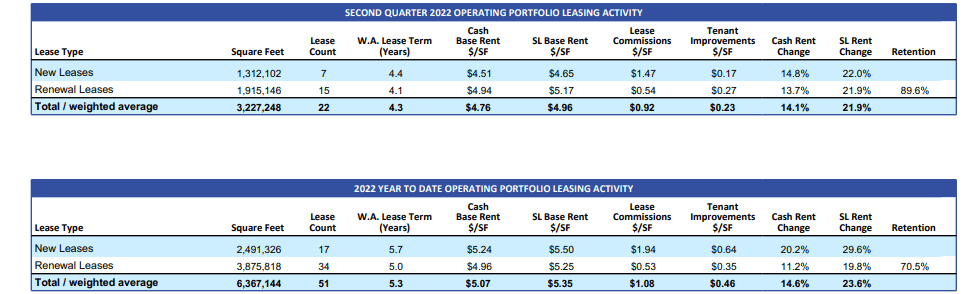

The industrial REIT business model focuses on aggressive mark-to-market rent increases upon lease expiration. In the latest quarter, STAG generated double-digit spreads on new and renewal leases. How do I explain the high leasing spreads? Industrial warehouses are typically quite "basic" in comparison with mall and shopping center real estate, leading to lower rents. The lower starting rent plus strong demand (sprung about from the continued rise of e-commerce) in turn lead to higher rent growth rates.

2022 Q2 Supplemental

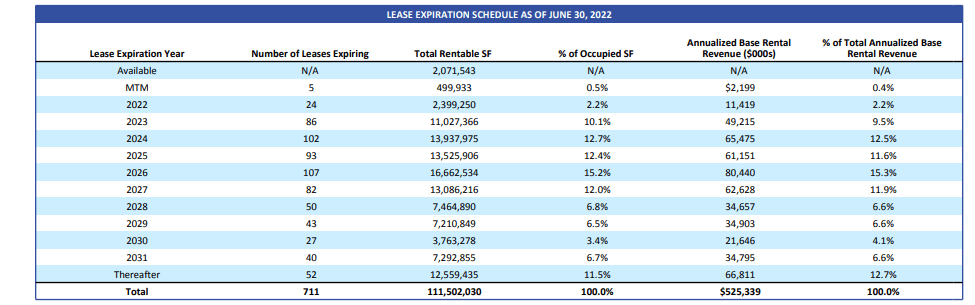

Looking ahead, about a double-digit percentage of leases will expire annually over the next five years.

2022 Q2 Supplemental

It is worth noting that STAG’s leasing spreads do pale in comparison to the 27% spread at Prologis (PLD) or the 50% at Terreno (TRNO). That is one crucial reason why STAG perennially trades at a discount to peers but more on that later.

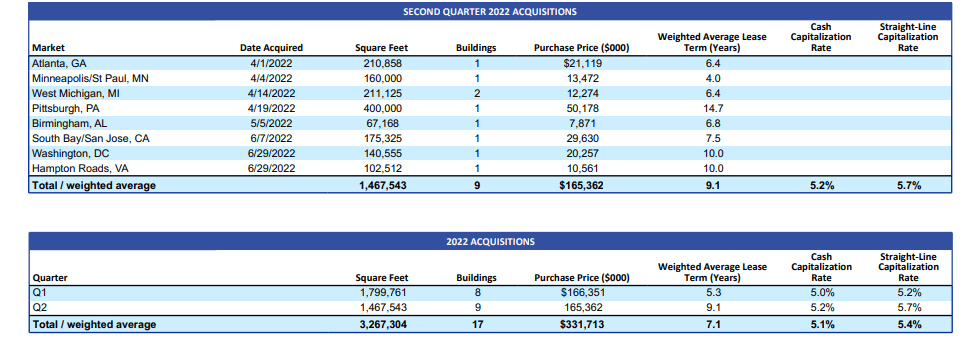

STAG has acquired $332 million of properties thus far this year at a weighted average cap rate of 5.1%.

2022 Q2 Supplemental

That low acquisition cap rate shows the high-quality perception of the industrial REIT sector. These leases do come with high annual rent escalators, but the low starting cap rate does limit the level of accretion to the bottom line.

