lo-chef/iStock via Getty Images

Infrastructure data REITs, such as Crown Castle (NYSE:CCI) and American Tower (AMT), were one of the top-performing segments of the market in recent years. Cell tower REITs were one of the few areas with a strong balance between high income and long-term growth. Further, many investors and analysts speculated that the widespread adoption of 5G would dramatically improve the value of the telecommunications infrastructure giants.

Last year, I was among a few analysts signaling alarm regarding cell-tower REITs in "American Tower: Global Cellular Data Usage May Already Be Peaking." That article was published around when American Tower's stock peaked, declining about 30% since then. Crown Castle has fared worse, losing 40% of its value. While CCI is much cheaper than last year, it ranks very low on quantitative metrics with "a high risk of performing badly" due to negative EPS revisions, a higher valuation (compared to other REITs), and high debt leverage.

Crown Castle is an interesting stock since it has a lower price-to-FFO of 16.9X and a yield of 4.8%. The stock has a more attractive valuation than it did when I looked at the industry last September; however, it is still more expensive than most other REITs. CCI's valuation premium stems from the belief that it has high long-term EPS growth potential. CCI has had decent EPS growth in past years, but shifting market dynamics may limit its future growth potential - primarily if data demand reaches a plateau.

Inflationary Forces Weigh on Growth

Last year, my negative outlook on cell tower REITs stemmed primarily from their high valuations. At the time, many investors were betting that 5G adoption would lead to a substantial rise in sales; a few which has not stood up in reality as customers do not wish to pay any more for 5G than they did for earlier technologies. Further, it seemed that the wave of growth in cell towers was reaching a peak across the US and most other developed countries, driving more significant potential for price competition - particularly as many large providers like AT&T (T) face greater competition from smaller firms like Mint Mobile.

Of course, immediate economic shifts have exacerbated Crown Castle's losses. Higher interest rates have marginally increased the firm's interest costs (and outlook), while high inflation has effectively lowered the present value of some of its long-term lease assets. Inflation has also asymmetrically increased the firm's labor costs - an essential issue since skilled telecom workers are in short supply. Additionally, the growing strain on real personal incomes may harm data demand, likely limiting the possibility for continued demand growth.

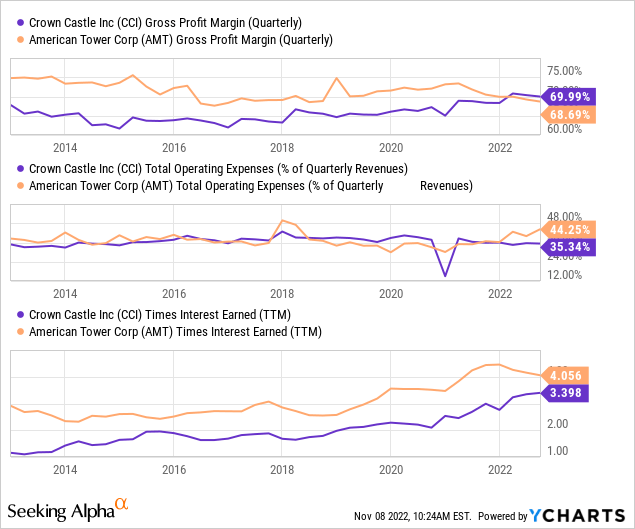

Last quarter, Crown Castle was in a surprisingly strong position compared to American Tower. Unlike AMT, the company has managed to keep its operating expense-to-sales ratio from rising and now has a higher gross profit margin. Crown Castle's effective leverage is slightly higher, with a times-interest-earned (EBIT-to-interest) of 3.4X compared to American Tower at 4X. See below:

American Tower has likely struggled a bit more due to its global exposure that creates adverse side effects as the value of foreign currencies declines to the US dollar. That said, rising operating costs due to worldwide labor and energy shortages are likely beginning to strain their traditionally large profit margins. Further, CCI trades at a slightly higher "P/FFO" of 16.9X compared to AMT at 15.9X, which is higher than the sector median at 13.6X.