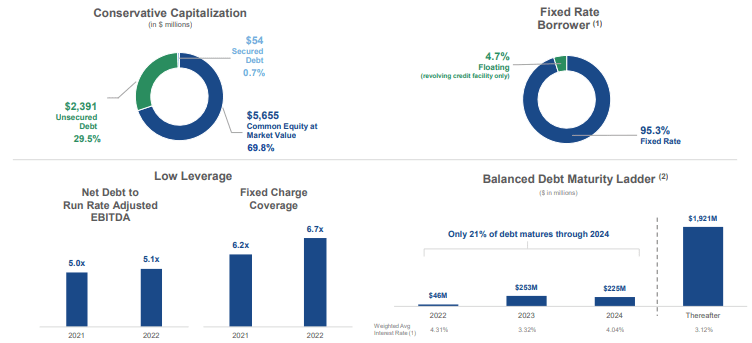

STAG maintains a balance sheet with 5.1x debt to EBITDA, significantly higher than peers which typically see leverage around the 3x to 4x range.

2022 Q2 Supplemental

The higher leverage ratio is a direct consequence of STAG typically trading at a discount to peers, as it has had to be more reliant on debt to help fund its acquisition pipeline.

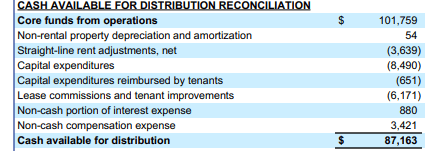

In the latest quarter, STAG increased core FFO by 18%, but core FFO per share increased by only 7.7% due to equity dilution. Same-store cash NOI grew by 4% - this is generated from the aforementioned annual lease escalators and leasing spreads. Cash available for distribution stood at $87.2 million - this is the cash leftover after capital expenditure requirements (and other adjustments).

2022 Q2 Supplemental

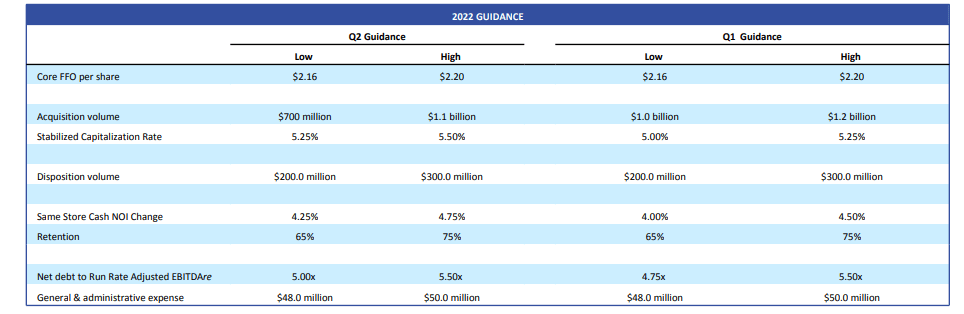

For the full year, STAG has guided for up to $2.20 in core FFO per share, with the underlying assumptions including up to $1.1 billion in acquisition volume and $300 million in dispositions.

2022 Q2 Supplemental

On the conference call, management stated that it expects its disposition cap rate to stand at between 4.5% and 5% for the year.

Investors might be wondering how STAG might be impacted by the rising interest rate environment. A typical hope is that the company can offset rising cost of capital with increased cap rates on acquisition. This is what management said on the conference call:

As part of our underwriting, cost of capital as an input that's in our underwriting model, inclusive of debt costs, forward interest rates, our stock price and because of that, our hurdle rates naturally increase, as I mentioned in the prepared remarks, price discovery in this market is real. There are less assets coming to market now given the uncertainty in the market, which is one of the reasons why we widened our acquisition guidance. And we expect once this price discovery period to normalize, we expect to return to our more normalized acquisition pace.

In my view, those remarks did not seem to indicate a material rise in acquisition cap rates. It seems that there is quite a lot of competition keeping prices high (not really a good thing).

Analysts repeatedly asked about how the company will continue to fund growth considering that its equity valuations are depressed. Management stated that they believe they can hit guidance without issuing equity, noting that their average annual lease escalator stands somewhere between 2.3% to 2.5%. That average rate has been increasing gradually due to the company realizing over 3% annual lease escalators on acquisitions.

Is STAG Stock A Buy, Sell, or Hold?

With leverage high and the equity valuation low, STAG will struggle to fund external acquisitions. It can’t really issue much debt without endangering the balance sheet and issuing equity won’t be so accretive. STAG is generating $510 million annualized NOI and has an enterprise value around $7.4 billion, for an implied cap rate of 6.9%. That is higher than the 5.1% acquisition cap rate realized thus far this year, even inclusive of the projected ~13% leasing spread upon expiration.