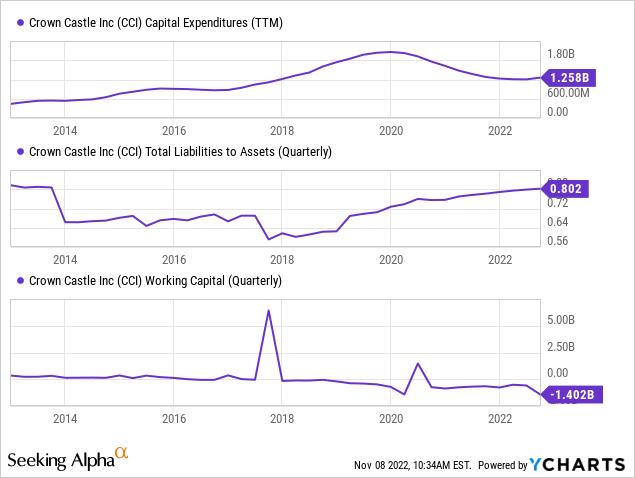

Rising interest rates should not negatively impact Crown Castle's EPS directly, as most of its debt is fixed with long-term maturities. Of course, its growth potential is seriously limited as new construction lending costs would be large enough to offset most cash flows. Due to this, the firm has reduced its CapEx spending, but its overall asset leverage continues to rise while its working capital declines, indicating a need for more debt financing. See below:

Crown Castle has a "BBB+" credit rating which puts it toward the bottom of the "investment grade" category. If the company continues to borrow or, more importantly, faces a decline in profitability, it may easily see its credit rating fall into "below investment grade" territory. If so, its future borrowing costs could spike, further harming its growth potential.

Overall, I believe Crown Castle has relatively sizeable negative exposure to inflation and its knock-on effects. While it can roll leases to keep up with inflation, labor, energy, and financing costs may rise faster than the CPI. Additionally, in light of the growing economic strain, Crown Castle's ability to raise leasing costs (at a necessary pace) may be limited, particularly if large carriers like AT&T continue to face earnings losses.

Crown Castle Cannot Grow Indefinitely

Crown Castle is among the few REITs that have managed considerable EPS growth. Most REITs cannot grow their earnings per share as rapidly and must usually sell shares to finance growth, resulting in little benefits for investors. Of course, instead of selling shares, Crown Castle has used debt financing to expand its EPS, increasing its downside risk in the event of an industry slowdown.

Many analysts and investors assume Crown Castle will continue along its growth trajectory without significant risk. The company benefits from being in an oligopoly and has an immense US market share. Crown Castle is investing heavily in small data towers in dense urban areas and believes that this will drive its growth in the future as 5G becomes more common. In my view, the profitability of these investments may be weakened by the fact that record numbers of people are leaving dense urban areas due to rising living costs and crime. Urban emigration is heavily skewed toward higher-income earners, further limiting market size in dense zones.

Broadly speaking, it is also unclear whether data demand will continue to grow at its historical pace. The median American spends around 5 to 6 hours per day on their phone, causing US data consumption and wireless revenue per user to be far higher in the US than in Europe and the UK. A major factor benefiting cell tower demand growth has been the rise in phone usage over the past decade. At this point, I believe it is unlikely people will spend more time on their phones than they already do, particularly as more work from home. New 5G smartphones are also not seeing high sales as consumer demand is weak amid high prices and a weakening economic environment.

Overall, I believe it is unwise for investors to extrapolate historical trends endlessly without regarding shifting dynamics. Most technologies experience rapid growth, followed by plateaus and occasionally reversals. I believe falling US labor productivity (and stress-related health issues) is potentially attributable to immense daily smartphone usage. Accordingly, I believe an argument could be made to support a decline in US smartphone data use over the coming years, particularly if economic conditions continue to strain discretionary spending capacity. While this may not negatively impact Crown Castle's income directly, it may cause its leasing rates to rise below the inflation rate for a prolonged period. Further, it adds to the long list of factors limiting Crown Castle's organic growth potential.

The Bottom Line

Overall, I am generally bearish on CCI and believe it will continue to decline in value. The stock is cheaper than last year, but economic conditions have worsened dramatically, limiting its immediate growth and EPS potential. The most important factor weighing on Crown Castle is the rise in interest rates which lower substantially the cash-flow potential of any new investments. On top of that, high-interest rates increase the risk associated with its high debt leverage. This factor could change if inflation slows and interest rates reverse, but I tend to believe inflation will remain near double-digit levels due to energy market dynamics.

I would not short CCI at this point as it does not appear highly overvalued. However, its "P/FFO" valuation is around 25% above the industry median. Its relatively large valuation premium is attributable to its long-term EPS growth outlook. While this outlook has shifted lower over the past year, I personally doubt it will achieve above-CPI EPS growth over the next decade. Critical reasons for my stagnant EPS outlook include high financing costs, potential increases in overhead costs, and a possible long-term plateau or decline in US cellular data usage. The latter may have the most considerable long-term negative impact on the company but is the least definite as there is still little concrete data that indicates Americans are feeling too inundated with smartphone technology - but there is soft data indicating it. Still, with this view in mind, I would not buy CCI at a high valuation premium and would be more neutral if the stock had an industry-median "P/FFO" of 13.6X, equating to a share price of ~$104.