STAG pays $1.46 in forward dividends per share, suggesting around $135 million in retained cash flows. While that represents firepower available to fund acquisitions, I question whether acquisitions would be the best use of capital considering current valuations. In fact, it could be considered a red flag if STAG continues to acquire properties instead of repurchasing shares given the valuation discrepancy. Obviously if cap rates expanded then my view would change, but net lease cap rates are still hanging in at around 6.5% to 7%, making it unlikely for industrial cap rates to expand. Alternatively, I would not mind if STAG prioritized bringing down leverage as the multiple expansion potential would compensate for the lower accretion.

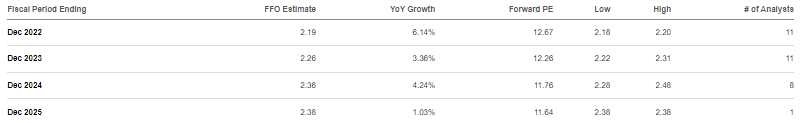

Consensus estimates are already factoring in the impact of limited access to capital, as STAG is expected to grow its bottom-line at a low single-digit clip over the next several years.

Seeking Alpha

Those estimates look reasonable. Remember that STAG has 2.3% to 2.5% average annual lease escalators across its portfolio. It gets around 13% leasing spreads upon expiration, but roughly 12% of rent expires annually over the next few years. That means leasing spreads could contribute around 1.6% to NOI growth - adding this with the escalators leads to the consensus 4% growth rate.

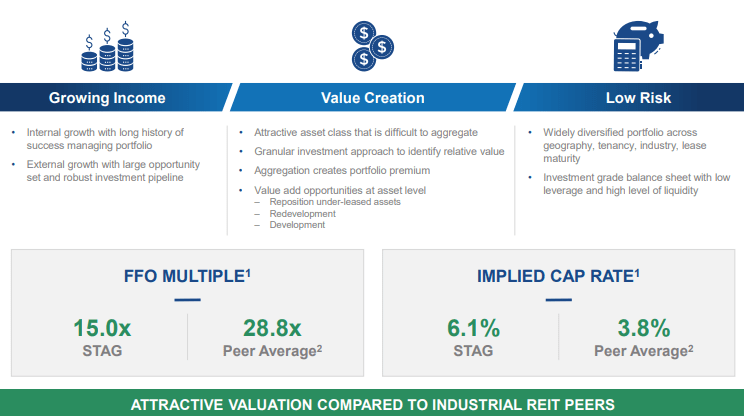

Both STAG and its investors have long made the case that the stock deserves a re-rating higher due to its discount to peers.

2022 Q2 Presentation

In my view, however, a discount is warranted because STAG generates significantly lower same-store growth and has significantly higher leverage. In the current environment, this means that peers will be able to grow faster through both internal growth as well as external growth (they can likely continue to lever their balance sheets). But perhaps the magnitude of the discount is too large?

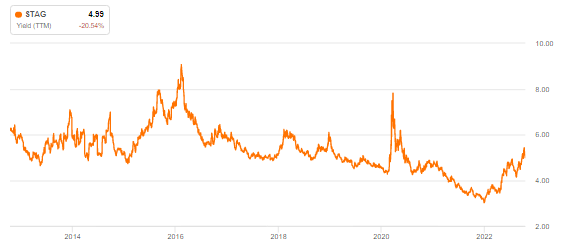

It is worth noting that STAG actually still trades below its average dividend yield over the past decade.

Seeking Alpha

I do think that the stock is too cheap at 13x FFO in light of the 4% same-store NOI growth potential. For reference, net lease REITs like Realty Income (O) typically trade at around 15x-18x FFO and they only have around 1% SS NOI growth potential. That suggests that STAG should trade around 20x FFO or higher, more in-line with industrial REIT peers, but perhaps some investors are concerned that the company will be unable to sustain the high leasing spreads and annual lease escalators as it has in the past. Another risk is that the low acquisition cap rates could suggest some sort of bubble in the industrial REIT sector - in my view cap rates have been driven lower largely due to the inflated valuations seen in the past. But what if the pandemic had a dramatic pull-forward, leading to lower demand for industrial real estate over the coming years? We are already seeing many e-commerce names like Shopify (SHOP) admit overinvestment in growth, it stands within reason to expect a slowdown in the buildout of logistics infrastructure. If acquisition volumes decline and cap rates remain low, that could present a perfect storm which stunts growth for many years. As stated above though, that might not necessarily be a bad thing if STAG instead focuses on repurchasing shares at lower valuations. I rate STAG a buy but caution investors to focus carefully on how management allocates capital here.

Growth stocks have crashed. The time to buy is when there is blood on the streets, when no one else wants to buy. I have provided for Best of Breed subscribers the 2022 Tech Stock Crash List, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!